What Is A Balloon Mortgage And How Does It Work?

Discover what is a balloon mortgage and how does it work? Learn what a balloon mortgage is, how it works, and whether it's the right choice for your financial goals.

Author:Stefano MclaughlinReviewer:Luqman JacksonDec 29, 202311.9K Shares173.1K Views

Explore the concept what is a balloon mortgage and how does it work?Discover how this unique mortgage structure may offer advantages and potential risks in your real estate endeavors. Understanding the dynamics of a balloon mortgage is crucial for prospective homebuyers seeking flexibility in their payment structures.

This introductory exploration aims to demystify the concept, shedding light on what is a balloon mortgage and how does it work?. As we delve into the intricacies, you'll gain insights into the advantages and potential pitfalls, empowering you to make well-informed decisions regarding your home financing journey.

What Is A Balloon Mortgage?

A balloon mortgage is a unique and unconventional home financing option that deviates from the traditional fixed-rate or adjustable-rate mortgages. In essence, it offers borrowers lower monthly payments for a specified initial period, typically ranging from 5 to 7 years. What sets a balloon mortgage apart is the substantial "balloon" payment that becomes due at the end of this initial term.

During the initial period, borrowers benefit from reduced monthly payments, providing temporary financial relief. This feature makes balloon mortgages appealing to those who anticipate changes in their financial situation or plan to sell or refinance their homes before the balloon payment comes due.

However, the crux of a balloon mortgage lies in the balloon payment, a lump sum representing the remaining loan balance, that must be paid in full at the end of the term. This characteristic introduces a level of risk, as borrowers need to secure the means to cover this sizable payment. The ability to refinance or sell the property becomes crucial for managing this financial obligation.

While balloon mortgages can offer flexibility for certain homeowners, they require careful consideration and strategic financial planning to navigate the potential challenges associated with the looming balloon payment. Understanding the intricacies of this unconventional mortgage option is essential for making informed decisions about home financing.

How Balloon Mortgages Work?

Balloon mortgages operate on a distinctive payment structure, providing a temporary financial advantage followed by a significant financial commitment. The workings of a balloon mortgage involve an initial period, commonly 5 to 7 years, where borrowers make lower monthly payments compared to traditional mortgages. This period is characterized by affordability, making it an attractive choice for those seeking short-term financial flexibility.

However, the defining feature of a balloon mortgage is the looming "balloon" payment that awaits at the end of this initial period. This final payment is a lump sum, equivalent to the remaining loan balance. The challenge, and potential risk, lies in securing the means to satisfy this sizable obligation.

The lower initial payments are often achieved through fixed or adjustable interest rates, contributing to the overall appeal of balloon mortgages. Homebuyers who anticipate changes in their financial situation or plan to sell or refinance their homes before the balloon payment is due may find this payment structure advantageous.

To successfully navigate the intricacies of how balloon mortgages work, borrowers must carefully assess their financial stability and future plans. The ability to refinance the loan or sell the property before the balloon payment becomes due is crucial for managing this unconventional mortgage effectively.

Balloon mortgages, while offering short-term benefits, demand strategic planning to mitigate potential risks and ensure a smooth financial transition at the end of the initial term. Understanding the mechanics of this unique mortgage option empowers borrowers to make informed decisions aligning with their long-term financial goals.

