Unlocking The Potential Of Advanced Trading - TradeStation Vs. Interactive Brokers - A Deep Dive Into Platform Capabilities

Embark on a journey to unlock the potential of advanced trading. Explore the nuances of TradeStation and Interactive Brokers, unraveling their platform capabilities and exposing the true nature of online dealerships, guided by Reddit's wisdom.

Author:Gordon DickersonReviewer:Habiba AshtonJan 05, 20245.2K Shares127.2K Views

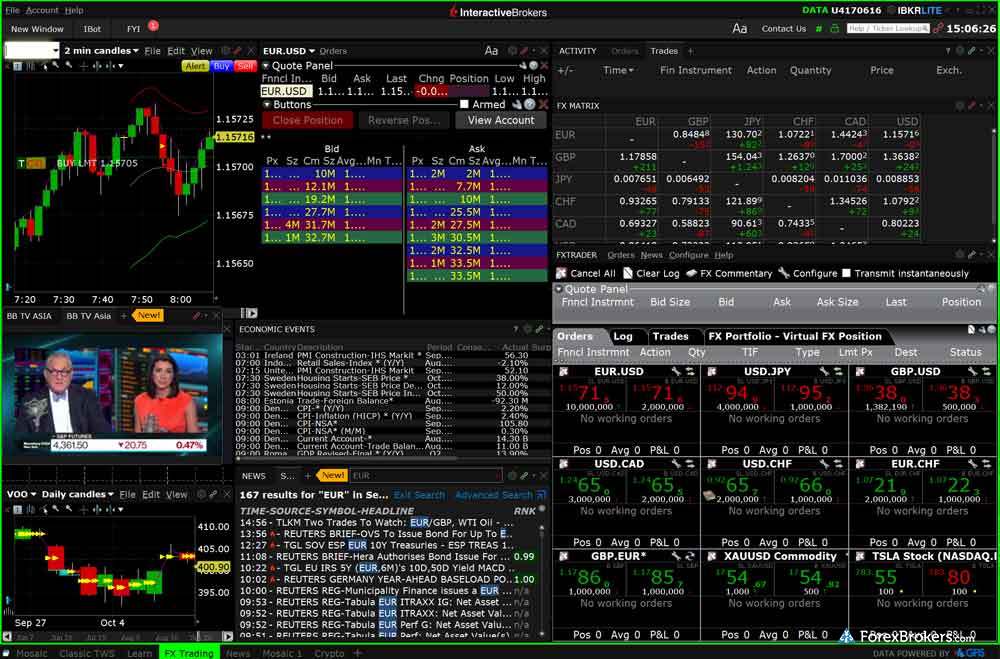

Delving into the intricacies of TradeStation and Interactive Brokers unveils a world of advanced trading capabilities, tailored to the needs of discerning investors. Both platforms provide comprehensive charting tools, enabling traders to visualize market trends and identify potential opportunities with precision. Customizable technical indicators further enhance the analytical arsenal, allowing traders to tailor their strategies to specific market conditions.

Beyond technical analysis, TradeStation and Interactive Brokers excel in order execution, offering a range of order types, including advanced options like OCO (One Cancels the Other) and Iceberg orders. Algorithmic trading enthusiasts can leverage the platforms' powerful scripting languages to automate their strategies, ensuring consistent execution even in volatile market conditions.

Delving Into The World Of Advanced Trading Platforms

In the ever-evolving landscape of financial markets, discerning traders seek platforms that can elevate their strategies to new heights. TradeStation and Interactive Brokers stand as two titans in the world of electronic trading, each offering a sophisticated suite of tools to empower advanced traders.

For seasoned traders seeking to refine their trading expertise, advanced platforms offer an arsenal of technical indicators, charting tools, and backtesting capabilities. These tools enable traders to identify patterns, analyze trends, and optimize their strategies meticulously, drawing valuable insights from historical data. Furthermore, algorithmic trading, also known as automated trading, emerged as a powerful feature championed by many advanced platforms. Algorithmic trading empowers traders to execute pre-programmed trading strategies consistently, adhering to specific criteria and eliminating emotional biases from the trading process.

TradeStation - A Platform Tailored For Technical Traders

For technical traders who rely on technical analysis to identify trading opportunities, TradeStation emerges as a powerful ally. Its extensive charting capabilities, including a vast array of technical indicators and customizable chart styles, enable traders to visualize market trends and patterns with precision. Additionally, TradeStation's powerful scripting language, EasyScript, empowers traders to develop and automate their own trading strategies, harnessing the power of technical analysis to its fullest potential.

