How To Find Retailers Who Accept Starter Checks

Discovering who accepts starter checks introduces a convenient payment method for various transactions. Businesses often receive small checks called "starter checks" to help them get their operations off the ground.

Author:Luqman JacksonReviewer:Liam EvansJan 15, 20244.2K Shares65.9K Views

Discovering who accepts starter checksintroduces a convenient payment method for various transactions. Businesses often receive small checks called "starter checks" to help them get their operations off the ground.

New hires typically take advantage of them as a low-paying stepping stone to learning the ropes of the company.

You can pay for your first purchase with a starter check at some stores like Target, Walmart, and The Home Depot. As a standard feature of most new checking accounts, they are convenient for making regular purchases.

Personal information is not included on starter checks, but routing, processing, and transfer details such as bank ACH and account numbers are. A starter check is easily identifiable by its low check number.

Unlike ordinary checks, these are instruments that the bank can negotiate. Moving out of state often necessitates closing bank accounts in order to save money, so starter checks are a common form of payment during this time.

What Are Starter Checks?

New hires often get "starter checks," which are smaller bank accounts, to help them get their businesses off the ground. Usually, these are entry-level positions with low pay that teach employees the ropes of the company and pave the way for promotions.

Retailers such as Walmart, Target, The Home Depot, and The Home Depot frequently take starter checks as initial payments. When it comes to starter checks, some companies are more forgiving than others.

Like standard checks, starter checks include the account and ACH routing number at the very bottom. Businesses are obligated to offer a range of benefits and perks to their employees, in addition to salary. As a means of doing this, some businesses provide starter checks.

The account and ACH routing number are located at the bottom of starter checks, which are otherwise identical to standard checks. Starter checks are accepted as payment at many establishments, including Walmart, Target, The Home Depot, and Walmart.

Prospective workers can learn more about the organization and its needs by familiarizing themselves with the starter check requirements.

Is A Starter Check Free?

Indeed, in many cases, starter checks are provided free of charge, especially when using the basic generic template where you input your personal information.

It's important to keep in mind that if you choose customized starter checks that the bank prints with your personal information already on them, there may be additional costs involved. These checks are commonly referred to as counter checks or instant counter checks.

Unfortunately, some banks have started viewing the printing of temporary checks, including counter checks, as a new revenue source. This shift in approach has raised concerns and garnered negative attention, as it seems counterintuitive at a time when the banking industry is transitioning towards a more cashless system.

The prospect of charging fees for starter checks, even if temporary, adds to the existing grievances people have regarding banking fees.

This move has the potential to create a poor public relations image for banks, particularly as customers may find it discouraging to open a new checking account only to be unexpectedly charged for temporary counter checks.

In such cases, my advice would be to explore alternative banking options that align more favorably with your preferences and financial expectations, avoiding unnecessary fees for temporary checks during the account-opening process.

Starter Check Vs Regular Check

Starter checks and permanent checks exhibit notable distinctions, highlighting their unique characteristics.

