5 Explosive Altcoin Season Trading Strategies To Boost Your Portfolio

Maximize Your Crypto Gains: Unleash altcoin season trading strategies! Discover expert tactics to ride the wave of alternative cryptocurrencies, seize opportunities, and skyrocket your portfolio.

Author:Camilo WoodReviewer:James PierceFeb 08, 20244.3K Shares119.5K Views

Are you ready to elevate your cryptocurrency trading game to new heights? Brace yourself for the exhilarating altcoin season trading strategies, where opportunities abound for savvy investors to capitalize on the dynamic fluctuations of alternative cryptocurrencies. In this electrifying landscape, strategic prowess reigns supreme.

From identifying promising altcoins poised for explosive growth to executing precision-timed trades, our expert insights will equip you with the tools needed to navigate the volatile altcoin market with confidence. Discover how to leverage momentum indicators, analyze market sentiment, and implement risk management techniques to stay ahead of the curve.

Altcoin Season Strategies

The season of altcoins is a market cycle when the profitability of alternative coins significantly exceeds the profitability of investments in the main instrument of the cryptocurrency world, BTC.

Here are 5 Explosive Altcoin Season Trading Strategies to Boost Your Portfolio:

1. Don't Invest More Than You Can Afford To Lose

This is another important tip to remember. The altcoin market is very risky, so it's important to only invest money that you can afford to lose.

2. Be Patient

The altcoin market is very volatile, so it's important to be patient and not expect to get rich overnight. If you're looking for quick gains, altcoins are probably not the right investment for you.

3. Diversify Your Portfolio

Don't put all your eggs in one basket. It's important to diversify your portfolio across a variety of altcoins to reduce your risk. This way, if one altcoin goes down, you won't lose everything.

4. Invest In Altcoins With Real-world Use Cases

There are many altcoins out there that are simply scams or have no real-world use cases. When you're investing in altcoins, it's important to focus on projects that have the potential to solve real-world problems and have a positive impact on the world.

5. Do Your Research

This is the most important tip of all. Before you invest in any altcoin, it's important to do your research and understand the project, the team behind it, and the potential risks and rewards. There are many resources available online to help you with your research, such as whitepapers, blog posts, and community forums.

Here Are Some Additional Tips For Trading Altcoins:

- Use a reputable exchange -There are many cryptocurrency exchanges out there, but it's important to use a reputable one that has a good track record. Some popular exchanges include Binance, Coinbase, and Kraken.

- Set stop-loss orders -A stop-loss order is an order that automatically sells your altcoin if it falls below a certain price. This can help you to limit your losses if the market turns against you.

- Take profits -It's important to take profits when you're up. Don't get greedy and hold on to your altcoins for too long, hoping for even higher prices.

How Do I Know Which Altcoin Will Pump?

1. Use CoinGecko to select an exchange with which to view the volumes of assets.

2. Select a lesser-known coin with a large trading volume, which is at least a quarter of the asset's market capitalisation.

3. Use the daily chart of the asset to pick out the support and resistance levels.

Factors Influencing Altcoin Season

Altseason, the period of surging altcoin prices compared to Bitcoin, is a complex phenomenon influenced by various factors. Here's a breakdown of some key influences:

Market-Driven Factors

- Bitcoin Dominance -When Bitcoin's dominance (market share) declines, it often indicates capital flowing into altcoins, potentially triggering Altseason. This can be due to investors perceiving Bitcoin as reaching a peak and seeking higher potential returns elsewhere.

- Macroeconomic Conditions -Broader economic conditions can impact the crypto market, including altcoin season. Bullish periods, with low interest rates and ample liquidity, may encourage risk-taking behavior, driving funds into altcoins. Conversely, bearish downturns can suppress risk appetite and dampen altcoin performance.

- Regulations and News -Regulatory developments and positive news surrounding specific altcoin projects or the wider blockchain industry can fuel optimism and investment inflows, contributing to Altseason. Conversely, negative news or regulatory crackdowns can create uncertainty and hinder altcoin performance.

Investor Behavior

- Risk Appetite and Speculation -During bullish periods, investors may become more comfortable with risk and seek higher potential returns in altcoins, leading to increased buying pressure and price hikes. However, this speculative behavior can also contribute to bubbles and market corrections.

- Fear of Missing Out (FOMO) -When some altcoins experience significant gains, others might see a surge in investment due to FOMO, pushing prices up without necessarily thorough research, potentially leading to unsustainable rallies and crashes.