Unveiling The Power Of Advanced Charting Tools

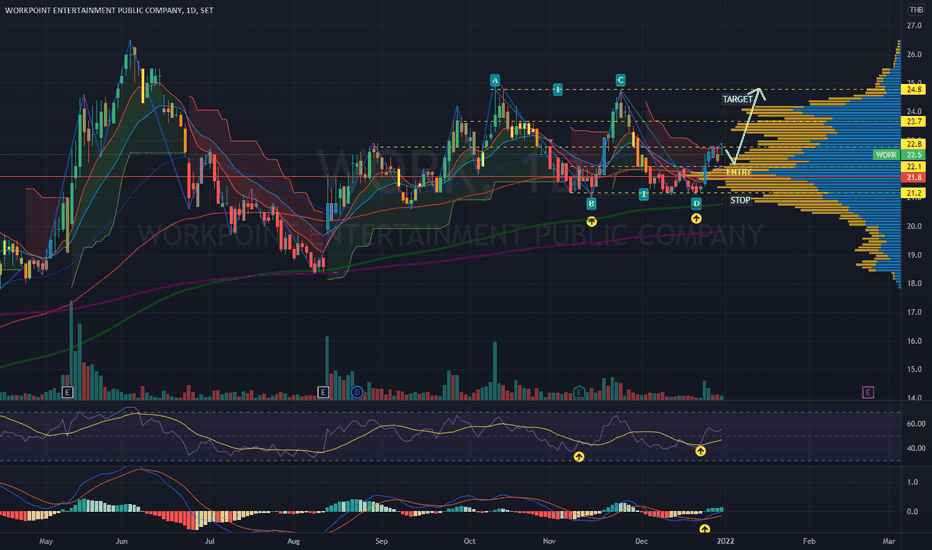

At the heart of advanced trading lies the ability to decipher market movements and identify potential opportunities with precision. Advanced charting tools serve as the cornerstone of this endeavor, providing traders with a visual representation of market trends and patterns. TradeStation and Interactive Brokers both excel in this domain, offering a comprehensive suite of charting tools that empower traders to make informed trading decisions.

