Stonk O Tracker - How To Beat The Hedge Funds And Make Money On Meme Stocks

Stonk o tracker is a real-time data tracker that can help you identify meme stocks that are undervalued and ripe for a short squeeze. The tracker provides data on short interest, dark pools, and fails to deliver.

Author:Stefano MclaughlinReviewer:Luqman JacksonAug 10, 202321.8K Shares308K Views

Stonk O Trackeris a real-time data tracker that can help you identify meme stocks that are undervalued and ripe for a short squeeze. The tracker provides data on short interest, dark pools, and fails to deliver. This information can help you make informed investment decisions and beat the hedge funds.

Meme stocks have become a phenomenon in recent years, with retail investors using social media to coordinate their buying and selling of stocks. This has led to some high-profile short squeezes, where the price of a stock has skyrocketed as short sellers have been forced to cover their positions.

What Are Meme Stocks?

A meme stock is a stock that gains popularity among retail investors through social media. The popularity of meme stocks is generally based on internet memes shared among traders, on platforms such as Reddit's r/wallstreetbets. Investors in such stocks are often young and inexperienced investors.

Meme stocks are often characterized by high volatility and short-term price swings. This is because the prices of these stocks are often driven by social media sentiment, which can change rapidly. As a result, meme stocks can be risky investments.

However, meme stocks can also be profitable investments. In January 2021, a group of retail investors on Reddit banded together to buy shares of GameStop, a struggling video game retailer. The investors' goal was to drive up the price of GameStop's stock and force short sellers to cover their positions, which would result in a profit for the retail investors. The investors were successful in their goal, and GameStop's stock price skyrocketed.

The GameStop short squeeze was a watershed moment for the meme stock phenomenon. It showed that retail investors could use social media to coordinate their buying and selling of stocks, and it led to a surge in interest in meme stocks.

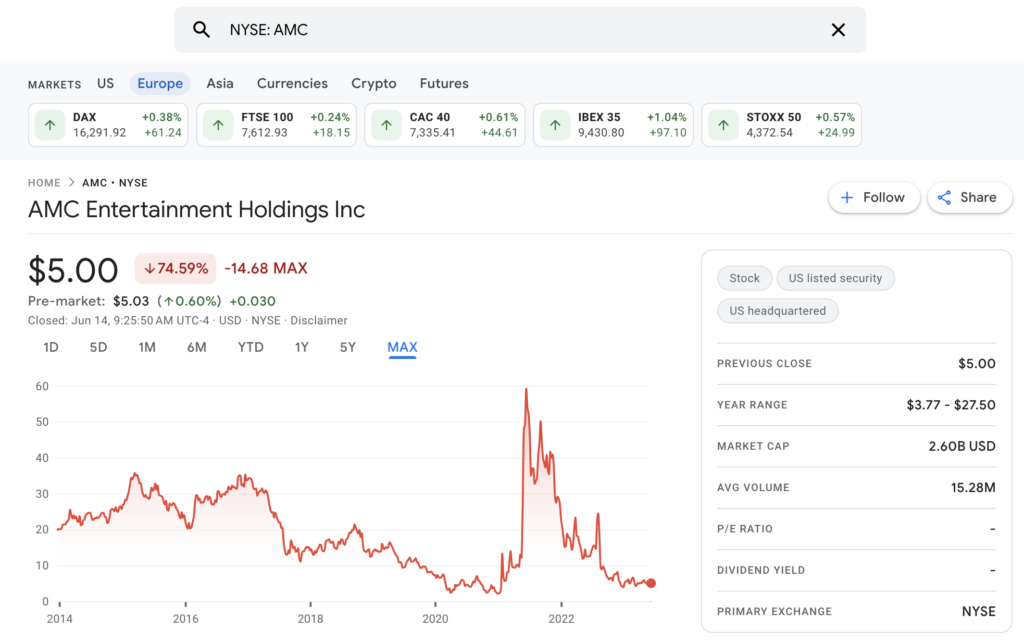

Since the GameStop short squeeze, there have been a number of other meme stocks, including AMC Entertainment, BlackBerry, and Bed Bath & Beyond. These stocks have all seen their prices rise sharply, driven by social media sentiment.

Whether meme stocks are a good investment is a matter of debate. Some investors believe that meme stocks are too risky, while others believe that they can be profitable. Ultimately, the decision of whether or not to invest in meme stocks is a personal one.

Here are some of the characteristics of meme stocks:

- They are often stocks of companies that are struggling or out of favor.

- They are often stocks that have a high short interest, which means that a large number of investors have bet that the price of the stock will go down.

- They are often stocks that are popular on social media, especially Reddit.

- They are often stocks that are volatile, meaning that their prices can change rapidly.

If you are considering investing in meme stocks, it is important to do your research and understand the risks involved. Meme stocks can be profitable investments, but they can also be very risky.

How Did Meme Stocks Become A Phenomenon?

Here are some of the factors that contributed to the rise of meme stocks:

- The rise of social media. Social media platforms like Reddit and Twitter have made it easier for retail investors to communicate with each other and coordinate their buying and selling of stocks. This has led to the formation of online communities of meme stock traders who share information and memes about their favorite stocks.

- The decline of traditional financial institutions. In recent years, there has been a decline in trust in traditional financial institutions, such as banks and hedge funds. This has led some retail investors to turn to meme stocks as a way to invest their money outside of the traditional financial system.

- The COVID-19 pandemic. The COVID-19 pandemic has led to a significant increase in the number of people trading stocks online. This is because many people have been stuck at home during the pandemic and have turned to trading stocks as a way to pass the time and make some extra money.

