Open Banking Developments Futuristic Frontier - Unlocking Tomorrow

Stay ahead of the curve with the latest open banking developments. Explore innovative solutions, regulatory updates, and industry trends shaping the future of financial services.

Author:Stefano MclaughlinReviewer:Luqman JacksonJan 08, 202411.2K Shares160.4K Views

In the dynamic realm of finance, open banking developmentshave emerged as a pivotal force, reshaping traditional practices and fostering a more interconnected financial ecosystem. The paradigm shift towards openness and collaboration has paved the way for innovative solutions, empowering both consumers and businesses.

From enhanced data accessibility to the integration of cutting-edge technologies, the landscape is evolving at an unprecedented pace. This introduction delves into the key facets of Open Banking, exploring how these open banking regulations are not only redefining the banking experience but also driving industry-wide transformation.

Open banking developments continue to reshape the financial landscape, fostering innovation and improving customer experiences. Through secure data sharing, it enables seamless transactions, encourages competition, and propels the evolution of financial services into a more interconnected and user-centric era.

Changes In The Banking And Financial System's Paradigm

The traditional landscape of banking and financeis undergoing a profound transformation, marked by unprecedented changes that redefine the industry's core paradigms. This evolution is not merely incremental; it represents a seismic shift in how financial services are conceptualized, delivered, and consumed.

- Embracing Technological Disruption - At the heart of the paradigm shift is the pervasive influence of technology. From blockchain to artificial intelligence, financial institutions are harnessing innovative solutions to streamline operations, enhance security, and deliver more personalized services. This embrace of technology is redefining customer interactions, rendering traditional models obsolete, and paving the way for a digitized future.

- The Rise of Open Banking - One of the most significant drivers of change is the ascent of Open Banking. This revolutionary approach to financial services emphasizes collaboration, transparency, and data-sharing. As traditional silos crumble, Open Banking fosters an interconnected ecosystem that empowers consumers and businesses alike. The paradigm now revolves around accessibility, with financial data becoming a catalyst for innovation and improved decision-making.

- Regulatory Reshaping - Adapting to a New Normal - In tandem with technological advancements, regulatory frameworks are adapting to ensure a harmonious integration of innovation and security. Authorities worldwide are recalibrating policies to accommodate the evolving landscape, fostering an environment that encourages innovation while safeguarding the interests of all stakeholders.

- Customer-Centricity Takes Center Stage - Perhaps the most noticeable shift is the renewed focus on customer-centricity. Financial institutions are moving away from one-size-fits-all approaches, leveraging data-driven insights to provide tailored services. This customer-centric paradigm acknowledges the diverse needs of a modern, interconnected world, placing the individual at the forefront of banking and financial experiences.

The administration of the financial data of the customer is an innovative feature of the open banking ecosystem. With the implementation of PSD2, personal data can now be accessed by entities outside of banks that aren't necessarily in the financial industry.

However, access to this data must always be granted with the consent of the customer and in accordance with GDPR, the General Data Protection Regulation that the European Union established and went into effect on May 25, 2018.

Open banking's increased competition has forced banks to create new business models and reshape their offerings and commercial focus to better target the new partners, stakeholders, and potential consumers entering this market.

Additionally, banks are beginning to implement platform economy models, which, like other companies like Amazon, eBay, or Uber, are enabling a technology-enabled value exchange between individuals, organizations, and resources.

What Adjustments Does Open Banking Make For The Customer?

Banks and fintechs stand to gain from this shift in personal data management, but end users are also sensitive to it, as they voice concerns about the privacy of their personal data when doing business with consumer companies (32%) and retailers (30%).

Empowering Financial Control

Open Banking fundamentally alters the customer experience by providing unparalleled visibility and accessibility to financial information. Through secure data-sharing mechanisms, customers gain real-time insights into their accounts, transactions, and overall financial health. This newfound transparency empowers individuals to make informed decisions, fostering a sense of control over their financial well-being.

Seamless Integration Of Financial Services

One of the key adjustments facilitated by Open Banking is the seamless integration of diverse financial services. Customers can now enjoy a holistic banking experience, transcending traditional boundaries. From budgeting apps to investment platforms, Open Banking enables the integration of third-party services, creating a personalized financial ecosystem tailored to individual needs and preferences.