Technical Indicators-Unveiling Market Insights

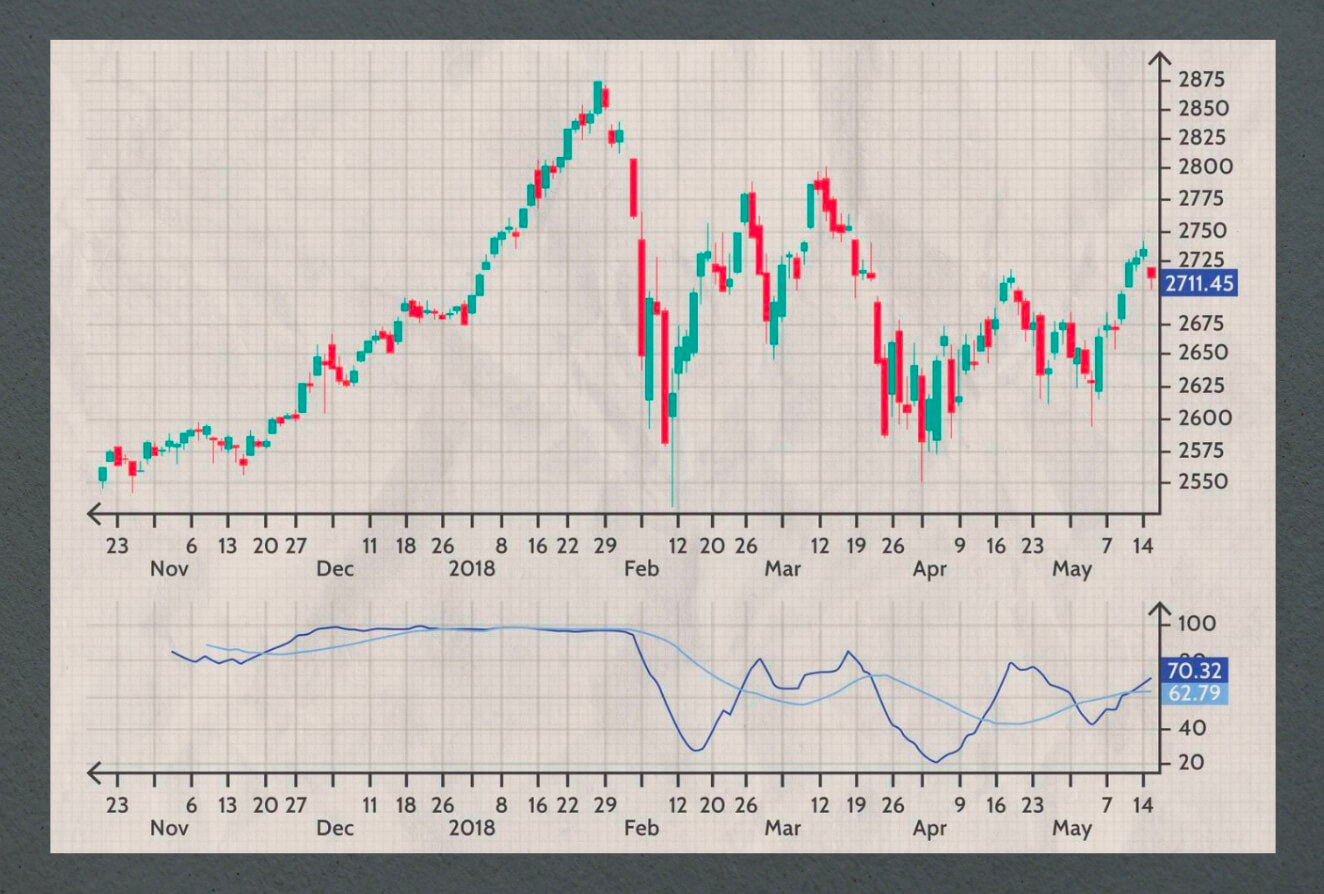

Technical indicators are the language of the charts, providing traders with quantitative insights into market behavior. TradeStation and Interactive Brokers offer a vast library of technical indicators, including trend indicators, momentum indicators, and volatility indicators, enabling traders to identify overbought and oversold conditions, assess market momentum, and gauge market volatility.

Customizable Charts - Adapting To Market Dynamics

The ability to customize charts to suit individual trading styles and market conditions is paramount for advanced traders. TradeStation and Interactive Brokers provide traders with the flexibility to customize their charts, allowing them to select from a range of chart types, apply multiple time frames, and overlay multiple technical indicators. This level of customization ensures that traders can visualize market data in a manner that aligns with their trading strategies and preferences.

By harnessing the power of advanced charting tools, TradeStation and Interactive Brokers empower traders to navigate the complexities of financial markets with greater confidence and clarity. The ability to extract actionable insights from market data is essential for advanced traders, and these platforms provide the tools and capabilities necessary to succeed in this endeavor.