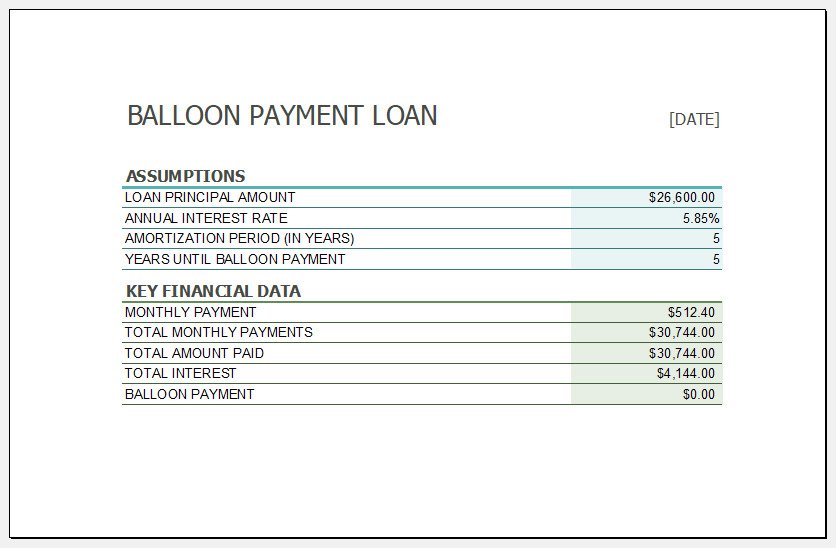

Balloon Payment Schedule

A balloon payment schedule is a crucial element of a balloon mortgage, delineating the repayment structure and, notably, the substantial lump sum payment due at the end of the loan term. This schedule outlines the timeline of payments over the loan's life, highlighting the lower monthly payments during the initial period and culminating in the balloon payment.

Typically, the balloon payment schedule involves an initial phase, often spanning 5 to 7 years, during which borrowers enjoy reduced monthly payments compared to traditional mortgages. This lower payment structure can be particularly appealing for those who seek short-term financial flexibility.

As the loan term progresses, the balloon payment looms large on the schedule, representing the remaining loan balance. The challenge for borrowers lies in preparing for this significant financial obligation. Planning becomes paramount, and homeowners often explore options such as refinancing or selling the property before the balloon payment becomes due.

The schedule serves as a roadmap, guiding borrowers through the phases of the loan and empowering them to make informed decisions that align with their financial goals and circumstances. Balloon payment schedules underscore the necessity of careful financial planning to navigate the unique dynamics of this mortgage structure successfully.

What Are The Advantages Of A Balloon Mortgage For Businesses?

Businesses may find benefits in utilizing balloon mortgages as part of their financial strategy, particularly when considering real estate investments. Balloon mortgages offer lower initial monthly payments, allowing businesses to allocate more resources to other operational needs during the initial term, typically ranging from 5 to 7 years.

One significant advantage is the potential for short-term cost savings. Businesses may use the lower initial payments to invest in growth initiatives, fund operational expansions, or address immediate financial priorities. This flexibility aligns well with companies that anticipate increased cash flow in the future, enabling them to manage the impending balloon payment strategically.

Additionally, for businesses engaged in real estate, balloon mortgages can be advantageous when there's a clear exit strategy. If a company plans to sell or refinance the property before the balloon payment becomes due, the lower initial payments offer a cost-effective financing option during the ownership period.

Businesses should weigh the benefits against potential risks and devise a comprehensive financial strategy to make the most of the unique advantages offered by balloon mortgages in the commercial real estate landscape.

