Powerful Trade Ideas For Savvy Investors - Unlocking The Stock Market's Secrets

Cracking the market code, discover high-probability trade ideas & unlock explosive profits. Master the secrets savvy investors use to dominate Wall Street.

Author:Darren McphersonReviewer:Dexter CookeFeb 01, 20248.4K Shares196.4K Views

You're scrolling through Reddit, knee-deep in memes and cat videos, when a post catches your eye. It's titled "The $10 Stock Poised to Soar 1000% – Don't Miss This!". Curiosity piqued, you click, and a whirlwind of charts, technical jargon, and bullish predictions engulfs you. This, my friends, is the allure of the Trade Idea a whispered promise of riches hidden within the labyrinthine world of finance.

But let's be real, Reddit fam. While the stock market may seem like a casino for the privileged few, the truth is, there's no magic formula or whispered secret that guarantees overnight success. However, there is a powerful tool at your disposal – the trade idea. These nuggets of investment wisdom, gleaned from technical analysis, company fundamentals, or even the latest market buzz, can be the compass that guides you through the murky waters of Wall Street. Whether you're a seasoned trader seeking alpha or a curious newbie dipping your toes in, understanding trade ideas can unlock a whole new level of investing savvy.

So, buckle up, Redditors, because we're about to crack the code on this whole "trade idea" thing. We'll delve into the different types, from technical analysis patterns that whisper of hidden trends to fundamental insights that expose undervalued gems. We'll equip you with the tools to evaluate these ideas like a pro, separating the market-beating diamonds from the fool's gold hype. And remember, this journey isn't about chasing get-rich-quick schemes; it's about building a portfolio that reflects your goals and risk tolerance, brick by carefully chosen brick.

Demystifying Trade Ideas - Your Guide to Market Wisdom

Have you ever stumbled upon a Reddit post touting a "surefire" stock pick, leaving you torn between skepticism and FOMO? These whispers, often referred to as trade ideas, hold the potential to unlock market secrets, but navigating them requires understanding. So, what exactly are these elusive tidbits?

A trade idea is like a whispered roadmap, suggesting a specific stock and the rationale behind buying or selling it. It typically includes:

- The Stock -The target of your investment, often accompanied by a ticker symbol.

- The Rationale - The logic behind the suggestion, whether it's technical analysis, fundamental strength, or a news-driven catalyst.

- Entry and Exit Points -Suggested times to buy and sell the stock to maximize potential profit.

Remember, trade ideas are not financial advice. They're merely suggestions, and the responsibility for your investment decisions lies solely with you. Think of them as sparks of inspiration, prompting you to do your own research and analysis before making any moves.

So, where do these whispers originate? The market is a cacophony of voices. Financial professionals, for instance, share their insights with clients, while online platforms offer automated algorithms churning out potential trades. Research reports and even Reddit communities can be valuable sources, but always approach them with a critical eye.

Now, let's delve into the different types of trade ideas:

- Technical Analysis -This approach uses charts and indicators like moving averages and RSI to identify patterns and predict future price movements. Think of it as reading the market's tea leaves.

- Fundamental Analysis -This method focuses on a company's financials, industry trends, and economic data to assess its long-term potential. It's like peering into the company's engine room.

- News-driven Trade Ideas -These ideas capitalize on breaking news events and their immediate impact on specific stocks. It's like riding the wave of market reactions.

- Contrarian Trade Ideas -This strategy involves going against the grain, seeking undervalued gems or stocks everyone else has abandoned. It's like being a contrarian treasure hunter.

Each approach has its strengths and weaknesses, and understanding them is key to choosing the ones that resonate with your investment style and risk tolerance. Remember, the market is a complex beast, and no single trade idea guarantees success. But by demystifying them and equipping yourself with knowledge, you can transform those whispers into informed decisions, leading you closer to your financial goals.