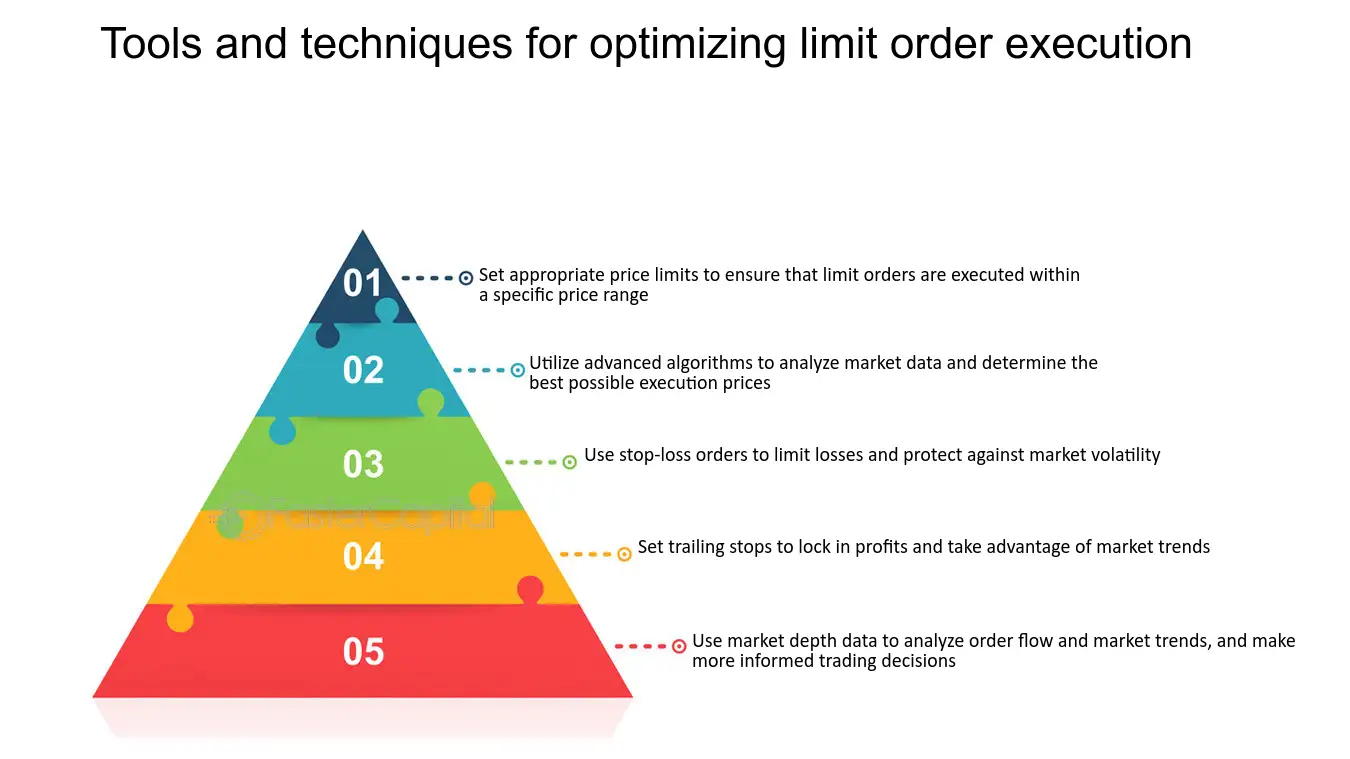

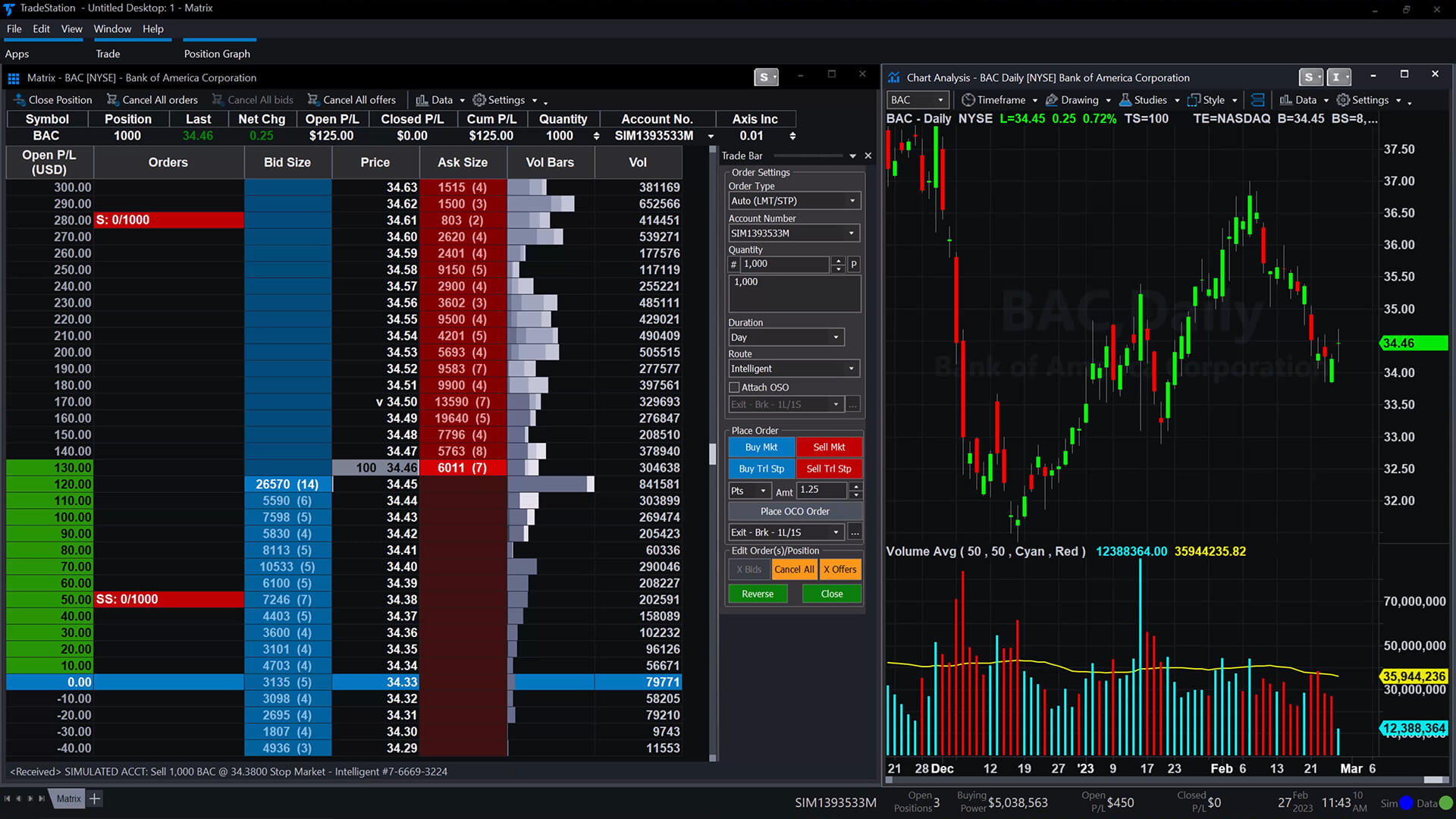

Mastering Order Execution With Advanced Order Types

In the dynamic world of financial markets, the ability to execute trades effectively is crucial for success. TradeStation and Interactive Brokers provide a range of advanced order types that empower traders to execute their strategies with precision and control. These order types go beyond basic market orders and limit orders, offering traders greater flexibility and control over their order execution.

