What Are The Characteristics Of Real Estate? Deciphering The Distinctive Traits

Real estate, as a tangible and immovable asset, possesses unique characteristics that distinguish it from other forms of property. Understanding these features is essential for investors, developers, and anyone involved in the real estate industry. So, what are the characteristics of real estate?

Author:Luqman JacksonReviewer:Liam EvansJan 18, 202414.8K Shares228.5K Views

Real estate, as a tangible and immovable asset, possesses unique characteristics that distinguish it from other forms of property. Understanding these features is essential for investors, developers, and anyone involved in the real estate industry. So, what are the characteristics of real estate?

When one thinks about real estate, numerous pictures spring to mind, including large farms, skyscrapers in cities, and suburban residences. Although most of us have a general notion of what real estate is, it could be more difficult to put concepts into words.

It's worth reviewing the precise definition of real estate and going over its key attributes, both in terms of its physical and economic qualities. To effectively include real estate into your investing portfolio, it's critical to understand what it is and isn't.

What Is Real Estate?

Real estate is essentially defined as properties that include land and its material attachments. The earth's physical surface, any permanently occurring natural features like rock, water, or soil, as well as any minerals or other details beneath the surface, are all considered to be part of the land.

Real estate comprises structures that are erected on land and permanently attached to it, both naturally occurring and man-made. It is not the same as personal property, which includes things like cars, boats, jewelry, furniture, and farm equipment but is not permanently affixed to the land. The five primary categories of real estate are raw land, commercial, industrial, residential, and special use.

Land, attachments, and any rights or interests that a property owner may have in the property are all considered real estate examples. Artificial attachments, for instance, might include any type of construction, road, fence, or house. In the context of business, it's the acquisition and upkeep of real estate with the goal of making money.

Any residences, structures, and land used for business, industrial, or commercial purposes are considered real estate. This is among the best investments one can make. Buying real estate is a great way to guarantee long-term financial security. Whether you're buying your first home or making rental property investments, there are a lot of things to consider when it comes to real estate.

It's important to research the market circumstances in the area you're contemplating and consult with professionals like real estate agents or lawyers before making any decisions. Understanding the terminology and vocabulary used in the real estate sector may help you deal with contracts and talk more easily. All things considered, real estate investing requires careful planning.

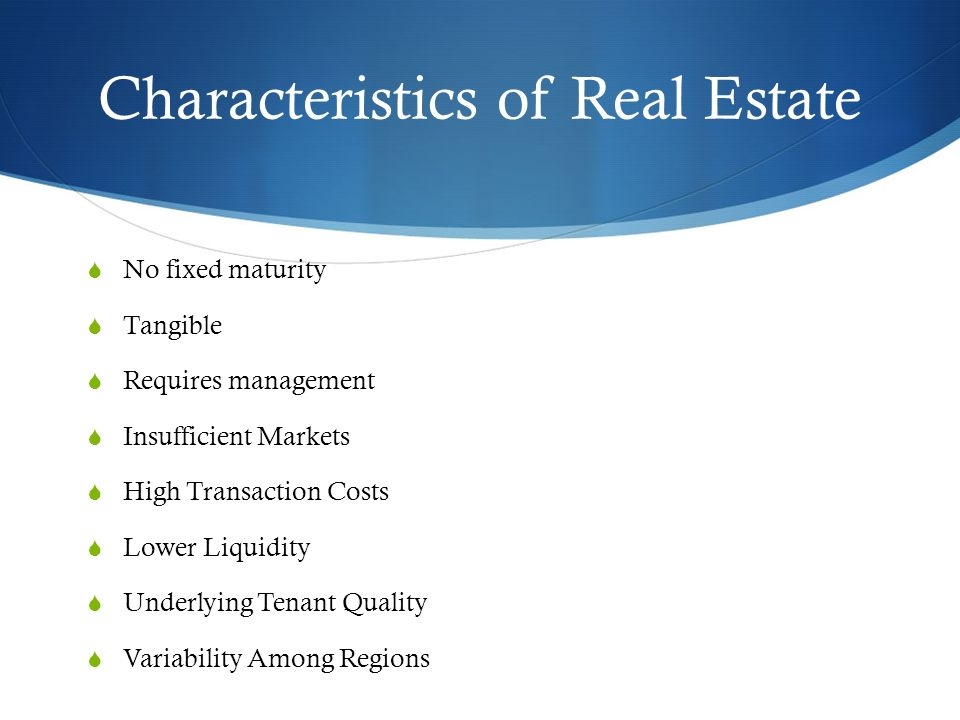

So, what are the characteristics of real estate? Let's delve into the key characteristics that define real estate:

Immobility

Immobility stands as a foundational characteristic of real estate, setting it apart from other assets. Land and structures are firmly fixed in a specific location, unable to be moved. This immobility plays a pivotal role in the value and utility of real estate, as its location becomes a defining factor. The impact of location on property value is profound, reflecting factors such as proximity to amenities, transportation, and economic centers.

