Top 5 Trending Stocks In 2024 - A Deep Dive Into Market Movers

Unleash Market Momentum: Top Trending Stocks in 2024 (Hidden Gems!) Discover the hottest stocks soaring past the competition. Don't miss out on the next market gold rush!

Author:Emmanuella SheaReviewer:Camilo WoodJan 12, 20241.7K Shares95.6K Views

Imagine a world where fortunes are made and lost in the blink of an eye, where whispers of potential turn into roaring profits, and where the next big thing might just be hiding in plain sight. This, my friends, is the exhilarating world of trending stocks.

But what exactly are trending stocks? They're the market's darlings, the companies whose names are on everyone's lips and whose share prices are making a meteoric rise. They're the ones that capture the imagination of investors, fueled by innovation, groundbreaking technology, or simply the sheer buzz surrounding them.

Think of it like a treasure hunt, but instead of gold and jewels, you're digging for market gems. Every day, new contenders emerge, vying for the coveted title of "trending stock." Some are established giants experiencing a resurgence, while others are fresh-faced startups disrupting their industries. The beauty of it all is that the possibilities are endless.

But here's the catch: just like any good treasure hunt, finding the right trending stock requires more than just luck. It takes a keen eye, a sharp mind, and a healthy dose of research. You need to understand the market, the companies involved, and the factors driving their rise.

Interpreting Stock Trends

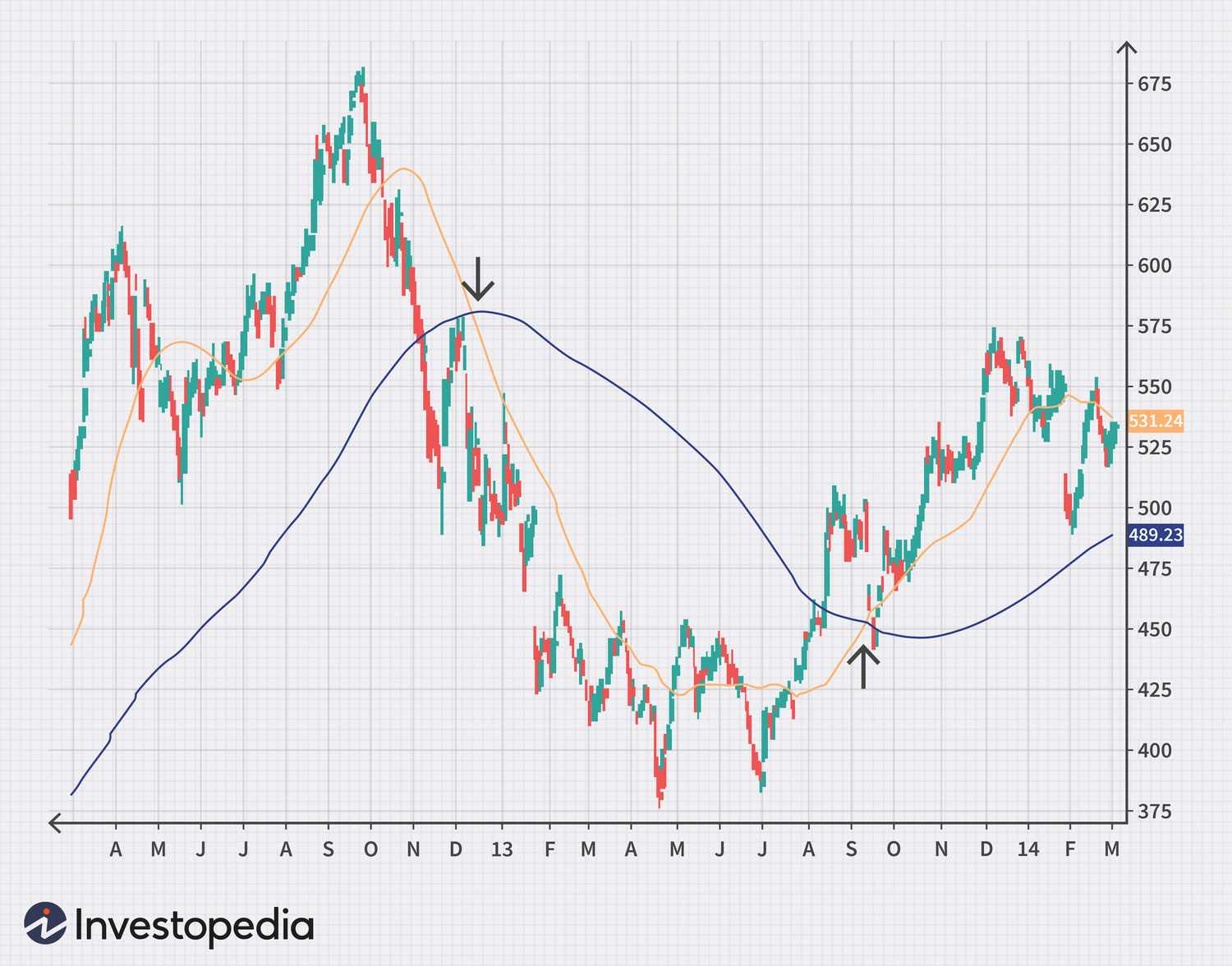

Moving averages are a common topic of discussion when discussing how to interpret stock trends. That's the name given to it because it is ever-changing. A 50-day moving average, for instance, will accumulate the closing price of a stock for a period of 50 business days. This sum, divided by 50, yields the 50-day moving average for that particular day. With this measure, daily fluctuations may not have a significant impact on the moving average, yet, over time, patterns emerge.

Stock trends can be divided into three categories: sideways, up, and down. Bearish downtrends indicate that the stock price is headed lower. Bullish patterns indicate that they are on an upward trajectory. Sideways trends don't go up or down, and their value is steady over time. It is irrelevant that these patterns are not linear; instead, they can be visualized more clearly by charting the moving average rather than the daily stock price.