Catalyzing Innovation

Open Banking serves as a catalyst for innovation by opening the door to a plethora of cutting-edge financial solutions. Customers can explore and adopt a range of fintech services that leverage their financial data for personalized recommendations, efficient money management, and innovative investment opportunities.

This adjustment transforms the customer from a passive participant to an active beneficiary of the dynamic financial landscape.

Enhanced Security And Privacy Measures

As Open Banking involves the sharing of sensitive financial data, paramount importance is placed on security and privacy. The adjustment here is the implementation of robust security measures, such as advanced encryption and authentication protocols. These measures ensure that customer data remains secure, fostering trust and confidence in the Open Banking ecosystem.

Facilitating Streamlined Transactions

Open Banking streamlines transactions by simplifying payment processes and reducing friction in financial interactions. Customers experience faster and more efficient fund transfers, payment authorizations, and overall transactional activities. This adjustment enhances the overall convenience of financial transactions, aligning with the modern customer's expectation for seamless and rapid interactions.

Nonetheless, a European Forrester survey indicates that 50% of customers would be receptive to exchanging certain personal information for improved financial services, indicating that consumers are prepared to embrace the open banking revolution.

In actuality, new opportunities are generated for both enterprises and end users, who may now expect a broader range of financial services that aren't just supplied by their bank but also by third-party providers (TPPs), who may not even be direct rivals of their establishment.

The following are the most illustrative advantages of open banking for clients:

Using The Favored Banking App, Current Account Management Across Many Banks

Through their platforms, institutions facilitate the management of active accounts across many banks, allowing the end user to access from a single point of access once they have granted permission for this operation.

Making Use Of Tailored Solutions

PSD2 facilitates data exchange, which gives institutions the ability to create customized offerings and consumer experiences.

Lowering Of Costs

An expanded offering would result in lower costs, as predicted by 75% of consumers, per Capgemini. Numerous financial institutions have made progress in this regard by creating innovative services like light banking with the intention of appealing to a younger clientele.