Real estate's immobility extends beyond the physical structure; it encompasses the entire parcel of land. This permanence contributes to the long-term stability and value of real estate. However, it also means that the significance of location, influenced by economic and societal factors, can fluctuate over time.

Indestructibility

Indestructibility is a distinctive characteristic of real estate, highlighting its enduring nature. While structures on the land may deteriorate over time, the land itself is considered indestructible. This quality provides real estate with a level of permanence and longevity that distinguishes it from other assets with finite lifespans.

The indestructibility of real estate contributes to its role as a store of value. Unlike certain commodities or consumables that can be exhausted or depleted, real estate retains its intrinsic value, representing a tangible and lasting asset. Investors often view real estate as a hedge against inflation, appreciating the enduring nature of the underlying land.

Heterogeneity

Heterogeneity refers to the unique and diverse nature of real estate properties. No two properties are identical, and each parcel of land or structure possesses its own distinct characteristics. These differences can include size, shape, topography, architectural style, and various features.

The heterogeneity of real estate presents both challenges and opportunities for investors and developers. Each property requires careful assessment and analysis to understand its specific attributes and potential. Market conditions and consumer preferences contribute to the diverse range of real estate offerings, reflecting the individuality inherent in each property.

Non-homogeneity

Non-homogeneity underscores the fact that real estate properties are not interchangeable. Even if two properties appear similar at first glance, subtle differences in location, condition, or other factors make each property unique. This characteristic demands a customized approach to valuation and investment analysis.

The non-homogeneity of real estate extends beyond the physical attributes to encompass intangible factors. Perception, historical significance, and the cultural context of a property contribute to its uniqueness. This individuality introduces subjectivity into the valuation process, as the perceived value of a property is influenced by factors beyond its physical characteristics.

Durability

Durability is a fundamental characteristic that distinguishes real estate as a long-lasting asset. While structures on the land may require maintenance and renovations over time, the underlying land itself is considered durable and enduring. This quality contributes to the stability and permanence of real estate as an investment.

Real estate's durability is a key factor in its role as a store of value. Unlike certain commodities that can be consumed or assets with a finite lifespan, real estate has the potential to last for generations. Investors often appreciate the resilience of real estate in the face of economic fluctuations and market uncertainties, making it a reliable and durable component of diversified investment portfolios.

High Transaction Costs

Real estate transactions are associated with high transaction costs, including legal fees, real estate agent commissions, taxes, and other expenses. These costs significantly impact the overall expense of buying or selling real estate. The complexity of real estate transactions, involving legal processes, due diligence, and negotiations, contributes to these high costs.

The presence of high transaction costs influences the decision-making process for both buyers and sellers. Investors must carefully weigh the potential returns against the upfront expenses associated with acquiring or divesting real estate. These costs also emphasize the importance of thorough research and planning to ensure that transactions align with financial goals and expectations.

Location And Situs

Location and situs are critical factors that shape the value and desirability of real estate. The economic location of a property, known as situs, encompasses various considerations, including proximity to amenities, transportation, schools, and economic centers. The concept of location is paramount in real estate, influencing market demand and property values.

The importance of location extends beyond the physical attributes of a property. It encompasses the surrounding neighborhood, community, and the overall economic environment. A property's situs can have a profound impact on its appreciation potential and its attractiveness to potential buyers or tenants. Real estate professionals carefully assess and leverage location and situs considerations in their investment and development strategies.

Scarcity

Scarcity is a defining characteristic of real estate, particularly in the context of finite land resources. As populations grow and urbanization continues, the availability of desirable land becomes more limited. This scarcity dynamic contributes to increased demand and rising property values.

The scarcity of land plays a significant role in shaping the real estate market. Desirable locations with limited available land often experience heightened competition, leading to higher property prices. Scarcity drives investors and developers to carefully evaluate opportunities, considering not only the existing supply but also the potential for future demand in a given location.