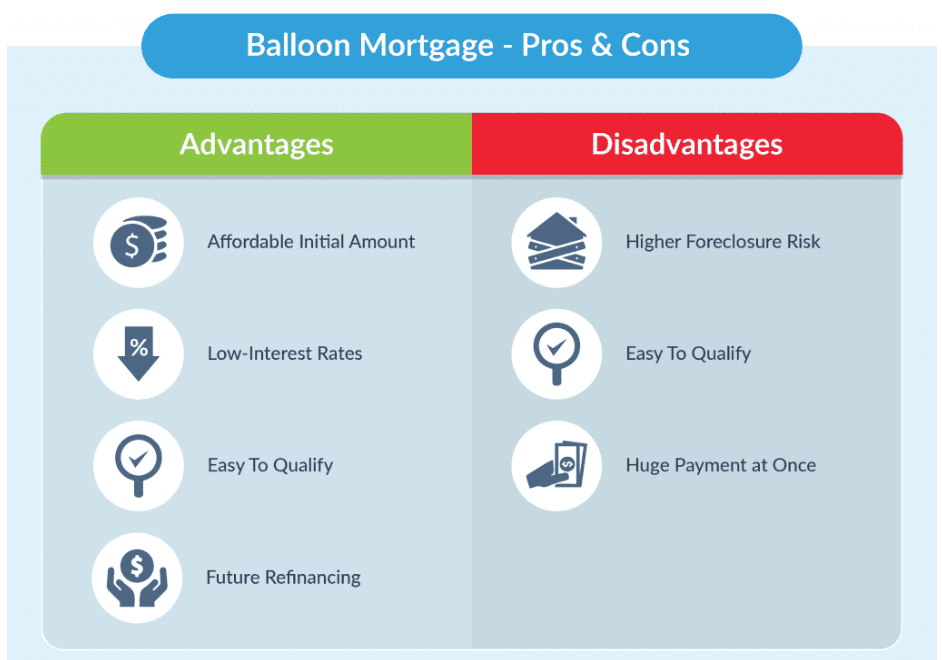

Balloon Mortgage Pros And Cons

- Lower monthly payments - You'll pay less each month than if you had a standard mortgage, especially if your balloon mortgage doesn't need any monthly principal payments. If the thought of making large payments keeps you from purchasing a home, a balloon mortgage may allow you to do so sooner.

- Lower interest rates -Rates on balloon mortgages are frequently lower than rates on other types of mortgages. Because interest rates are currently at historic lows, you may want to pick a fixed rate on your balloon mortgage over an adjustable rate to lock in a good deal for the whole term.

- If you intend to relocate soon, this is a fantastic alternative- If you anticipate to sell your house before your lump sum payment is due, you can take advantage of a low interest rate and modest monthly payments without having to make a large payment in a few years.

- If you intend to get additional money later, this is an excellent alternative - A balloon mortgage may be appealing if you are convinced that you will receive a big chunk of money before your whole payment is due. For example, suppose you get a large financial bonus from your employment at the end of each calendar year and are confident that you can put it toward your mortgage.

Cons Of Balloon Mortgages

- Pay a large amount at once -The disadvantage of making modest monthly payments is that you must pay a large sum at the conclusion of your balloon mortgage term. Larger monthly payments on a conventional mortgage let you pay off the total principal over a fixed number of years. You don't make much progress on your loan with modest balloon mortgage payments, and you could pay hundreds of thousands of dollars all at once in a few years.

- High risk -A balloon mortgage comes with a number of hazards. What if you intend to pay off the lump sum with your annual bonus but lose your job? Or do you require the funds for a financial emergency? Selling the home to avoid paying off the principal is also a dangerous strategy, because the home's value may decline between the time you buy and the time you sell, depending on the market.

- Difficult to refinance -Refinancing a balloon mortgage may be more difficult than refinancing another type of debt. Lenders consider how much equity you've accumulated in your house when deciding whether to approve your refinance application. Because you're not paying down the debt, you'll acquire little if any equity with a balloon mortgage. Even if your refinancing application is approved, you may be left with a high-interest rate if you don't have significant equity.

- Hard to find -Because balloon mortgages are dangerous for lenders, not all companies provide them. It may be difficult to find a lender who offers the conditions and interest rate you require. If you're willing to take on some risk, a balloon mortgage could be a suitable fit. Otherwise, you might want to look into another sort of mortgage.

Balloon Mortgages Compare To Other Home Loans

Balloon mortgages stand out in the realm of home loans due to their distinctive payment structure, setting them apart from traditional fixed-rate and adjustable-rate mortgages. The primary point of departure lies in the initial payment terms.

While traditional mortgages maintain consistent monthly payments over the entire loan term, balloon mortgages offer lower initial payments for a specific period, typically 5 to 7 years.

This initial phase of reduced payments makes balloon mortgages appealing for certain homebuyers, especially those who foresee changes in their financial circumstances or have short-term homeownership plans. However, the defining feature of a balloon mortgage is the significant "balloon" payment due at the end of this initial term, representing the remaining loan balance.

Comparatively, traditional fixed-rate mortgages provide stability with predictable monthly payments throughout the loan term. Adjustable-rate mortgages, on the other hand, may offer flexibility by adjusting interest rates based on market conditions but lack the specific "balloon" feature found in balloon mortgages.