Open Banking Trends 2024

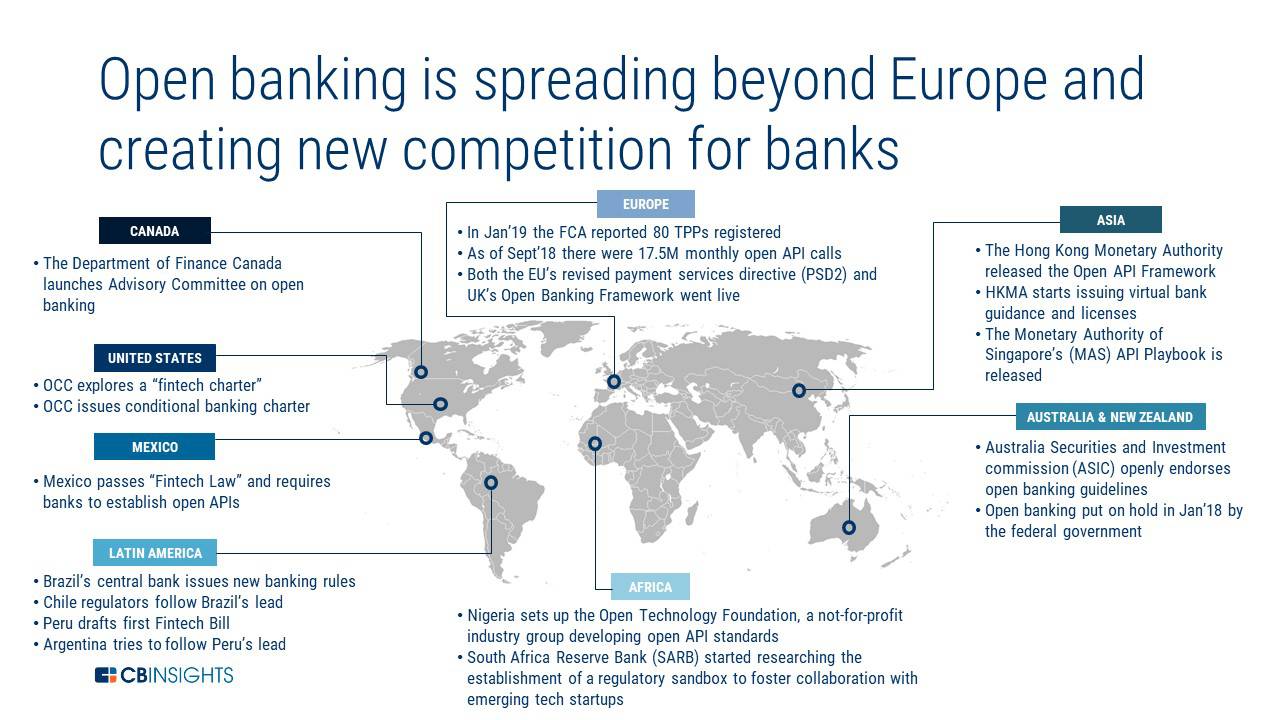

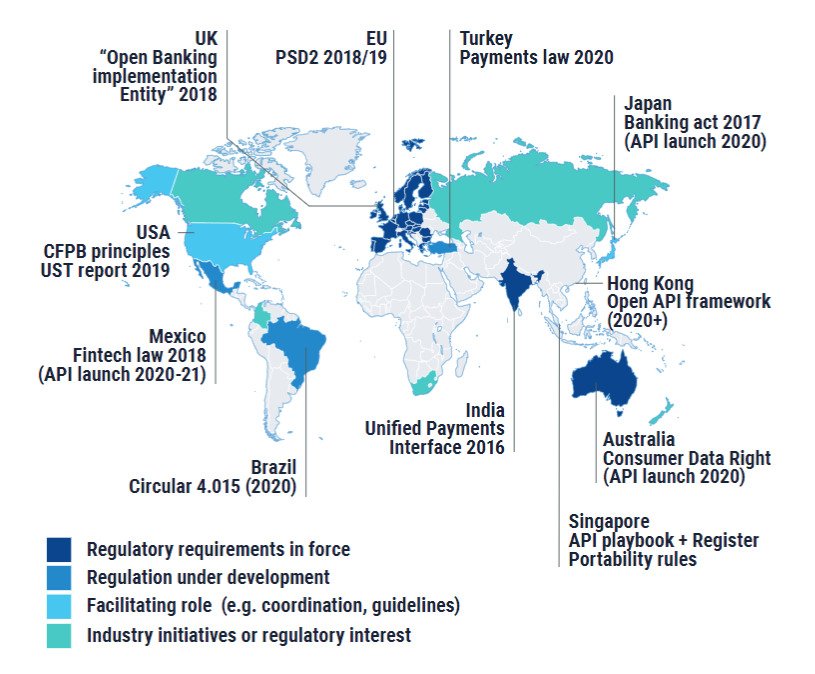

Explore the evolution of open banking around the world, where financial landscapes are transforming through collaboration, innovation, and interconnected ecosystems.

Increasing Maturity Of Open Banking

Leveraging its experience, the European Union is spearheading innovative regulatory frameworks such as PSD3. Though it's not the only initiative, the goal is to encourage even more innovation in the European financial sector.

Though at a slower pace, other significant markets such as the US, China, India, and Australia are all exhibiting hopeful signs of adoption. For instance, the US will implement new open banking regulations in 2024 that are expected to change opinions about the region's reputation as a "laggard" and avoid the open banking growing pains that were previously seen in Europe.

Regulating and adopting open banking unfortunately varies worldwide. Business executives in various markets thus confront a challenging environment when it comes to software implementation and compliance.

The Growth Of Digital Wallet Integrations And A2A Payments

The availability of instantaneous account-to-account (A2A) payments supported by open banking is expected to increase for end users through digital wallet integrations such as PayPal, Google Pay, Apple Pay, and Stripe. Digital wallets are already essential for rewards programmes, allowing for quick and easy transactions between companies, partners, workers, and customers.

In fact, Apple introduced an open banking payment integration for the UK market earlier this year. In addition, 75% of independent software suppliers and payment service providers intend to add features like rapid A2A payments to their platforms within the next two years.

