Mastering Retirement Portfolio Strategies - Optimizing Your Golden Years

Explore expert retirement portfolio strategies to secure your financial future. Discover investment tips, asset allocation techniques, and personalized approaches to optimize your retirement savings.

Author:Camilo WoodReviewer:Emmanuella SheaJan 18, 20241.5K Shares90.2K Views

In the realm of retirement portfolio strategies, navigating the myriad options is paramount. Embarking on the journey towards a secure retirement necessitates meticulous planning and strategic financial decisions. As individuals seek to safeguard their financial well-being in the golden years, understanding and implementing effective investment strategies become indispensable.

This introduction serves as a gateway to a wealth of insights into optimizing your retirement portfolio, exploring diverse investment avenues, and crafting a personalized approach tailored to your financial goals.

Join us on this exploration, where we unravel the intricacies of best retirement portfolio strategies, empowering you to make informed decisions that pave the way for a financially robust and fulfilling retirement.

How To Structure Your Retirement Portfolio?

Planning for a retirement portfolio by age that lasts 30 years or more is acceptable these days. Actually, our three-step method for earning income in retirement starts with setting up a savings account.

Selecting the appropriate combination of investments, or portfolio allocation, is the next step in managing your portfolio. Establishing a strategy for taking out your money is the third step.

So, how ought your allotment to be organized? Here are some ideas:

Set Aside One Year Of Cash

Make sure you have enough cash on hand at the beginning of each year to cover any shortfall in your annual income from annuities, pensions, Social Security, rental properties, and other recurring sources. Keep the funds in a liquid, somewhat safe account, like a money market fund or bank account that pays interest.

You won't be as concerned about the markets or a monthly salary if you have this money on hand. Use the money in this account to make purchases, and top it off from time to time with money from your investments.

Create A Short-term Reserve

After you've taken into account other regular income sources, we advise you to next establish a short-term reserve in your investment portfolioequal to two to four years' worth of living expenditures. This money can be used to purchase premium short-term bonds or other fixed income instruments like bond funds or short-term bonds.

A short-term CD or bond ladder is a strategy in which you invest in CDs or bonds with staggered maturity dates so that the proceeds can be collected at regular intervals. Alternatively, if you'd prefer to manage individual investments, you might choose to establish one. You can utilize the proceeds from the bonds or CDs to top off your bank account when they expire.

The interest income and other revenues from this reserve can be used to pay for the withdrawals from the portfolio that were discussed in section #1. Being able to earn cash without having to rely on more risky investments, such as stocks, is another benefit of having this kind of reserve, which can help you weather an extended market downturn.

Invest The Rest Of Your Portfolio

After setting up a short-term reserve and having a year's worth of cash on hand, allocate the remaining portion of your portfolio to investments that suit your risk tolerance and investing goals. Keeping a mix of cash, bonds, and stock assets that can increase in value, yield income, and protect your wealth should be your main objective here.

What suits you the best can vary depending on your age, financial objectives, time horizon, income requirements, and risk tolerance. And it's acceptable to make adjustments as needed. For instance, in the early years of retirement, you may feel at ease with taking on greater risk in exchange for greater growth. Later on, you can become increasingly conservative, concentrating on protecting your cash and earning revenue.

Retirement Portfolio Strategies

Retirement income management is the process of ensuring that your retirement resources produce adequate income to meet your demands and that you do not outlive your assets. This begins with creating and managing a portfolio that is suitable for you.

The amount of money you have when you start retirement is one of the most critical elements in deciding how to manage your assets.

If you have a large enough portfolio, it may create enough income to ensure that you never have to touch your investment, assuming sensible expenditure. If that's the case, a combination of bank products like CDs and Treasury bonds to protect your principal, as well as dividend-paying stocks and bonds, could be a good place to start with retirement investments.

On the other side, if you're like the majority of retirees, you'll start retirement with a smaller nest egg that will force you to withdraw your principal at some point. One critical issue is how much to withdraw and from which accounts. Another factor to consider is how much risk you are willing to take in order to develop your nest fund. You should also consider whether your partner is currently working and when he or she will retire.

Unfortunately, there are no quick answers or guaranteed methods for managing an investing portfolio. However, there are certain useful concepts and general recommendations that can help you decide what is best for you while also avoiding severe blunders that could damage your financial well-being.

