Top US Financial Experts - Navigating The Complex World Of Finance

In this article, we'll delve into the profiles of some of the top US financial experts who have made a lasting impact on the financial world.

Author:Frazer PughReviewer:Emmanuella SheaNov 30, 20234.8K Shares180.9K Views

In the dynamic landscape of finance, having guidance from seasoned experts is crucial for making informed decisions. The United States boasts a plethora of financial experts who have demonstrated unparalleled expertise and have significantly contributed to shaping the financial industry. In this article, we'll delve into the profiles of some of the top US financial expertswho have made a lasting impact on the financial world.

Janet Yellen - A Trailblazing Economist And Pioneer At The Federal Reserve

Janet Yellenis not merely an economist; she is a trailblazer who has left an indelible mark on the financial world. Breaking through the glass ceiling, she achieved a historic milestone by becoming the first woman to serve as the Chair of the Federal Reserve. Yellen's journey is a testament to her resilience, expertise, and dedication to advancing economic stability.

Pioneering Leadership At The Federal Reserve

Yellen's tenure as the Chair of the Federal Reserve, from 2014 to 2018, marked a period of significant economic challenges and uncertainties. Her leadership was characterized by a steady hand and a keen understanding of monetary policy, contributing to the resilience of the US economy during pivotal moments. Yellen's ability to navigate complex financial landscapes earned her the respect of colleagues and policymakers alike.

Shattering The Glass Ceiling

Yellen's appointment as the first female Chair of the Federal Reserve was a groundbreaking moment in the traditionally male-dominated field of economics. Her achievement not only symbolized progress but also inspired countless women to pursue careers in finance and economics. Yellen's success serves as a reminder that diversity and inclusion are not just ethical imperatives but also catalysts for excellence in leadership.

Extensive Expertise In Monetary Policy

With a robust background in economic research and monetary policy, Yellen brought a wealth of knowledge to her role at the Federal Reserve. Her academic achievements, including a Ph.D. in Economics from Yale University, provided a solid foundation for the challenges she faced in guiding the nation's monetary policy. Yellen's ability to blend academic rigor with practical application made her a respected authority in economic circles.

Steadfast Leadership In Economic Challenges

Yellen's term at the Federal Reserve coincided with a period of economic recovery from the 2008 financial crisis. Her leadership was pivotal in implementing measures to stimulate economic growth while maintaining financial stability. Yellen's decisions were guided by a deep understanding of economic dynamics, a trait that continues to make her insights highly sought after in times of economic uncertainty.

Continued Influence In Financial Circles

Even after her tenure at the Federal Reserve, Yellen remains a prominent figure in financial circles. Her perspectives on economic trends, policy implications, and global financial dynamics are highly valued by policymakers, investors, and economists alike. Yellen's ability to distill complex economic concepts into understandable insights contributes to her enduring influence.

