Which Investment Data Is Best Modeled By An Exponential Function - Exploring Data Based Investment

Investing in financial markets involves analyzing various types of data to make informed decisions. One powerful mathematical tool that can be employed for modeling certain investment data is the exponential function. In this article, we will explore the types of investment data that are best suited for modeling using an exponential function, providing insights into how this mathematical model can enhance decision-making in the financial realm to answer the questions which investment data is best modeled by an exponential function?

Author:James PierceReviewer:Camilo WoodJan 29, 202413 Shares12.5K Views

Investing in financial markets involves analyzing various types of data to make informed decisions. One powerful mathematical tool that can be employed for modeling certain investment data is the exponential function. In this article, we will explore the types of investment data that are best suited for modeling using an exponential function, providing insights into how this mathematical model can enhance decision-making in the financial realm to answer the questions which investment data is best modeled by an exponential function?

Understanding Exponential Functions In Finance

In the intricate landscape of finance, mathematical models play a pivotal role in deciphering and predicting the complexities inherent in investment scenarios. One such powerful model is the exponential function, a mathematical construct that encapsulates the constant rate of growth or decay. Before we explore its application in specific investment contexts, let's lay the groundwork by delving into the essence of exponential functions in the realm of finance.

The Essence Of Exponential Functions

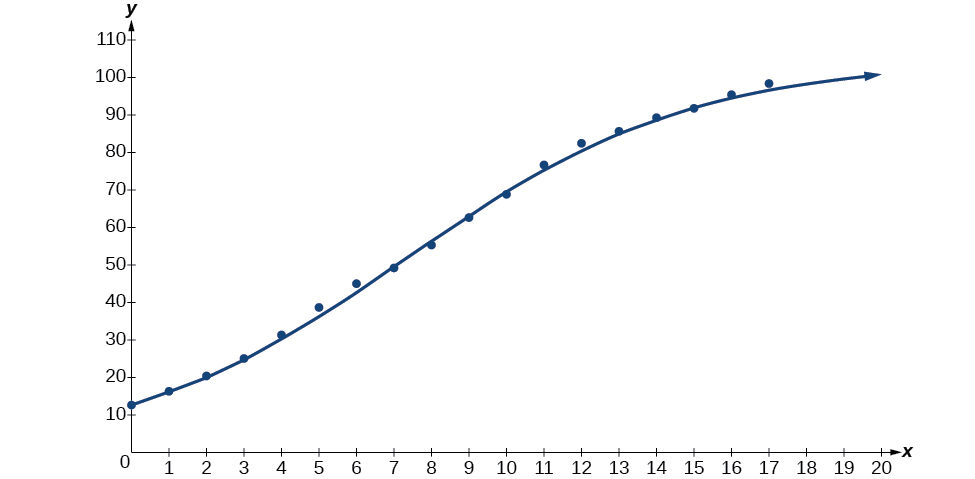

At its core, an exponential function is a mathematical expression that describes the phenomenon of compounded growth or decay. In simpler terms, it captures the idea that a quantity increases or decreases at a consistent percentage rate over a specified period. This makes exponential functions particularly adept at modeling processes characterized by continuous, compounded changes over time.

Compounded Growth In Financial Terms

In the financial arena, compounded growth is a fundamental concept that underscores the potential for investments to accrue value exponentially. Whether it's the appreciation of asset prices, the expansion of a portfolio, or the accumulation of interest, exponential functions provide a sophisticated framework to map out these dynamic financial processes.

Investment Value Dynamics

Consider an investment that undergoes compounded growth. The value of the investment doesn't increase or decrease by a fixed amount but rather by a percentage of the current value. This characteristic aligns seamlessly with the nature of exponential functions, where the growth or decay is proportional to the existing value. Consequently, when plotting investment value against time, the resulting curve often follows an exponential trajectory.

Constant Percentage Rate In Finance

One of the defining features of exponential functions in finance is the concept of a constant percentage rate. This means that the rate at which an investment grows or diminishes remains uniform throughout the investment horizon. This uniformity simplifies the modeling process, allowing investors and analysts to apply a consistent mathematical framework to understand and predict financial outcomes.