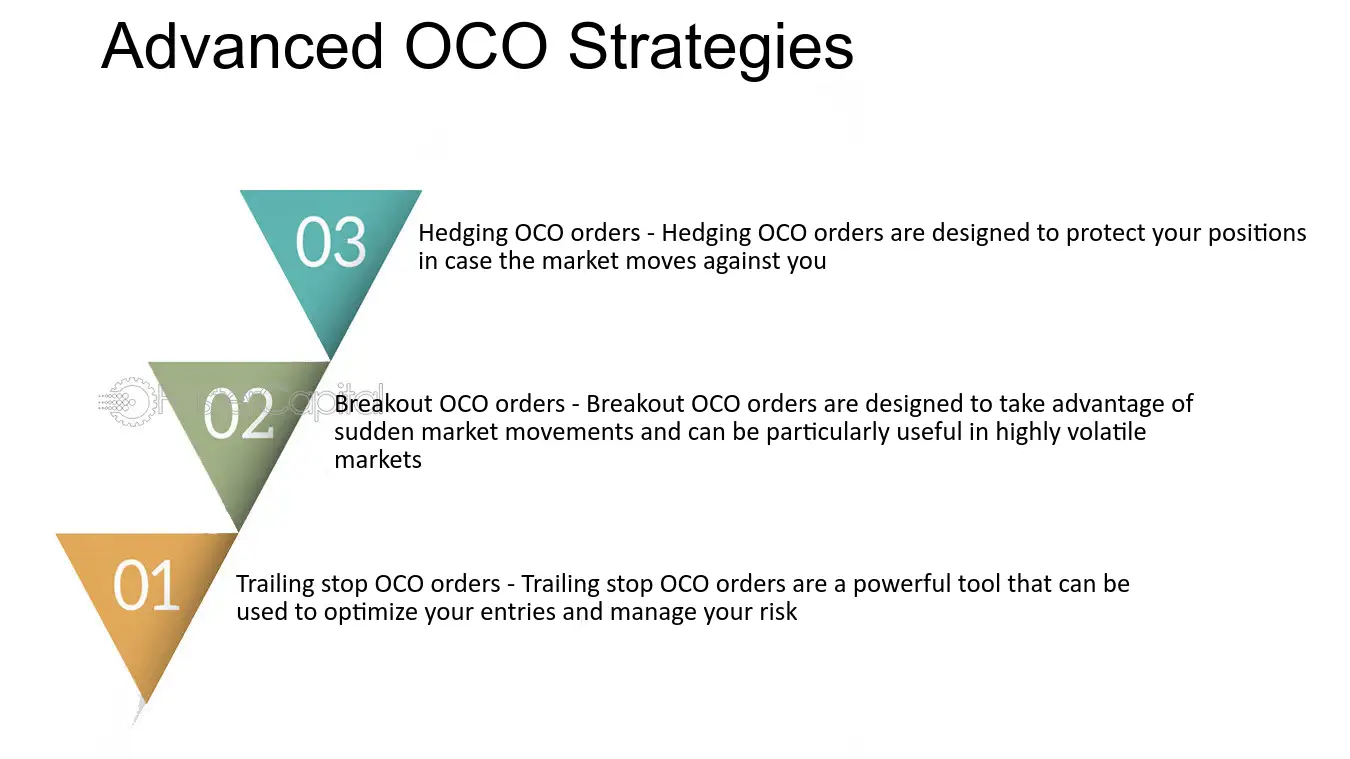

OCO Orders - Ensuring Strategic Trades

OCO orders or One Cancels the Other orders, are a valuable tool for managing multiple orders simultaneously. When placing an OCO order, traders specify two orders a buy order and a sell order. The execution of one order automatically cancels the other, ensuring that the trader's desired position is achieved without the risk of over-execution. OCO orders are particularly useful for traders seeking to establish a specific price range for their trades or to hedge against potential price movements.

