8 Proven Crypto Trend Following Strategies You Can't Afford To Ignore

Unlock the secrets of crypto trend following strategies! Discover how to ride the wave of cryptocurrency trends with expert insights.

Author:Stefano MclaughlinReviewer:Camilo WoodFeb 22, 20248.3K Shares111.5K Views

In the fast-paced world of cryptocurrency, staying ahead of market trends is paramount for success. Embracing crypto trend following strategiesis the key to navigating the volatile waters of digital assets. By leveraging these strategies, investors can capitalize on the momentum of market movements, whether upward or downward, to optimize their returns.

Picture yourself effortlessly riding the waves of Bitcoin's ascent or Ethereum's surge, all thanks to the power of trend following. These strategies empower investors to identify and capitalize on emerging trends, allowing them to enter positions at opportune moments and exit before trends reverse.

Mastering Crypto Trends

Navigating the dynamic realm of cryptocurrency demands a strategic approach, and mastering trend following strategies can be the game-changer in your investment journey. Here are eight proven tactics to help you ride the waves of cryptotrends and unlock the potential for profitable outcomes:

1. Moving Average Crossovers

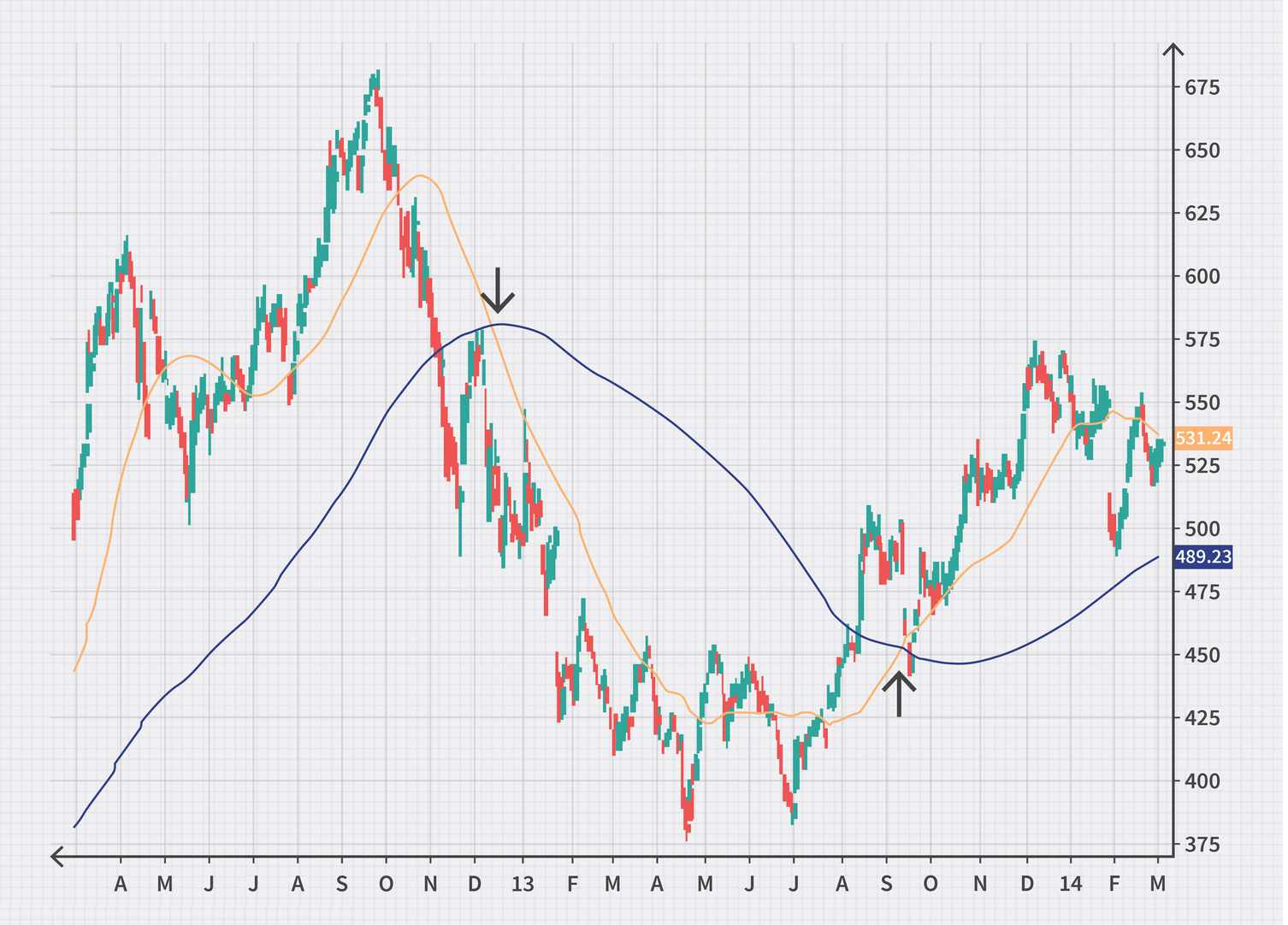

Utilize the power of moving averages to identify shifts in market momentum, signaling optimal entry and exit points for your trades.

2. Relative Strength Index (RSI)

Gauge the strength of a cryptocurrency's price movements to determine overbought or oversold conditions, guiding your trading decisions with precision.

3. Bollinger Bands

Capitalize on volatility by analyzing price volatility and potential breakouts, allowing you to capitalize on emerging trends and maximize profits.

4. MACD (Moving Average Convergence Divergence)

Harness the insights provided by MACD histograms to identify trend reversals and confirm the strength of ongoing trends, empowering you to make informed trading choices.

5. Fibonacci Retracement Levels

Apply Fibonacci retracement levels to pinpoint potential areas of support and resistance, aiding in strategic entry and exit points in volatile crypto markets.

6. Trendline Analysis

Draw trendlines to visualize the direction of price movements and identify trend reversals, providing invaluable guidance for your trading decisions.

7. Volume Analysis

Incorporate volume analysis to validate the strength of price movements, ensuring that your trades align with robust market trends.

8. Ichimoku Cloud

Leverage the comprehensive insights offered by the Ichimoku Cloud indicator, which combines multiple trend-following elements to provide a holistic view of market dynamics, enabling you to make well-informed trading decisions.