Predictive Power

By grasping the constant percentage rate inherent in exponential functions, financial professionals can make more accurate predictions about the future values of investments. This predictive power is invaluable in a field where foresight and proactive decision-making are paramount.

Benefits Of Exponential Modeling In Finance

Embracing exponential modeling in the financial realm offers a myriad of advantages, equipping investors and analysts with powerful tools to unravel the intricacies of dynamic markets. Let's explore the key benefits that exponential functions bring to the forefront:

Compounded Growth Mastery

At the heart of exponential modeling lies an unparalleled ability to capture compounded growth. In the world of finance, where returns on investments often compound over time, exponential functions emerge as indispensable tools. Whether analyzing the appreciation of asset values or the compounded returns of a portfolio, these functions provide a robust framework for depicting the snowball effect of consistent, compounding growth.

Time Sensitivity Unveiled

Investments are inherently influenced by time-sensitive factors, and exponential functions excel in illustrating how these factors evolve over time. The dynamic nature of financial markets demands a nuanced understanding of how values fluctuate with the passage of time. Exponential modeling, by virtue of its time-sensitive nature, empowers investors to discern the trajectory of financial phenomena, facilitating more informed and timely decision-making.

Precision In Risk Assessment

Understanding the inherent risks associated with an investment is a cornerstone of effective financial management. Exponential functions prove invaluable in this domain by facilitating meticulous modeling of the potential growth or decline of an investment. This, in turn, enables investors to conduct thorough risk assessments, identifying vulnerabilities and opportunities with a level of precision that traditional models may fall short of achieving. Armed with this insight, stakeholders can implement strategic measures to both assess and mitigate risks effectively.

Risk Mitigation Strategies

The ability to model potential growth or decline using exponential functions enhances risk mitigation strategies. Investors can proactively adjust their portfolios, hedge against potential downturns, or seize opportunities aligned with the expected growth trajectory—all informed by the comprehensive risk assessments derived from exponential modeling.

Strategic Decision-Making

In the dynamic and unpredictable landscape of finance, strategic decision-making is paramount. Exponential modeling, with its ability to capture compounded growth, navigate time-sensitive factors, and assess risks with precision, becomes an indispensable ally in the strategic decision-making process. Investors armed with insights derived from exponential functions are better equipped to seize opportunities, navigate uncertainties, and optimize their financial portfolios for sustained success.

Investment Data Suited For Exponential Modeling

In the ever-evolving landscape of finance, certain types of investment data lend themselves particularly well to the application of exponential modeling. Here, we explore two key areas where exponential functions prove to be powerful tools for analysis and prediction:

Stock Prices Over Time

Stock prices are renowned for their dynamic nature, characterized by volatility and the potential for exponential growth. Companies positioned for substantial expansion, especially in emerging industries, often witness exponential surges in their stock prices over time. The inherent compounding effect in stock valuation can be effectively captured and visualized using exponential functions. By analyzing historical stock data through this lens, investors gain valuable insights into the potential future trends of stock prices.

Strategic Investment Planning

Armed with the foresight derived from exponential modeling, investors can strategically plan their investments, anticipating potential surges or downturns in stock prices. This nuanced understanding enables a more proactive and informed approach to portfolio management.

Cryptocurrency Valuations

Cryptocurrencies, exemplified by the likes of Bitcoin and Ethereum, are renowned for their volatile price movements. Exponential modeling is particularly well-suited to capture the exponential valuation patterns inherent in the cryptocurrency market. The limited supply of digital assets coupled with an ever-increasing demand contributes to the exponential growth potential. Investors keen on navigating the complex and unpredictable world of cryptocurrencies can leverage exponential functions to predict potential price trajectories.

