What Are Land Loans? An In-depth Review

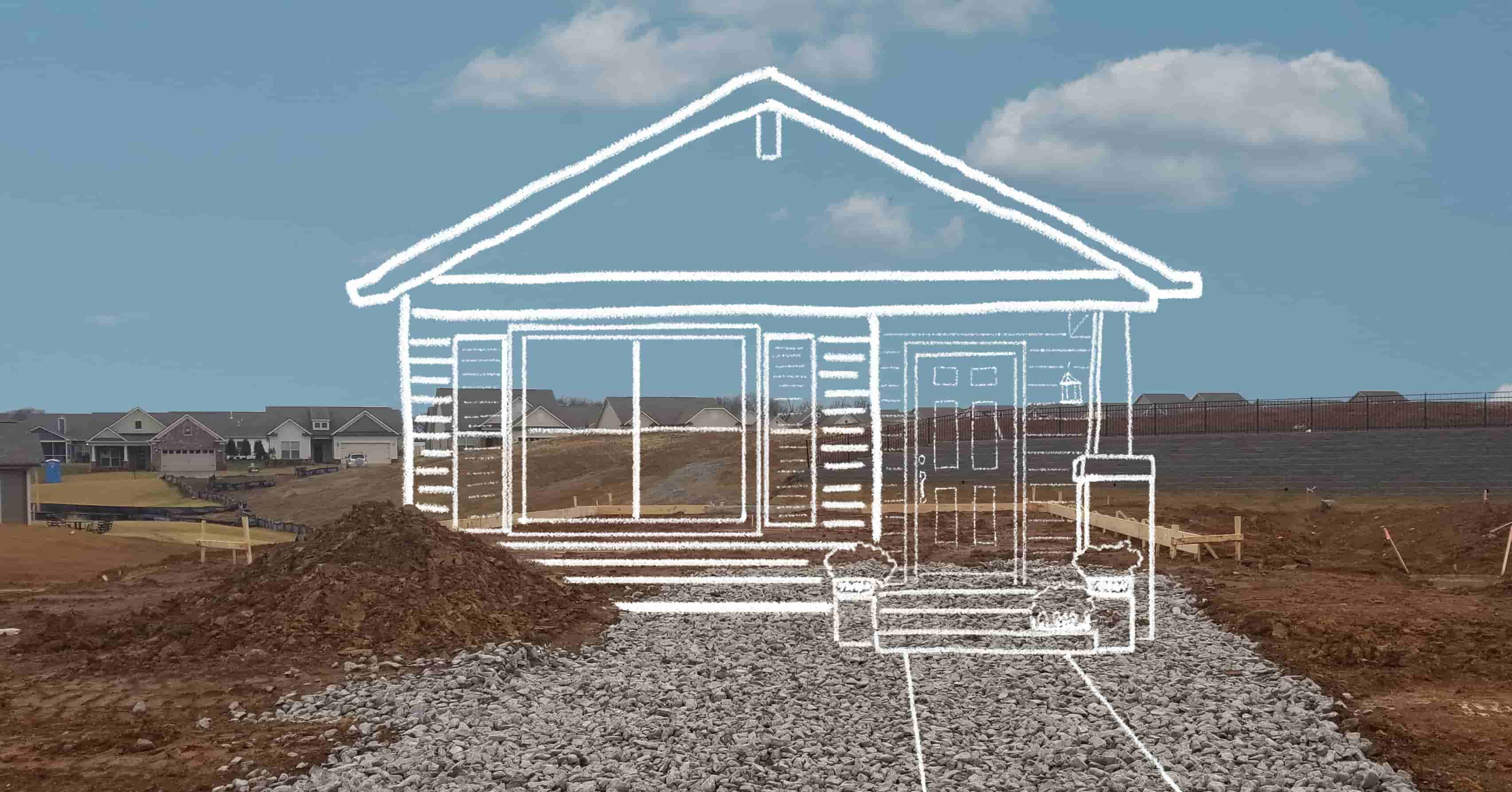

Land loans play a crucial role in facilitating land acquisition and development projects for individuals, investors, and businesses. To navigate the complexities of land financing effectively, it's essential to understand the various types of land loans, eligibility requirements, associated risks, and potential uses. In this comprehensive guide, we'll explore everything you need to know about land loans. That brings us to the big question: what are land loans?

