Tech Stock Insights Unleashed - Are You Ready For The Next Investment Revolution?

Stay ahead in the dynamic world of technology investments with tech stock Insights. Get expert analysis, real-time updates, and strategic recommendations for maximizing your returns in the fast-paced tech stock market.

Author:James PierceReviewer:Camilo WoodJan 19, 2024147 Shares36.8K Views

Welcome to tech stock insights, your gateway to a wealth of knowledge designed to empower your investment journey. In the ever-evolving landscape of financial markets, navigating the realm of technology stocks requires a keen understanding and timely insights. In this dynamic environment, where technological advancements and market trends intersect, tech stock platform becomes your invaluable resource.

From cutting-edge innovations to market analyses, we strive to provide you with a comprehensive understanding of the best tech stock insights. Stay ahead of the curve, make informed decisions, and unlock the full potential of your investments with our curated insights into the world of technology stocks.

Why Are Tech Stocks Down Today?

The volatility of the stock market, particularly in the tech sector, often prompts investors to ask, "Why are tech stocks down today?" The answer to this question can be multifaceted, as various factors contribute to the daily fluctuations in tech stock prices.

Firstly, macroeconomic factors such as interest rates, inflation, and geopolitical events can significantly impact the broader stock market, including technology stocks. If there is uncertainty in global economic conditions or geopolitical tensions, investors may adopt a risk-averse approach, leading to a sell-off in tech stocks and a decline in their prices.

Secondly, company-specific news and events play a crucial role. Negative developments, such as a weaker-than-expected earnings report, a product recall, or changes in leadership, can lead to a decrease in investor confidence, triggering a decline in the stock price. Conversely, positive news, such as successful product launches or strong financial performances, can drive stock prices higher.

Furthermore, market sentiment and speculation can influence tech stocks on any given day. If there is a prevailing belief among investors that the tech sector is overvalued or facing headwinds, it can lead to a broad sell-off, causing tech stocks to decline collectively.

Additionally, changes in industry trends, regulatory concerns, or disruptions in supply chains can impact tech companies and contribute to stock declines. For instance, shifts in consumer preferences, emerging technologies, or regulatory changes affecting data privacy can influence the market sentiment towards certain tech stocks.

The daily fluctuations in tech stocks are a result of a complex interplay of macroeconomic factors, company-specific events, market sentiment, and industry dynamics. Investors should stay informed about the broader economic landscape and specific developments within the tech sector to better understand the reasons behind the fluctuations in tech stock prices on any given day.

