Required Minimum Distributions - Essential Tips For Tax-Savvy Retirement Planning

Required Minimum Distributions, or RMDs, play a pivotal role in retirement planning and financial management. We aim to demystify RMDs, emphasizing their importance, how they're determined, and potential tax implications. Let's dive deep into understanding these mandatory distributions.

Author:Liam EvansReviewer:Habiba AshtonAug 18, 202323.4K Shares458.8K Views

Required Minimum Distributions, or RMDs, play a pivotal role in retirement planning and financial management. We aim to demystify RMDs, emphasizing their importance, how they're determined, and potential tax implications. Let's dive deep into understanding these mandatory distributions.

What Are Required Minimum Distributions (RMDs)?

A required minimum distribution (RMD) is a safeguard implemented by the Internal Revenue Service (IRS) to ensure that individuals don't indefinitely defer tax on their retirement accounts.

Essentially, an RMD is the minimum amount you must withdraw from your retirement account each year. This amount is calculated based on the retirement account’s prior year-end fair market value (FMV) divided by the applicable distribution period or life expectancy.

The IRS provides specific worksheets to assist taxpayers in calculating this amount. In many instances, your account custodian or plan administrator will calculate these amounts for you and report them to the IRS. However, it’s always a good practice to be aware of how these amounts are determined.

Certain qualified plans permit some participants to delay the commencement of their RMDs until they retire, even if they're beyond age 73. This typically applies to plans where the participant is currently employed.

Importantly, while you must withdraw at least the RMD amount, there's no limitation on withdrawing more. But remember, the more you withdraw, the higher the potential tax implications.

Interestingly, Roth IRAs are exempt from RMD rules while the owner is alive. But, this isn’t the case for Roth 401(k) accounts.

To give you a clearer picture, imagine a retiree named Linda. She diligently saved in her retirement account and reached the age of 72. Now, she must start withdrawing a portion to ensure she isn't merely using the account as a permanent tax shelter.

MASSIVE Changes to RMDs: What Retirees Need to Know! | Required Minimum Distributions

Why Do RMDs Exist?

RMDs ensure that retirees don't simply accumulate tax-deferred retirement savings and pass the balance on to heirs without ever paying taxes on it. Since many retirement accounts provide tax-deferred growth, the government eventually wants its share of the tax revenues from these accounts. By requiring minimum distributions, this ensures a continual flow of tax revenue.

Accounts Subject To RMDs

The following types of retirement accounts are subject to RMD rules:

- Traditional IRAs

- SEP IRAs

- SIMPLE IRAs

- 401(k) plans

- 403(b) plans

- 457(b) plans

- Profit sharing plans

- Other defined contribution plans

Take Note

Roth IRAs are not subject to RMDs during the account owner's lifetime. However, beneficiaries of Roth IRAs might have RMD obligations.

How To Calculate RMDs

Although your account custodian should be able to provide you with the RMD for your account, you can independently determine what you owe. Always ensure you're referencing the most recent calculation worksheets on the IRS website.

There are different calculation tables for various situations. For example, if your spouse is the sole beneficiary of your IRA and is more than ten years younger than you, you would reference a different table.

The basic steps for determining your RMD for a traditional IRA are:

- Record the balance of your account as of Dec. 31 of the preceding year.

- Locate your age-related distribution factor on the IRS's tables.

- Divide your account balance by this factor number.

The basic formula is:

For instance, if a 75-year-old has a $100,000 IRA balance, the Distribution Period according to the IRS table is 22.9. Therefore, the RMD would be approximately $4,366.38.

It's vital to review the latest IRS tables and guidelines or consult with a financial professional when calculating RMDs.

Penalty For Missing The RMD Deadline

Navigating the world of Required Minimum Distributions (RMDs) can be complex. Failing to comply can lead to steep penalties. Here's what you need to know:

Understanding Your RMD Responsibility

It's essential for retirement account holders to realize their role in ensuring they take the full RMD amount by the deadline:

- Initial RMD -The first time you opt for an RMD, you have until April 1 of the year after the one in which you turn 72 (or 73 if you turn 72 in 2023 onwards) to execute the transaction.

- Subsequent RMDs -From then on, typically by December 31 of the ongoing year, the year's RMD should be taken.

Consequences Of Missing The RMD Deadline

Historically, if you didn't withdraw the entire RMD sum by the stipulated deadline, the untaken money faced a taxation rate of 50%. However, due to recent legislation, this rate has been reduced to 25%.