What Is Trend Following And Why Is It So Useful For Crypto Trading?

Trend following is a trading strategy that aims to capture gains by riding established price trends, regardless of the underlying asset. In crypto trading, it can be useful for several reasons, but it's essential to acknowledge the risks involved before applying it.

What Is Trend Following?

Trend followers use technical analysis to identify and capitalize on periods of consistent price movement, both upwards (uptrend) and downwards (downtrend). They typically employ tools like:

- Moving averages -Indicate the average price over a specific period, helping gauge the overall trend direction.

- Trendlines -Visually represent support and resistance levels, suggesting future price movements.

- Technical indicators -Signal potential trend reversals or continuations based on momentum or volatility.

Once a trend is identified, they enter positions aligned with the direction and hold them until the trend weakens or reverses. They also employ risk management techniques like stop-loss orders to mitigate losses if the trend changes unexpectedly.

Why Trend Following Can Be Useful In Crypto?

- Crypto's Volatile Nature -Cryptos exhibit strong trends compared to traditional assets, potentially offering larger gains if captured correctly.

- Limited Fundamental Analysis -Due to their young age and complex nature, fundamental analysis of cryptos can be challenging. Trend following offers an alternative approach.

- Reduced Transaction Costs -Compared to high-frequency trading strategies, trend following involves fewer trades, potentially minimizing transaction costs.

The Risks

- False Signals -Technical indicators can generate false signals, leading to losses if blindly followed.

- Trend Reversals -Crypto markets are highly volatile, and trends can reverse quickly, causing significant losses.

- Not Guaranteed Profits -No trading strategy guarantees profits, and past performance is not indicative of future results.

What Are Some Popular Technical Indicators Used In Crypto Trend Following?

Crypto trend following leverages various technical indicators to identify and capitalize on price movements. Here are some popular ones:

Trend Direction

- Moving Averages -Simple Moving Average (SMA), Exponential Moving Average (EMA), and their variations like Double Exponential Moving Average (DEMA) and Triple Exponential Moving Average (TEMA). They smooth price data and identify the general trend direction.

- Trendlines -Manually drawn lines connecting swing highs and lows, visually depicting the trend's direction and potential support/resistance zones.

Momentum And Strength

- Relative Strength Index (RSI) - Measures momentum and potential overbought/oversold conditions, helping spot trend continuations or reversals.