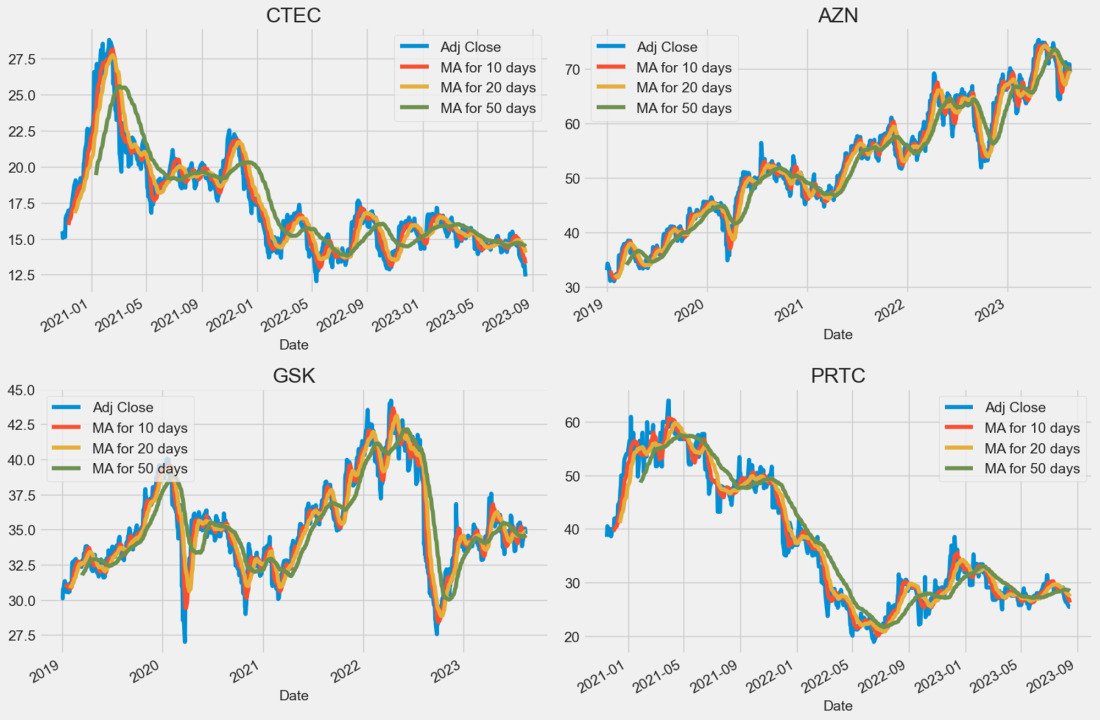

Analyzing Tech Stocks - A Yearly Trend Analysis

Investing in the stock market necessitates a thorough understanding of specific stocks and sectors, as well as attentive trend analysis. In recent years, the technology industry has risen as a dominant force, providing significant growth potential for investors. In this post, we will look at a complete trend analysis of tech stocks over the last five years, providing significant information for anyone trying to maximize their investment choices.

Market Indicators

Key market indicators must be considered when evaluating the overall health of the technology stock market. These include technology-focused indexes such as the Nasdaq Composite and Nasdaq-100, which provide a broad view of the sector's performance. Monitoring the volatility index (VIX) can also assist evaluate market mood and identify potential dangers and opportunities for technology stocks.

Stock Valuation Methods

Understanding how stocks are evaluated is critical for determining their investing potential. The Price-to-Earnings (P/E) ratio, Price-to-Sales (P/S) ratio, and Price-to-Book (P/B) ratio are three common valuation methodologies for technology firms. These measures show how a company's earnings, revenue, and asset base compare to its stock price. By comparing these measures to historical data and industry averages, investors can find cheap or overvalued technology companies.

Fundamental Analysis Techniques

Fundamental analysis is an important factor in analyzing technology stocks. Key considerations are revenue growth, profit margins, cash flow, and debt levels. Examining a company's competitive position, management team, and product innovation can also yield useful information. Furthermore, studying macroeconomic trends, regulatory environments, and industry dynamics can aid in determining the overall health and future prospects of the technology sector.

Investment Opportunities

Several investment opportunities exist in the technology sector. Companies focused on artificial intelligence (AI), cloud computing, e-commerce, and renewable energy have demonstrated great growth potential in recent years. Furthermore, emerging technologies like the Internet of Things (IoT), 5G, and cybersecurity are likely to fuel significant market growth. By researching and finding promising companies within these subsectors, investors can position themselves for possible profits.

Sector Trends And Risk Factors

Understanding sector trends and associated risks is critical to effective investing. While technology equities have grown dramatically, they are also vulnerable to unexpected market upheavals, regulatory changes, and disruptive breakthroughs. Keeping a watch on developing trends, such as the use of remote work solutions during the pandemic, can help investors predict market developments and alter their portfolios accordingly. Furthermore, geopolitical problems, supply chain disruptions, and intellectual property issues all offer dangers to IT companies.

Are Tech Stocks In The US Still Overvalued?

Since the share prices of large tech companies seem to keep rising forever, u.s. tech stocks today have long been the darlings of every amateur investor's portfolio. Yes, there are always risks, but a large number of the most valuable companies in the world are in the technology sector. And who could resist the allure of putting money into the next Apple or Amazon?

Additionally, tech stocks frequently indicate the health of the economy and the stock market as a whole. Tech stocks surged in response to the outbreak. In 2009, the S&P 500 had a 400% increase from its lows, and the Nasdaq 100 index saw an increase of more than 700%. These stocks, known as FANG stocks (Facebook, Amazon, Netflix, and Google, but also included Microsoft and Apple), left other markets far behind.

However, when the bull market ended, everything changed. Due to rising interest rates, soaring energy prices, and geopolitical tensions, Wall Street had its worst start in fifty years in the first half of 2022. In the last half-year, tech stocks have plummeted: Tesla saw a 30% decline, Microsoft saw a 16% decline from $334.75 in January to $280.74 at the close of business on July 29, 2022, Apple saw a 13% decline, and Amazon once saw a staggering 39% decline.

Then, between July and the first few days of August, the market began to pick up steam once more. Fed Chair Jerome Powell'scomments that interest rates are at "neutral" caused the US Tech 100 to rise.

Is The Price Of US Tech Stock Too High?

Generally speaking, tech equities are regarded as high-risk investments. Investors took advantage of historically low borrowing rates during the pandemic period to invest in technology and cryptocurrency* in the hopes of earning substantial returns. Investors have taken their profit from those gains in recent months as central banks have started taking that cheap money out by decreasing quantitative easing or raising interest rates, which has led to an inevitable decline in prices.

It's also likely that some of the changes when they shift from being on hold to then moving to a rising bias have been made worse by central banks misinforming the financial markets and acting slowly. The market has been twitchy and unpredictable due to the inflation spiral and the need for higher raises; before confidence returns, we might have to wait for the Federal Reserve to declare that they are going on pause.

