8 Crypto Market Cap Analysis For Profitable Investments

Unlock the Secrets of the crypto market cap analysis - Dive into Expert Analysis & Insights. Discover Trends, Predictions, and Strategies for Maximizing Returns. Stay Ahead in the Crypto Game with Actionable Data & Proven Tactics.

Author:Camilo WoodReviewer:James PierceFeb 22, 20241.5K Shares46.9K Views

Are you ready to take your crypto investments to the next level? Dive deep into the world of crypto market cap analysisand unlock the secrets to maximizing your returns. In today's fast-paced digital economy, understanding the intricacies of market capitalization is more crucial than ever.

Discover how to identify emerging trends, pinpoint undervalued assets, and mitigate risks effectively. From analyzing the market dominance of top cryptocurrencies to uncovering hidden gems with explosive growth potential, our comprehensive analysis empowers you to make informed investment decisions.

Exploring 8 Profitable Analysis

Capitalization (market cap) refers to the total market value of all outstanding shares of a company or, in the case of cryptocurrency, the total value of all the coins incirculation. It's essentially a gauge of a company's or cryptocurrency's overall size and market worth.

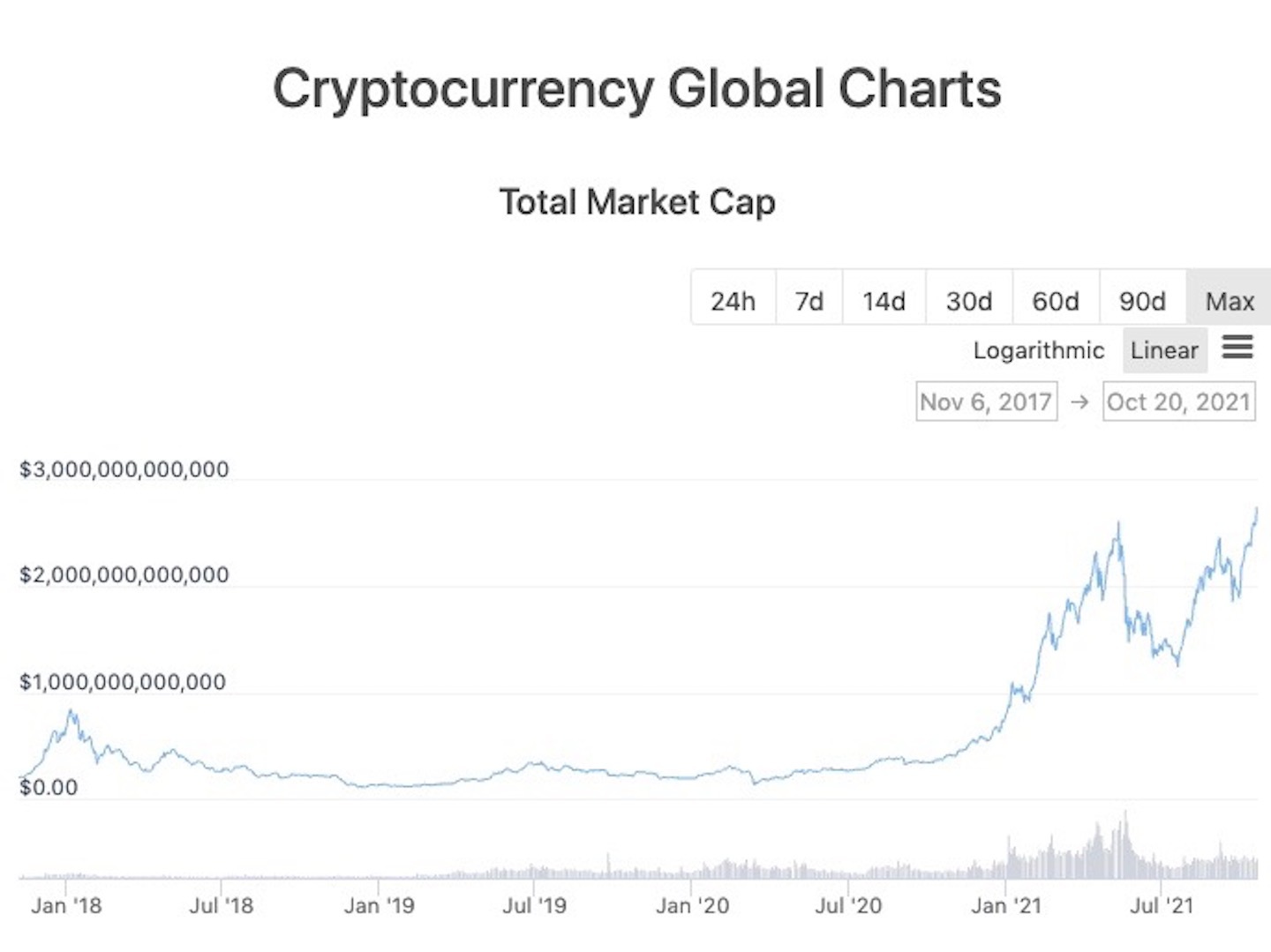

The global cryptocurrency market cap today is $2.03 Trillion, a-1.22% change in the last 24 hours(17/02/2024). Analyzing the market capitalization (market cap) of cryptocurrencies is essential for understanding their relative size and significance within the broader crypto market. Here are ten different analyses of crypto market caps, each with a detailed description:

1. Market Cap Dominance Of Bitcoin Vs. Altcoins

This analysis compares the market capitalization of Bitcoin to that of all other cryptocurrencies combined, known as the "Bitcoin dominance." A high Bitcoin dominance indicates that Bitcoin's market cap comprises a significant portion of the total crypto market, while a lower dominance suggests greater market share for altcoins. Tracking changes in Bitcoin dominance can provide insights into shifting investor sentiment and market dynamics.

2. Market Cap Growth Rate

Examining the growth rate of the total crypto market cap over time provides valuable insights into the overall expansion of the cryptocurrency ecosystem. By analyzing historical data, investors can identify periods of rapid growth or consolidation, assess market cycles, and make informed decisions about investment strategies.

3. Market Cap Distribution By Sector

This analysis categorizes cryptocurrencies into different sectors based on their use cases or underlying technologies (e.g., decentralized finance, non-fungible tokens, privacy coins). By examining the market capitalization distribution across sectors, investors can identify emerging trends, assess sectoral performance, and allocate their investments accordingly.