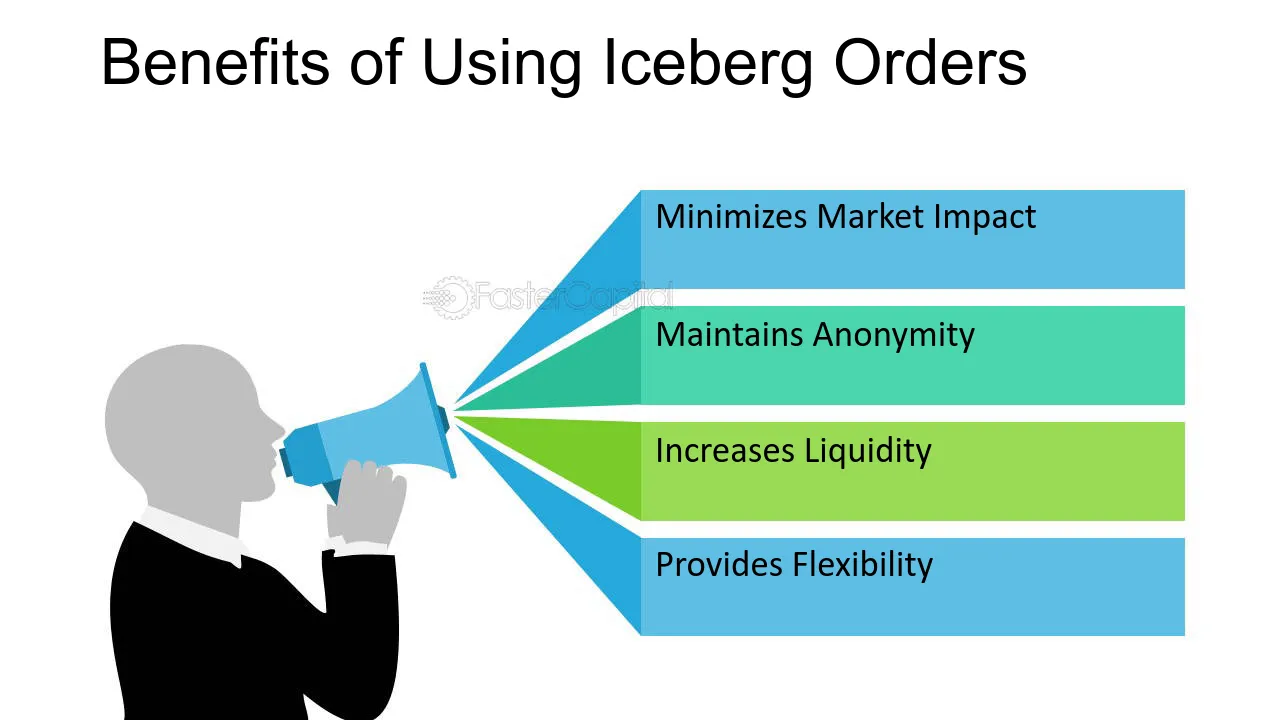

Iceberg Orders-Discreetly Entering And Exiting Markets

Iceberg orders are designed to minimize market impact and reduce slippage, particularly when entering or exiting large positions. With an iceberg order, traders split a large order into multiple smaller orders, or "legs," and only the first leg is initially visible to the market. As the first leg is executed, the next leg is automatically released, and this process continues until the entire order is filled. This approach helps to disguise the true size of the order and minimize its impact on market prices.

TradeStation and Interactive Brokers both offer robust support for advanced order types, providing traders with the tools they need to execute their strategies with greater sophistication and control. These advanced order types are particularly valuable for professional traders and algorithmic traders who require precise control over their order execution.

Embracing Algorithmic Trading - Automation For Enhanced Efficiency

In the realm of advanced trading, algorithmic trading stands as a powerful tool for automating trading strategies and achieving consistent performance. TradeStation and Interactive Brokers both provide comprehensive support for algorithmic trading, offering powerful scripting languages and advanced backtesting capabilities to empower traders to develop, refine, and implement their algorithmic strategies.

Scripting Languages - Unleashing Algorithmic Strategies

At the core of algorithmic trading lies the ability to translate trading strategies into executable code. TradeStation and Interactive Brokers provide traders with powerful scripting languages, EasyScript and TWS API, respectively, that enable them to express their trading strategies in a clear and concise manner. These scripting languages offer a wide range of functionalities, including technical analysis tools, order management functions, and risk management parameters, empowering traders to automate their strategies with precision and control.

