Panic Selling Crypto - Market Starting To See Even Old-Timers ‘Panic Selling’

This year, as the crypto market fell, short-term traders were among the first to sell their holdings and to panic selling crypto.

Author:Camilo WoodReviewer:James PierceMay 31, 202319.5K Shares528.4K Views

This year, as the crypto market fell, short-term traders were among the first to sell their holdings and topanic selling crypto.

Now that losses are getting worse, even some of the most loyal investors look like they want to get out.

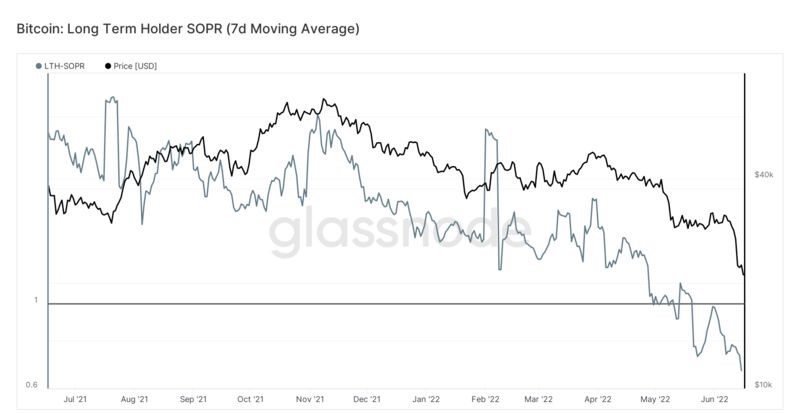

Glassnode data shows that a measure called the "spent output profit ratio," which shows how much money was made from trading digital currencies on a blockchain on any given day, has dropped to its lowest level in a year.

The disappearing gains could be a sign that long-term owners are under pressure. This could be a bad sign for a market known for its hodlers, who are loyal investors who would ride out any downturn no matter what.

“„The thought was not to worry, the long-term investors are holding strong.

In an interview, Noelle Acheson, who is the head of market insights at Genesis Global Trading, said.

“„Well, we’ve started to see the long-term holders sell as well. According to on-chain data, some of them seem to be panic selling, exiting at below cost.

Glassnode says that the spent output profit ratio gives an idea of how people feel and how profitable something is over a certain time period. It also shows how much all coins moved on the chain have gained.

It gives an average and doesn't mean that all long-term investors are selling or that everyone who is selling is losing money.

But it's another reason to worry about a market that's had a lot of setbacks and doesn't seem to have many things that could help it turn around.

Digital assets and other risky investments have been going down in value all year, as central banks around the world have started to raise interest rates to slow down inflation.

This year, Bitcoin is down about 50 percent, and Ether is down about 70 percent.

As of Friday, an index of the 100 biggest coins was down more than 60% this year.

The latest problems with cryptocurrencies have come from the lending market, where well-known companies like Celsius Network and Babel Finance have frozen withdrawals.

At the same time, a tweet from Three Arrows Capital, a large crypto hedge fund, made people worry that the company might be having money problems. This added to the feeling that things were getting worse.

“„I am so, so glad that that is being flushed out as we speak - that needed to break, that needed to be out of the system,

On Bloomberg's "What Goes Up" podcast, Anastasia Amoroso, chief investment strategist at iCapital, talked about how speculation is being squeezed out of the system.

Because crypto has such strong supporters, market watchers have been obsessed with figuring out who's getting hurt by the bear market and selling off their investments.

Short-term investors who bought Bitcoin in the past year and a half were put to the test early when the price dropped to its lowest level since 2020.

Then, this month, strategists at Glassnode said that the downturn had moved into its "deepest and darkest" phase, putting even long-term holders under pressure.

This year, the value of the crypto market as a whole has dropped by more than $1 trillion.

Some small coins have lost 90 percent of their value.

“„The most stunning feature of this bear market in crypto is its monotonic relentlessness - there is no sneaky underlying bull narrative to catch the market short.

Said Brent Donnelly, president of Spectra Markets.

“„What was once a massive flood of FOMO money trying to get in is now an equally raging torrent the other way.

Prepare For Pullbacks And Accept The Risks

The cryptocurrency market is known for being very unstable. The best way to deal with this is to accept it.

People have lost thousands of dollars on the market in just a few hours.

You need to be ready for that if you want to invest in the best-performing asset in history.

Even though the Bitcoin price has lost more than 85 percent of its value more than once, it has always gained that value back.

Even people who bought Bitcoin at $20,000 in 2017 saw their money more than double in value during the bull run of December 2020.

Be ready for the market to go down, but know that it will come back.

Pullbacks and dips in the market shouldn't hurt you if you're thinking about the long term and have used money that you don't need.

Camilo Wood

Author

James Pierce

Reviewer

Latest Articles

Popular Articles