Proven Tax Optimization Tips - Dollars And Sense

Explore expert tax optimization tips to maximize savings and efficiency. Unlock key insights and stay informed on the latest tax optimization techniques for a secure and prosperous future.

Author:Camilo WoodReviewer:Emmanuella SheaJan 08, 20241.1K Shares68.8K Views

In the ever-evolving landscape of finance, mastering the art of tax optimization tipsare paramount for individuals and businesses alike. Navigating the intricate web of tax regulations requires strategic planning and insightful tips to ensure maximum savings and compliance.

This comprehensive guide delves into the realm of Tax Optimization Tips, providing you with a roadmap to financial success. From smart investment strategies to leveraging available deductions, our insights aim to empower you with the knowledge needed to make informed decisions and enhance your overall financial well-being.

What Is Tax Optimization?

Tax optimization is the strategic and proactive management of financial affairs to minimize tax liabilities while staying within the bounds of the law. It involves employing a variety of legal and ethical methods to structure financial activities in a way that maximizes tax efficiency, ultimately leading to reduced tax burdens. This practice is not about evading taxes but rather about making informed decisions to take advantage of available deductions, credits, and exemptions.

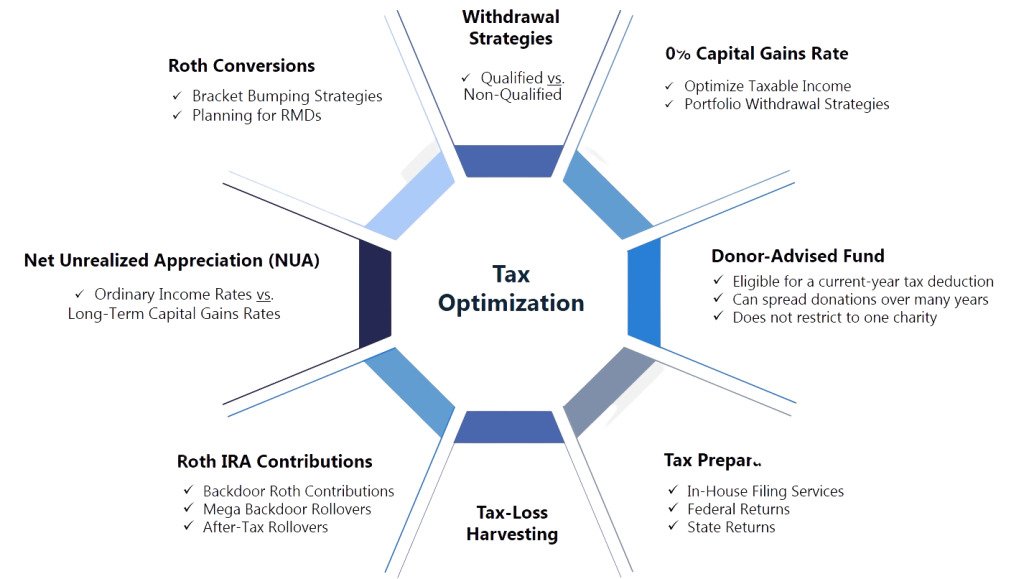

Tax planning tips encompasses a broad range of strategies tailored to individual or business circumstances. For individuals, this could include optimizing contributions to retirement accounts, leveraging tax credits, and managing investment portfolios tax-efficiently. On the business front, strategies might involve careful expense tracking, exploring industry-specific tax incentives, and making strategic decisions on business structures.

Consulting with tax professionals is often recommended to navigate the complexities of tax codes and ensure that optimization efforts align with current legal frameworks. In essence, tax optimization is a dynamic and ongoing process that aims to empower individuals and businesses with the knowledge and tools needed to make well-informed financial decisions while minimizing their tax burden.

Tax Optimization Tips For Businesses And Individuals

The process of analyzing and organizing one's financial affairs to optimize tax benefits and reduce tax obligations in a way that is both lawful and effective is known as tax planning. Although tax laws can be confusing, you can alter how much you pay or receive back when you file on tax day by taking the time to learn about them and applying them to your advantage.

Before you make your next financial decision, be sure you comprehend this list of tax planning strategies and tax optimization.

Examine Your Tax Return With A Modest Amount Of Skepticism

Generally speaking, it makes sense to review the tax returns. Whether you are an individual or a business, you have contracted with a tax preparation firm to do it for you. Increase your retirement plan contributions, pay attention to any new deductions, and double-check your financial withholdings. It is one of the best tax-planning strategies available to help companies stay competitive.