AI Improvements

AI made significant strides in 2023, and it appears that 2024 will be no different, with open banking companies expected to continue integrating the technology.

Furthermore, using customer-facing AI systems in open banking environments has the potential to significantly boost user experiences and innovation. For instance, value-added informative services might be offered by third parties who obtain secure access to customer transaction data. Especially, making customized suggestions for goods or services to enhance their financial health.

The best aspect is that, thanks to account initiation service (AIS), banks and other third parties may provide personalized experiences based on native affordability checks because user insights are based on actual spending patterns.

The Growth Of Banking-as-a-service (BaaS)

Another important development in open banking is the rise of Banking-as-a-Service (BaaS), which is revolutionizing the financial services value chain. The BaaS business model, which is based on open APIs, enables financial institutions to easily integrate new services and share client data.

For instance, a recent PYMNTS survey revealed that 42% of customers directly attribute BaaS to the need for solutions like BNPL. Millennials are the generation that uses this payment option the most, and overall, customers find it convenient because it allows them to spread out their payments. Since interest rate peaks are expected to last until 2024, BaaS providers will need to investigate how using customer data might help them better prepare for what lies ahead.

The Influence Of Variable Recurring Payments (VRP)

Currently being implemented in the UK is an open banking effort called variable recurring payments (VRP). The program seeks to provide customers greater control over their outgoing payment caps and subscriptions. Users will be able to examine the payment parameters that are in effect for their outgoings, for example, and make changes or cancellations to them up until the time of payment.

Given that the UK has one of the most developed marketplaces and that open banking payments doubled to 68 million in 2022 alone, 2024 will be a critical year for the program. Because of this, we believe that VRPs will be the "next big thing" in open banking, and in the upcoming years, similar programs will probably expand to Europe and other regions.

Open Banking Cybersecurity

Ultimately, financial fraud continues to be a major issue on a global scale; in the EU alone, the amount lost to fraud has more than doubled in recent years. Because of this, both organizations and consumers are searching for improved cybersecurity solutions in their financial services.

Once more, open banking provides a prompt resolution because immediate account-to-account transfers can reduce the chance of fraud. Through the implementation of strong network security systems, zero-trust security protocols, and user identity authentication at every transaction, businesses and consumers can strengthen their defenses against malicious actors.

In fact, AI is contributing as well by helping anti-money laundering (AML) teams keep an eye on transactions. Positively, Strong Customer Authentication (SCA) procedures will be improved as part of PSD3, which will take significant actions to improve security.

Open Banking Developments - FAQs

What Opportunities Does Open Banking Present For Businesses?

Businesses can capitalize on Open Banking by creating new services, improving efficiency, and tapping into a broader range of financial data for strategic decision-making.

How Is Customer Data Protected In Open Banking?

Security measures, such as robust authentication and encryption protocols, are in place to ensure the protection of customer data in Open Banking systems.

What Are The Global Trends In Open Banking Adoption?

Open Banking adoption varies globally, with some regions embracing it more rapidly than others; understanding these trends is crucial for businesses operating in diverse markets

How Is Open Banking Influencing Financial Services?

Open Banking is revolutionizing financial services by fostering collaboration, enhancing customer experiences, and driving innovation.

What Role Does Technology Play In Open Banking Developments?

Technology, including APIs and digital platforms, is instrumental in enabling Open Banking, facilitating secure data sharing and seamless integrations.

Conclusion About Open Banking Developments

The trajectory of open banking developments is steering the financial sector towards a future characterized by increased efficiency, transparency, and customer-centricity. As regulatory frameworks adapt and technology continues to advance, the impact of Open Banking will only intensify.

The collaborative spirit and the infusion of digital solutions herald a new era for financial services, where agility and innovation are paramount. Embracing these developments positions stakeholders at the forefront of progress, unlocking opportunities for growth and differentiation in a competitive landscape. The journey of Open Banking unfolds with promises of a more inclusive, interconnected, and technologically empowered financial future.

Stefano Mclaughlin

Author

Luqman Jackson

Reviewer

Latest Articles

Popular Articles