Personal Loan Options - Strategic Debt Management 2024

Explore diverse personal loan options - unsecured, secured, fixed or variable rates. Learn eligibility criteria, interest rates, and make informed financial decisions.

Author:Stefano MclaughlinReviewer:Luqman JacksonJan 10, 202419K Shares275.8K Views

Personal loans are financial tools that can be utilized for various purposes, such as consolidating debt, covering unexpected expenses, or financing significant life events. Understanding the available personal loan optionsis crucial for individuals seeking to meet their financial needs effectively. In this comprehensive guide, we will delve into different aspects of personal loans, exploring types, eligibility criteria, interest rates, and key considerations.

What Is A Personal Loan?

A personal loan is a lump-sum loan that you repay over time with predetermined monthly payments. Typically, this kind of loan is unsecured, which means you don't need to pledge assets like your home or vehicle as security.

Banks, credit unions, and online lenders are your options for personal loans. Personal loans range in size from $1,000 to $100,000 and are normally returned over a two - to seven-year period. Lenders consider your debt-to-income ratio, credit score, and credit record when determining your eligibility.

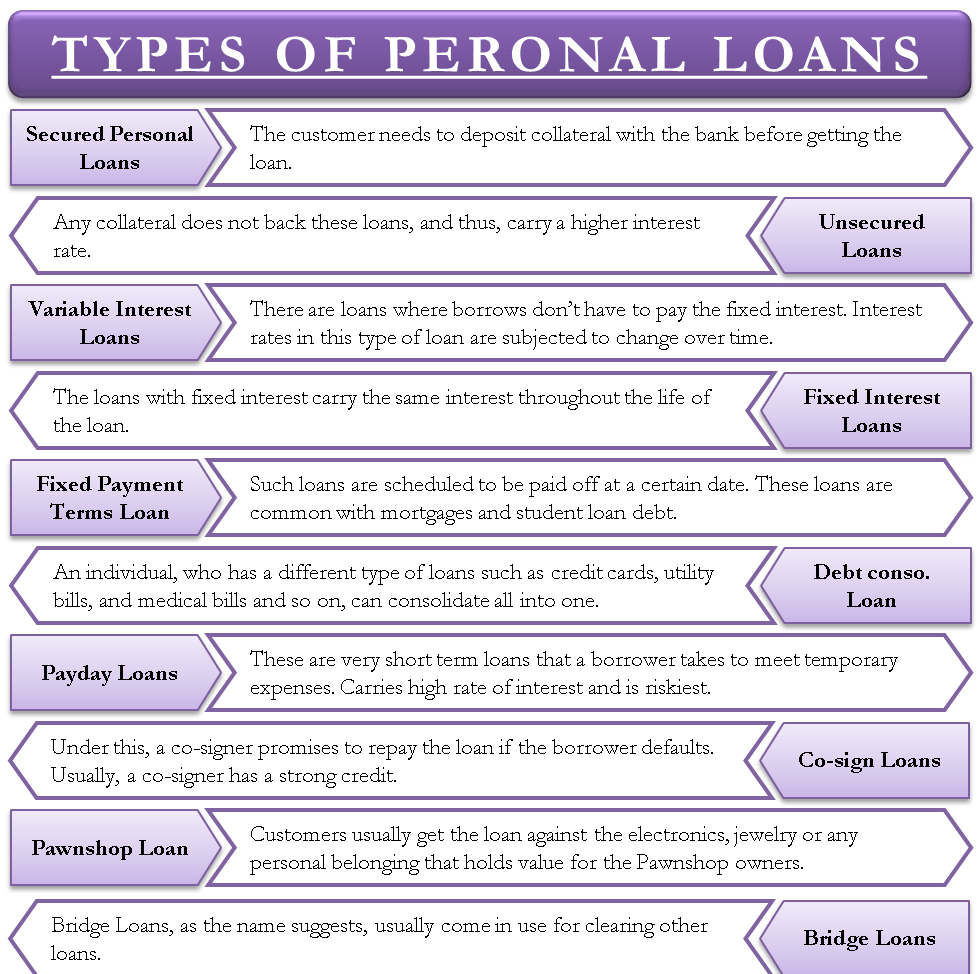

Types Of Personal Loans

Personal loans are a very versatile product that is available with a range of terms. Know what you need and be aware of your possibilities before deciding to take out a personal loan. Here's an in-depth exploration of common types of personal loans:

Unsecured Personal Loans

Unsecured personal loans are a popular choice for borrowers with good credit. These loans do not require collateral, making the approval process primarily based on the borrower's creditworthiness. Lenders assess factors such as credit score, income, and employment history to determine eligibility. While unsecured loans offer flexibility, they often come with higher interest rates compared to secured alternatives.

Secured Personal Loans

Secured personal loans involve collateral, such as a car, home equity, or a savings account. The presence of collateral reduces the lender's risk, resulting in potentially lower interest rates for the borrower. However, it's crucial to understand that defaulting on a secured loan can lead to the seizure of the collateral by the lender. Secured loans are suitable for individuals who are confident in their ability to meet repayment obligations and want to benefit from lower interest rates.