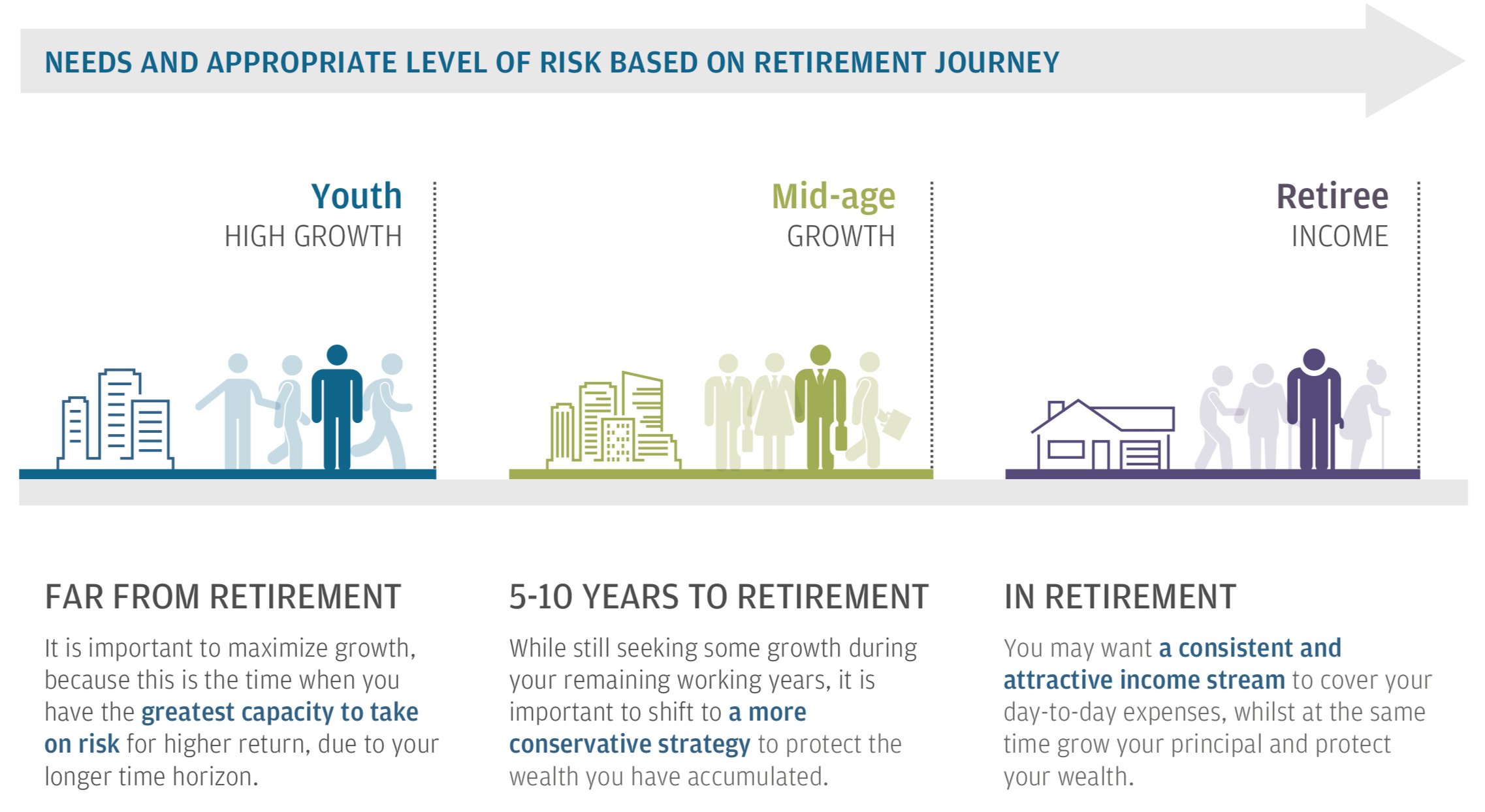

Reassessing Risk

As you approach retirement, you should reevaluate your level of investing risk, particularly the likelihood of losing money from your investments. Your timescale is one of the most important considerations when analyzing risk. Because you may no longer have time to recover from market downturns, you should examine if the proportion of your assets in higher-risk securities is too high.

You also don't want to fall victim to inflation risk, which is the danger that price changes will exceed your purchasing power. Finding the correct balance is not easy.

If you're worried about making your money last a lifetime, examine the following questions:

- What effect would withdrawing funds from your various retirement accounts have on their ability to grow and provide you with a steady income for life?

When selecting what to do with any single account, you should evaluate all of your assets and income sources, as well as the impact of taxes and your specific circumstances.

- What sources of income can you count on for the rest of your retirement? And what is less predictable?