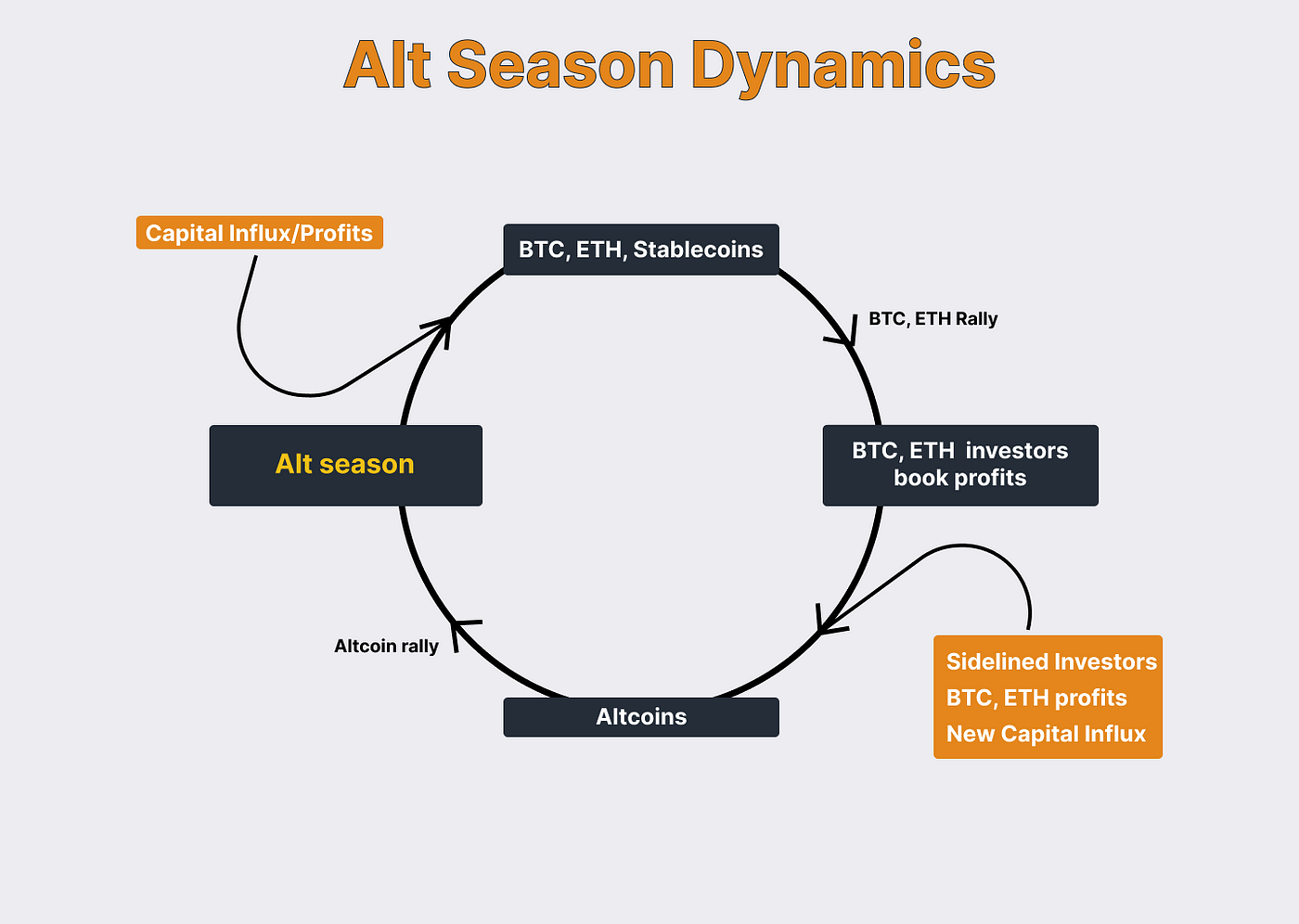

- Profit-Taking and Re-investment -After a Bitcoin bull run, some investors might take profits and diversify their portfolios into altcoins, anticipating further gains. This can create a domino effect as more capital enters the altcoin market.

Other Factors

- Technological Advancements -Breakthroughs in blockchain technology or specific altcoin projects can attract investor interest and adoption, potentially leading to price increases.

- Social Media Hype and Influencer Activity -Social media sentiment and online discussions around specific altcoins can influence investor behavior and buying decisions, impacting their prices.

How To Identify Altcoin Season?