4. Market Cap Vs. Trading Volume

Comparing a cryptocurrency's market capitalization to its trading volume provides insights into its liquidity and investor activity. High trading volume relative to market cap suggests robust market participation and liquidity, while low trading volume may indicate limited interest or liquidity constraints. This analysis helps investors assess the ease of buying and selling a particular cryptocurrency.

5. Market Cap Vs. Network Activity

Analyzing a cryptocurrency's market capitalization alongside its on-chain metrics, such as transaction volume, active addresses, and network activity, can provide insights into its fundamental value and adoption. Strong network activity and usage metrics may support a higher market cap by indicating widespread adoption and utility.

6. Market Cap Vs. Development Activity

Evaluating the correlation between a cryptocurrency's market capitalization and its development activity, such as GitHubcommits, code updates, and community contributions, can help assess its long-term viability and innovation potential. Projects with active development and community engagement may be better positioned for future growth and adoption.

7. Market Cap Vs. Regulatory Environment

Assessing the impact of regulatory developments and legal considerations on cryptocurrency market caps can provide insights into investor sentiment and market dynamics. Regulatory clarity or uncertainty surrounding a particular cryptocurrency or jurisdiction can influence its market capitalization and investor confidence.

8. Market Cap Vs. Market Cap-to-Transaction Ratio (MCT Ratio)

The market cap-to-transaction ratio (MCT Ratio) compares a cryptocurrency's market capitalization to its daily transaction volume, providing insights into its valuation relative to its utility as a medium of exchange. A low MCT Ratio may indicate undervaluation or potential growth opportunities, while a high ratio may suggest overvaluation or limited utility as a transactional currency.

Why Is Market Cap Important?

Market cap holds importance for several reasons in the world of investment and analysis, both for stocks and cryptocurrencies. Here's a breakdown of its key uses:

Comparing Size And Liquidity

- Large market cap -Generally indicates a larger, more established company or cryptocurrency. This translates to higher liquidity, meaning you can more easily buy and sell without significantly impacting the price. Think of it like selling water versus diamonds - water has a high supply and lower price (low market cap), making it easy to buy and sell without affecting the available water. Diamonds, with a lower supply and higher price (high market cap), require more careful transactions to avoid influencing the market.