Lenders

One notable distinction is the type of lenders who offer balloon mortgages. Small or private lenders frequently offer balloon payment loans, which can be reserved for specific types of lending, such as construction.

Requirements

Balloon mortgage lenders have their own standards. They can be more stringent, demanding better credit scores and larger down payments.

They can, however, be more lax in other respects if the lender is catering to a customer base that requires alternatives to typical mortgage standards. They might not require as much income documentation or let you bypass a home appraisal, for example.

Rates Of Interest

Because lenders are taking on a significant amount of risk, balloon mortgage rates are often higher than the ordinary 30-year fixed-rate mortgage. However, in some situations, the rates you're offered may be momentarily lower. If you refinance the loan before the balloon payment is due, you'll still have a high sum and no guarantee that mortgage rates will have reduced by then.

Should You Get A Balloon Mortgage?

Deciding whether to opt for a balloon mortgage is a nuanced decision that hinges on individual financial circumstances, risk tolerance, and long-term homeownership goals. The appeal of a balloon mortgage lies in its initial affordability, offering lower monthly payments compared to traditional mortgages for a specified period, typically 5 to 7 years.

This can be advantageous for those who anticipate changes in their financial situation or plan to sell or refinance their homes before the balloon payment is due. However, the critical consideration is the looming balloon payment, a substantial lump sum representing the remaining loan balance, due at the end of the initial term.

Opting for a balloon mortgage requires a realistic evaluation of one's financial stability, future plans, and the potential for changes in income or housing needs. It is a strategy that demands foresight and proactive financial planning to mitigate the risks associated with the impending balloon payment.

Borrowers must carefully assess their ability to manage this sizable financial obligation, either through refinancing or selling the property. While it can provide short-term financial benefits, borrowers should weigh the potential risks and have a clear plan in place to handle the balloon payment when the time comes.

What Is A Balloon Mortgage And How Does It Work? - FAQs

Can You Refinance A Balloon Mortgage?

Yes, refinancing is an option to manage the balloon payment, but eligibility depends on factors like creditworthiness and market conditions.

Are Balloon Mortgages Suitable For First-time Homebuyers?

Balloon mortgages are generally more suitable for experienced homeowners with a clear understanding of their future financial situation.

How Does The Interest Rate Work In A Balloon Mortgage?

Balloon mortgages may have fixed or adjustable interest rates, impacting the overall affordability and long-term financial commitment.

What Alternatives Exist For Those Hesitant About Balloon Mortgages?

Traditional fixed-rate or adjustable-rate mortgages provide alternatives, offering more predictable payment structures without the large balloon payment characteristic of balloon mortgages.

How Does A Balloon Mortgage Differ From A Traditional Mortgage?

Unlike traditional mortgages with consistent monthly payments, a balloon mortgage offers lower initial payments but requires a large balloon payment at the end.

Conclusion

A balloon mortgage, with its unique blend of initial affordability and long-term considerations, emerges as a financial instrument that demands careful evaluation. While its lower initial payments may attract some, the looming balloon payment requires thorough planning to avoid potential financial strains.

As you navigate the realm of what is a balloon mortgage and how does it work? Consider your financial goals, risk tolerance, and the specific terms of a balloon mortgage too.

It is not a one-size-fits-all solution, and prudent decision-making involves weighing the benefits against the risks. Armed with this knowledge, you can confidently navigate the complexities of a balloon mortgage, ensuring that your home financing aligns harmoniously with your overall financial strategy.

Jump to

What Is A Balloon Mortgage?

How Balloon Mortgages Work?

Balloon Payment Schedule

What Are The Advantages Of A Balloon Mortgage For Businesses?

Balloon Mortgage Pros And Cons

Balloon Mortgages Compare To Other Home Loans

Should You Get A Balloon Mortgage?

What Is A Balloon Mortgage And How Does It Work? - FAQs

Conclusion

Stefano Mclaughlin

Author

Luqman Jackson

Reviewer

Latest Articles

Popular Articles