Top 10 Security Risks In Crypto Trading Revealed

Unlock Financial Freedom with security risks in crypto trading! Discover the exciting world of cryptocurrency investments while navigating potential pitfalls.

Author:Camilo WoodReviewer:Stefano MclaughlinFeb 05, 20241.3K Shares31.8K Views

Embark on a thrilling journey into the heart of Security Risks in crypto trading, where fortunes are made and risks run high. As the digital frontier evolves, so do the security challenges that every crypto investor must face. In this riveting exploration, uncover the clandestine world of cyber threats, hacking endeavors, and market manipulations that pose significant dangers to your crypto assets.

Your hard-earned gains hanging in the balance as phishing attacks, exchange breaches, and ransomware threats loom large. From the shadows, malicious actors exploit vulnerabilities in the decentralized realm, preying on unsuspecting traders. But fear not armed with knowledge, you can turn the tide in your favor.

Security Risks - Ultimate Guide

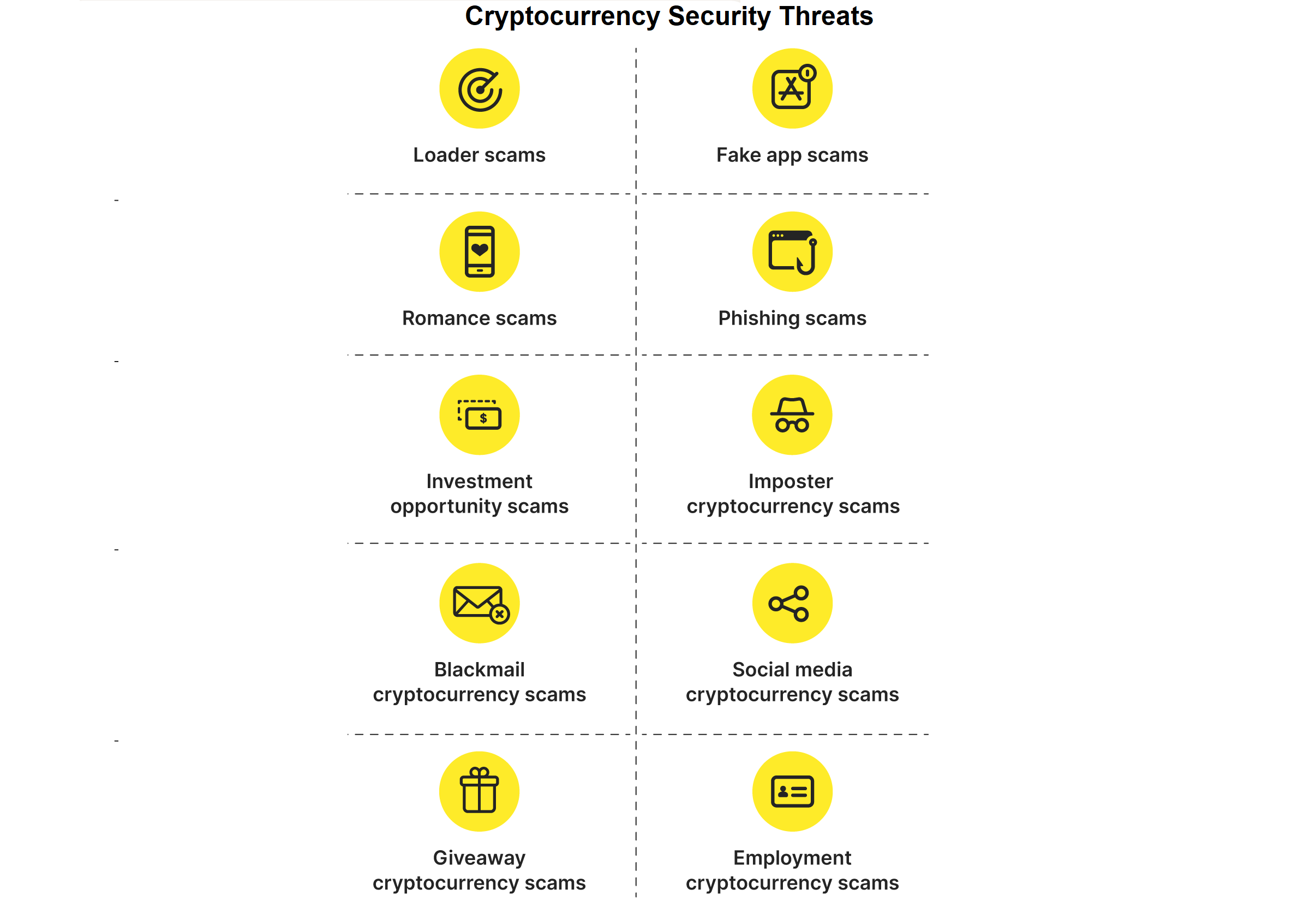

The world of crypto trading is exciting, but it's crucial to be aware of the security risks and threats involved before diving in. Here are 10 major ones to keep on your radar:

1. Exchange Hacks -Cryptocurrency exchanges are prime targets for hackers due to the large sums of money involved. Major breaches have happened in the past, resulting in millions of dollars stolen.

2. Phishing Attacks -Deceptive emails or websites designed to steal your login credentials are a constant threat. Be cautious of any suspicious links or requests for personal information.

3. Malware -Malicious software can infect your devices and steal your crypto holdings. Always use reputable security software and avoid downloading files from untrusted sources.

4. Social Engineering -Scammers may try to manipulate you into revealing sensitive information or sending them crypto. Be wary of unsolicited investment advice or emotional appeals.

5. Insider Trading -Unethical exchange employees or developers could misuse their access to manipulate markets or steal funds. Choose reputable exchanges with strong security measures.

6. Rug Pulls -Fraudulent projects might hype up a new coin and then disappear with investors' funds after launch. Do thorough research before investing in any new cryptocurrency.

7. Unsecured Wallets -Losing your private keys means losing access to your crypto forever. Use secure wallets with strong passwords and consider hardware wallets for added protection.

8. Cloud Storage Risks -Storing your crypto on cloud platforms introduces additional security risks like data breaches or unauthorized access. Consider self-custody options for larger holdings.

9. Market Manipulation -Whales (individuals or groups with large holdings) can manipulate markets through pump-and-dump schemes. Be cautious of sudden price movements and avoid emotional trading decisions.

10. Regulatory Uncertainty -The constantly evolving regulatory landscape surrounding crypto can create uncertainty and potential risks. Stay informed about regulatory developments and their impact on your investments.

Cyber Risks Of The Cryptocurrency Industry

While the previous response provided a valuable overview of the top 10 security risks in crypto trading, the cyber threats in the cryptocurrency industry go far beyond those specific examples. Here's a deeper dive into some key areas of concern:

1. Infrastructure Vulnerabilities

- Smart Contract Bugs -Code errors in smart contracts, which automate transactions on blockchains, can be exploited by hackers to steal funds or manipulate the system.

- Exchange Weaknesses -Security flaws in cryptocurrency exchange platforms can leave them vulnerable to attacks, as seen in numerous historical breaches.

- Wallet Hijacking -Vulnerabilities in individual wallets, both software and hardware, can expose private keys and allow unauthorized access to funds.

2. Targeted Attacks

- Ransomware -Crypto-focused ransomware attacks lock victims out of their wallets and demand ransom payments in cryptocurrency, often targeting businesses with large holdings.

- Supply Chain Attacks -Hackers may target third-party providers used by crypto companies, gaining access to sensitive data or injecting malware into software updates.

- Insider Threats -Malicious actors within crypto companies can exploit their access to steal funds or manipulate markets.

3. Emerging Threats

- Quantum Computing -The potential development of powerful quantum computers could pose a significant threat to the security of blockchain technology and cryptography.

- Deepfakes -Sophisticated AI-generated video or audio could be used for social engineering attacks to trick individuals into revealing sensitive information or sending crypto.

- Regulations and Compliance -Evolving regulations and compliance requirements can introduce new complexities and potential vulnerabilities for crypto businesses.

How Can I Protect Myself From These Risks?

Here are some specific actions you can take to protect yourself from security risks in crypto trading:

1. Security Measures For Your Accounts And Data

- Choose reputable exchanges and wallets -Research their security measures, track records, regulatory compliance, and user reviews. Opt for established platforms with multi-factor authentication (MFA), strong encryption, and regular security audits.

- Enable strong passwords and 2FA -Use unique, complex passwords for every account and activate 2FA (two-factor authentication) wherever possible. Consider hardware security keys for added protection.

- Beware of phishing scams -Never click on suspicious links or download attachments from unknown senders. Verify email addresses and website URLs before interacting. Double-check before entering sensitive information.

- Never share your private keys - Treat your private keys like your bank account PIN. Don't share them with anyone, store them securely (ideally offline in a hardware wallet), and avoid entering them on untrusted websites.

