From Millennial To Millionaire - Exploring The Percentage Of 30-Year Olds Making Six-Figures In 2023

Navigate the financial landscape with ease as we unveil the percentage of 30-year-olds making six-figures. Empower yourself with knowledge and pave your way towards financial success.

Author:James PierceReviewer:Paolo ReynaNov 30, 202363 Shares63.2K Views

Financial prosperity is the state of having enough money to live comfortably and securely. It is a goal that many people strive for, as it can give them the freedom to pursue their dreams and goals. In today's world, financial prosperity is more important than ever, as the cost of living has been rising in recent years. There are many factors that contribute to financial prosperity, including education, job choice, and personal financial management. However, one of the most important factors is earning a high salary. In recent years, there has been an increase in percentage of 30-year olds making 6 figures.

The increasing prevalence of 30-year-olds earning six-figure salaries is a positive trend that is having a number of positive consequences. However, it is important to note that not everyone will be able to achieve this level of financial success. There are still many people who are struggling to make ends meet, and there is a growing gap between the rich and the poor.

It is important to remember that financial prosperity is not the only measure of success. There are many other things that are important in life, such as health, happiness, and relationships. However, financial prosperity can give people the freedom to pursue their goals and dreams, and it can make a significant difference in their quality of life. As the trend of 30-year-olds earning six-figure salaries continues to grow, it is important for young people to be aware of the factors that contribute to this trend and to develop strategies to achieve financial success.

Unveiling The Percentage Of 30-Year-Olds Making Six Figures

In today's world, financial success is often measured by one's ability to earn a high salary. For many, achieving a six-figure income is a significant milestone that represents financial stability and the ability to afford a comfortable lifestyle. While the path to financial prosperity is unique for each individual, understanding the trends and factors that contribute to this achievement can provide valuable insights for aspiring young professionals.

Data Insights - The Percentage Of 30-Year-Olds Earning Six Figures

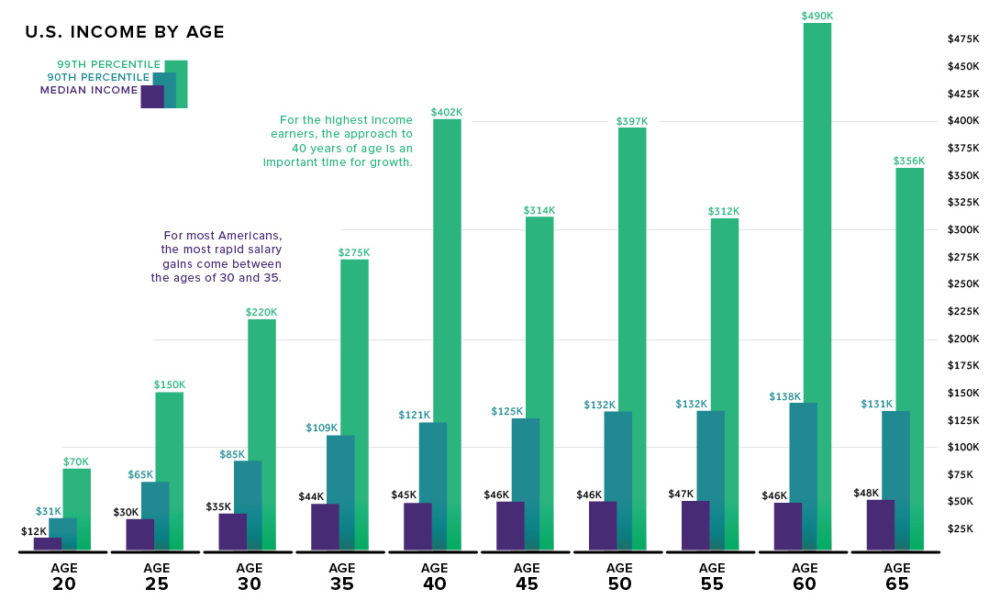

According to the Bureau of Labor Statistics (BLS), in 2021, approximately 2.9% of 30-year-olds in the United States earned $100,000 or more per year. This figure represents a slight increase from previous years, indicating a growing trend of young professionals reaching six-figure incomes.

Implications And Opportunities For Young Professionals

The increasing number of 30-year-olds earning six figures has significant implications for both the financial landscape and the opportunities available to young professionals. On the financial front, this trend suggests that achieving financial prosperity earlier in life is becoming more attainable, potentially leading to greater financial security and stability for younger generations.

From an employment perspective, the rise of six-figure salaries among 30-year-olds highlights the growing demand for skilled professionals in high-paying fields. This demand presents opportunities for young professionals to pursue careers in areas such as technology, healthcare, finance, and business, where six-figure incomes are more prevalent.

Exploring The Factors Influencing Six-Figure Salaries

In today's competitive job market, achieving a six-figure salary is a significant accomplishment that can open doors to financial freedom and opportunities. While the factors influencing six-figure salaries are complex and multifaceted, there are several key elements that play a crucial role in determining earning potential.

