What Is Tax Avoidance - Navigating The Fine Line Between Legality And Ethics

What is tax avoidance? It refers to legally minimizing tax liabilities through strategic financial planning within existing laws. It involves leveraging deductions, credits, and loopholes to reduce tax obligations. While technically legal, it can raise ethical concerns regarding fairness and equity in the tax system.

Author:Emmanuella SheaReviewer:Frazer PughMar 06, 2024353 Shares16K Views

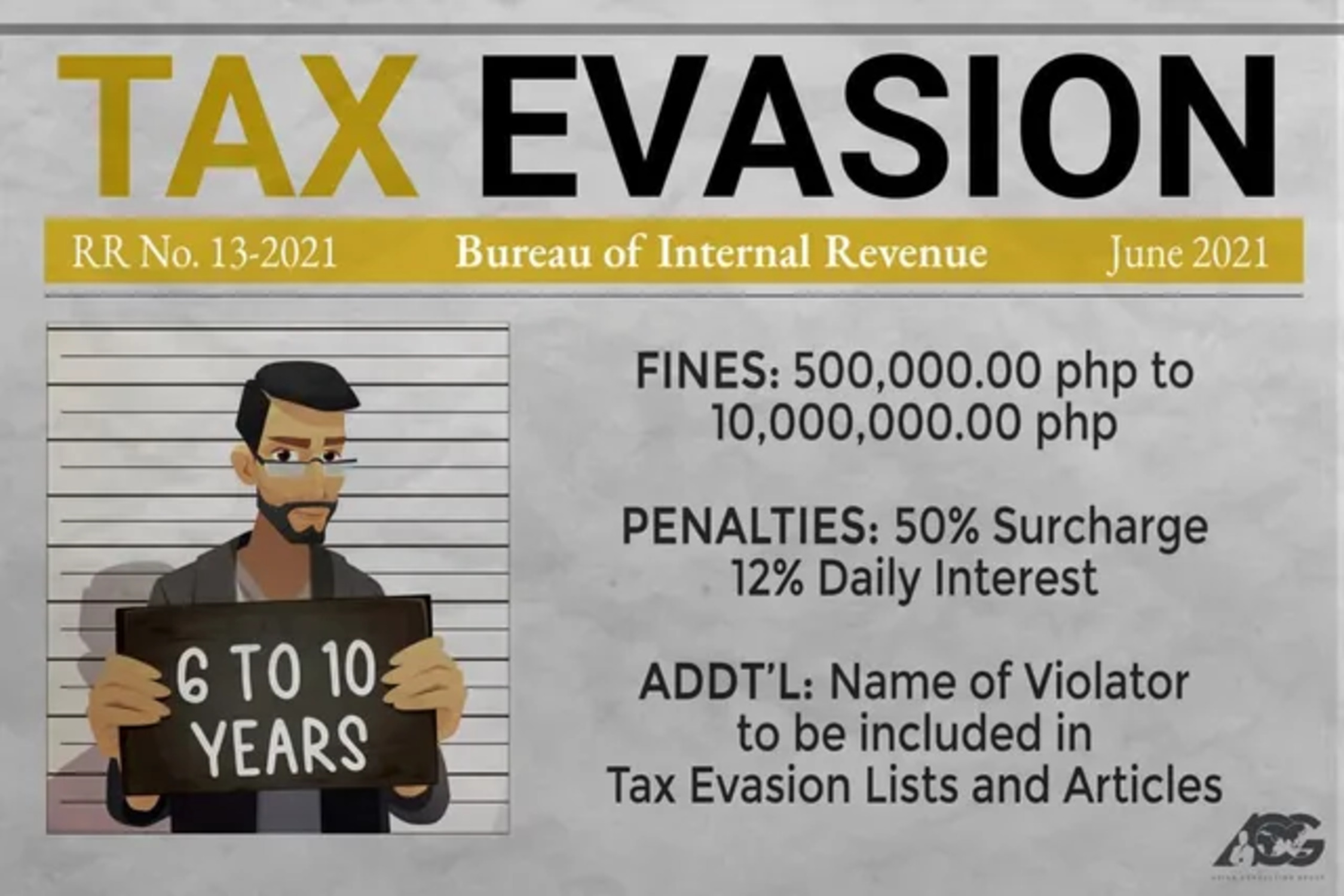

What is tax avoidance?The term "tax avoidance" describes the legal strategies used by people or organizations to lower their tax liabilities by taking advantage of tax code loopholes and strategic financial planning. It's critical to separate tax avoidance from tax evasion, which is the illegal practice of concealing income or purposefully falsifying financial information in order to avoid paying taxes.

Even though tax evasion is usually accepted as lawful, it frequently brings up moral concerns about justice, equity, and social responsibility. Aggressive tax avoidance methods, according to critics, take advantage of loopholes in the tax code to allow wealthy people and corporations to pay far less in taxes than they should, placing the onus on regular taxpayers and eroding public confidence in the tax system.

Ethics Vs. Legality

Compliance with current tax rules and regulations is essential for the legitimacy of tax evasion. In order to reduce their tax obligations, taxpayers are entitled to arrange their financial affairs in a tax-efficient manner by utilizing all applicable credits, exemptions, and deductions. There is, nevertheless, a thin line separating dishonest tax avoidance strategies that straddle the lines of morality and legality from proper tax planning.

Even if tax avoidance is technically permissible, there may be moral questions raised, especially when intricate plans are used to take advantage of tax breaks or artificially lower tax obligations without improving society as a whole. When evaluating the social impact and fairness of tax avoidance tactics, ethical issues are frequently raised, particularly when the tactics cause governments to lose a substantial amount of income or erode public confidence in the tax system.

Typical Techniques For Avoiding Taxes

