Scam Protection - Defend Yourself From Marketing Frauds

Anyone can be scammed – as in anyone! – because even people trained to spot a scam can still be tricked and deceived. Scam protection is therefore for everyone.

Author:James PierceReviewer:Paolo ReynaMay 31, 2023268 Shares89.1K Views

Extensive and minute advice and tips from experts, professionals, and ordinary citizens regarding scam protectionabound.

The same goes for scams: bank scams, investment scams, telephone scams, etc. They’re numerous, too!

Someone wrote about her own experience, and mind you, she labeled herself as a “scam prevention expert.”

It even took her 6,664 words to narrate it.

The main characters?

A familiar multinational bank, a famous multibillion-dollar tech company, and a forensics/cybersecurity engineer and software developer (the “expert”).

Plus, of course, the devil incarnate: this time, in the form of a male scammer.

In her portfolio website Lupinia Studios, Natasha Lupinia, from the Washington DC-Baltimore area, shared how she almost lost a thousand bucks through a debit card scam.

This scamming incident, by the way, happened in 2018 (article got updated in March 2022).

While other people may remark that it’s such a long time ago, it’s difficult to dispute the fact that scamming continues to happen right up to this day.

Information about scam protection will never get old.

Phone Scammer Gets Scammed by Police Captain

Scam Protection

Some might dismiss reminders and instructions regarding scam protection until they become scam victims themselves.

A man claiming to be from the Fraud Prevention Department of Wells Fargo called Natasha Lupinia.

He didn’t succeed (after approximately 2 hours of phone conversation), though.

But if he did, Lupinia would have been cheated into approving three Apple Pay transactions worth $150, $49, and $800 each.

Lupinia confessed she almost fell for it, prompting to remind people:

“„Security experts – even those with professional experience in social engineering – are not immune to scams . . . no one is immune to deception.

Scam protection is indeed for every person.

From garbage collectors to those who deal with sophisticated technology, everyone can be victimized.

As the Federal Bureau of Investigation (FBI) warns, scammers “target individuals of all ages and walks of life.”

A scam involves making false claims and offering false promises carefully presented through a combination of true and false information.

It's a marketing fraud, which also goes by the names mass marketing fraud, mass marketing scam, and consumer fraud.

Action Fraud, U.K.’s fraud and cybercrime reporting center, describes it like this:

“„Mass marketing fraud is when you receive an uninvited contact by email, letter, phone, or adverts, making false promises to con you out of money.

Such promises come in the form of goods, services, and/or money – even a romantic relationship (who would resist love?) and marriage!

It uses different modus operandi (Latin for “mode of operating”) but always the same goal: to illegally obtain people’s money through deception.

U.K.'s Action Fraud, the FBI, and the Northern Territory Government of Australia and the Australian Competition and Consumer Commission (ACCC) identified various scams or mass marketing frauds.

Some of these scams fall in the following categories:

- money-making opportunity(e.g., investment/trading scams, get-rich-quick business ventures)

- job/employment(e.g., bogus job hiring/offers/vacancies)

- surprise winning(e.g., private/government-sponsored contest or raffle draw, lottery)

- paying (e.g., online payments, credit/debit card payments, debt/loan payments, overdue payments, etc.)