- The GameStop short squeeze. The GameStop short squeeze in January 2021 was a watershed moment for the meme stock phenomenon. It showed that retail investors could use social media to coordinate their buying and selling of stocks, and it led to a surge in interest in meme stocks.

Since the GameStop short squeeze, there have been a number of other meme stocks, including AMC Entertainment, BlackBerry, and Bed Bath & Beyond. These stocks have all seen their prices rise sharply, driven by social media sentiment.

It is still too early to say whether meme stocks will be a lasting phenomenon. However, they have certainly captured the attention of the investing world in recent years. It will be interesting to see how the meme stock phenomenon evolves in the years to come.

Here are some of the risks of investing in meme stocks:

- Meme stocks are volatile and their prices can change rapidly.

- Meme stocks are often shorted by hedge funds, which means that there is a risk of a short squeeze.

- Meme stocks are often based on hype and speculation, which means that there is a risk of losing money.

How Can Retail Investors Beat The Hedge Funds?

Here are some tips on how retail investors can beat the hedge funds:

- Do your research.Before you invest in any stock, it is important to do your research and understand the company. This includes looking at the company's financial statements, reading analyst reports, and following news about the company.

- Don't follow the herd.It can be tempting to follow the crowd and invest in stocks that are popular on social media. However, it is important to remember that not all meme stocks are created equal. Some meme stocks are simply based on hype and speculation, and they may not be good investments.

- Be patient.The stock market is a volatile place, and prices can go up and down rapidly. If you are investing in meme stocks, it is important to be patient and not panic sell if the price of the stock goes down.

- Use tools to your advantage.There are a number of tools available to retail investors that can help them to beat the hedge funds. These tools can provide you with real-time data on short interest, dark pools, and fails to deliver. This information can help you to identify undervalued meme stocks and profit from short squeezes.

Here are some additional tips:

- Invest for the long term.Meme stocks can be volatile, so it is important to invest for the long term. This will help you to ride out any short-term fluctuations in the price of the stock.

- Diversify your portfolio.Don't put all of your eggs in one basket. By diversifying your portfolio, you will reduce your risk if one of your meme stocks goes down in value.

- Don't over-invest.Only invest money that you can afford to lose. Meme stocks are risky investments, so it is important to not over-invest.

It is important to remember that there is no guarantee of success when investing in meme stocks. However, by following these tips, you can increase your chances of beating the hedge funds.

How Stonk O Tracker Can Help

Stonk-O-Tracker is a real-time data tracker that can help you identify meme stocks that are undervalued and ripe for a short squeeze. The tracker provides data on short interest, dark pools, and fails to deliver. This information can help you make informed investment decisions and beat the hedge funds.

Here are some of the ways that Stonk-O-Tracker can help you:

- Identify undervalued meme stocks.Stonk-O-Tracker's data on short interest can help you identify meme stocks that are heavily shorted. These stocks are more likely to be subject to a short squeeze, which can lead to a sharp increase in the price of the stock.

- Monitor dark pool activity.Dark pools are private exchanges where large orders can be placed without affecting the price of the stock. Stonk-O-Tracker's data on dark pool activity can help you track the buying and selling activity of large investors, which can give you an indication of whether a meme stock is about to undergo a short squeeze.

- Track fails to deliver.Fails to deliver are shares that have been sold but not yet delivered. This can be a sign that a short squeeze is underway, as short sellers may be struggling to find shares to deliver.

- Set up alerts.Stonk-O-Tracker allows you to set up alerts for specific stocks or events. This way, you will be notified if there are any significant changes in the data, such as a sudden increase in short interest or a large dark pool trade.

Stonk-O-Tracker is a powerful tool that can help you make informed investment decisions and beat the hedge funds. However, it is important to remember that there is no guarantee of success when investing in meme stocks. Always do your research and understand the risks involved before investing any money.

Here are some of the limitations of Stonk-O-Tracker:

- The data on short interest is not always accurate.

- Dark pool activity is not always transparent.

- Fails to deliver can be difficult to track.

Despite these limitations, Stonk-O-Tracker can be a valuable tool for retail investors who are looking to invest in meme stocks.

People Also Ask

What Is Stonk-O-Tracker?

Stonk-O-Tracker is a real-time data tracker that can help you identify undervalued meme stocks and profit from short squeezes. The tracker provides data on short interest, dark pools, and fails to deliver. This information can help you make informed investment decisions and beat the hedge funds.

How Does Stonk-O-Tracker Work?

Stonk-O-Tracker collects data from a variety of sources, including the SEC, exchanges, and dark pools. The data is then processed and analyzed to provide users with insights into the meme stock market. Stonk-O-Tracker also allows users to track multiple meme stocks at the same time and set up alerts to be notified of significant changes in the data.

What Are The Benefits Of Using Stonk-O-Tracker?

There are a number of benefits to using Stonk-O-Tracker, including:

- Real-time data-Stonk-O-Tracker provides real-time data on meme stocks, which can help you make informed investment decisions.

- Insightful analysis-Stonk-O-Tracker's analysis of the meme stock market can help you identify undervalued stocks and profit from short squeezes.

- Ease of use-Stonk-O-Tracker is easy to use and navigate, even for beginners.

- Affordability-Stonk-O-Tracker is free to use.

Conclusion

Stonk O Trackeris a powerful tool that can help you identify undervalued meme stocks and profit from short squeezes. However, it is important to remember that meme stocks are volatile, and there is no guarantee that you will make money.

If you are considering using Stonk-O-Tracker, it is important to do your research and understand the risks involved. You should also remember that Stonk-O-Tracker is not a magic bullet, and it will not guarantee you success. However, if you use it wisely, it can be a valuable tool in your investment arsenal.

Stefano Mclaughlin

Author

Luqman Jackson

Reviewer

Latest Articles

Popular Articles