This would create room for deduction opportunities such as "bunching." In order to be eligible for the deductions, your expenses must also be doubled. Bunch deductions, for example, are useful for deducting charitable contributions. Here, individuals have a great deal of latitude in terms of the amount and time of their donations.

Think About Capital Losses

Since the stock market has increased over the past nine years, fortunately, few investors have experienced financial loss. This might not be the case right now given that the market might wind up losing money for the majority of 2018. Reinvesting the earnings into something other than the stock market is therefore advised.

Stated differently, the realized gain from the tax dealings is offset by the realized loss. If your losses exceed your gains, you can deduct up to $3000 USD from your annual average earnings. You may, however, carry over losses to the following years if they total more than $3,000. The tax change has no bearing on these requirements concerning the capital gain and loss scenarios.

51% of US citizens approve of the most recent tax reform, according to a Buzz60 survey. This is an increase from the previous year's results, which showed that 37% were approved in December.

Considerations For Roth Conversions

Generally speaking, there is no tax associated with any type of withdrawal from a Roth Individual Retirement Account. As a result, taking out a Roth withdrawal won't put you in a higher tax bracket or perhaps increase the amount of your Social Security benefits that are subject to taxes. dependable tax planning advice for both individuals and companies.

The main drawback is that you must pay taxes on the amount of money you move when you "convert" or transfer money from a traditional IRA into a Roth. However, this would be a good moment to do so as the equity markets are flat to lower. Additionally, because of the tax reform, average income tax rates have been lowered, meaning that there will likely be a slight reduction in taxes than there was previously. Use funds outside of your IRA to pay for the conversion if you decide to do a Roth conversion.

Organize Yourself

It is annoying to stop what you're doing and search for documents and bills in order to properly submit your taxes. A modest amount of organizational planning ahead could be quite beneficial in these situations.

Having a reliable model for maintaining records is a good idea if you want to send bills and statements all year long. Make copies of your returns and save them somewhere safe so you can refer to them later. If you own digital copies, consider keeping them on hard drives, cloud-based services, or maybe other programs that run independently of your computer and are susceptible to theft or hacking.

The general rule of thumb is to retain tax returns and all supporting documentation for a minimum of three years. However, some documents, such as those that show how much you invested in your home or other purchases, especially if you haven't traded them yet, must be kept for a longer period of time.

Develop A Tax-Refunding Plan

It might not be a wise plan for the following year if, like the majority of people, you received a refund and used it to pay off your loan or put money in your savings account because the return might be smaller the following year. Create a backup plan if you are one of those people who rely on your tax refund to help you organize your finances.

Additionally, determine whether you want to keep receiving a sizable tax refund each year and try your hardest to maintain that amount. While refunds are a positive thing, they also indicate interest-free borrowing.

Observe Changes At The State Level

State and local tax laws will be impacted by federal tax reform initiatives. More than half of the US states base changes to their tax laws on federal directives, and these changes are frequently influenced by decisions made in Washington.

Many federal exemptions and deductions have been eliminated as a result of tax reform. On the other hand, it also lowered federal income tax rates. Because of this, many states will need to lower their individual income tax rates in order to restrict their citizenry.

This tax planning advice no longer saves you money by requiring you to make further purchases. The following states will see significant increases in revenue as a result of the federal tax reform: Nebraska, Minnesota, New York, Georgia, Michigan, Maryland, Colorado, and Arizona.

Types Of Tax Planning

- Strategic Tax Planning -Strategic tax planning involves developing a comprehensive, long-term approach to minimize tax liabilities. Businesses and individuals strategically organize their financial affairs, investments, and transactions to optimize tax outcomes while staying compliant with current tax laws.

- Short-term Tax Planning -Short-term tax planning focuses on immediate tax benefits, often involving strategies like timing income recognition or delaying deductible expenses. This approach aims to take advantage of specific tax provisions applicable to the current fiscal year.

- Investment Tax Planning -This type of tax planning centers around optimizing investment portfolios to minimize tax consequences. It includes considerations such as capital gains management, tax-efficient investment selection, and the utilization of tax-advantaged accounts.

- Estate Tax Planning -Estate tax planning involves strategies to minimize tax liabilities related to the transfer of assets upon death. Techniques may include setting up trusts, gifting, and utilizing exemptions to ensure a smooth and tax-efficient transfer of wealth to heirs.