There are several ways to evade taxes, from straightforward tactics like increasing credits and deductions to more intricate plans utilizing offshore accounts, shell corporations, and intricate financial products. Several popular techniques for evading taxes include:

- Income shifting - The practice of moving income to low-tax jurisdictions in order to reduce one's tax obligations. Manipulating prices in linked entity transactions in order to move profits to lower tax jurisdictions is known as transfer pricing.

- Utilizing tax havens- involves creating offshore businesses in countries with little or no taxation in order to protect money from being taxed.

- Tax Deferral- Postponing the recognition of gains or income until a subsequent tax year in order to postpone paying taxes.

- Abusive Trusts and Structures- Putting up intricate legal organizations and structures to give the appearance of being in control of assets while evading taxes.

Taking advantage of uncertainties or discrepancies in tax legislation in order to save money on taxes is known as "loophole hunting."Though these techniques could be lawful in certain situations, they can also draw attention from lawmakers and tax officials, which could result in enforcement actions and regulatory changes meant to plug holes and stop abusive tax practices.

Consequences Of Tax Avoidance

There are significant ramifications for people, companies, governments, and society at large from the prevalence of tax evasion. Among the most important ramifications are

- Revenue Losses- Governments may suffer large revenue losses as a result of tax evasion, which may limit their capacity to pay for infrastructure and other necessary public services.

- Growing Inequality- Tax evasion can increase income and wealth inequality, widening the gap between the rich and the poor, by allowing wealthy individuals and corporations to avoid paying their fair share of taxes.

- Erosion of Tax Base- Vigorous tax evasion tactics have the potential to reduce the tax base, which makes it more challenging for governments to collect enough money to cover their spending commitments.

- Public Mistrust- The public's faith in the fairness and integrity of the tax system may be damaged by the impression that tax evasion is commonplace, which may prompt calls for reform and increased openness.

- Global collaboration- Global attempts to combat tax evasion and avoidance are necessary since tax avoidance is a cross-border issue that requires international collaboration and coordination to address efficiently.