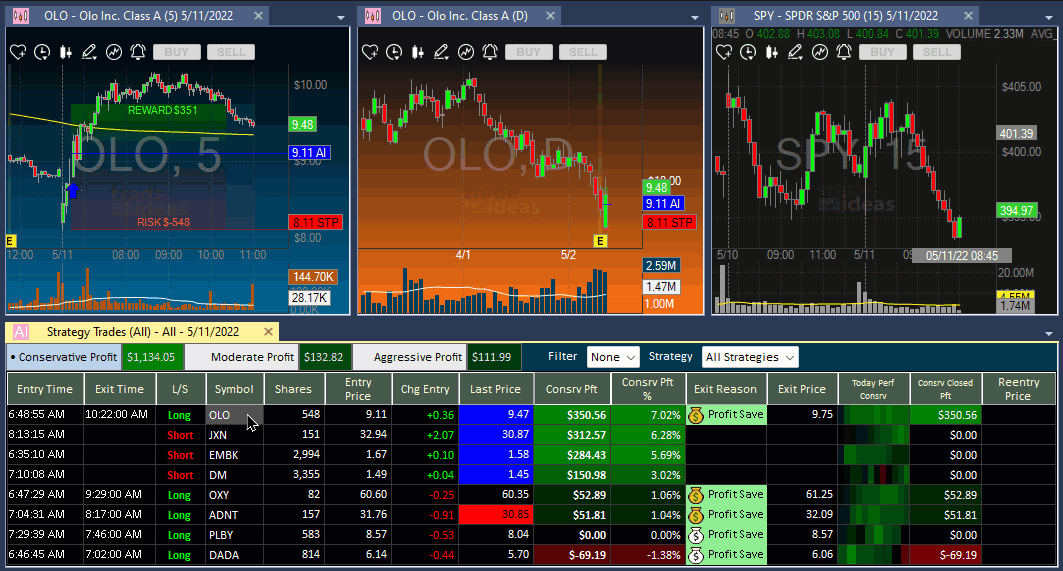

Trade Idea Scanners

Whisper secrets across the market, but they come in two distinct voices software and human.

Software tools act like tireless robots, scouring the market landscape day and night. Driven by your customized settings, they scan stocks through a web of technical indicators like moving averages and RSI, fundamental factors like P/E ratios and dividends, and even news-driven catalysts like earnings releases. Like vigilant watchtowers, they send alerts when potential opportunities flicker into existence, ready for your astute analysis.

But don't underestimate the power of the human touch. Seasoned financial analysts, honed by experience and meticulous research, whisper their own trade ideas directly into your ear. These personalized insights, tailored to your specific goals and risk tolerance, can be like gold dust, illuminating hidden gems the scanners might miss.

Both these voices offer unique advantages. Software tools, often at affordable prices, cater to both beginners and seasoned investors, democratizing market insights. Human analysts, while potentially expensive, provide personalized guidance and deep dives into specific sectors or investment strategies.

Unlocking the Secrets - From Whispers to Wisdom

Unearthing hidden gems in the market isn't just about deciphering trade ideas; it's about mastering the art of evaluation and exploration. But fear not, fellow investor, for this is where the real treasure hunt begins!

Evaluating a trade idea requires a keen eye for potential, a steady hand against risk, and a unwavering commitment to your own investment strategy. Think of it as building a sturdy bridge between whispers and informed decisions.

First, assess the risk-reward ratio. Is the potential gain worth the potential loss? Align this with your risk tolerance and overall strategy. A high-risk, high-reward opportunity might be tempting, but if it clashes with your conservative approach, it's best left unexplored.

Independent research is your shield against the hype. Don't blindly follow whispers; dig deeper into the company's financials, industry trends, and technical indicators. Use credible sources like research reports, financial news, and even online tools to validate the rationale behind the idea.

Beware of common pitfalls! Chasing hype and emotional investing are two wolves in sheep's clothing. Remember, popular stocks aren't always the best choices, and knee-jerk reactions to market swings can lead to costly mistakes. Don't let greed or fear cloud your judgment.

But the true power lies in building your own trade ideas! Hone your research skills and discover data sources like financial news, industry reports, and online platforms. Learn the language of technical indicators and fundamental analysis. This opens the door to a universe of possibilities, where you can identify potential gems before the whispers even begin.

Finally, before venturing into the real market, test your ideas in a safe haven. Backtesting and paper trading allow you to simulate real-world scenarios without risking real money. This is your training ground, your proving ground, where you can refine your strategies and build confidence before taking the plunge.

Powerful Trade Ideas for Savvy Investors

Alright, Reddit fam, let's crack open the treasure chest of trade ideas and see what gems we can uncover! We'll delve into real-world examples based on different types of analysis, then explore how to navigate the bustling streets of Reddit for even more market savvy. Buckle up, because we're about to level up your investment game.

From Whispers to Windfalls

- Technical Trendsetter - Riding the Dogecoin Wave (Fundamental & Technical Analysis) - The Doge craze of 2021? While many saw it as a meme-fueled fad, savvy investors spotted a confluence of technical and fundamental factors primed for a surge. The Relative Strength Index (RSI), a technical indicator for overbought/oversold conditions, dipped below 30, signaling potential undervaluation. Meanwhile, news of Tesla's Bitcoin adoption and Elon Musk's Dogecoin tweets fueled buying pressure. The entry point could have been around $0.05, with a target near $0.70 when the hype peaked. This case highlights the power of combining technical analysis with news-driven catalysts to identify explosive opportunities.

- Fundamental Gem Hunter - Unearthing Value in Beyond Meat (Fundamental Analysis) - While the plant-based protein market was heating up, Beyond Meat (BYND) saw a dip in 2022 due to competition and production issues. However, fundamental analysis revealed a strong story: leading market share, high brand recognition, and innovative product launches. The company's price-to-earnings (P/E) ratio had also dropped to a tempting level, indicating potential undervaluation. A long-term buy around $50 with a target of $100+ could have capitalized on the company's long-term growth potential. This case emphasizes the importance of looking beyond short-term fluctuations and identifying companies with strong fundamentals for long-term gains.