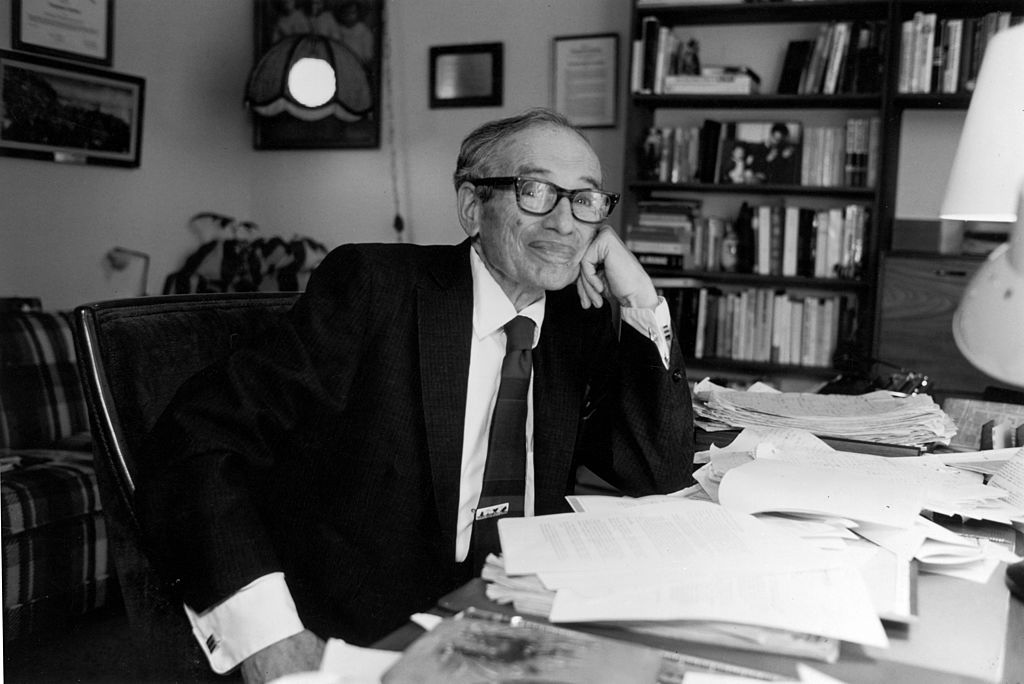

Benjamin Graham - The Father Of Value Investing

Benjamin Graham, often hailed as the father of value investing, has left an indelible mark on the world of finance. His groundbreaking approach to investing has stood the test of time, influencing generations of investors and shaping the very foundations of modern investment strategies.

Value Investing Philosophy

Graham's philosophy of value investing is rooted in the idea of identifying and acquiring undervalued stocks with the potential for long-term growth. Unlike the prevailing trends of his time, Graham's approach, introduced in the 1930s, eschewed speculative fervor and hot market ideas. Instead, he advocated for a disciplined methodology that prioritized fundamental analysis, thorough research, and, above all, patience.

Intrinsic Value Calculation

A cornerstone of Graham's value investing philosophy is the concept of intrinsic value. Rather than being swayed by market trends or short-term fluctuations, Graham believed in determining the intrinsic value of a company. This intrinsic value, representing the true worth of a stock, is calculated through meticulous financial analysis, considering factors such as earnings, dividends, and growth potential.

Revolutionary Ideas In The 1930s

Graham's ideas were revolutionary in the 1930s, a period marked by the aftermath of the Great Depression and the need for a more rational and analytical approach to investing. In an era dominated by speculative excesses, Graham's emphasis on a conservative and systematic investment strategy was nothing short of groundbreaking.

Legacy At Columbia Business School

Graham's influence extends beyond his groundbreaking ideas; he played a pivotal role as a professor at Columbia Business School. His teachings, encapsulated in the classic book "Security Analysis" co-authored with David Dodd, have become foundational texts for aspiring investors and business students. Graham's academic legacy continues to shape the curriculum at Columbia, ensuring that future generations of financial professionals benefit from his wisdom.

Continued Relevance Today

The principles of value investing introduced by Benjamin Graham continue to be relevant in today's dynamic financial landscape. Investors worldwide turn to his timeless wisdom, seeking a steady and reasoned approach to navigating the complexities of the stock market. Graham's influence is evident not only in the strategies employed by individual investors but also in the practices adopted by institutional investors and fund managers.