Taking On The Problems Of Tax Avoidance

A multifaceted strategy involving legislative reforms, regulatory oversight, enforcement actions, and international cooperation is needed to address the problems caused by tax avoidance. Among the most effective tactics for preventing tax evasion are

- Closing Loopholes- Laws can be passed by governments to close tax code loopholes and stop the exploitation of abusive tax evasion tactics.

- Improving Transparency- By bringing complicated financial arrangements and transactions to light, more disclosure laws and transparency can make it more difficult to participate in tax evasion.

- Boosting Enforcement- In order to successfully target abusive tax tactics and high-risk taxpayers, tax authorities can improve their enforcement skills and implement risk-based strategies.

- Encouraging Fairness- Lawmakers can put progressive taxes and safeguards against profit and income shifting into place in order to encourage equity and fairness in the tax system.

- International Collaboration- In order to address the issues of tax avoidance, nations must cooperate in order to harmonize tax laws, share information, and fight tax evasion and avoidance globally.

- Public Awareness and Education- Raising public awareness of the negative effects of tax evasion as well as the value of tax compliance can contribute to the development of an accountable and transparent culture. Tax avoidance has a negative social impact, and by making people and businesses aware of this, we may encourage them to embrace ethical tax policies.

- Corporate Social Responsibility- One way to combat tax evasion is to promote corporate social responsibility (CSR) among companies. By voluntarily sharing their tax plans, participating in fair and transparent reporting, and giving back to the communities in which they operate, businesses can show that they are committed to moral tax practices.

- Inclusive Policy Debate- More effective and fair tax policies can result from involving a wide range of stakeholders in policy debate and decision-making processes, including legislators, tax professionals, civil society organizations, and the corporate sector. Policymakers can address tax avoidance by developing plans that take into account the demands and priorities of all stakeholders by promoting collaboration and consensus-building.

- Investing in Tax Administration- To prevent tax evasion and guarantee compliance with tax regulations, tax administration capability must be strengthened. Governments can improve the efficacy and efficiency of revenue collection activities by investing in infrastructure, training, and technology. Tax authorities can prevent tax evasion and increase fairness for all taxpayers by updating tax systems and enhancing compliance procedures.

- International Tax Reform- Since tax evasion is a cross-border activity, international coordination of efforts is necessary to make significant headway against it. Through coordinated legislative measures and improved international cooperation, initiatives like the Base Erosion and Profit Shifting (BEPS) project, spearheaded by the Organisation for Economic Co-operation and Development (OECD), seek to address the tax dodging methods employed by multinational firms.

What Is Tax Avoidance - FAQ

What Is The Avoidance Of Taxes?

Tax avoidance—An action taken to lessen tax liability and maximize after-tax income. tax evasion—The failure to pay or a deliberate underpayment of taxes. underground economy—Money-making activities that people don't report to the government, including both illegal and legal activities.

What Is Tax Avoidance According To Authors?

It is stated that tax avoidance is a situation when a taxpayer reduces a tax basis simulating one or some actions, which officially fulfill the requirements of tax laws.

What Is The Difference Between Tax Evasion And Tax Avoidance?

The major distinction between the two terminologies hinges on the fact that tax evasion occurs when a taxpayer does not pay taxes while tax avoidance is the legal reduction of tax liabilities by a taxpayer.

Final Words

To sum up, tax evasion is a complicated and diverse problem that poses serious difficulties for people, organizations, governments, and society at large. Although tax evasion can be technically lawful in many situations, it can also give rise to ethical questions and have a significant impact on social cohesion, equity, and justice.

A comprehensive strategy that includes legislative reforms, regulatory oversight, enforcement actions, public awareness and education, corporate social responsibility, inclusive policy dialogue, investment in tax administration, and global tax reform is needed to address the problems of tax avoidance. Together, we can combat tax evasion and create a more egalitarian, transparent, and long-lasting tax system that benefits everyone's social and economic advancement.

Emmanuella Shea

Author

Frazer Pugh

Reviewer

Latest Articles

Popular Articles