There is a compelling case to be made that the tech industry was overvalued in 2020–2021, given the significant inflows of capital into these stocks. This is most likely the case for "lockdown" stocks like Peloton Interactive, Inc. and Zoom Video Communications, which are currently trading at a small percentage of their all-time highs. The pandemic's poster child stock, Tesla Inc., had a half-reduction in valuation between November and May 2022 before gradually regaining some ground.

Despite a brief uptick, the Nasdaq has already lost 30% of its value this year. This prompted many to predict a tech-driven crash akin to the late 1990s dot.com bubble burst.

What's Coming Up For US Tech Shares?

Undoubtedly, certain equities still make sense as investments, and investors ought to consider taking advantage of the decline to increase their exposure to particular companies that pique their interest. But according to some economists, if the US were to go through a long recession, firm earnings would start to become more noticeable.

Therefore, the collapse may not be done. Some have noted that tech giants like Microsoft and Alphabet, who have amassed substantial cash reserves throughout the pandemic, will have the capacity to develop and engage in significant acquisitions in the months ahead.

The Creating Helpful Incentives to Produce Semiconductors and Science Act of 2022 (CHIPS), which President Biden recently signed into law, will provide $52 billion in subsidies over the following five years to increase US chip production, address supply chain problems, and lessen the nation's dependency on nations like Taiwan and China. The supply of semiconductors is essential to a large portion of the tech sector.

It's unclear, though, how globally competitive US production may be given its increased costs and whether this could put more pressure on inflation. The act's effectiveness will rely on how soon it can be put into effect, considering how severe the shortages are right now. Tech investors are best advised to stick to what they can afford, keeping in mind that it may take some time for some tech stocks to experience significant growth, especially with belt buckles tightening everywhere.

4 Momentum Technology Stocks That Promise Growth In 2024

Four standout companies are currently capturing attention with their promising potential:

- First on the list is a leading cloud computing innovator, leveraging the growing demand for scalable and efficient solutions. With a track record of consistent growth and strategic partnerships, this company remains positioned for further expansion in the tech landscape.

- Another compelling contender is a disruptor in the electric vehicle sector. As the global shift towards sustainable transportation gains momentum, this company's cutting-edge technology and forward-thinking approach place it at the forefront of the industry, offering significant growth prospects for investors.

- In the realm of artificial intelligence, a tech giant is making waves with its groundbreaking advancements. With a commitment to pushing the boundaries of AI capabilities, this company is poised to capitalize on the increasing integration of artificial intelligence across industries.

- Lastly, a biotech firm leveraging technology for groundbreaking medical solutions completes the quartet. With a focus on innovation and transformative healthcare solutions, this company holds the potential for substantial gains in 2024.

Investors seeking momentum in the tech sector should keep a keen eye on these four companies, each presenting a unique value proposition and positioned to deliver gains as technology continues to shape the future.

Tech Stock Insights - FAQs

What Is The Significance Of Tech Stock Insights In Investment Strategies?

Tech Stock Insights offers crucial analysis and real-time updates, empowering investors with strategic information for navigating the dynamic world of technology stocks.

Does Tech Stock Insights Cover A Wide Range Of Tech Sectors?

Yes, Tech Stock Insights encompasses a diverse array of tech sectors, ensuring a holistic approach to understanding and investing in the broader technology market.

How Frequently Is The Information On Tech Stock Insights Updated?

Tech Stock Insights provides real-time updates, ensuring that users have access to the latest information, trends, and analyses as they unfold in the fast-paced tech stock market.

Are There Specific Features On Tech Stock Insights That Differentiate It From Other Financial News Platforms?

Yes, Tech Stock Insights stands out with its expert analyses, timely updates, and focus specifically on the intricate dynamics of the technology stock market.

Is There A Subscription Model For Accessing Tech Stock Insights, Or Is It Freely Available?

Tech Stock Insights may offer a subscription model for premium features, but basic insights and analyses are often available for free, making valuable information accessible to a broad audience.

Final Words

Remember that success in the tech stock insights market demands a strategic approach and continuous learning. Our commitment is to keep you informed, offering not just data but the insights needed to thrive in this dynamic sector. Whether you're a seasoned investor or just entering the market, this platform is designed to be your companion in the journey to financial success.

Embrace the future with confidence, armed with the latest trends, expert analyses, and a solid understanding of the ever-changing tech stock landscape. Tech Stock Insights is not just a source of information; it's your strategic ally in navigating the complexities of technology investments.

James Pierce

Author

Camilo Wood

Reviewer

Latest Articles

Popular Articles