- News Ninja - Capitalizing on the Green Rush (News-driven Trade) - When California legalized recreational cannabis in 2016, early investors identified a goldmine in cannabis-related stocks. Companies like Tilray (TLRY) and Cronos Group (CRON) saw explosive growth as news of the legalization fueled buying frenzy. A short-term buy around the legalization announcement, followed by a quick exit as the hype subsided, could have captured significant profits. This case reminds us that staying informed about major news events and their potential market impact can create lucrative opportunities.

Reddit Riches - Unlocking the Power of the Hivemind

Reddit isn't just memes and cat videos; it's a treasure trove of investment insights. But navigating this buzzing marketplace requires some know-how:

- Subreddits -Dive into communities like r/wallstreetbets, r/investing, or industry-specific subs for discussions, analyses, and even potential trade ideas. Remember, always do your own research before blindly following any suggestions.

- Threads -Don't miss valuable deep dives! Look for high-quality threads with detailed analysis, data-driven arguments, and constructive discussions. Engage with the community, ask questions, and learn from different perspectives.

- Skepticism is Key -Be wary of hype and pump-and-dumps. If something sounds too good to be true, it probably is. Always verify information, cross-check data, and avoid emotionally charged posts promising quick riches.

By combining case studies with Reddit-specific tips, you're equipped to turn whispers into informed actions and navigate the market with confidence. Remember, there's no guaranteed formula for success, but with critical thinking, independent research, and a healthy dose of skepticism, you can unlock the power of Reddit and become a savvy investor, one trade idea at a time.

People also ask

Is trade ideas worth it?

Trade Ideas is an invaluable asset for any trader. Out of the thousands of stocks in the market that you could trade, these scanners will find the small handful that are actually worth trading each day. When it comes to AI scanners, there is nothing else that compares. It's a 5 star product.

How do you create?

To create a strategy, you'll need access to charts that reflect the time frame to be traded, an inquisitive and objective mind, and a pad of paper to jot down your ideas. Then you formalize these ideas into a strategy and "visually backtest" them on other charts.

Is Ideas good for day trading?

Trade ideas is absolutely an essential tool i use daily to scan the stock market, i have been using this software for the last 5 years and it has been great!

Conclusion

The whispers that fill the market, once shrouded in mystery, now have the potential to become roaring bullhorns of opportunity. We've cracked the code on trade ideas, explored their different flavors, and even navigated the bustling streets of Reddit to find hidden gems. But remember, fellow investor, this treasure map is just the beginning.

Trade ideas are not holy grails but sparks of inspiration. They provide a starting point, not a guaranteed path to riches. Responsible investing, meticulous research, and thorough due diligence are your true shields against risk. Understand your risk tolerance and align your strategies with it. Chasing fleeting trends or succumbing to FOMO might lead to costly lessons.

Remember, slow and steady often wins the investment race. Sharpen your research skills and never stop learning. The market is a dynamic beast, and continuous learning is the key to staying ahead of the curve. Dive into financial news, research reports, and online tools to hone your analysis and build your own treasure trove of knowledge. Become an active explorer, not a passive follower. Reddit communities can offer valuable insights, but always approach them with a critical eye. Verify information, challenge assumptions, and build your own informed opinions.

Darren Mcpherson

Author

Darren Mcpherson brings over 9 years of experience in politics, business, investing, and banking to his writing. He holds degrees in Economics from Harvard University and Political Science from Stanford University, with certifications in Financial Management.

Renowned for his insightful analyses and strategic awareness, Darren has contributed to reputable publications and served in advisory roles for influential entities.

Outside the boardroom, Darren enjoys playing chess, collecting rare books, attending technology conferences, and mentoring young professionals.

His dedication to excellence and understanding of global finance and governance make him a trusted and authoritative voice in his field.

Dexter Cooke

Reviewer

Dexter Cooke is an economist, marketing strategist, and orthopedic surgeon with over 20 years of experience crafting compelling narratives that resonate worldwide.

He holds a Journalism degree from Columbia University, an Economics background from Yale University, and a medical degree with a postdoctoral fellowship in orthopedic medicine from the Medical University of South Carolina.

Dexter’s insights into media, economics, and marketing shine through his prolific contributions to respected publications and advisory roles for influential organizations.

As an orthopedic surgeon specializing in minimally invasive knee replacement surgery and laparoscopic procedures, Dexter prioritizes patient care above all.

Outside his professional pursuits, Dexter enjoys collecting vintage watches, studying ancient civilizations, learning about astronomy, and participating in charity runs.

Latest Articles

Popular Articles