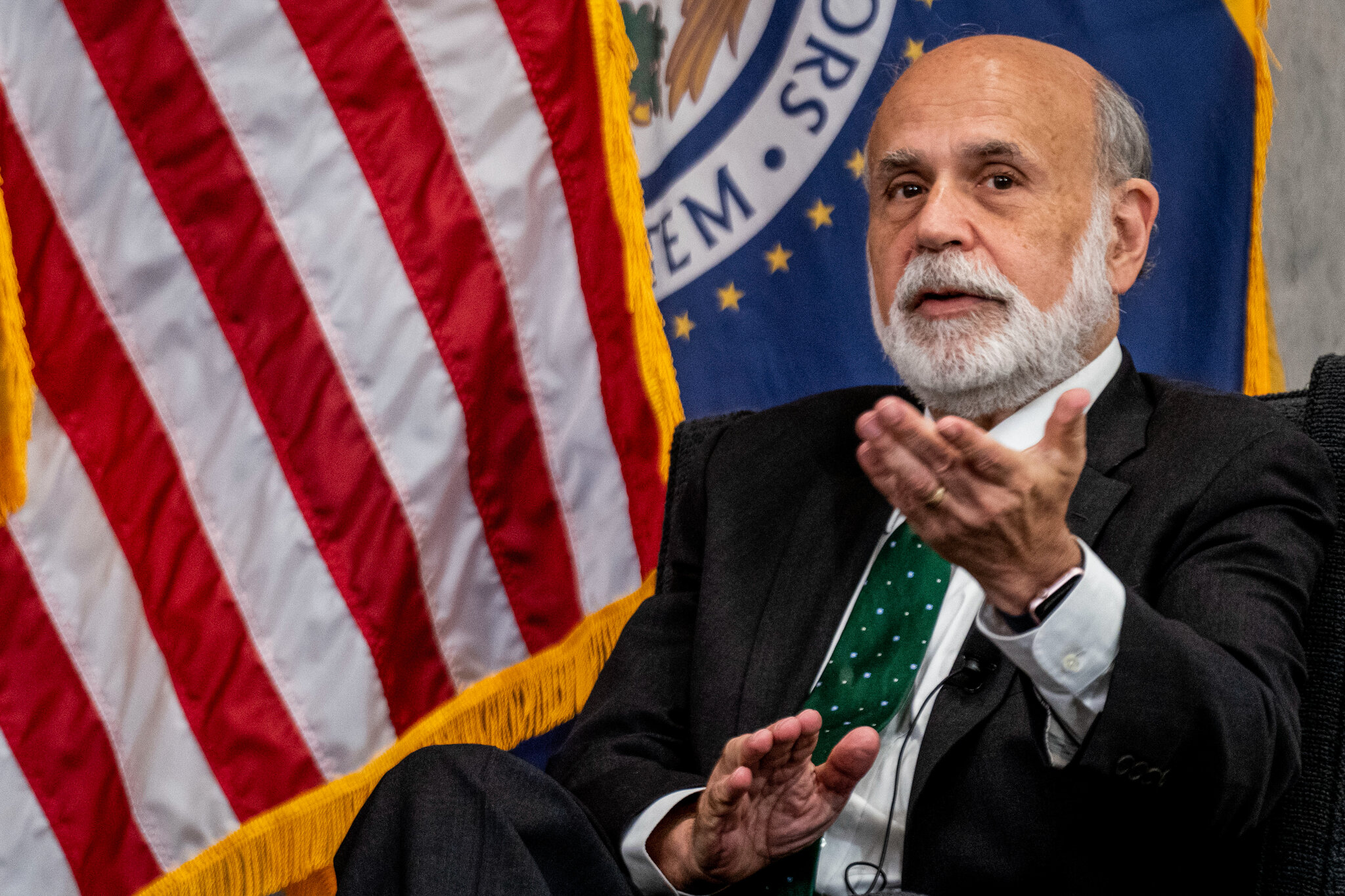

Ben Bernanke - Architect Of Economic Resilience

Ben Bernanke, a luminary in the world of economics, emerged as a central figure during one of the most challenging periods in recent financial history. Serving as the Chairman of the Federal Reserve during the tumultuous 2008 financial crisis, Bernanke played a pivotal role in steering the United States through the storm.

His leadership was characterized by a deep understanding of economic dynamics and a series of decisive actions that garnered praise and recognition on a global scale.

Crucial Role In The 2008 Financial Crisis

As the financial crisis unfolded, Bernanke's expertise was put to the ultimate test. His strategic interventions, which included implementing unconventional monetary policies and orchestrating emergency measures to stabilize financial markets, were instrumental in preventing a complete economic collapse. Bernanke's bold and decisive actions not only averted a potential catastrophe but also laid the groundwork for a gradual economic recovery.

Global Recognition For Expertise

Bernanke's prowess as a financial leader extended far beyond the borders of the United States. His expertise in monetary policy and crisis management earned him global recognition. Central banks and financial institutions worldwide looked to Bernanke's leadership as a beacon of stability during a time of unprecedented uncertainty. His collaborative approach with international counterparts showcased the interconnected nature of the global economy and the need for coordinated efforts in times of crisis.

Enduring Contributions To Economic Policy Discussions

Even after the storm of the financial crisis subsided, Bernanke's contributions continued to reverberate in economic policy discussions. His insights into monetary policy, financial stability, and the intricacies of economic management remain invaluable to policymakers, economists, and academics alike. Bernanke's post-crisis analyses have become foundational in understanding the mechanisms that underpin a resilient and adaptive economic system.