Fixed-Rate Personal Loans

Fixed-rate personal loans offer stability in interest rates throughout the loan term. Borrowers receive a fixed interest rate at the outset, ensuring that monthly payments remain consistent. This predictability makes fixed-rate loans an attractive option for individuals who prefer a clear and steady repayment schedule. It simplifies budgeting, providing borrowers with confidence in managing their finances over the life of the loan.

Variable-Rate Personal Loans

Variable-rate personal loans come with interest rates that can fluctuate based on market conditions. While these loans may offer lower initial interest rates compared to fixed-rate options, there is an inherent risk of rates increasing in the future. Borrowers considering variable-rate loans should assess their risk tolerance and financial goals carefully. These loans are suitable for those who can adapt to potential changes in monthly payments.

Debt Consolidation Loans

Debt consolidation loans are designed to help borrowers streamline their finances by combining multiple high-interest debts into a single loan. This approach aims to simplify repayment by offering a lower overall interest rate. By consolidating debts, individuals can manage their financial obligations more efficiently and potentially reduce the total interest paid over the life of the loan.

Eligibility Criteria For Personal Loans

Ensuring eligibility is a crucial step in securing a personal loan. Lenders evaluate various factors to assess a borrower's ability to repay the loan. Here's an in-depth look at the key eligibility criteria:

Credit Score

A credit score plays a pivotal role in determining eligibility for a personal loan. A higher credit score indicates a better credit history and enhances the likelihood of loan approval. Lenders often set minimum credit score requirements, and borrowers with excellent credit scores may qualify for more favorable interest rates and terms.

Income And Employment History

Lenders typically require proof of a stable income and employment history. A consistent and reliable source of income assures lenders that the borrower can meet their repayment obligations. Employment stability is a key factor in establishing a borrower's ability to repay the loan over the agreed-upon term.

Debt-to-Income Ratio

The debt-to-income ratio is a critical metric that compares a borrower's monthly debt payments to their gross monthly income. Lenders use this ratio to assess the borrower's capacity to take on additional debt responsibly. A lower debt-to-income ratio indicates a healthier financial situation and improves the chances of loan approval.

Best Personal Loans

Here are some best personal loan options:

LightStream Personal Loans

LightStreamprovides flexible-term, low-interest loans to borrowers with good credit or above; but, if your credit is exceptional, you may be eligible for some of the lowest interest rates.

This lender offers personal loans for almost any purpose, with the exception of small companies and higher education. The ranges of interest rates are determined by the kind of loan you are obtaining.

If you apply on a banking business day, your application is accepted, and by 2:30 p.m. ET, you have electronically signed your loan agreement and verified the details of your direct deposit banking account, you should receive your funds the same day. If, however, you are unable to meet this deadline, your cash should be disbursed the following business day.

The fact that LightStream offers repayment terms ranging from 24 to 144 months and doesn't charge origination, administration, or early payout costs is another benefit of working with this lender.

SoFi Personal Loan

Origination fees are waived for SoFi Personal Loans, which are also available in larger sums. With a $5,000 minimum loan amount and a $100,000 maximum credit amount, this personal loan is an excellent choice for borrowers who require additional funds to meet larger bills.

Additionally, money is typically disbursed fast; 92.6% of applicants for personal loans who sign their agreement by 7 p.m. ET on a business day were funded the same day. If not, your money will be sent to you the next day.

When you enroll in autopay, the interest rates on these loans can range from 8.99% to 23.43% APR, and the lender will give you a 0.25% interest rate reduction in exchange.

Additionally, you have a little more freedom in selecting the kind of interest rate you get. Those applying for loans have the option of fixed or variable APR. While variable interest rates change over time and are capped by SoFi at 23.43%, fixed APRs have a single rate that you pay for the duration of your loan.

PenFed Personal Loans

PenFed, which offers numerous personal loan choices for debt consolidation, home remodeling, medical costs, auto financing, and other purposes, is actually a federal credit union. Applying is free of charge, but in order to get your money, you must register for a PenFed membership and maintain $5 in an eligible savings account.

For individuals who don't want larger amounts of credit, this lender is an excellent choice because you can be authorized for a loan of as little as $600. The interest rates for personal loans range from 4.99% to 17.99%. Since it will rely on your creditworthiness, not all applicants will be eligible for the lowest rate; nonetheless, the likelihood of receiving a lower interest rate increases with your credit score.

However, it should be noted that PenFed receives funding in the form of paper checks. You can pick up your check directly from the bank at any time if you are aware of a PenFed location in the area. If not, you can pay for expedited shipping and get your money as soon as the following day.

OneMain Financial

Compared to other lenders, OneMain Financialprovides slightly more versatile lending alternatives. OneMain Financial gives clients the opportunity to secure the loan with collateral in order to potentially earn an interest rate on the lower end of the lender's range (APRs range between 18.00% and 35.99%). Repayment durations vary from 24 to 60 months. Additionally, borrowers have the choice to apply with a co-applicant and can select the day on which their monthly installments are due.