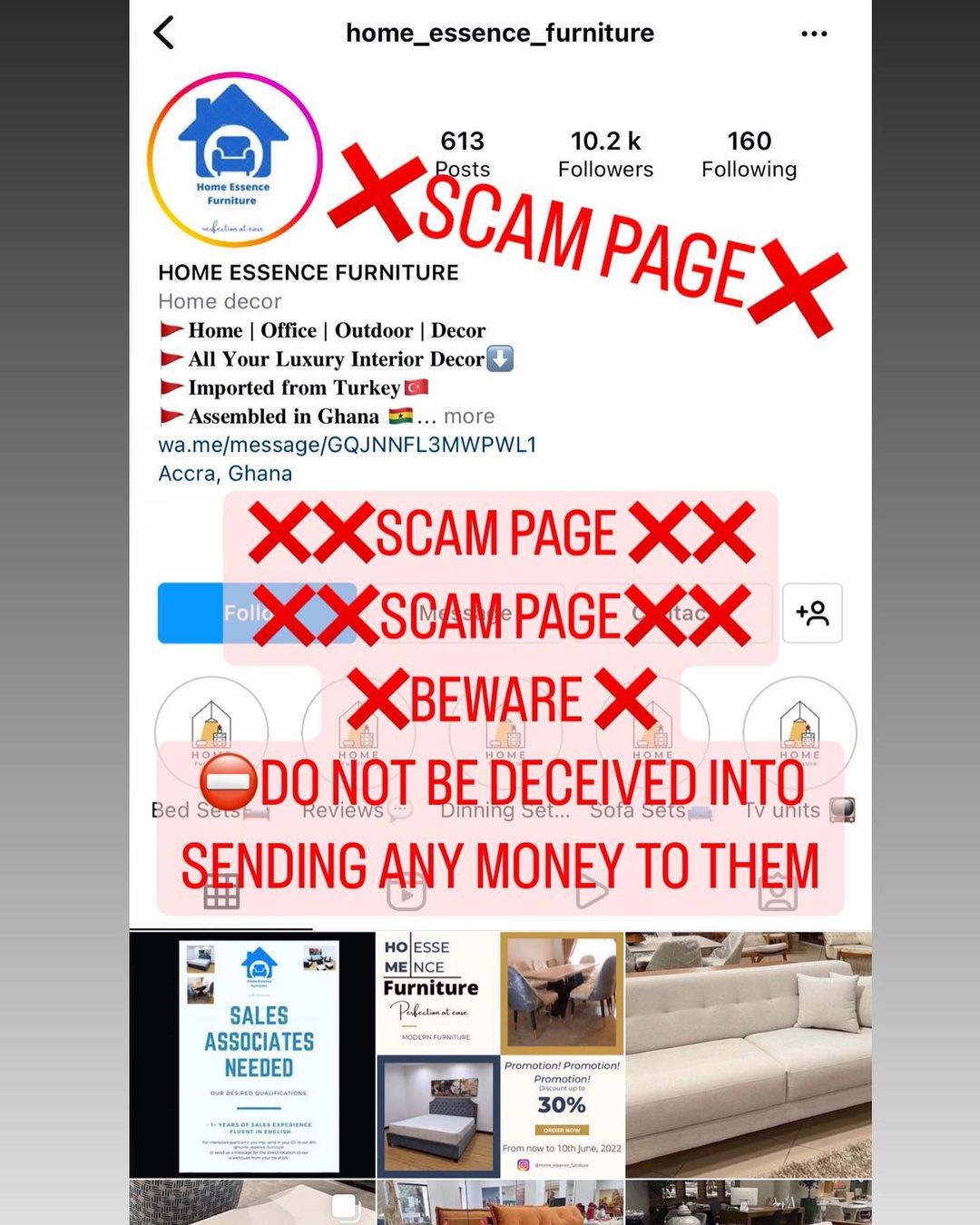

- buying/selling[e.g., auction scams; online shopping scams; ; medical scams (fake ads, false testimonies on the effectiveness of a certain herbal medicine); fake land titles, etc.]

- charity(e.g., donations to NGOs and orphanages; financial support to missionary/religious works or someone’s medical expenses, fake fund-raising projects, etc.)

- romance/dating/marriage(e.g., fake profiles in online dating sites)

So many!

That’s why people should find time to familiarize themselves with scam protection.

Scammers, after all, have all the time in the world to defraud anyone, including you.

Scam Prevention Tips

As mentioned at the start of this article, scam protection guidelines are given out online by different organizations.

From the U.S. Federal Trade Commission (FTC), watch out for these signs because you might have already become a scammer's next target:

1. A caller who introduces him/herself as someone from an agency/ institution/organization familiar to you.

For example, so-called representatives/personnel from a government agency, your bank, or a civic/religious organization where you’re a member.

2. A caller says that you won a cash prize.

You know very well you didn’t join any contest, buy a lottery ticket, or make any bet online/offline.

3. A caller says you have a problem.

It could be of personal nature (e.g., a family member/relative figured in a vehicular accident).

Also, there’s a problem with your bank account (or credit/debit card), you have an overdue payment, or your computer has been infected with a virus.

4. In relation to numbers 2 and 3, a caller will insist that you do something ASAP.

The caller/scammer will pressure you to send money now, to claim your prize today, to pay/buy/subscribe immediately, etc.

Or else, the prize money will be forfeited, your credit card will be temporarily blocked, or the offer will expire.

5. A caller will demand for a specific payment form.

He/she will assert that you need to pay only through, for example, money transfer.

In general, the caller/scammer will carry out the conversation smoothly, convincingly, and professionally.

As Natasha Lupinia recalled, when someone tried to scam her:

“„The caller was professional, knowledgeable, patient, and easy to understand.

Aside from these signs given by the FTC, the FBI also advises the public to consider these other red flags for scam protection:

1. Remember the phrase, “too good to be true.”

Be extra alert with those get-rich-quick business offers/plans/ideas.

For example, incredible investment returns within a short span of time (again, it appears too good to be true).

In the words of the FBI:

“„Don’t believe everything you are told.

2. Advanced payment is required.

3. You’re being asked to give your personal data (e.g., your mother’s maiden name).

4. The offers being given to you are “unsolicited.”

Don’t trust someone so easily. Verify something directly (do the calling yourself!) from the supposed source of information (e.g., your bank) BEFORE giving any personal information or paying/sending money.