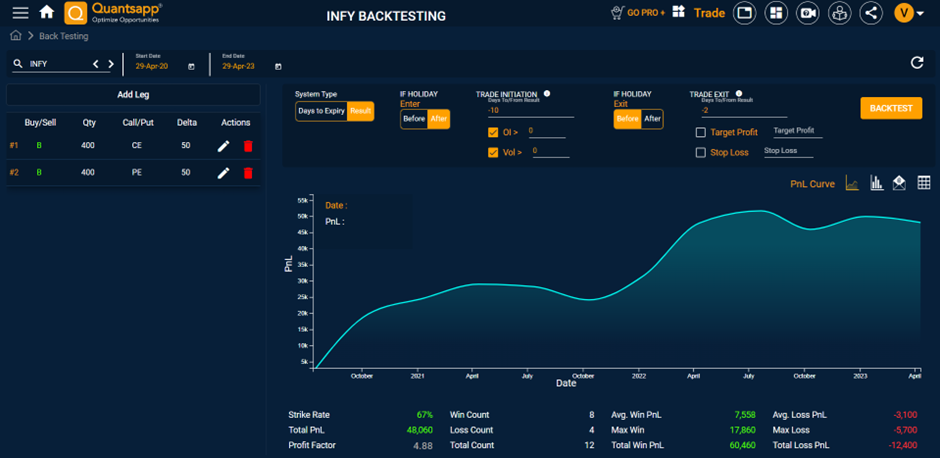

Backtesting - Refining Strategies For Market Success

Before deploying algorithmic strategies in live markets, traders must rigorously test their strategies to assess their performance under various market conditions. TradeStation and Interactive Brokers provide sophisticated backtesting tools that enable traders to evaluate their strategies against historical market data. Through backtesting, traders can identify potential weaknesses in their strategies, refine their parameters, and optimize their performance before risking real capital.

By embracing algorithmic trading, TradeStation and Interactive Brokers empower traders to automate their strategies, achieve consistent execution, and enhance their overall trading efficiency. These platforms provide the tools and capabilities necessary to develop, test, and implement robust algorithmic strategies, enabling traders to navigate the complexities of financial markets with greater sophistication and control.

Choosing The Right Platform - Matching Needs And Aspiration

Navigating the world of advanced trading platforms requires careful consideration of individual trading styles, goals, and experience levels. TradeStation and Interactive Brokers both excel in their respective domains, offering traders a range of features and capabilities to suit their specific needs.

TradeStation - A Platform For Technical Traders And Algorithmic Enthusiasts

For traders who prioritize technical analysis and algorithmic trading, TradeStation emerges as the ideal choice. Its extensive charting capabilities, customizable trading tools, and powerful scripting language, EasyScript, cater to the needs of technical traders seeking to identify trading opportunities and automate their strategies with precision. Additionally, TradeStation's user-friendly interface and comprehensive educational resources make it a suitable platform for both novice and experienced technical traders.

Interactive Brokers-A Comprehensive Suite For Professional Traders

Professional traders seeking a robust and versatile trading platform find Interactive Brokers to be an invaluable partner. Its comprehensive suite of trading tools, including advanced order types, institutional-grade market access, and sophisticated risk management features, is tailored to the demands of professional traders. Moreover, Interactive Brokers' global reach and deep market liquidity ensure seamless order execution and optimal performance for professional traders.

When selecting between TradeStation and Interactive Brokers, traders should carefully assess their trading style, experience level, and specific needs. TradeStation caters to technical traders and algorithmic enthusiasts seeking a platform with extensive charting capabilities and a powerful scripting language. Interactive Brokers, on the other hand, provides a comprehensive suite of trading tools and institutional-grade infrastructure for professional traders seeking advanced order execution and global market access.

Risk Management - Safeguarding Capital In Volatile Markets

The dynamic nature of financial markets presents inherent risks, making risk management an essential component of advanced trading. TradeStation and Interactive Brokers provide a range of robust risk management tools that empower traders to safeguard their capital and optimize their risk-reward profile.

Stop-Loss Orders - Limiting Potential Losses

Stop-loss orders serve as a crucial safeguard against excessive losses, automatically exiting a position when it reaches a predetermined price level. By setting stop-loss orders, traders can limit their potential losses and protect their capital, preventing significant drawdowns in volatile market conditions. TradeStation and Interactive Brokers offer a variety of stop-loss order types, including trailing stops and bracket orders, providing traders with flexible options to manage risk and protect their capital.