Robert Kiyosaki - Architect Of Financial Independence

Robert Kiyosaki, acclaimed author and financial educator, has left an indelible mark on the landscape of personal finance with his best-selling book series, "Rich Dad, Poor Dad." Beyond his literary success, Kiyosaki extends his influence through personal finance and real estate seminars, franchised under his renowned Rich Dad company. His philosophy revolves around the creation of passive streams of investment income, emphasizing the goal of financial independence—building wealth to a point where it sustains a comfortable lifestyle without the need for constant work.

The Essence Of Kiyosaki's Philosophy

At the core of Kiyosaki's teachings is the notion of financial independence through strategic wealth-building. He advocates for creating and nurturing passive income streams, such as investments and real estate, that can eventually generate enough revenue to sustain one's lifestyle. Kiyosaki's approach challenges the traditional mindset of trading time for money and encourages individuals to cultivate assets that work for them, allowing for a more flexible and liberated lifestyle.

Global Impact Through Best-Selling Books

The impact of Kiyosaki's philosophy is underscored by the success of his best-selling book, "Rich Dad, Poor Dad." With sales exceeding 32 million copies and translations into over 40 languages, the book has become a global phenomenon. Its popularity attests to the universal appeal of Kiyosaki's message, resonating with individuals seeking financial empowerment and a roadmap to navigate the intricacies of wealth creation.

Beyond Books: Rich Dad Company And Seminars

Kiyosaki's commitment to financial education extends beyond the written word. Through his Rich Dad company, he has created a platform for disseminating financial wisdom to a broader audience. The franchised personal finance and real estate seminars provide participants with practical insights and strategies to implement Kiyosaki's principles in their own lives. This hands-on approach ensures that the principles of financial independence are not just theoretical but actionable.

Ben Stein - Hollywood Luminary Turned Financial Guru

Ben Stein, renowned for his wit and charm as the host of Comedy Central's "Win Ben Stein's Money," has seamlessly blended his Hollywood persona with a rich background as a former economist and law professor. Beyond the entertainment realm, Stein has become a sought-after figure in financial news shows, where his straightforward and to-the-point advice has garnered attention and respect.

A Versatile Background - Economist And Law Professor

Stein's journey into the financial world is marked by his diverse skill set. As a former economist and law professor, he brings a unique blend of analytical thinking and legal acumen to his financial insights. This background sets him apart, allowing him to dissect complex economic concepts and present them in a digestible manner for a broader audience.

Hollywood Stardom And Financial Expertise

While Stein's Hollywood stardom is well-established, his transition into the role of a financial guru is noteworthy. His affable personality and comedic prowess have made him a natural fit for both the entertainment industry and the serious business of finance. This dual identity has not only expanded his reach but has also made financial discussions more engaging and accessible to a wider audience.

Straightforward Advice In Financial News Shows

Stein's appearances on various financial news shows are characterized by his no-nonsense approach to financial advice.

Whether dissecting market trends or offering investment insights, his opinions are delivered with clarity and simplicity. This straightforward approach resonates with viewers, demystifying financial jargon and empowering them to make informed decisions.

A Trusted Voice In Finance

In an industry often characterized by complexity and ambiguity, Stein's reputation as a trusted voice in finance has solidified.

His ability to bridge the gap between Hollywood and the financial world makes him a unique and relatable figure. Viewers and readers alike turn to Stein for practical, actionable advice, appreciating the blend of entertainment and financial wisdom he brings to the table.

Bernard Madoff - Architect Of Deception In The Financial World

Bernard Madoff, once a prominent figure in the financial industry, ultimately became infamous for orchestrating one of the largest Ponzi schemes in history. Having previously run a legitimate securities firm and served as the chair of the Nasdaq for three years in the '90s, Madoff's descent into deception shocked the financial world.

A Notorious Disciple Of Charles Ponzi

Madoff's story is often regarded as a dark chapter in financial history, with his fraudulent activities resembling those of Charles Ponzi, the pioneer of such schemes. Madoff capitalized on his reputable background to create an elaborate web of deception, luring unsuspecting investors into what seemed like a lucrative hedge fund division.

Legitimate Facade: Securities Firm And Nasdaq Chairmanship

Prior to the exposure of his fraudulent scheme, Madoff maintained a legitimate securities firm and even held the prestigious position of chair of the Nasdaq for three years during the '90s. These credentials not only added a veneer of credibility to his operations but also allowed him to exploit his connections and reputation to attract high-profile investors.