As a growing number of Americans lose their pensions, Social Security becomes the only "annuity" income they can rely on for the rest of their lives.

- How diverse are your sources of income?

If your investments behave similarly during market volatility, you should diversify to protect your retirement income.

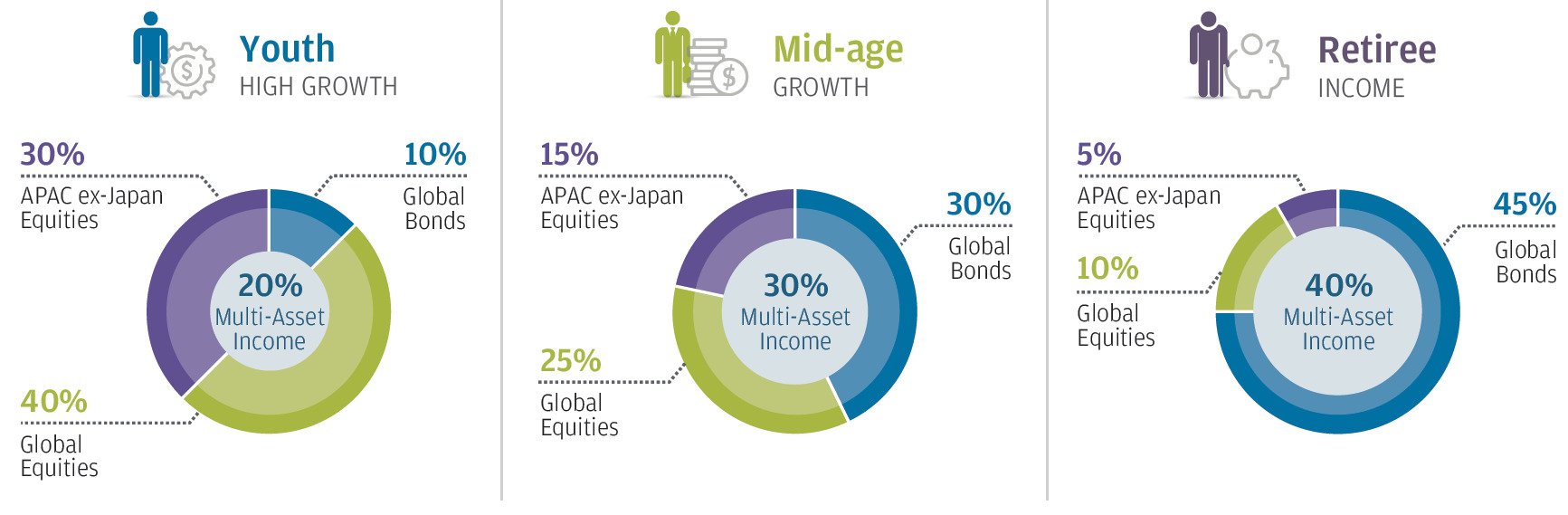

Asset Allocation

One strategic approach to investing in retirement is to keep a certain mix of investments in your portfolio that you believe will produce the return you seek at the risk level you are willing to accept. Asset allocation refers to the process of establishing such a portfolio and dispersing your risk.

Asset allocation is crucial since each investment category, such as stocks, bonds, or cash, behaves differently under different economic conditions. Spreading your investment capital over a variety of assets can help to smooth out the ups and downs in your overall portfolio.

Each broad investment type, from bank products to stocks and bonds, has its own set of characteristics, risk concerns, and ways in which investors might employ them. For more information, visit FINRA's Types of Investments section.

To minimize expenditures and make your money last, you'll probably have a mix of income-generating and growth assets. Income-producing investments, such as dividend-paying stocks, bank products like CDs, and bonds, are significant in retirement since once you stop working, you usually need this money to live on.

Growth investments, including growth mutual funds and individual equities, are projected to outperform their counterparts and the general market. They have higher price volatility than income-producing investments, but they are frequently suggested by financial advisers to help your retirement portfolio stay up with, or even outperform, inflation.

Throughout retirement, you may want to progressively change your asset allocation. For example, you may desire to shift money across investments in reaction to a lifestyle change or a change in economic conditions. You can get asset allocation advice from an experienced investment expert, such as your broker, registered investment adviser, or financial planner.

Income From Selling Your Investments

Receiving investment income is not the only option to generate retirement income from your investments. You can also make money by selling investments that are worth more than you paid for them.