Identifying Altseason can be tricky, as there's no foolproof method and historical patterns may not guarantee future occurrences. However, here are some key indicators and strategies you can use to increase your chances of recognizing it:

Market-Level Indicators

- Bitcoin Dominance - Watch for a decline in Bitcoin dominance (market share) over a sustained period. This can suggest capital flowing into altcoins. However, be mindful of temporary dips and analyze the overall trend.

- Altcoin Market Cap Growth -Monitor the overall market capitalization of altcoins compared to Bitcoin. If altcoins are collectively gaining ground, it might be an early sign of Altseason.

- Trading Volume -Increased trading volume across various altcoins can indicate growing interest and potential momentum. However, distinguish genuine buying from speculative activity.

Technical Analysis

- Altcoin Price Charts -Analyze technical indicators like Relative Strength Index (RSI) and Moving Averages on individual altcoin charts. Look for bullish signals and potential breakouts, but remember these are not guarantees.

- Altseason Index -Some tools track an "Altseason Index" based on the performance of top altcoins against Bitcoin. While not definitive, it can offer a general overview of altcoin sentiment.

Fundamental Analysis

- News and Developments -Stay informed about positive news and developments surrounding specific altcoin projects or the wider blockchain industry. This can fuel optimism and potentially trigger price surges.

- Project Fundamentals -Research the fundamentals of individual altcoins, including their technology, team, and real-world use cases. Don't solely rely on hype or short-term trends.

The Role Of Sentiment And Speculation

Sentiment and speculation play a crucial and intertwined role in shaping Altseason dynamics. Understanding their influence is essential for navigating this volatile period:

Sentiment

- Market Psychology -Altseason thrives on positive market sentiment.News, social media buzz, and community excitement surrounding altcoins can create a self-fulfilling prophecy, attracting more investors and driving prices up. Conversely, negative sentiment can trigger panic selling and price crashes.

- Influencer Impact -Prominent figures in the crypto space can sway sentiment through recommendations, endorsements, or even critical analysis. While some offer valuable insights, be wary of those solely driven by hype or personal gain.

Speculation

- High-Risk, High-Reward -Altcoins inherently attract speculative investors seeking high potential returns. During Altseason, the promise of explosive gains fuels further speculation, driving prices even higher. However, remember that speculation often leads to bubbles and subsequent corrections.

- Short-Term vs Long-Term -Speculation typically focuses on short-term profits, leading to frequent buying and selling, which can increase market volatility. This contrasts with long-term investment strategies based on fundamental analysis and project potential.

- Overvaluation Risks -When speculation dominates, altcoin prices can become overvalued compared to their underlying fundamentals. This can lead to unsustainable rallies followed by sharp corrections, leaving unprepared investors exposed to significant losses.

The Interplay

- Sentiment fuels speculation -Positive sentiment creates a fertile ground for speculative activity, pushing prices up and potentially triggering Altseason.

- Speculation amplifies sentiment -When speculation drives prices up, it reinforces positive sentiment, attracting more investors and further inflating the bubble.

- The flip side -Both sentiment and speculation can turn negative quickly, leading to panic selling and market crashes.

FAQ's About Altcoin Season Trading Strategies

How Do I Prepare For Altseason?

Pay close attention as prices begin to rise, and make sure you sell out from most of your positions before Altseason ends and prices fall as quickly as they rose – don't worry about trying to sell at the very peak, just take profits on the way up and be ready for things to end as quickly as they begun!

What Is The Altcoin Season Cycle?

Altcoin season is a popular trope in the crypto world that references a phase in a market boom cycle when alternative cryptocurrencies (altcoins) begin to outperform Bitcoin (BTC) and more recently, Ethereum (ETH).

How Do You Trade Altcoins For Profit?

Start by creating an account, verifying your identity, and depositing funds, whether in cryptocurrencies or traditional fiat currencies. Opt for market orders for quick execution at the prevailing market price, and employ stop-loss and take-profit orders for managing your trades.

Conclusion

Altcoin season presents a thrilling landscape of opportunity for traders willing to embrace its volatility and harness its potential. Through the implementation of strategic approaches outlined in this guide, you are equipped to navigate the altcoin market with confidence and precision. Remember, success in altcoin trading requires a blend of market knowledge, risk management, and a disciplined approach.

By staying informed, remaining adaptable, and continuously refining your strategies, you position yourself for long-term success in this ever-evolving ecosystem. As you embark on your trading journey, may these insights serve as your compass, guiding you towards profitable decisions and sustainable growth.

Camilo Wood

Author

James Pierce

Reviewer

Latest Articles

Popular Articles