2. Investing And Trading Practices

- Do your own research (DYOR) -Before investing in any crypto project, thoroughly research its whitepaper, team, roadmap, community engagement, and independent audits. Don't rely solely on social media hype or recommendations.

- Diversify your portfolio -Spread your investments across different cryptocurrencies and projects to mitigate risk. Avoid putting all your eggs in one basket.

- Invest only what you can afford to lose -The crypto market is volatile, and prices can fluctuate significantly. Only invest what you can comfortably lose without impacting your finances.

- Beware of unrealistic promises -Be skeptical of projects offering guaranteed returns or unsustainable growth. If it sounds too good to be true, it probably is.

- Set stop-loss orders -Use stop-loss orders to automatically sell your assets if the price falls below a certain level, limiting potential losses.

3. Staying Informed And Vigilant

- Follow reliable news sources - Stay updated on industry news, security threats, and best practices by following reputable crypto news sites, security experts, and educational resources.

- Beware of FOMO (Fear of Missing Out) -Don't make impulsive decisions driven by market hype or social pressure. Stick to your research and investment strategies.

- Report suspicious activity - If you encounter any suspicious activity or potential scams, report them to the relevant platform, authorities, and crypto community to raise awareness and help others avoid falling victim.

Unregulated And Hackable Cryptocurrency Exchanges

Unregulated and hackable cryptocurrency exchanges are a major concern in the crypto space, posing significant risks to investors and the overall stability of the market. These exchanges operate outside the purview of traditional financial regulations, leaving users vulnerable to fraud, scams, and security breaches.

Risks Of Unregulated And Hackable Exchanges

- Increased Fraud and Scams -Unregulated exchanges often lack the necessary safeguards to prevent fraudulent activities. This can include pump-and-dump schemes, insider trading, and exit scams where the exchange operators disappear with user funds.

- Security Vulnerabilities -These exchanges are more susceptible to hacking attacks due to weaker security measures and a lack of oversight. Hackers can exploit these vulnerabilities to steal user funds, manipulate markets, or disrupt operations.

- Lack of Consumer Protection -Unlike regulated exchanges, users on unregulated platforms have limited recourse in case of losses due to fraud, hacks, or technical glitches.

- Systemic Risks -Widespread breaches or failures on unregulated exchanges can erode trust in the entire cryptocurrency ecosystem, leading to significant financial losses.

Examples Of Unregulated And Hackable Exchanges

- Mt. Gox -Once the world's largest Bitcoin exchange, Mt. Goxfiled for bankruptcy in 2014 after hackers stole millions of dollars worth of Bitcoin.

- Bitfinex -Bitfinexexchange suffered a major hack in 2016, resulting in the loss of almost $120 million in Bitcoin.

- Bithumb -BithumbA South Korean exchange that has been hacked multiple times, most recently in 2022, losing millions of dollars in various cryptocurrencies.

FAQ's About Security Risks In Crypto Trading

What Is The Biggest Risk In Crypto?

The most obvious risk is that governments worldwide could ban Bitcoin, making it illegal to own or mine. This has happened in China, the world's second-largest economy. For a completely digital asset like Bitcoin, a ban is more difficult to implement and enforce than physical gold.

Is Crypto Trading A Security?

The U.S. Securities and Exchange Commission takes the position that nearly all cryptocurrencies are securities, with bitcoin the only known exception.

What Are The Financial Risks Of Cryptocurrency?

Volatility - Prices of crypto assets are often driven by media or social media hype and can rise and fall quickly and dramatically. Liquidity - When trading on a crypto asset trading platform, the CTP may not have enough crypto assets to cover your order.

Conclusion

The dynamic world of crypto trading demands a vigilant and informed approach to mitigate the inherent security risks. As we navigate the intricate pathways of blockchain technology and decentralized finance, it becomes abundantly clear that safeguarding one's assets is not merely a precaution but a necessity. The tales of cyber threats and market vulnerabilities are cautionary reminders that, in this digital frontier, knowledge is power.

Embracing robust security measures, staying updated on the latest developments, and adopting proactive strategies are the keys to fortifying your position as a resilient crypto investor. So, as you embark on your crypto trading journey, let these insights serve as your beacon, guiding you through the choppy waters of risk towards a future where your investments thrive in the world of decentralized opportunities.

Camilo Wood

Author

Stefano Mclaughlin

Reviewer

Latest Articles

Popular Articles