Improvements

Real estate improvements encompass the enhancements made to a property, typically involving the construction of buildings, structures, or other developments. These improvements serve to increase the overall value and utility of the real estate. Whether it's the construction of residential dwellings, commercial buildings, or infrastructure projects, improvements contribute to the economic and aesthetic aspects of a property.

Real estate developers strategically plan and implement improvements to optimize the potential of a given parcel of land. This process involves careful consideration of the intended use, market demand, and economic viability of the proposed improvements. Successful real estate projects often integrate innovative and sustainable improvement strategies to meet the evolving needs of the market.

Economic Drivers

Economic drivers play a pivotal role in influencing the value and performance of the real estate market. Factors such as supply and demand, interest rates, employment levels, and overall economic conditions impact the dynamics of real estate transactions. Understanding these economic drivers is essential for investors, developers, and industry professionals to make informed decisions in a constantly evolving market.

Changes in supply and demand, for instance, can lead to fluctuations in property values. Interest rates influence borrowing costs and, consequently, the affordability of real estate. Economic indicators, including employment rates and GDP growth, provide insights into the overall health of the real estate market. Successful participants in the real estate industry closely monitor these economic drivers to anticipate market trends and position themselves strategically.

Land Use Controls

Land use controls, including zoning laws, building codes, and environmental regulations, shape the development and use of real estate properties. These controls are implemented by local governments to manage growth, ensure public safety, and protect the environment. Compliance with land use controls is a critical consideration for real estate developers and investors, influencing the feasibility and success of a project.

Zoning laws designate specific areas for residential, commercial, or industrial use, impacting the permissible uses of a property. Building codes set standards for construction and safety, ensuring that structures meet established guidelines. Environmental regulations address concerns such as conservation, pollution prevention, and sustainable development practices. Navigating and understanding these controls is integral to the planning and execution of real estate projects.

Financing Challenges

Acquiring real estate often involves substantial financing, and accessing capital can present significant challenges. Real estate developers and investors may encounter obstacles in securing financing due to factors such as creditworthiness, market conditions, and the perceived risk associated with the project. The financing landscape includes various options, from traditional loans to partnerships, each with its unique set of considerations.

Financing challenges require careful consideration of the financial structure of a real estate project. Developers must assess the capital needed for land acquisition, construction, and other associated costs. Interest rates, loan terms, and the availability of funding sources are critical factors influencing the financial viability of a project. Successful real estate professionals navigate these challenges by developing strong relationships with lenders, employing effective financial planning, and adapting to changing market conditions.

What Are The Characteristics Of Real Estate? - FAQs

What Are The 7 Characteristics Of Real Estate?

All real estate, regardless of kind, contains seven fundamental qualities that characterize both its physical and economic qualities. These attributes include immobility, indestructibility, location, investment permanency, scarcity, upgrades, and uniqueness.

What Are The Physical Characteristics Of Real Estate?

The physical attributes of land are its uniqueness, indestructibility, and immobility due to the geographical differences between each piece of land. Real estate includes both the original land and any long-term human constructions, including homes and other structures.

What Role Do Economic Drivers Play In The Real Estate Market?

Economic factors such as supply and demand, interest rates, and employment levels significantly influence real estate values. Monitoring economic trends is crucial for informed decision-making in the real estate sector.

How Does Real Estate Financing Differ From Financing Other Assets?

Real estate financing involves substantial costs, including mortgage considerations, interest rates, and collaboration with lenders. Access to capital is a significant challenge in real estate transactions.

How Do Improvements Impact The Value Of Real Estate?

Real estate can be enhanced through improvements like buildings and structures. These improvements contribute to increased property value and utility.

Why Is Real Estate Value Considered Subjective?

Real estate value is subjective and influenced by factors like perception, market trends, and investor sentiment. Both objective and subjective considerations are vital when assessing property values.

How Does Non-homogeneity Distinguish One Real Estate Property From Another?

Non-homogeneity in real estate means that no two properties are identical. Even seemingly similar properties have subtle differences, making each property unique and requiring customized approaches to valuation and analysis.

Conclusion

What are the characteristics of real estate? The characteristics of real estate encapsulate its unique nature as an immobile, durable, and heterogeneous asset. Investors, developers, and industry professionals must grasp these fundamental features to navigate the complexities of the real estate market successfully.

Recognizing the interplay between location, economic factors, and regulatory controls is crucial for making informed decisions and unlocking the full potential of real estate as a valuable and dynamic investment.

Luqman Jackson

Author

Liam Evans

Reviewer

Latest Articles

Popular Articles