- Small market cap -Smaller companies or cryptos have the potential for high growth but also come with greater risk. Their lower liquidity could mean difficulty buying or selling large amounts without affecting the price.

Identifying Growth Potential

- Smaller market cap -While riskier, they offer the chance for explosive growth if successful. Imagine a new, innovative company with exciting technology; its market cap might be small initially, but if the technology takes off, the value could skyrocket.

- Larger market cap -While less volatile, established companies tend to exhibit slower, incremental growth.

How Is Market Cap Calculated?

Calculating market cap is straightforward! Here's the formula for both companies and cryptocurrencies:

Market Cap = Price Per Share/Coin * Number Of Shares/Coins In Circulation

Let's break it down:

- Price per Share/Coin -This is the current trading price of a single share of the company's stock or a single unit of the cryptocurrency. You can find this readily on financial websites or cryptocurrency exchanges.

- Number of Shares/Coins in Circulation -This represents the total number of shares or coins that are currently available for trading in the market. This information is also usually available on financial websites or directly from the company or cryptocurrency project.

For Example

- Company -Imagine a company has 100 million shares outstanding, and each share is trading at $20. Its market cap would be:

- Market Cap = $20/share * 100 million shares = $2 billion

- Cryptocurrency -If a cryptocurrency has 21 million coins in circulation and each coin is trading at $50,000, its market cap would be:

- Market Cap = $50,000/coin * 21 million coins = $1 trillion

Here's a table showing top 10 Cryptocurrencies and their market caps:

| Cryptocurrency | Market Cap |

| Bitcoin(BTC) | $1.03T |

| Ethereum(ETH) | $350.07B |

| Tether(USDT) | $97.78B |

| BNB(BNB) | $54.23B |

| Solana(SOL) | $49.34B |

| XRP(XRP) | $30.61B |

| Lido Staked Ether(STETH) | $28.47B |

| USDC(USDC) | $28.07B |

| Cardano(ADA) | $22.16B |

| Avalanche(AVAX) | $14.70B |

Is Market Cap The Best Way To Measure The Popularity Of A Cryptocurrency?

While market capitalization is a commonly used metric to assess the value and popularity of a cryptocurrency, it's important to recognize that it may not always provide a complete picture on its own. Here are some points to consider regarding market capitalization:

1. Limited Perspective -Market capitalization only considers the current price and circulating supply of a cryptocurrency. It doesn't take into account factors such as technology, adoption, utility, development activity, or community support, which are also crucial in assessing the long-term potential and popularity of a cryptocurrency.

2. Vulnerability to Manipulation -Market capitalization can be influenced by factors such as liquidity, trading volume, and price manipulation. As a result, it may not always accurately reflect the true popularity or value of a cryptocurrency.

3. Focus on Established Coins -Market capitalization tends to favor established cryptocurrencies with high market liquidity and large circulating supplies. This can overlook newer projects or tokens with innovative technology and strong community support but smaller market capitalizations.

4. Dynamic Nature of the Market -Cryptocurrency markets are highly volatile and dynamic, with prices and market capitalizations fluctuating rapidly. A cryptocurrency's market capitalization can change significantly over short periods, impacting its perceived popularity.

5. Complementary Metrics -While market capitalization is a useful metric, it's often used in conjunction with other indicators such as trading volume, network activity, developer activity, and community engagement to gain a more comprehensive understanding of a cryptocurrency's popularity and potential.

FAQ's About Crypto Market Cap Analysis

How Can I Manage Risk When Using Market Cap Analysis?

Diversify your portfolio across different cryptocurrencies with varying risk profiles and don't invest more than you can afford to lose.

How Can I Compare Market Caps Across Different Blockchains?

Be cautious, as different blockchains have different tokenomics and supply structures. Comparing directly can be misleading.

Does A Higher Market Cap Always Mean A Better Investment?

Not necessarily. Large-cap coins might be less volatile, but smaller-cap coins can offer higher growth potential (and higher risk). Research each project's fundamentals.

Conclusion

Crypto market cap analysis serves as a valuable tool in the arsenal of cryptocurrency investors, offering insights into the relative value and popularity of digital assets within the market. While market capitalization provides a convenient metric for comparing the size of different cryptocurrencies, it's essential to recognize its limitations and complement it with a holistic understanding of the crypto landscape.

Camilo Wood

Author

James Pierce

Reviewer

Latest Articles

Popular Articles