In addition, the FTC recommends doing the following:

a. Disregard and delete text messages and emails from anonymous senders. Block those numbers. Don’t open any links.

b. Don’t give personal information even if the caller says it’s urgent.

Verify what is being told to you by the caller/scammer.

For one, a website contains information about one’s real office address, landline numbers, email address, etc.

d. Don’t get pressured to make a quick decision.

Take time to research and verify the caller’s claims.

e. When you begin feeling uncomfortable and in so much doubt, cut the phone conversation.

Then immediately confide with trustworthy people (e.g., your parents, spouse, siblings, etc.) about what the caller/scammer told you about.

When it comes to scam protection, sometimes you’ll need one or two confidants to help you sort things out.

Scam Protection Credit Card

In an article published by French tech company Spendesk in December 2021, there were 2.8 billion credit card holders in the world.

Nearly half of these credit card owners – approximately 1.06 billion – are in the U.S.

Now imagine the number of possible targets for credit card scams.

According to Security.org, a 2021 report revealed that an estimated 127 million American credit/debit card holders “had a fraudulent charge.”

In addition, Security.org found out from the report that:

“„More than one in three credit or debit card holders has experienced card fraud more than once.

In her 2021 article for U.S. News, credit card expert and finance analyst Beverly Harzog offered these scam protection tips:

1. Always keep a copy of your credit card statements, and review them regularly.

Be wary of purchases you didn’t make.

2. For online transactions/payments, make sure the website is secure.

Look at the left side of the address bar. There should be a padlock symbol.

Also, the web address should start with “https://.”

3. After making online transactions/payments, delete all information you gave. Don’t save them.

4. Avoid transacting with your credit card when you’re using public Wi-Fi.

5. When shopping in person, ask the store personnel/cashier if they have an in-store card/chip reader.

On its website, Dublin-based Experian, a consumer credit reporting company, made similar recommendations for scam protection.

Experian cautions that one should never divulge personal details.

Going back to Natasha Lupinia’s debit card scam experience, she admitted that she “definitely made some big mistakes.”

What were her huge mistakes?

“„I trusted the caller too much, gave up too much information before confirming whether it was real.

The realization that she was being scammed ultimately dawned on her when the caller asked for these two:

- complete birth date

- Social Security Number

Real banks, through their legitimate representatives, won’t ask for such information.

Scam Protection For Seniors

Why scam protection for senior citizens?

Simple: scammers target them, too!

As Experian stated:

“„They are perceived as having more wealth or being less likely to report the crime.

In fact, as ABC News reported, scams that happened in 2020 in the U.S. involved 105,301 seniors (aged 65 and up), and some $1 billion lost to scammers.

Per an FBI report, scammers “use tactics of intimidation and threats.”

What scam protection measures can we suggest to the elder members of society?

Protecting Seniors Online

According to a 2022 article by ConsumerAffairs.com, the FTC reported that there were 16,000 cases of scams via phone calls, with seniors as victims.

Moreover, there were 10,000 cases for online theft and 4,000 cases for email scams.

Scam protection for senior citizens can be done through the following:

1. Educate them on how to use a computer, a smartphone, and the Internet.

2. Guide them when making online purchases.

3. Teach them how to make strong passwords and about multi-factor authentication.

4. Show them how to block unsolicited text messages and emails as well as how to filter them.

5. Install a reliable scam protection app on their smartphone and a trustworthy security software on their computer.

6. Remind them to always log out from websites and apps and to never store passwords.

7. Advise them about the other tips mentioned in this article, for they apply to everyone.

People Also Ask

Who Can Help Me If I Have Been Scammed?

The local government, through its various agencies (e.g., in the U.S., there’s the Federal Trade Commission).

You may also report a scammer to the police.

What Information Does A Scammer Need?

Per MyBankTracker, a scammer desires the following:

- complete name

- complete address

- email address

- Social Security Number

- bank account information

- credit/debit card information

What Might Someone Do If They Steal Your Identity?

One possibility, according to the FTC, is for the scammer to pretend to be you (a case of identity theft) and then apply for a credit/debit card.

How Do I Get My Money Back From A Scam?

One must immediately report the scamming incident to the concerned institution/organization (e.g., your bank).

Still, getting back your money depends on how the scamming happened.

Conclusion

Scam protection will remain important.

Fraudulent calls from supposed bank representatives, rip-off products from online sellers, fake adverts from popular social media sites . . . the list goes on.

It seems scams are here to stay.

Take time to know about scam protection to safeguard your hard-earned money, not to mention, your precious peace of mind.

James Pierce

Author

Paolo Reyna

Reviewer

Latest Articles

Popular Articles