Starter Check

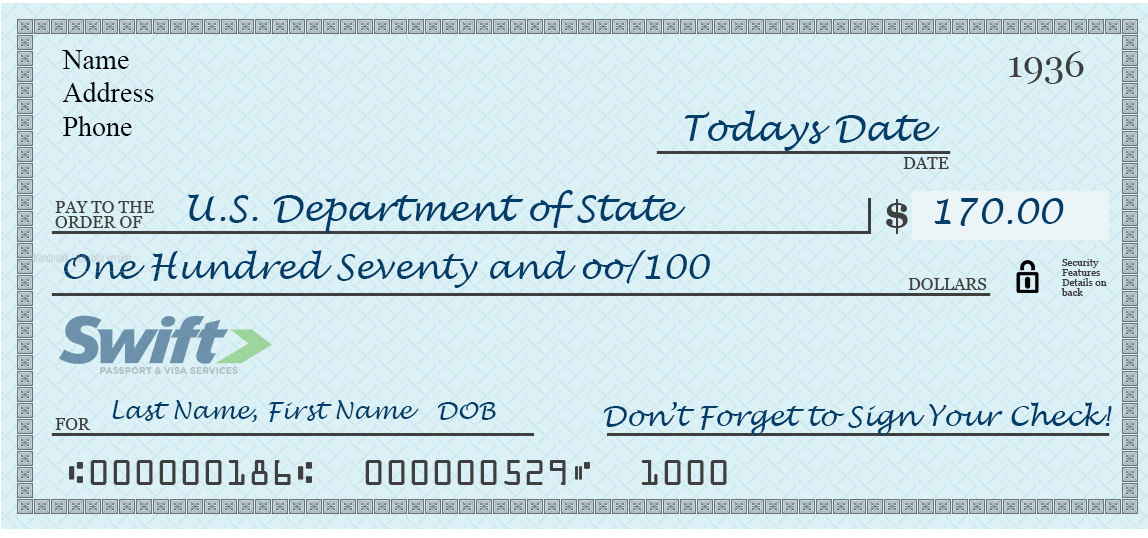

- Lacks pre-printed personal information on the check.

- Displays a very low check number in the upper right-hand corner.

- May or may not include the bank account number along the bottom.

- Some businesses might be hesitant to accept starter checks.

- Customized starter checks feature the bank name and address, while generic ones do not.

Regular Check

- It comes with pre-printed personal information on the check.

- Can have a high or low check number printed on the check.

- It includes the bank routing number and customer account number at the bottom.

- Generally accepted by all companies for transactions, although some may require ID verification.

It's essential to recognize that a starter check serves as a temporary, non-customized solution until regular checks arrive. It is distinct from basic checks, which banks often provide for free to new account holders. These basic checks should not be confused with starter checks due to their inherent differences.

Who Accepts Starter Checks?

Numerous stores and establishments in close proximity accept personal checks, including starter checks, providing convenient options for various transactions. From gas stations to department stores, these checks are widely accepted, making them versatile for everyday use.

In certain instances, even landlords are willing to acknowledge starter checks as a valid form of rent payment, particularly for new tenants who may be in the process of establishing new banking and checking accounts. For tenants relocating from different areas, this flexibility is valuable during the transition period.

In the realm of utility bill payments, companies often accept starter checks sent through the mail, sparing customers the need for a new check. The inclination is to attempt depositing the check if it is in hand, rather than returning it.

While there are limited grocery stores that accept temporary checks, Publix is an exception, providing a service to cash both temporary and personal checks. This convenience, however, requires customers to provide photo ID, address details, and phone numbers.

On the other hand, Walmart does not accept temporary checks according to its check cashing policy. Nevertheless, Walmart accommodates a variety of other check types, including government checks, payroll checks, tax refund checks, insurance settlement checks, cashier's checks, and retirement account disbursement checks.

Walmart's check cashing services extend to pre-printed checks, and the store also offers a convenient location for purchasing money orders.

While Target does not cash temporary checks, an alternative is to explore online shopping with eCheck purchases, eliminating the need for a temporary check.

Surprisingly, 7-Eleven stands out as a location that accepts starter checks through the Transact card, offering a convenient check-cashing option. Customers should ensure they have the necessary ID and familiarize themselves with 7-Eleven's check-cashing policies for a seamless experience.

What Places Accept Starter Checks?

While it's true that some businesses may accept counter checks like starter checks, there are notable exceptions and risks associated with their use.

Despite their potential utility, not every place that accepts checks will necessarily take starter checks. Unlike regular printed checks, starter checks lack the assurance of legitimacy as they often come from new accounts and may be considered more prone to fraudulent activity.

Printed checks from established accounts provide a certain level of confidence to retailers and businesses, knowing there's recourse in case of issues. On the other hand, starter checks carry higher risks, including the possibility of being fraudulent or bouncing due to insufficient funds.

Merchants may hesitate to accept counter checks because they lack the account holder's personal information and are printed on regular paper, making them potentially easier to replicate or misuse. The absence of personal details complicates the verification process for merchants trying to confirm the identity of the account holder.

For instance, major retailers like Walmart generally do not accept starter checks due to the associated risks and the potential for losses on their end. Businesses that do accept them often engage in thorough verification processes, requesting proof of personal information, checking photo IDs, noting driver's license numbers on the check, and even contacting the bank for fund verification.

However, despite these limitations, starter checks can still serve a purpose, such as paying bills, including monthly utility bills, where the risks may be lower compared to in-store transactions.

