Integral Altcoin Mining Guide For Beginners (2024) To Earn Max Profit

Dive into the world of altcoin mining guide with our comprehensive guide! Uncover the secrets to profitable mining, discover top-performing altcoins, and master the latest techniques. Whether you're a seasoned pro or a newbie, our step-by-step instructions will turn you into a mining expert.

Author:Stefano MclaughlinReviewer:Camilo WoodFeb 05, 202416.2K Shares216.4K Views

Embark on a thrilling adventure into the realm of altcoin mining Guidewith our groundbreaking guide! Uncover the hidden gems of the cryptocurrency world as we demystify the intricacies of mining lesser-known coins. From setting up your mining rig to optimizing hash rates, our expert tips and insider knowledge will empower you to navigate the complex landscape of altcoin mining like a seasoned pro.

Discover the untapped potential of alternative cryptocurrencies and unlock new streams of income as you follow our comprehensive step-by-step instructions. Whether you're a curious beginner or a seasoned enthusiast, our altcoin mining guide is your key to unlocking the lucrative world of digital assets. Join us on this exciting journey and turn your passion for crypto into a profitable venture with the ultimate guide to altcoin mining!

How To Mine Altcoins?

Here's the general guide to get you started:

1. Choose An Altcoin

Research -different altcoins, considering factors like:

- Mining algorithm -Choose one suitable for your hardware (e.g., CPU, GPU).

- Difficulty level -Lower difficulty means easier mining but potentially lower rewards.

- Market potential -Consider the altcoin's long-term viability and adoption.

Popular optionsin 2024 include:

- Monero (XMR) -CPU-mineable privacy coin.

- Ravencoin (RVN) -GPU-mineable asset issuance platform.

- Ergo (ERG) -GPU-mineable smart contracts platform.

2. Select A Mining Method

- Solo Mining -You mine independently, keeping all rewards but facing high difficulty and competition.

- Mining Pools -Combine resources with others for better chances of finding blocks and share rewards based on contribution.

3. Set Up Your Mining Rig

- Solo Mining - Choose hardware based on the altcoin's algorithm (e.g., ASICs for Bitcoin, GPUs for Ethereum).

- Mining Pools -Often offer software compatible with various hardware.

- Cloud Mining -Rent hashing power from cloud providers (involves trust and fees).

4. Start Mining

- Follow the chosen pool's or software's instructions.

- Monitor your progress and earnings regularly.

- Be prepared for adjustments as difficulty levels change or profitability fluctuates.

Risks

- Volatility -Altcoin prices can fluctuate significantly, potentially leading to losses.

- Hardware Costs -Building or buying a mining rig requires upfront investment, with no guarantee of ROI.

- Electricity Consumption -Mining can be energy-intensive, resulting in high electricity bills.

- Competition -Difficulty levels for mining popular altcoins like Ethereum have increased dramatically, making solo mining less profitable.

- Scams -Be wary of cloud mining services or get-rich-quick schemes, as many are fraudulent.

Limitations

- Profitability -Mining profitability depends on various factors, and it's often difficult to predict future earnings.

- Technical Knowledge -While some altcoins can be mined with user-friendly software, others require more technical expertise.

- Environmental Impact -The energy consumption of mining raises concerns about its environmental sustainability.

What Is Altcoin Mining & How Does It Work?

Altcoin mining, at its core, follows the same principles asBitcoinmining, but with some variations depending on the specific altcoin:

The Basics

- Verifying transactions -Just like in Bitcoin, miners use their computing power to verify and secure transactions on the altcoin's blockchain.

- Adding new coins -As a reward for their work, miners earn newly created altcoins. This process helps regulate the total supply of the coin.

- Competition -Miners compete to solve complex mathematical puzzles. The first one to find a solution gets the rewards.

Key Differences

- Algorithms -While Bitcoin uses Proof-of-Work (PoW), many altcoins use different consensus mechanisms like Proof-of-Stake (PoS) or Proof-of-Authority (PoA). These can change how mining works and who can participate.