Author:Stefano MclaughlinReviewer:Luqman JacksonMar 03, 20245.8K Shares83.3K Views

Land loans play a crucial role in facilitating land acquisition and development projects for individuals, investors, and businesses. To navigate the complexities of land financing effectively, it's essential to understand the various types of land loans, eligibility requirements, associated risks, and potential uses. In this comprehensive guide, we'll explore everything you need to know about land loans. That brings us to the big question: what are land loans?

Types Of Land Loans

Raw Land Loans

Raw land loans are used to finance the purchase of undeveloped land without any existing infrastructure or improvements. This type of loan is suitable for individuals or investors looking to acquire land for future development or investment purposes. Raw land loans typically have higher down payment requirements and may have shorter loan terms than other land loan types.

Lot Loans

Lot loans are specifically tailored for purchasing individual lots or parcels within developed areas, such as residential subdivisions or urban neighborhoods. These loans are ideal for buyers who want to purchase a specific lot for constructing a custom home or for investment purposes. Lot loans may have more lenient eligibility requirements compared to raw land loans, but they still typically require a down payment and proof of income.

Construction Loans

Construction loans provide financing for both the purchase of land and the construction of a new property, such as a residential home or commercial building. These loans are typically short-term and disbursed in stages as construction progresses. Borrowers can use the funds to acquire land, cover construction costs, and pay for permits and fees. Once construction is complete, the borrower may refinance the construction loan into a traditional mortgage or another long-term financing option.

Land Development Loans

Land development loans are designed for larger-scale development projects, such as subdividing land into residential lots, building infrastructure (e.g., roads, utilities), or developing commercial properties. These loans provide funding for various stages of the development process, from land acquisition to site preparation and infrastructure construction. Land development loans may involve more complex underwriting and approval processes due to the higher risks and larger loan amounts involved.

Eligibility And Requirements For Land Loans

Credit Score And Financial History

Lenders typically require a good credit score and a solid financial history from applicants seeking land loans. A higher credit score demonstrates a borrower's ability to manage debt responsibly and reduces the lender's risk. Lenders may review factors such as credit utilization, payment history, and debt-to-income ratio to assess the borrower's creditworthiness.

Down Payment Requirements

Land loans often require larger down payments compared to traditional mortgages. Down payment requirements typically range from 20% to 50% of the land's purchase price, depending on factors such as the borrower's creditworthiness, loan amount, and the type of land being financed. A larger down payment reduces the lender's risk and provides the borrower with greater equity in the property.

Zoning And Land Use Restrictions

Zoning regulations and land use restrictions play a significant role in the eligibility and approval process for land loans. Lenders assess whether the intended use of the land complies with local zoning ordinances and regulations. Properties located in areas with restrictive zoning regulations or environmental concerns may pose higher risks for lenders, potentially affecting loan eligibility and terms. Borrowers should conduct thorough due diligence to understand any zoning restrictions or land use limitations that may impact their ability to secure financing for the desired property.

Risks And Considerations Associated With Land Loans

Market Volatility And Investment Risks

Land values can be subject to significant fluctuations due to market volatility and economic conditions. Factors such as changes in supply and demand, interest rates, and economic trends can impact land prices and investment returns. Borrowers should carefully assess market conditions and conduct thorough due diligence to mitigate investment risks. Additionally, land investments may have longer holding periods compared to other types of investments, increasing exposure to market volatility.