Impact Of Educational Attainment

Educational attainment is widely recognized as a significant factor influencing earning potential. Studies have consistently shown a positive correlation between higher levels of education and higher salaries. Individuals with bachelor's degrees or higher typically earn more than those with only a high school diploma or less education.

The reason for this correlation is multifaceted. Higher education equips individuals with specialized skills, knowledge, and critical thinking abilities that are highly valued in the modern economy. These skills make them more competitive in the job market and more likely to secure high-paying positions.

Influence Of Occupational Choice

Occupational choice plays a significant role in determining earning potential. Certain occupations are inherently more likely to offer higher salaries than others. For instance, fields such as technology, healthcare, finance, and business management are known for their high concentration of six-figure earners.

This is due to several factors, including the demand for skilled professionals in these fields, the complexity and specialized nature of the work, and the competitive nature of the industries. Individuals who choose to pursue careers in these areas are more likely to achieve six-figure incomes throughout their career path.

Significance Of Experience And Expertise

Experience and expertise are crucial factors in achieving six-figure earnings. As individuals gain experience in their field, they develop deeper knowledge, specialized skills, and a strong track record of accomplishments. This expertise makes them more valuable to employers and increases their earning potential.

In addition to experience, continuous learning and skill development are essential for staying ahead of the curve in today's rapidly changing job market. By actively pursuing professional development opportunities, individuals can enhance their skillsets, expand their knowledge base, and increase their chances of achieving six-figure incomes.

Additional Factors Influencing Six-Figure Salaries

While educational attainment, occupational choice, and experience are key factors, other elements also contribute to achieving six-figure earnings. These include:

- Location -Salaries can vary significantly based on geographic location. High-cost-of-living areas, such as major cities, often offer higher salaries to compensate for living expenses.

- Industry -Certain industries, such as technology and finance, are known for their high concentration of six-figure earners.

- Company size -Larger companies typically have more opportunities for advancement and higher salaries compared to smaller companies.

- Individual performance -Exceptional performance and contributions to the organization can lead to higher salaries and bonuses.

- Negotiation skills -Effective negotiation skills can play a significant role in securing higher salaries and maximizing earning potential.

Implications For Employers, HR Professionals, And Policymakers

The increasing number of 30-year-olds earning six-figure salaries has significant implications for employers, HR professionals, and policymakers. Understanding these implications and adapting strategies accordingly is crucial for navigating the changing workforce landscape and supporting the financial prosperity of young professionals.

Impact On Workforce And Talent Acquisition Strategies

For employers, the rise of six-figure salaries among 30-year-olds presents both challenges and opportunities. On the one hand, it increases the cost of labor and intensifies competition for top talent. On the other hand, it also signals a growing pool of skilled and experienced professionals who can contribute significantly to an organization's success.

To effectively navigate this trend, employers and HR professionals need to adopt strategic talent acquisition strategies. This includes:

- Conducting thorough market research -Understanding salary trends and competitive benchmarks for specific occupations and geographic locations is crucial for setting realistic salary expectations and attracting top talent.

- Offering competitive compensation packages -While salaries are important, other factors such as benefits, flexible work arrangements, and opportunities for career growth can also play a significant role in attracting and retaining top talent.

- Developing strong employer branding -Creating a positive and appealing employer image can help attract young professionals who are seeking a fulfilling and rewarding work environment.

- Investing in employee training and development -Fostering a culture of continuous learning and professional development can enhance employee satisfaction, retention, and productivity.

- Building strong employee relationships -Prioritizing employee engagement, open communication, and recognition can create a sense of belonging and loyalty among employees, reducing turnover and increasing productivity.

Recommendations For Attracting And Retaining Top Talent

In the face of rising salary expectations, employers and HR professionals can implement specific strategies to attract and retain top talent:

- Conduct regular salary reviews - Regularly evaluating and adjusting salaries based on market trends, performance, and individual contributions can help ensure that employees feel valued and compensated fairly.

- Offer performance-based bonuses and incentives -Rewarding employees for their achievements and contributions can motivate them to stay and perform at a high level.

- Provide non-monetary benefits -Offering attractive benefits such as flexible work arrangements, healthcare plans, and retirement savings options can enhance the overall value of the compensation package.

- Create a culture of appreciation and recognition -Regularly acknowledging and celebrating employee accomplishments can boost morale, engagement, and retention.

- Foster a culture of innovation and growth -Encouraging creativity, providing opportunities for skills development, and supporting employee growth can make an organization a more attractive place to work.

Policy Insights For Supporting Financial Prosperity

Policymakers play a crucial role in creating an environment that supports financial prosperity among young adults. Here are some policy recommendations to consider:

- Investing in education and training -Providing accessible and affordable education and training opportunities can help young adults acquire the skills needed for high-paying jobs.

- Promoting entrepreneurship -Encouraging entrepreneurship and providing support for small businesses can create new job opportunities and foster economic growth.

- Supporting financial literacy programs -Providing financial literacy education can help young adults make informed financial decisions and achieve long-term financial stability.