- Retirement Tax Planning -Focused on optimizing tax outcomes during retirement, this planning addresses factors like contributions to retirement accounts, withdrawal strategies, and maximizing available tax credits for seniors.

Objectives Of Tax Planning

Tax planning is a strategic financial management process aimed at achieving specific objectives within the framework of applicable tax laws. The primary goals include:

- Minimizing Tax Liability -The core objective of tax planning is to legally minimize tax obligations. By leveraging available deductions, credits, and exemptions, individuals and businesses can optimize their financial structures to reduce the overall tax burden.

- Enhancing Cash Flow -Efficient tax planning contributes to improved cash flow by identifying opportunities to defer taxes or accelerate deductions. This allows businesses and individuals to have more liquidity for operational needs or investment opportunities.

- Achieving Compliance -Ensuring compliance with tax laws is a fundamental objective. Effective tax planning seeks to align financial activities with regulatory requirements, mitigating the risk of penalties or legal complications.

- Supporting Financial Goals -Tax planning aligns with broader financial objectives. Whether aiming for business expansion, personal wealth accumulation, or retirement planning, strategic tax management plays a crucial role in realizing these goals.

- Encouraging Economic Growth -Governments often design tax incentives to stimulate specific economic activities. Tax planning can involve taking advantage of these incentives, contributing to economic growth and development.

- Facilitating Investment and Innovation -Tax planning encourages investment and innovation by creating favorable conditions for businesses and individuals to allocate resources efficiently. Incentives for research and development or capital investment can drive economic progress.

How Tax Optimization Strategies Can Help Your Business Grow?

Implementing effective tax optimization strategies can be a catalyst for substantial business growth by enhancing financial efficiency and fostering a conducive environment for expansion.

One key aspect is optimizing deductions and credits, allowing businesses to retain more of their earnings for reinvestment. By strategically managing expenses and leveraging available tax incentives, companies can channel saved funds back into critical areas such as research and development, technology upgrades, or employee training.

Furthermore, tax optimization can provide businesses with a competitive edge. Streamlining tax obligations not only improves financial health but also allows companies to allocate resources strategically.

This financial flexibility empowers businesses to seize growth opportunities, whether through mergers and acquisitions, geographic expansion, or innovative product development.

Tax-advantaged investment strategies also play a pivotal role in supporting business growth. By intelligently structuring investments and capitalizing on tax-efficient financing options, companies can access additional capital for expansion initiatives.

Additionally, a well-optimized tax strategy contributes to better financial planning, enabling businesses to make informed decisions about resource allocation and long-term investments.

In essence, tax optimization is a potent tool for business growth, providing the means to reinvest in core operations, stay competitive, and seize opportunities that drive sustained success. As tax laws and business landscapes evolve, regularly reassessing and adapting these strategies ensures continued support for the dynamic growth of a business.

Tax Optimization Tips - FAQs

How Can Small Businesses Benefit From Tax Optimization?

Small businesses can optimize taxes by carefully tracking expenses, leveraging available deductions, and exploring tax credits specific to their industry.

Are There Any Specific Tax Optimization Strategies For Real Estate Investors?

Yes, real estate investors can benefit from strategies like cost segregation, 1031 exchanges, and utilizing deductions related to property management expenses.

What Role Do Tax-advantaged Investments Play In Tax Optimization?

Tax-advantaged investments, such as municipal bonds or certain retirement accounts, can offer benefits like tax-free growth or tax-deductible contributions, contributing to overall tax optimization.

How Does Tax Optimization Differ For Self-employed Individuals?

Self-employed individuals can optimize taxes by deducting business expenses, considering a Solo 401(k), and managing income to stay within favorable tax brackets.

Can Tax Optimization Strategies Change With Evolving Tax Laws?

Absolutely. Staying informed about changes in tax laws is crucial for adapting your tax optimization strategies. Consult with a tax professional for the latest insights.

Conclusion About Tax Optimization Tips

The journey towards financial prosperity involves mastering the nuances of tax optimization. By incorporating the tips and strategies outlined in this guide, individuals and businesses can proactively manage their tax liabilities, unlock potential savings, and foster long-term financial stability.

Remember, staying informed and adapting to changes in tax laws is a continuous process. Embrace the power of tax optimization tips to not only minimize your tax burden but also to pave the way for a secure and thriving financial future. With these insights at your disposal, embark on a path of financial empowerment and make tax optimization an integral part of your financial strategy.

Camilo Wood

Author

Emmanuella Shea

Reviewer

Latest Articles

Popular Articles