In addition to these patterns, there is support and opposition. Also referred to as ceilings and floors. A resistance trend line, which indicates a price that the stock finds challenging to break through and above, follows an upward trend. Conversely, support trend lines appear when a stock's price is down. The stock struggles to drop below this level because there is a limit to how low the price can go before buyers get interested.

Ways To Discover Trending Stocks

The Volume Of Trade Has Increased

High transaction volume is always present in conjunction with trending equities. Stocks that have the highest daily transaction volume are the ones that are getting the most attention, so look for them. Unexpected shifts in volume might be used to spot either good or negative trends.

Elevated Unpredictability

Additionally, trending stocks usually exhibit high price volatility. Seek out equities that have significant daily price fluctuations. Profit is waiting for you if you can buy a stock while its price is declining and sell it when it rises.

Keeping Up With The News

Companies don't function in a vacuum. Observe the events occurring in the world. You can tell that when a tech company debuts a new device, investors are keeping a careful eye on that stock as anticipation grows.

Top Trending Stocks To Buy

The stock market can be a thrilling rollercoaster, with fortunes made and lost in the blink of an eye. But for savvy investors, staying ahead of the curve and identifying trending stocks can be a lucrative strategy. In this article, we'll explore some of the hottest stocks making waves in the market.

- Tesla (TSLA) -The electric vehicle giant continues to defy expectations, with its stock price soaring over 700% in the past year. Driven by strong demand for its innovative cars and Elon Musk's visionary leadership, Tesla is a clear leader in the green energy revolution.

- Apple (AAPL) -The tech titan recently hit a record market valuation of over $3 trillion, fueled by its booming iPhone sales and its ever-expanding ecosystem of devices and services. Apple's consistent innovation and loyal customer base make it a reliable long-term investment.

- Amazon (AMZN) -The e-commerce behemoth continues to dominate online retail, with its market share growing at an impressive clip. Amazon's cloud computing business, Amazon Web Services (AWS), is also a major growth engine, making it a well-rounded investment play.

- NVIDIA (NVDA) -The graphics chipmaker is a major player in the gaming and artificial intelligence (AI) markets, both of which are experiencing explosive growth. NVIDIA's cutting-edge technology and strong brand reputation make it a stock to keep an eye on.

- Moderna (MRNA) -The biotech company was at the forefront of the COVID-19 vaccine development race, and its mRNA technology has the potential to revolutionize medicine. Moderna's promising pipeline of future treatments makes it a stock with significant upside potential.

Riding The Wave Of Market Momentum

It's important to remember that past performance is not necessarily indicative of future results. While these trending stocks have been performing well lately, there's always the risk of a downturn. Before investing in any stock, it's crucial to do your own research and consider your individual risk tolerance.

Here are some tips for making the most of market momentum:

- Diversify your portfolio -Don't put all your eggs in one basket. Spread your investments across different sectors and asset classes to mitigate risk.

- Do your research -Before buying any stock, take the time to understand the company's business model, its financials, and its competitive landscape.

- Set stop-loss orders -These orders will automatically sell your shares if the price falls below a certain level, helping to protect you from significant losses.

- Stay patient -The stock market can be volatile in the short term. Don't get discouraged if your investments don't see immediate gains. Focus on the long term and stay invested in companies with strong fundamentals.

By following these tips and doing your own due diligence, you can increase your chances of success in the ever-changing world of the stock market.

Stock Trend Analysis Tactically

The fundamental tenet of technical analysis is that historical performance predicts future results. indicating that, given all other factors being equal, a successful business will continue to prosper. Performance is assessed using charts and other tools that forecast a business's future.

Technical analysis disregards a company's intrinsic worth since it is frequently arbitrary. Rather, it examines past data for trends, including changes in market prices. In a sense, technical analysis is less concerned with examining the fundamental causes of the trend and more focused on predicting the future using historical data.

Stock Charts

Bar charts are a type of stock chart that investors frequently use to analyze a stock's technical analysis. Although they utilize other types of stock charts as well, bar charts are the most widely used. Because stock charts show all essential price data, including the day's starting and closing prices as well as the highest and lowest prices, they are useful tools for technical analysis. Once you plot the days adjacent to one another, you can begin to see trends and make stock selections.

People Also Ask

Which Day Stock Price Is Low?

Many forums will tell you that Monday is the best day to buy stocks, while Friday is the best day to sell stocks. The logic behind this advice is that stock prices are said to be at the lowest on a Monday.

Is Bitcoin A Good Investment?

Eye-popping returns make Bitcoin attractive, but make sure you understand the risks before investing.

How To Buy Tesla Stock?

Tesla's shares trade on the NASDAQ exchange, under the ticker symbol TSLA. To purchase shares, you will need to do so through a broker. If you do not have a brokerage account, you will need to open one. At this time, Tesla does not have a direct stock purchase program.

Conclusion

Before we leave the stormy waters of trending stocks, let's review our navigational tools: fundamentals, dependable sources, and a long-term plan. Hype's seductive words, manipulative tactics, and psychological vulnerabilities are now familiar to us. We have the critical thinking skills to see beyond headlines and the emotional discipline to control fear and greed.

Facts are your lifeboats in the sea of popular news and social media buzz, helping you make smart investments. Don't let FOMO lead you down dangerous paths of misinformation and impulsivity. Instead, let information guide you to financial security and sustainable progress.

It's your turn to sail. Use our strategies, set your own course, and confidently manage the market. Continuous learning, critical thinking, and skepticism are essential to investment success.

Emmanuella Shea

Author

Camilo Wood

Reviewer

Latest Articles

Popular Articles