While taxes should not be the major concern when making an investment decision, you should be aware of the ramifications of selling investments held in taxable accounts. You may be required to pay capital gains taxes on the selling proceeds, as well as broker commissions for managing the transaction. If you have owned the investment for more than a year, you may be required to pay capital gains tax. That rate can be 20% for those in the highest tax band and 0% for those in the lowest two tax groups.

That's probably lower than your ordinary income tax rate. However, liquidating a large portion of your possessions in a single year may increase your tax burden if you do not have any offsetting capital losses. So, if you intend to sell equities to generate present income, you should plan ahead.

You should also be aware that, as of January 1, 2013, the tax code levies a 3.8% Net Investment Income Tax on investors who fulfill certain income limits and other requirements. To understand more about the tax, who is subject to it, and how to compute net investment income, consult your tax professional or see the IRS's Net Investment Income Tax FAQ.

Of course, the situation changes if you sell investments in a tax-deferred account. You pay transaction charges but not capital gains taxes. However, when you remove from the account, you are taxed at your regular rate.

Make Your Principal Last

To make your money last as long as you need it, you must be disciplined with your spending. Experts advise against overspending in your first few years of retirement. They also recommend that you be prepared to cut back on luxuries if your retirement portfolio experiences losses in a given year. The other key to increasing your retirement income is proper management of the annual withdrawals from your retirement account principle.

While there is no "one size fits all" proportion for how much of your nest egg to remove each year, professional opinion tends to fall between 3 and 5 percent. Most retirement planning experts believe that you should start withdrawing as prudently as possible at the outset of your retirement.

One of the reasons for starting cautiously is that even a well-diversified investment portfolio will fluctuate, sometimes significantly, year after year. You want to give your portfolio a chance to rebound if the market takes a dive.

It's also a good idea to consider inflation while withdrawing. Consider adding an inflation rate to your annual withdrawals. It is important to recognize that rising expenses and diminishing investment returns might shorten the life of your money. Keep a watch on both, and be prepared to change your withdrawal rate as needed.

Asset Categories For Growth Portfolios

There are a variety of growth stocks, including -

- Small and mid-cap companies have greater room for expansion than megacaps such as Apple AAPL - 0.4%. They can appreciate swiftly but are also extremely sensitive to macroeconomic developments.

- Emerging market stocks refer to economies that are evolving to more mature, developed states. These economies can experience quick development and expansion, as well as high instability.

- Disruptive technology stocks: These companies invest in and create innovations that disrupt current sectors or markets. TeslaTSLA-0.2% (TSLA) is an example. The electric vehicle (EV) manufacturer has permanently altered the century-old automobile industry.

- Established growth stocks offer the best of both worlds: strong growth prospects and financial soundness. Alphabet (GOOGL) and Amazon (AMZN +0.5%) are examples.

Retirement Portfolio Strategies - FAQs

What Are The Key Components Of A Successful Retirement Portfolio Strategy?

A successful retirement portfolio strategy typically includes a diversified mix of assets, a clear risk management plan, and consideration of individual financial goals and time horizon.

How Can One Determine The Right Asset Allocation For Their Retirement Portfolio?

Determining the right asset allocation involves assessing risk tolerance, time to retirement, and financial objectives. Consult with a financial advisor for personalized guidance.

Are There Specific Investment Vehicles Recommended For Retirement Portfolio Strategies?

Common investment vehicles for retirement portfolios include stocks, bonds, mutual funds, and retirement accounts such as 401(k)s and IRAs. The ideal mix depends on individual circumstances.

How Do Economic Factors Impact Retirement Portfolio Strategies?

Economic factors, such as interest rates and inflation, can influence investment decisions. Staying informed about economic trends is essential for effective portfolio management.

Is It Advisable To Seek Professional Financial Advice For Retirement Portfolio Strategies?

Yes, consulting with a qualified financial advisor can provide personalized guidance, helping individuals make informed decisions aligned with their unique financial situations.

Final Thoughts

In the tapestry of financial planning, the significance of astute retirement portfolio strategies cannot be overstated. As we conclude this journey through the realm of retirement investments, the emphasis remains on adaptability and foresight.

Armed with a repertoire of insights, you're now better equipped to navigate the dynamic landscape of financial markets, ensuring your portfolio aligns seamlessly with your retirement aspirations.

Remember, the path to a secure future involves continuous evaluation and adjustment. By integrating the lessons learned here, you fortify your financial foundation, providing the assurance that your retirement years can be not only financially sound but also a chapter of life marked by fulfillment and peace of mind.

Camilo Wood

Author

Emmanuella Shea

Reviewer

Latest Articles

Popular Articles