The Illusion Of Sophisticated Trading Strategies

Madoff's deceit extended to the creation of an illusionary hedge fund division. While purporting to employ sophisticated trading strategies, the reality was far more sinister. Instead of engaging in legitimate investment activities, Madoff simply deposited new funds into a single bank account. This account served as the source for payouts to existing clients who wished to cash out, perpetuating the facade of a successful investment operation.

Exposure During The 2008 Financial Crisis

The façade began to crumble during the 2008 financial crisis when Madoff found himself unable to keep up with redemption requests. The ensuing revelation exposed the true nature of his operation as a staggering $65 billion Ponzi scheme. The scale of the deception sent shockwaves through the financial community and prompted a reevaluation of regulatory oversight and due diligence in the investment world.

Legacy Of Deception And Financial Ruin

Madoff's legacy is one of betrayal and financial ruin for thousands of investors, including wealthy individuals, celebrities, and even other hedge funds. The fallout from his scheme highlighted the vulnerability of even sophisticated investors to carefully crafted deception. The Madoff scandal remains a cautionary tale, emphasizing the critical importance of transparency, due diligence, and regulatory vigilance in the financial industry.

Top US Financial Experts - FAQs

Who Is The Best Finance Expert?

Identifying the "best" finance expert is subjective and may vary based on individual preferences and needs. Some widely respected finance experts include Warren Buffett, Ray Dalio, and Janet Yellen, each known for their significant contributions to finance and economics.

What Are The Top Five Financial Advisors?

- Vanguard Personal Advisor Services:Vanguard is known for its low-cost index funds and offers personalized financial advisory services.

- Fidelity Investments:Fidelity is a leading financial services provider offering a range of investment and advisory services.

- Charles Schwab:Schwab is renowned for its comprehensive financial services, including investment management and financial planning.

- J.P. Morgan Private Bank:J.P. Morgan provides wealth management and private banking services, catering to high-net-worth individuals.

- Merrill Lynch Wealth Management:Merrill Lynch is a division of Bank of America and is recognized for its wealth management and financial advisory services.

What Are The Top Financial Advisory Companies In The US?

- Goldman Sachs:A global investment banking and financial services company, Goldman Sachs provides a range of advisory services, including wealth management.

- Morgan Stanley:Another major player in the financial services industry, Morgan Stanley offers wealth management and investment advisory services.

- J.P. Morgan Chase & Co.:J.P. Morgan provides extensive financial services, including asset management and private banking.

- Wells Fargo Advisors:Wells Fargo offers financial advisory and wealth management services to individuals and institutions.

- UBS Wealth Management:UBS is a global financial services company with a strong focus on wealth management and financial advisory services.

Conclusion

The top US financial experts highlighted in this exploration have demonstrated not only a deep understanding of their respective fields but also a remarkable ability to adapt to the evolving landscape. Their profound impact, unique perspectives, and valuable contributions serve as guiding beacons for individuals navigating the intricate world of finance.

Whether you're an investor seeking strategic insights, an economist analyzing market trends, or an individual striving to enhance financial literacy, tapping into the expertise of these financial luminaries can be a transformative experience.

In this dynamic environment, staying informed is paramount. The wisdom distilled from the experiences and strategies of these experts can provide a solid foundation for making informed decisions and navigating the complexities of the financial landscape. As you embark on your financial journey, consider the lessons and principles espoused by these experts, and let their insights serve as a source of inspiration.

By leveraging the knowledge and expertise of these financial leaders, you can better position yourself for success and make informed decisions that align with your financial goals. Stay inspired, stay informed, and let the wisdom of these luminaries guide you toward financial success.

Jump to

Janet Yellen - A Trailblazing Economist And Pioneer At The Federal Reserve

Benjamin Graham - The Father Of Value Investing

Ben Bernanke - Architect Of Economic Resilience

Robert Kiyosaki - Architect Of Financial Independence

Ben Stein - Hollywood Luminary Turned Financial Guru

Bernard Madoff - Architect Of Deception In The Financial World

Top US Financial Experts - FAQs

Conclusion

Frazer Pugh

Author

Emmanuella Shea

Reviewer

Latest Articles

Popular Articles