- Addressing income inequality -Implementing policies that address income disparity and promote fair pay can help reduce the financial gap between different groups.

- Encouraging saving and investment -Creating incentives for saving and investment can help young adults build wealth and secure their financial future.

Strategies For Achieving Financial Prosperity

Set Clear Financial Goals

The first step towards achieving financial prosperity is to set clear and specific financial goals. This involves defining your desired income level, identifying your financial priorities, and establishing a timeline for achieving your objectives. Having clear goals provides direction and motivation, allowing you to make informed decisions about your career, investments, and spending habits.

Develop A Roadmap To Achieve Your Goals

Once you have established clear financial goals, it is essential to develop a roadmap to achieve them. This involves breaking down your long-term goals into smaller, achievable steps. Identify the skills, education, and experience you need to acquire to reach your desired salary level. Research career paths and industries that offer six-figure incomes and explore opportunities for professional development and training.

Pursue Higher Education And Professional Development

Higher education is a significant factor in determining earning potential. Investing in education, particularly in high-demand fields such as technology, healthcare, finance, and business, can open doors to higher-paying job opportunities. Additionally, continuous professional development, through certifications, workshops, and online courses, can enhance your skills and knowledge, making you a more valuable asset to potential employers.

Network And Build Relationships

Networking is invaluable in today's competitive job market. Building relationships with professionals in your field, attending industry events, and engaging in online forums can expand your network and provide insights into career opportunities and salary expectations. These connections can also open doors to mentorship opportunities, which can provide valuable guidance and support throughout your career journey.

Cultivate Personal Financial Management Skills

Effective financial management is crucial for achieving and maintaining financial prosperity. Develop a budget to track your income and expenses, ensuring that you are living within your means. Create a savings plan to build an emergency fund and save for long-term goals such as retirement or homeownership. Seek professional financial advice if needed to develop a personalized strategy for managing your finances effectively.

Explore Entrepreneurial Opportunities

The rise of the gig economy and the increasing availability of resources for entrepreneurs have created new opportunities to generate six-figure incomes. If you have a passion for a particular business idea, consider exploring entrepreneurial ventures. While entrepreneurship comes with its own set of challenges, it can also offer greater flexibility, autonomy, and potential for significant financial rewards.

Embrace Continuous Learning

In today's rapidly changing world, continuous learning is essential for staying ahead of the curve and maintaining your earning potential. Dedicate time to learning new skills, staying updated on industry trends, and exploring emerging technologies. This commitment to lifelong learning will make you a more adaptable and valuable asset in the workforce.

Frequently Asked Questions - Percentage Of 30-year Olds Making 6 Figures

What Is A Good Net Worth At 35?

One common benchmark is to have two times your annual salary in net worth by age 35. So, for example, say that you earn the U.S. median income of $74,500. This means that you will want to have $740,500 saved up by age 67. To reach this goal, at age 35 you may want to have about $149,000 in savings.

How Is The Percentage Of 30-year-olds Making Six Figures Calculated?

This percentage is calculated by dividing the number of 30-year-olds earning six figures by the total number of 30-year-olds in a given population or sample, and then multiplying by 100 to get the percentage.

How Does The Percentage Of 30-year-olds Making Six Figures Compare To Other Age Groups?

The percentage of 30-year-olds making six figures is higher than any other age group. According to the Bureau of Labor Statistics, 2.9% of 30-year-olds in the United States earned $100,000 or more per year in 2021. This is compared to 2.6% of 25-29-year-olds, 2.4% of 35-39-year-olds, and 2.2% of 40-44-year-olds.

Conclusion

The increasing percentage of 30-year-olds making six-figures is a testament to the changing landscape of the workforce and the opportunities available to young professionals. While achieving financial prosperity is a journey that requires dedication, planning, and strategic career choices, understanding the factors that influence six-figure salaries and implementing effective strategies can significantly increase one's chances of success.

By pursuing higher education in high-demand fields, gaining valuable experience and expertise, continuously developing skills, and cultivating personal financial management skills, young professionals can position themselves for a successful and rewarding career path. Additionally, networking effectively, exploring entrepreneurial opportunities, and embracing lifelong learning can further enhance their earning potential and pave the way to achieving financial prosperity.

Remember, financial success is not the sole measure of a fulfilling life, but it can provide freedom, opportunity, and security. By taking the initiative to set clear financial goals, develop a roadmap for achievement, and continuously invest in their personal and professional growth, 30-year-olds can increase their chances of joining the growing ranks of six-figure earners and securing a brighter financial future.

Jump to

Unveiling The Percentage Of 30-Year-Olds Making Six Figures

Exploring The Factors Influencing Six-Figure Salaries

Implications For Employers, HR Professionals, And Policymakers

Strategies For Achieving Financial Prosperity

Frequently Asked Questions - Percentage Of 30-year Olds Making 6 Figures

Conclusion

James Pierce

Author

Paolo Reyna

Reviewer

Latest Articles

Popular Articles