- Hardware -PoW often relies on specialized hardware like ASICs or GPUs, but some altcoins can be mined with regular computers (CPUs).

- Rewards -The amount and type of rewards can vary depending on the altcoin's economics.

Breakdown Of The Process

- Transactions occur -Users send and receive altcoins on the network.

- Transactions are bundled -These transactions are grouped into "blocks" of data.

- Miners compete -Miners use their hardware to solve complex calculations related to the block.

- Winner validates -The first miner to solve the puzzle validates the block and adds it to the blockchain.

- Rewards distributed -The winning miner receives newly created altcoins as a reward, plus transaction fees (if applicable).

What Are The Different Types Of Altcoin Mining?

There are several different ways to approach altcoin mining, each with its own advantages and disadvantages. Here are the main types:

1. Solo Mining

- Individual effort - You mine directly on the network without relying on others.

- Full control -You have complete control over your mining process and rewards.

- Low probability of success -The chances of finding a block and earning rewards are very low, especially for popular altcoins.

- High resource demands -Requires powerful hardware and consumes significant electricity.

2. Pool Mining

- Combined resources -Join a group of miners to share computing power and increase the chance of finding blocks.

- Faster rewards -Pools distribute rewards more frequently, even if smaller in size compared to solo mining.

- Lower control -You share rewards with the pool according to pre-defined rules.

- Pool fees -Pools charge fees for their services, typically a percentage of earned rewards.

3. Cloud Mining

- Rent processing power - Pay a service provider to use their remote mining hardware.

- Convenient - No need to invest in your own hardware or manage maintenance.

- Limited control -You have minimal control over the mining process and hardware quality.

- Potential scams -Beware of unreliable providers, compare fees and transparency carefully.

- Lower profitability -Profits are shared with the provider, often resulting in lower returns.

4. Hybrid Mining

- Combine different methods -Utilize a combination of solo mining, pool mining, and cloud mining depending on your goals and resources.

- Increased flexibility -Allows for adjusting strategy based on market conditions and profitability.

- More complex management - Requires careful planning and monitoring of different mining activities.

5. Specialized Mining Methods

- Some altcoins use different consensus mechanisms beyond Proof-of-Work (PoW).

- Staking -Hold specific altcoins to participate in network validation and earn rewards (Proof-of-Stake, PoS).

- Masternode hosting -Operate a specialized server to secure the network and receive rewards (specific to certain PoS systems).