Moreover, if the RMD is adjusted promptly, the rate can further drop to 10%. In these instances, the IRA holder is required to complete the IRS Form 5329, with Part IX being specifically for excess contributions.

However, there is hope for those who've unintentionally missed their deadline. By showcasing a genuine reason for the delay, it's possible to procure a waiver from the IRS. For a more detailed understanding, one can consult the waiver of tax section in the Form 5329 instructions.

For example:

For example, if Michael's RMD for the year was $10,000 and he only withdrew $7,000, he missed out on $3,000. He'd then owe a penalty of $750 (25% of $3,000) to the IRS.

Seeking Penalty Waivers

The IRS offers an out if you can prove that the shortfall was due to a reasonable error and that steps are being taken to remedy the situation. In such cases, the 25% taxation penalty may be waived. You would need to attach a letter of explanation to Form 5329.

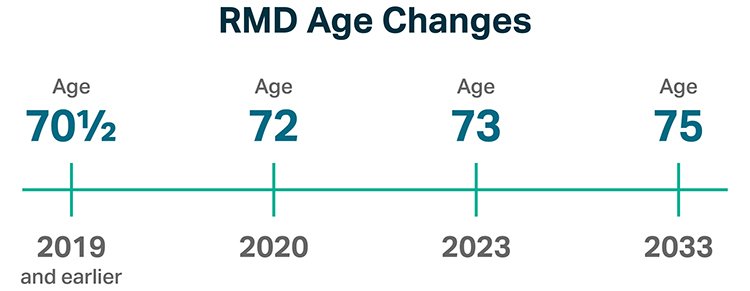

The Impact Of The SECURE Act On RMD Rules

The SECURE Act, which stands for Setting Every Community Up for Retirement Enhancement, has made significant changes to RMD rules:

- For individuals celebrating their 70th birthday after June 30, 2019, the initial RMD has shifted from age 70 1/2 to age 72.

- However, for those who turned 70 1/2 before July 1, 2019, the initial RMD still remains at age 70 1/2.

Furthermore, due to a spending bill passed at the conclusion of 2022, the RMD rules underwent another transformation. The age criteria for RMDs have been extended, with specifics being:

- If you reach 72 post-December 31, 2022, and turn 73 before January 1, 2033, the RMD age adjusts to 73.

- For individuals reaching 74 after December 31, 2032, the RMD age is set at 75.

Tax Implications

RMDs are generally treated as taxable income in the year they are taken out. The exact tax treatment depends on the type of retirement account:

- Traditional, SEP, and SIMPLE IRAs -RMDs are typically fully taxable unless you made non-deductible contributions.

- Roth 401(k), Roth 403(b), and Roth 457(b) accounts -Distributions are generally tax-free if taken five years after the first contribution and after age 59½.

If RMDs push your total income into a higher tax bracket, it might influence the tax you owe on other income sources.

Example Of An RMD

Suppose Bob turned 74 on Oct. 1 and his IRA was worth $205,000 on Dec. 31 of the last year.

Using the Uniform Lifetime Table, Bob finds the factor for a 74-year-old is 25.5. Dividing $205,000 by 25.5, Bob's RMD for the year is $8,039.22.

If Bob has multiple IRAs, each account would have its RMD calculatedseparately. However, the total can be withdrawn from just one or distributed among them.

Special Case - Inherited IRAs

If you inherit an IRA or another retirement account, you may have to take RMDs, even if you're many years away from retirement. The rules around this changed significantly with the SECURE Act of 2019.

Previously, if you were a non-spousal beneficiary of an inherited IRA, you could "stretch" your RMDs over your entire life expectancy. This was beneficial for younger beneficiaries who could grow the account tax-deferred over their lifetime. The SECURE Act largely eliminated this "stretch" provision.

Now, non-spousal beneficiaries of IRAs and defined contribution accounts like 401(k)s inherited in 2020 or later generally must withdraw the entire balance of the inherited account within ten years. There are exceptions, notably for spouses, disabled individuals, and individuals not more than ten years younger than the decedent.

This significant shift means that beneficiaries may be forced to take larger distributions than in the past, potentially resulting in bigger tax bills.