Navigating Cryptocurrency Volatility

Cryptocurrency markets are notorious for their volatility, and exponential modeling serves as a navigational tool in this unpredictable terrain. By understanding the exponential nature of cryptocurrency valuations, investors can make more informed decisions, mitigating risks and capitalizing on potential growth opportunities.

Technology Adoption Rates

The integration of new technologies into society often unfolds in an exponential manner. Companies pioneering technological advancements frequently experience rapid and exponential growth in user adoption and market share. The journey from early adoption to widespread usage typically follows an exponential curve, showcasing the potential for transformative shifts within the technology sector. By employing exponential functions, investors gain a powerful tool for modeling and predicting technology adoption rates.

Spotting Lucrative Opportunities

Technological breakthroughs can lead to paradigm shifts, creating opportunities for savvy investors. By leveraging exponential modeling, investors can identify key inflection points in technology adoption, allowing them to strategically position themselves to capitalize on the growth trajectory of innovative companies.

Population Growth In Emerging Markets

Emerging markets are characterized by exponential population growth, a phenomenon that significantly impacts various industries. Investments in sectors catering to these regions, such as consumer goods and infrastructure, stand to benefit from a nuanced understanding of population growth trends. Exponential functions prove invaluable in modeling the population dynamics of emerging markets, offering investors insights into the potential demand for diverse products and services.

Anticipating Demand In Emerging Economies

The exponential population growth in emerging markets signals a rising tide of potential consumers. Investors equipped with the ability to model and comprehend this growth using exponential functions are better positioned to anticipate and meet the increasing demand for goods and services, fostering strategic investments in burgeoning economies.

Which Investment Data Is Best Modeled By An Exponential Function - FAQs

Which Set Of Data Would Best Be Modeled By An Exponential Function?

The set of data that would best be modeled by an exponential function is one where the values exhibit compounded growth or decay over time. Examples include stock prices, population growth, technological adoption rates, and certain financial instruments.

Which Investment Data Is Best Modeled By An Exponential Function Abcd?

- A. Stock Prices Over Time:Exponential functions are well-suited for modeling the volatility and potential for exponential growth observed in stock prices.

- B. Cryptocurrency Valuations:Cryptocurrencies, characterized by volatile and exponential price movements, are ideal candidates for modeling using exponential functions.

- C. Technology Adoption Rates:The adoption of new technologies often follows an exponential curve, making it suitable for modeling with exponential functions.

- D. Population Growth in Emerging Markets:Exponential population growth in emerging markets can be effectively modeled using exponential functions, especially for industries like consumer goods and infrastructure.

Which Situation Could Be Best Modeled With An Exponential Function?

A situation that involves compounded growth or decay over time, such as the adoption of new technology, the growth of a population, or the appreciation of an investment with a consistent percentage rate, could be best modeled with an exponential function.

How Are Exponential Functions Used In Finance?

Exponential functions play a crucial role in finance by providing a mathematical framework to model and analyze various financial phenomena:

- Compounded Growth:Exponential functions are employed to capture compounded growth, making them suitable for modeling investment returns that increase or decrease at a consistent percentage rate over time.

- Time Sensitivity:Exponential functions help illustrate how financial factors evolve over time, allowing for a better understanding of the timing and duration of financial trends.

- Risk Assessment:Exponential functions aid in modeling the potential growth or decline of investments, facilitating a more accurate assessment of risks associated with financial decisions.

- Strategic Decision-Making:By leveraging exponential modeling, investors can make informed decisions, strategically plan investments, and navigate the dynamic landscape of financial markets with greater precision.

Conclusion

In the dynamic world of finance, where trends and patterns constantly evolve, employing mathematical models like exponential functions can provide a competitive edge to investors. Understanding which investment data is best modeled by an exponential function enables investors to make more accurate predictions, manage risks effectively, and capitalize on lucrative opportunities. Whether analyzing stock prices, cryptocurrency valuations, technology adoption rates, or population growth, the versatility of exponential functions makes them a valuable tool for informed decision-making in the realm of investments.

James Pierce

Author

Camilo Wood

Reviewer

Latest Articles

Popular Articles