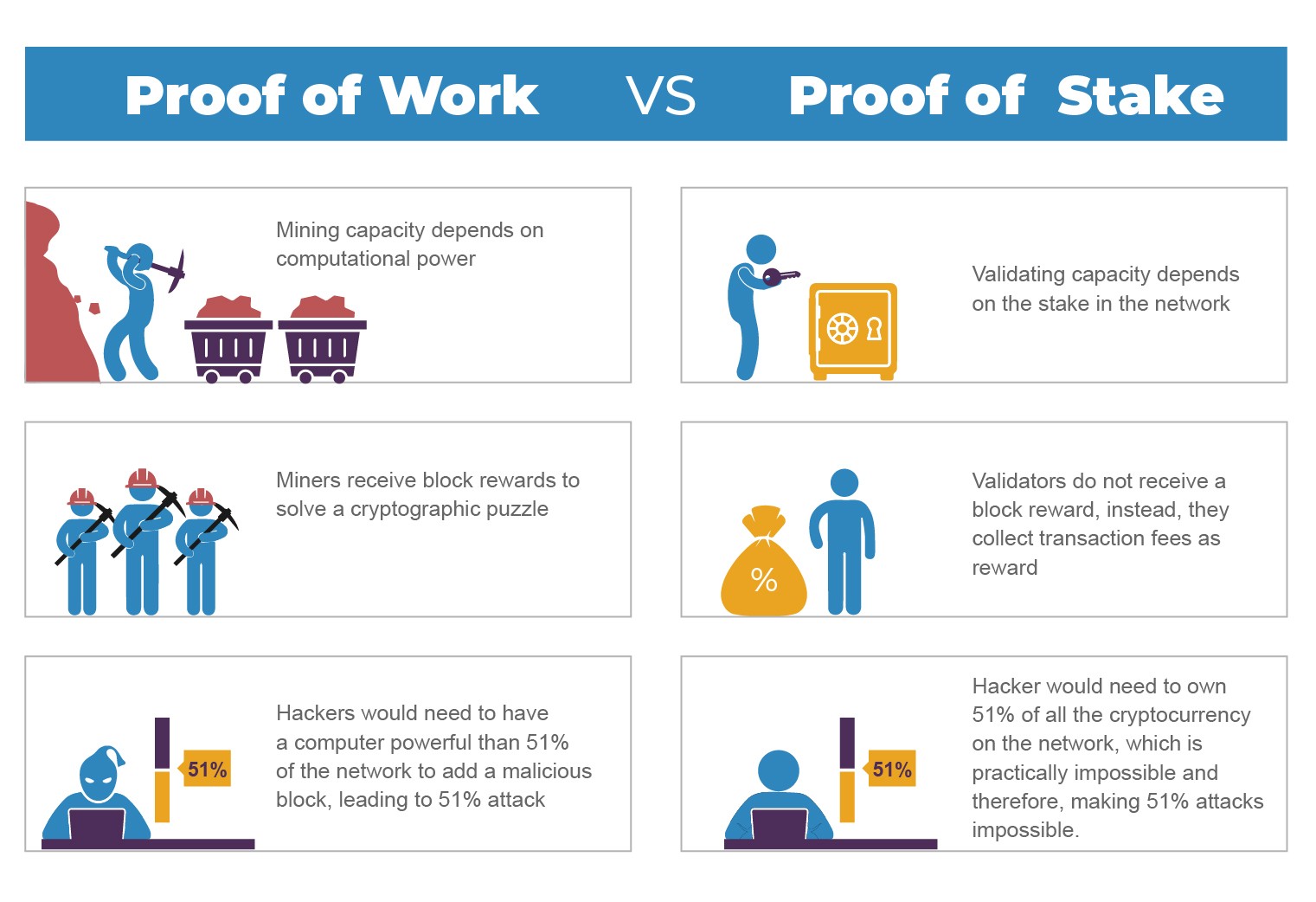

Proof-of-work Mining Vs Proof-of-stake Mining

Both Proof-of-Work (PoW) and Proof-of-Stake (PoS) are consensus mechanisms used in blockchains to validate transactions and secure the network, but they achieve this in fundamentally different ways. Here's a breakdown of their key differences:

1. Proof-of-Work (PoW)

- Validation -Miners compete to solve complex mathematical puzzles. The first one to find a solution gets to validate the block of transactions and add it to the blockchain.

- Security -The difficulty of solving the puzzles is adjusted to maintain a desired block creation rate, making it computationally expensive to tamper with the blockchain.

- Rewards -Miners are rewarded with newly created coins and transaction fees for their work.

Drawbacks

- High energy consumption -Requires specialized hardware (ASICs or GPUs) which can be expensive and energy-intensive, raising environmental concerns.

- Centralization -Powerful miners or mining pools can potentially gain control over the network.

- Scalability -Transaction processing can be slow due to the competition-based nature.

2. Proof-of-Stake (PoS)

- Validation -Validators are chosen based on the amount of cryptocurrency they have "staked." The more coins they stake, the higher the chance of being selected to validate the next block.

- Security -The more coins someone has staked, the more they have to lose if they try to attack the network, creating a strong incentive for honest behavior.

- Rewards -Validators earn transaction fees or newly created coins as rewards for their service.