- Stochastic Oscillator -Similar to RSI, but compares closing prices to a price range within a specific period, indicating potential trend exhaustion or continuation.

- Commodity Channel Index (CCI) -Measures momentum and compares current price to the average price over a specific period, identifying possible trend strength and reversals.

Volatility And Breakouts

- Bollinger Bands -Consist of a moving average and two volatility bands. Narrowing bands suggest potential breakouts, while wider bands indicate increased volatility.

- Average True Range (ATR) -Measures volatility by averaging the true range (difference between high and low, or the difference between the close and the previous close) over a specific period.

- Parabolic SAR - A trailing stop-and-reverse indicator that tracks price movement and dynamically adjusts its position to identify potential breakouts and reversals.

Additional Considerations

- MACD Divergence -Observing the difference between the MACD line and its signal line can suggest potential trend reversals when they diverge.

- Volume -Increasing volume alongside rising prices strengthens the uptrend, while decreasing volume might indicate weakening momentum.

- Combination is Key - Using multiple indicators in conjunction can provide a more comprehensive picture of market conditions and potential trends.

Cognitive Biases In Crypto Trading

Crypto trading, much like any other form of active investing, is susceptible to numerous cognitive biases that can cloud judgment and lead to suboptimal decisions. Here are some of the most prevalent biases in crypto trading and how they can negatively impact your experience:

1. Confirmation Bias -This bias arises from the tendency to seek out information that confirms existing beliefs and disregard contradicting evidence. In crypto, this can lead to ignoring negative news about a project or overemphasizing positive developments, potentially driving you to make uninformed investment decisions.

2. Fear of Missing Out (FOMO) -The fear of missing out on a potential surge in price can lead to hasty and impulsive buying decisions, often at the peak of a bubble. This can result in buying high and selling low, incurring significant losses.

3. Overconfidence Bias -An inflated sense of your trading abilities can lead to overestimating your knowledge and taking excessive risks. This can involve disregarding stop-loss orders, trading with large amounts of leverage, or ignoring risk management strategies.

4. Herd Mentality -Following the crowd without proper individual analysis can lead to missed opportunities or being caught in a market crash. In crypto, where trends can be amplified by social media hype, blindly following the herd can be particularly dangerous.

5. Anchoring Bias -This bias involves relying heavily on the initial price information you encounter. For example, if you bought a coin at a high price, you might hold onto it hoping it will reach that price again, even if there are signs it won't.

6. Loss Aversion -The fear of losing money can lead to holding onto losing positions for too long, hoping for a miraculous recovery, instead of cutting your losses and moving on. This can prevent you from adapting to changing market conditions and limit your overall portfolio performance.

7. Sunk Cost Fallacy -When you've already invested time, effort, or money into something, you might feel compelled to stick with it even if it's no longer a good option. This can lead to throwing good money after bad in failing projects.

FAQ's About Crypto Trend Following Strategies

What Is The Best Trend Following Strategy?

A trend-following strategy that combines the 10-period and 20-period Simple Moving Average (SMA) crossovers with the bearish pennant chart pattern can be a powerful approach to identifying and trading bearish trends. We plot the 10-hour and 20-hour SMAs on the chart and look for the formation of a bearish pennant.

How Do I Follow Crypto Trends?

Another tool for identifying probable cryptocurrency market trends, moving averages track the average price points of a crypto asset over a certain timeframe. The longer the time frame, the more it can tone down the daily fluctuations, which for some means it has the potential to be a strong indicator.

Does Trend Following Still Work?

Yes, trend following does work (please also read our take on commodity trading strategy). However, it works best in the commodity futures markets and is less effective in the stock market. Trend following works because they are less likely to get “arbed” away.

Final Words

Crypto trend following strategies represent a powerful arsenal for navigating the ever-changing landscape of digital currencies. By harnessing the insights provided by moving averages, technical indicators like RSI and MACD, and dynamic tools such as Bollinger Bands and Fibonacci retracement levels, investors can effectively ride the waves of market trends and capitalize on profitable opportunities.

Whether you're a seasoned trader or a newcomer to the world of cryptocurrency, these strategies offer a systematic approach to decision-making, enabling you to stay ahead of the curve and maximize your returns.Moreover, the flexibility and adaptability of trend following strategies empower investors to navigate the inherent volatility of crypto markets with confidence.

Stefano Mclaughlin

Author

Camilo Wood

Reviewer

Latest Articles

Popular Articles