The origination cost is on the higher end; depending on the state in which you reside, it may be a fixed fee ranging from $25 to $500 or as much as 10% of the loan amount. Although there are no penalties for early loan payback, there is a $30 late fee, or as much as 15%, depending on your jurisdiction. You might be paying a lot of interest since OneMain Financial has a minimum interest rate that is significantly greater than that of other lenders.

The lender's website states that completing your loan application and hearing back from them usually takes less than ten minutes (though this could obviously change based on how many papers you have to provide). However, you might start receiving your money as soon as the following day after you sign the loan agreement.

Interest Rates In Personal Loans

Interest rates play a pivotal role in personal loans, significantly impacting the overall cost of borrowing. Understanding how these rates work and the factors influencing them is crucial for borrowers. Here's an in-depth exploration of interest rates in the realm of personal loans:

Annual Percentage Rate (APR)

The Annual Percentage Rate (APR) is a comprehensive measure that includes not only the interest rate but also any additional fees associated with the loan. It provides borrowers with a more accurate representation of the total cost of borrowing. When comparing personal loan options, focusing on the APR rather than just the interest rate is essential for a comprehensive assessment.

Fixed Vs. Variable Rates

Personal loans offer either fixed or variable interest rates. Understanding the differences between these two options is crucial for borrowers:

- Fixed-Rate Personal Loan - A fixed-rate personal loan maintains a stable interest rate throughout the entire loan term. This consistency offers borrowers predictability, as monthly payments remain constant. This stability is advantageous for budgeting, providing borrowers with a clear understanding of their financial obligations over time.

- Variable-Rate Personal Loan - Variable-rate personal loans, on the other hand, have interest rates that can fluctuate based on market conditions. While these loans may initially offer lower rates, the uncertainty of future rate changes can make budgeting more challenging. Borrowers should carefully assess their risk tolerance and financial goals before opting for variable-rate loans.

Key Considerations For Borrowers

In addition to interest rates, several key considerations should guide borrowers in making informed decisions about personal loans. These considerations go beyond the numerical aspects and delve into the practical and strategic elements of borrowing:

Loan Terms

The loan term, or the duration of the loan, is a critical factor. Personal loans come with various terms, ranging from short-term options of one year to longer-term loans extending up to seven years. Choosing an appropriate loan term requires aligning it with one's financial goals and the ability to make monthly payments comfortably.

Fees And Penalties

Borrowers should be vigilant about any fees or penalties associated with the personal loan. Common charges include origination fees, prepayment penalties, and late payment fees. Reading the loan agreement thoroughly helps borrowers understand the financial implications of these fees and avoid any surprises.

Repayment Plans

Lenders often offer different repayment plans to accommodate diverse financial preferences. Borrowers can choose between monthly, bi-weekly, or automatic payment options. Selecting a repayment plan that aligns with one's budgeting strategy ensures a smoother loan management experience.

Credit Impact

Taking out a personal loan can have implications for a borrower's credit score. Timely payments contribute positively to the credit score, while missed payments can have adverse effects. Borrowers should be aware of how the loan will impact their credit history and take steps to maintain a positive credit profile.

Purpose Of The Loan

Considering the purpose of the loan is essential. Whether it's for debt consolidation, home improvement, or a major life event, understanding how the loan fits into one's overall financial plan ensures that the borrowed funds are used strategically.

Personal Loan Options - FAQs

How Does A Secured Personal Loan Differ From An Unsecured One?

Secured loans require collateral, like a car or savings account, while unsecured loans don't. Collateral in secured loans may lead to lower interest rates.

Can Personal Loans Be Used For Debt Consolidation?

Yes, debt consolidation loans combine multiple high-interest debts into a single, more manageable loan, often with a lower overall interest rate.

How Long Are Typical Loan Terms For Personal Loans?

Personal loan terms can vary, usually ranging from one to seven years. Borrowers should choose a term aligned with their financial goals and ability to make payments.

What Fees Should Borrowers Be Aware Of When Taking Out A Personal Loan?

Borrowers should be aware of origination fees, prepayment penalties, and other charges that may apply. Thoroughly reading the loan agreement helps avoid unexpected costs.

How Does Taking Out A Personal Loan Impact One's Credit Score?

Timely payments on a personal loan positively impact a credit score, while missed payments can have adverse effects. Borrowers should consider the potential impact on their credit history.

Conclusion

Understanding the various personal loan options, eligibility criteria, and key considerations is essential for making informed financial decisions. Whether it's an unsecured loan for immediate needs or a secured loan for more extended financial planning, individuals should carefully assess their circumstances and choose the option that aligns with their goals and financial capacity.

Before committing to a personal loan, thorough research, comparison of offers, and consultation with financial professionals can contribute to a successful borrowing experience.

Stefano Mclaughlin

Author

Luqman Jackson

Reviewer

Latest Articles

Popular Articles