Drawbacks

- Potentially less secure -Compared to PoW, a large stake holder could theoretically attack the network if they hold a significant portion of the coins.

- Centralization -Can still be susceptible to centralization if a few entities hold a large majority of the staked coins.

- Technical complexity -Implementing and maintaining a PoS system can be more complex than PoW.

Which Altcoins Are The Most Profitable To Mine?

Unfortunately, it's impossible to definitively say which altcoins are the mostprofitable to mine at any given time. Profitability depends on several constantly changing factors, making it crucial to conduct your own research before investing:

Key Factors Influencing Profitability

- Market price of the altcoin -Higher coin value generally leads to potentially higher profits.

- Mining difficulty -Higher difficulty means it's harder to find blocks and earn rewards, reducing profitability.

- Your hardware efficiency -More efficient hardware consumes less energy and mines faster, increasing profitability.

- Electricity costs -Higher electricity costs significantly impact profitability, especially for energy-intensive mining.

- Network hashrate -Higher hashrate (combined mining power) increases difficulty and reduces individual rewards.

- Transaction fees -Some altcoins offer transaction fees as rewards, which can contribute to profitability.

Instead of searching for the "most Profitable," consider these approaches:

1. Focus On Altcoins With

- Lower difficulty -Easier to mine, potentially leading to faster rewards.

- Stable or growing market value -Increases potential long-term profit.

- Algorithms suitable for your hardware -Match your hardware capabilities to the coin's algorithm (e.g., CPU for XMR, GPU for Ravencoin).

2. Continuously Monitor And Adapt

- Regularly check profitability estimations for your chosen altcoin.

- Adjust your mining strategy or switch coins based on changing market conditions and difficulty levels.

3. Join Mining Pools

- Share resources and increase chances of finding blocks, even with less powerful hardware.

- Research reputable pools with fair fee structures and good track records.

What To Look For When Choosing A Coin?

Choosing the right cryptocurrency depends on your goals and risk tolerance. Here are some key factors to consider:

Investment Goals

- Short-term trading -Are you looking for quick gains through fluctuations in price?

- Long-term investment -Do you believe in the long-term potential of a project and its token?

- Utility -Do you intend to use the coin for specific applications within its ecosystem?

Token Characteristics

- Market capitalization -How large is the total market value of the outstanding tokens?

- Liquidity -How easily can you buy and sell the token?

- Volatility -How much does the price of the token fluctuate?

- Regulations -Are there any regulatory concerns surrounding the project or token?

FAQ's About Altcoin Mining Guide

How Do You Mine Altcoins?

There are a few different ways to mine altcoins. The most common way is to use a CPU or GPU miner. These are programs that use your computer's processing power to mine for coins. However, this can be very resource-intensive, and it may not be profitable unless you have a very powerful computer.

How To Find 100x Altcoin?

Discovering the "100x Altcoin" involves steps like filtering by market cap, checking trading volume, assessing exchange listings, analyzing on-chain data, evaluating development activity, and considering team quality and community engagement.

What Is The Fastest Coin To Mine?

Litecoin has a faster block time than Bitcoin, which means faster confirmation of transactions and more frequent rewards for miners. Litecoin has an average block time of 2.5 minutes, compared to Bitcoin's 10 minutes.

Conclusion

Our altcoin mining guide is your passport to a realm of financial independence within the dynamic world of cryptocurrencies. We've covered everything from the basics to advanced strategies, ensuring that both beginners and seasoned miners alike can embark on a successful mining journey.

As you navigate through the intricacies of altcoin mining, remember that continuous learning and adaptation are key to staying ahead in this ever-evolving landscape. Now armed with the knowledge to identify promising altcoins, optimize mining setups, and maximize profits, you're ready to embark on a thrilling adventure that could reshape your financial future.

See Also: 10 Best Performing Altcoins Of 2024

Stefano Mclaughlin

Author

Camilo Wood

Reviewer

Latest Articles

Popular Articles