Nevertheless, it remains crucial to have alternative payment methods, such as debit cards, credit cards, or cash, readily available during shopping trips to ensure a smooth and secure transaction process.

How To Use Starter Check

Find out if the location you need to visit accepts starter checks by doing some online research or by contacting them directly. Due to the inherent risk, many businesses, including banks, gas stations, and grocery stores, no longer accept starter checks. What to do with starter checks while you wait is more important than asking if you can use them.

People nowadays mostly use cash or credit cards when making purchases. You can pay digitally before the physical versions come, with options like Apple Pay. Keep some starter checks on hand in case you ever need to write a check. If you want to avoid rejection from stores, it's recommended that you wait a few weeks before using starter checks.

You can confidently make out checks to someone once your new checkbook arrives. Another choice would be to inquire about the bank's in-house printing capabilities; this would allow them to print out temporary checks that appear like regular checks by adding your name and address.

There is typically a small fee for this service, but it might be worthwhile if you anticipate writing a lot of checks before your checkbook arrives.

Are Starter Checks Valid Checks?

A starter check can be used for a lot of things, like paying bills, buying groceries, paying for daycare, and even getting a car loan. Because they don't have the necessary personal and security information, they pose a greater risk of fraud to merchants and vendors.

Starter checks do not include the printing of the issuing bank and financial institution, whereas regular checks do.

Due to the absence of an address on the check, private parties and dealerships may refuse to accept starter checks as payment for cash when purchasing a new car.

These establishments might have trouble matching the check with a driver's license. In contrast to starter checks, you can use the name of a bank or other financial institution to pay for a vehicle with cash.

What Banks Give Starter Checks?

Many financial institutions, including Morgan Stanley, JP Morgan Chase Bank, and Bank of America, offer starter checks to account holders. However, some individuals prefer to forgo checks initially and rely on the immediate issuance of a debit card at the time of account opening.

Banks like Navy Federal Credit Union, Ally Bank, and CitiBank offer temporary checks, allowing customers to conduct transactions before receiving their regular checks. Some banks, including US Bank, Capital One, BB&T Bank, Key Bank, PNC Bank, and TD Bank, also offer starter checks as part of their account services.

Most banks offer complimentary checks when a new account is opened, providing an initial supply for convenience. It is advisable to explore the terms and conditions related to these checks, as some accounts may have varying eligibility criteria.

As banking practices evolve, individuals can explore the options provided by their chosen financial institutions to meet their specific needs.

FAQs

Can I Use Starter Checks To Pay Rent To My Landlord?

Yes, many landlords accept starter checks as a form of payment for rent, especially for new tenants.

Do Grocery Stores Generally Accept Starter Checks For Purchases?

While some grocery stores may accept starter checks, it's not a common practice. However, specific stores like Publix might cash them with proper identification.

Does Walmart Cash Starter Checks As Part Of Its Check-cashing Policy?

Walmart does not cash starter checks, but it accepts various other types of checks, including government checks, payroll checks, and tax refund checks.

Are Online Purchases With ECheck An Alternative For Those Concerned About Using Starter Checks In Stores?

Yes, shopping online with eCheck purchases eliminates the need to use starter checks, providing a convenient alternative.

Can I Cash A Starter Check At 7-Eleven?

Yes, you can cash your starter check at 7-Eleven using the Transact card, ensuring you have the necessary identification as per their check-cashing policies.

Final Words

In conclusion, knowing who accepts starter checks unveils a spectrum of options, offering individuals flexibility and accessibility in their financial transactions.

Whether it's grocery stores, utility companies, or even certain landlords, the acceptance of starter checks contributes to their practicality in various scenarios.

Paying bills with a starter check is a quick fix until your regular check arrives. You can use them to set up direct deposit or online bill pay, which can be helpful in a pinch. On the other hand, not all stores will take them.

Before attending college, high school seniors might benefit from starter checks. These checks may be less likely to be scrutinized if you print your name, address, and bank details on them. Printing is generally well-received by retailers and department stores.

Alternatively, you can avoid the hassle of temporary checks by paying for everyday purchases or bills online with a debit card. While you wait for permanent printed checks, there are other options that are just as convenient.

Luqman Jackson

Author

Liam Evans

Reviewer

Latest Articles

Popular Articles