Environmental And Regulatory Concerns

Land development projects are often subject to environmental regulations and permitting requirements, which can pose challenges and delays. Environmental concerns such as soil contamination, wetlands, and endangered species habitats may require costly remediation or mitigation measures. Additionally, regulatory changes or zoning restrictions imposed by local authorities can impact the feasibility and profitability of land development projects.

Lack Of Infrastructure And Utilities

Undeveloped land may lack essential infrastructure and utilities, such as water, sewer, electricity, and roads, which can pose challenges for development and limit property value. Developing infrastructure and utilities can be costly and time-consuming, requiring coordination with local authorities and utility providers. Borrowers should assess the availability and cost of infrastructure improvements and consider these factors when evaluating the feasibility and profitability of land development projects.

Uses Of Land Loans

Residential Development

Land loans are commonly used to finance residential development projects, including the construction of single-family homes, townhouses, condominiums, and residential subdivisions. Developers and homebuilders utilize land loans to acquire land parcels and develop residential communities to meet the demand for housing in growing markets. Residential development projects may involve infrastructure improvements, such as roads, utilities, and landscaping, to create desirable neighborhoods and enhance property values.

Commercial Development

Land loans also support commercial development projects, including the construction of office buildings, retail centers, industrial parks, and mixed-use developments. Developers and investors use land loans to acquire land parcels in strategic locations and develop commercial properties to serve businesses and consumers. Commercial development projects may involve feasibility studies, market analysis, and zoning approvals to ensure the viability and profitability of the proposed developments.

Agricultural And Farmland Investment

Land loans provide financing for agricultural and farmland investment opportunities, allowing investors to acquire land for farming, ranching, and agricultural production. Agricultural land loans support various agricultural operations, including crop cultivation, livestock farming, and agribusiness ventures. Investors may also use land loans to purchase farmland for conservation purposes, organic farming, or sustainable agriculture initiatives.

Recreational And Vacation Properties

Land loans are utilized to finance recreational and vacation properties, such as hunting land, waterfront properties, mountain retreats, and vacation homes. Individuals and families seeking recreational getaways or second homes often use land loans to acquire properties in scenic or desirable locations. Recreational land loans may offer flexible financing options and favorable terms for buyers looking to invest in vacation properties for personal use or rental income.

What Are Land Loans? - An In-depth Review - FAQs

What Types Of Land Can Be Financed With Land Loans?

Land loans can be used to finance various types of land, including raw land without any existing infrastructure or improvements, residential lots within developed neighborhoods, commercial parcels for business or retail developments, agricultural land for farming or ranching operations, and recreational properties for hunting or vacation purposes.

What Are The Drawbacks Or Risks Associated With Land Loans?

While land loans offer opportunities for land acquisition and development, they also come with risks and challenges. Drawbacks of land loans may include higher interest rates, larger down payment requirements, a lack of income generation, the potential for market volatility and investment risks, regulatory and environmental concerns, and longer holding periods compared to other types of real estate investments.

Are Land Loans Suitable For All Borrowers?

Land loans may not be suitable for all borrowers, as they require careful consideration of financial resources, investment objectives, and risk tolerance. Borrowers should assess their financial situation, conduct feasibility studies, and consult with professionals to determine whether obtaining a land loan aligns with their long-term financial goals and objectives.

Conclusion

In conclusion, land loans serve as valuable financial tools for individuals, investors, and businesses seeking to acquire land for various purposes, from residential and commercial development to agricultural and recreational use. By providing funding for land acquisition and development projects, land loans offer opportunities for growth, investment, and wealth accumulation.

However, borrowers need to understand the complexities and risks associated with land loans. From eligibility requirements and loan terms to market volatility and regulatory considerations, borrowers must carefully evaluate all aspects of the land loan process. Thorough research, due diligence, and consultation with financial and real estate professionals are crucial steps for borrowers to make informed decisions and mitigate risks effectively.

Stefano Mclaughlin

Author

Luqman Jackson

Reviewer

Latest Articles

Popular Articles