Maximizing Your RMDs

“„Every problem is an opportunity in disguise.- John Adams

As you plan for your future and navigate the intricacies of required minimum distributions (RMDs), it's essential to understand how to get the most out of your withdrawals. Here are strategies to help you optimize and make the most of your RMDs:

Charitable Donations

Donating a portion or all of your RMDs to charity can be a fulfilling way to give back. The benefits are twofold:

- Tax Advantages -When you transfer your RMD directly to a qualified charitable organization, it can reduce your taxable income.

- Legacy Building -This is an opportunity to support causes that resonate with you, making a lasting impact and building a legacy that aligns with your values.

Invest Smart

Instead of merely taking the distribution and placing it into a conventional account, consider reinvesting:

- Municipal Bonds -These are often tax-exempt, meaning the interest income they generate may not be subject to federal income tax. They can be a good choice for managing RMDs and preserving more of your wealth.

- Diversified Portfolios -Explore opportunities in different sectors and assets, reducing risks and potentially capitalizing on market upswings.

Remember, the key is to align your investment decisions with your overall financial goals and risk tolerance. Always consult with a financial advisor before making major investment decisions.

Why This Investment System Can Help Retirees Worry Less About Their Retirement Plan

Required Minimum Distributions FAQs

When Do RMDs Start?

As of now, RMDs must begin at age 73. However, this age has changed in the past, so always check the current regulation.

Are RMD Distributions Taxed?

Absolutely. Since RMDs come from accounts funded with pre-tax dollars, they are subject to taxation upon withdrawal.

What If I Don't Take RMDs?

Failure to withdraw your RMD can result in a substantial tax penalty from the IRS. Specifically, the undistributed amount will be taxed at 25%.

Why Does The IRS Impose RMDs?

The IRS introduced RMDs to ensure that individuals don't simply use retirement accounts as tax shelters. These rules ensure deferred taxes are eventually collected.

People Also Ask

What Are The Required Minimum Distributions From A 401k?

RMDs are amounts you must withdraw annually from certain retirement accounts after reaching a specified age. They were established to prevent retirement accounts from solely being used for estate planning.

What Does RMD Friendly Mean?

An RMD-friendly annuity ensures the account holder can take required minimum distributions without incurring penalties.

Is It Better To Take RMD Monthly Or Annually?

While your money has greater growth potential if you take the RMD at the end of each year, taking it in 12 monthly portions can simplify personal budgeting.

Can You Avoid Required Minimum Distributions?

Yes, by using a Roth individual retirement account (Roth IRA). While there are income limits for contributions, anyone can roll other retirement accounts into a Roth IRA to bypass RMDs.

What Can You Do With RMD If Not Needed?

If unneeded for living expenses, consider using the after-tax RMD to fund a life insurance policy. This can help cover future taxes on the IRA, preserving its full value for beneficiaries.

Why Is RMD Important?

RMD is the mandated amount to be withdrawn from your account to prevent tax penalties. Its calculation involves dividing the previous year-end retirement account value by an IRS-provided life expectancy factor. Withdrawing more than the RMD is allowed.

How Do You Handle RMD?

To manage RMDs:

- Begin after age 73.

- Avoid taking two distributions in the same year.

- For 401(k)s, delay withdrawals if still employed.

- Ensure correct withdrawal amounts.

- Opt for distributions from worst-performing accounts.

- Explore converting to a Roth IRA.

What Is The Difference Between RMD And Normal Distribution?

A Normal Distribution is any withdrawal made post age 59 ½. This differs from RMDs, which are mandated amounts. Between ages 59 ½ and 70 ½, you can choose any withdrawal amount, including none.

Conclusion

Understanding the intricacies of Required Minimum Distributions,or RMDs is crucial for anyone with tax-deferred retirement accounts. Not only do these rules impact your annual withdrawals in retirement, but they can also have significant tax implications. Being well-informed about RMDs can aid in making strategic financial decisions, potentially maximizing your retirement savings and minimizing tax liabilities.

Moreover, as retirement landscapes and legislations evolve, staying updated with the latest guidelines ensures that you are making the most of your retirement assets and avoiding costly penalties. Given the complexities involved, including changes from the SECURE Act and other related policies, it becomes even more imperative to stay informed.

For a deeper dive into RMDs and personalized advice tailored to your unique financial landscape, it's always recommended to consult with a financial professional. Their expertise can guide you through the nuances of RMDs and help you create a retirement strategy that aligns with your long-term goals.

Liam Evans

Author

Habiba Ashton

Reviewer

Latest Articles

Popular Articles