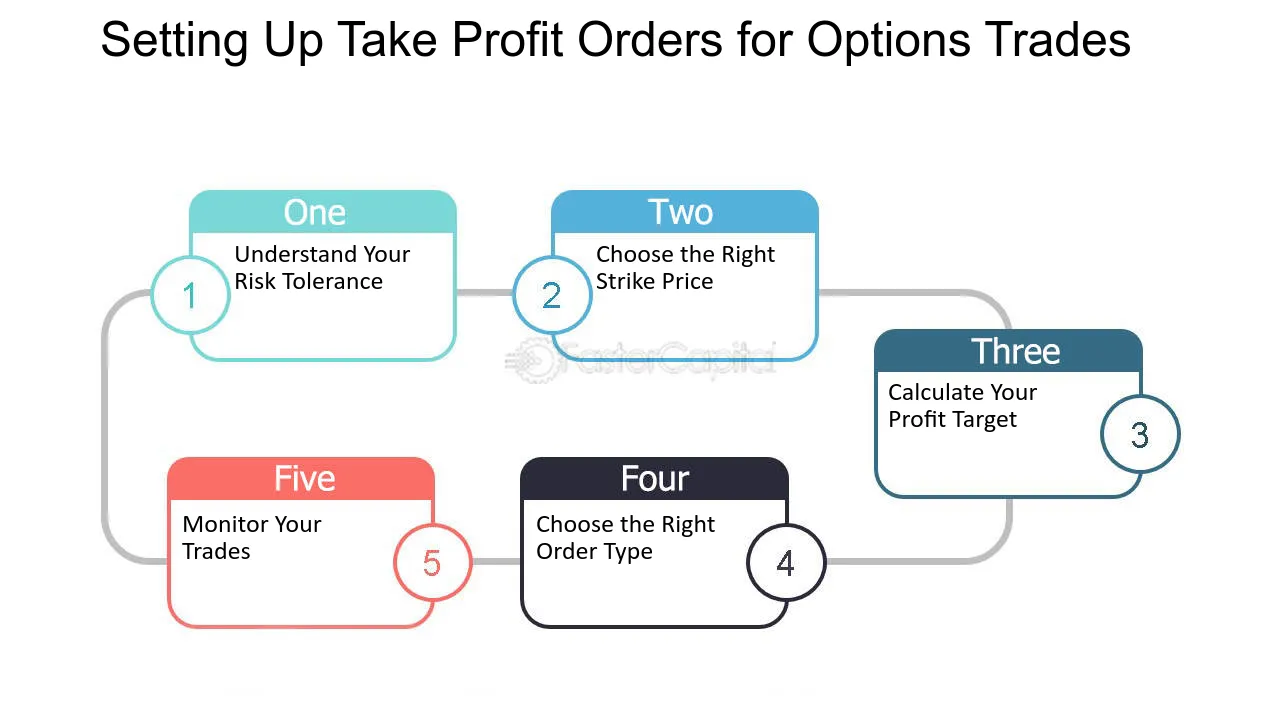

Profit Targets - Locking In Gains

Just as limiting losses is crucial, so is locking in profits. Profit targets, or take-profit orders, are designed to automatically exit a position when it reaches a predetermined profit level. This ensures that traders secure gains and prevent potential reversals in the market direction. TradeStation and Interactive Brokers offer various profit target order types, allowing traders to lock in profits while maintaining flexibility in their trading approach.

Position Sizing - Managing Risk And Optimizing Returns

Position sizing is a fundamental aspect of risk management, determining the appropriate size of each trade relative to the trader's overall portfolio. TradeStation and Interactive Brokers provide position-sizing calculators and risk management tools that help traders determine optimal position sizes based on their risk tolerance, account size, and trading strategy. By managing position sizes effectively, traders can optimize their risk-reward ratio and achieve their trading goals while maintaining prudent risk management practices.

By employing effective risk management strategies, TradeStation and Interactive Brokers empower traders to navigate the complexities of financial markets with greater confidence and control. These platforms provide the tools and capabilities necessary to protect capital, lock in profits, and optimize risk-reward profiles, ensuring that traders can pursue their trading aspirations with a sound foundation of risk management principles.

Frequently Asked Questions

Is TradeStation Or Interactive Brokers Better?

TradeStation is more of a purely technical trading platform, while Interactive Brokers gives you the fundamental tools with the technical ones. When it comes to technical trading, they are very evenly matched. Overall, however, Interactive Brokers edges TradeStation out in most of our comparison categories.

Can You Connect TradeStation To Interactive Brokers?

In order to get access to the TradeStation platform you must click on OPEN AN ACCOUNT and then click on “LINK MY IB ACCOUNT'. You must accept our Terms and Conditions and then contact your Interactive Brokers account representative to finalize the process.

Is TradeStation Zero Commission?

1. TS SELECT - Our zero commission pricing for stocks, options, and futures refers to our TS SELECT plan. This pricing is only available to U.S. residents. “Commission-free” for equities trades applies only to (a) exchange-traded stocks priced at or above $1.00 per share and (b) the first 10,000 shares per trade.

Conclusion

In conclusion, TradeStation and Interactive Brokers are both powerful electronic trading platforms that offer a sophisticated suite of tools to empower advanced traders. TradeStation is particularly well-suited for technical traders and algorithmic enthusiasts, while Interactive Brokers caters to the needs of professional traders seeking advanced order execution and global market access. Ultimately, the choice between the two platforms hinges on the individual trader's aspirations, trading style, and specific needs.tunesharemore_vertadd_photo_alternat.

Jump to

Delving Into The World Of Advanced Trading Platforms

Unveiling The Power Of Advanced Charting Tools

Mastering Order Execution With Advanced Order Types

Embracing Algorithmic Trading - Automation For Enhanced Efficiency

Choosing The Right Platform - Matching Needs And Aspiration

Risk Management - Safeguarding Capital In Volatile Markets

Frequently Asked Questions

Conclusion

Gordon Dickerson

Author

Habiba Ashton

Reviewer

Latest Articles

Popular Articles