The Revolution Of Online Banking Innovations - Secure, Seamless, Smart

Explore the latest online banking innovations that redefine the way you manage your finances. Discover cutting-edge technologies, seamless user experiences, and secure solutions revolutionizing the future of digital banking.

Author:James PierceReviewer:Camilo WoodJan 08, 20249 Shares8.7K Views

In the ever-evolving landscape of finance, online banking innovationshave emerged as the driving force behind a transformative shift in how we manage our money. The digital era has ushered in a wave of groundbreaking technologies that promise unparalleled convenience, security, and efficiency in financial transactions. From advanced mobile apps to artificial intelligence-driven personal finance tools, the world of online banking is witnessing a revolution.

This paradigm shift not only streamlines traditional banking processes but also opens up new possibilities for users to interact with their finances in ways previously unimaginable. This introduction sets the stage for a journey into the exciting realm of internet banking innovation, where every click brings us closer to a future of seamless digital banking innovation ideas.

What Are Online Banking Innovations?

Online Banking Innovationsrefer to the continuous evolution and transformation of the digital banking landscape through the integration of cutting-edge technologies and novel approaches. In a world increasingly driven by technology, the traditional paradigm of brick-and-mortar banking has given way to a dynamic and innovative online banking experience.

At its core, online banking innovations encompass a spectrum of advancements aimed at enhancing user convenience, security, and overall efficiency. This includes the incorporation of artificial intelligence, blockchain technology, biometric authentication, and seamless mobile applications, all geared towards providing users with a more personalized and streamlined financial experience.

Online Banking Innovations - Latest Trends

Every bank's future rests on how successfully it can use the newest technologies to concentrate on the needs, desires, and behaviors of its clients. Customers will reward banks with their loyalty, confidence, support, and recommendations in return.

We'll go over important trends and technologies in this piece that banks may employ to offer seamless, creative, inventive, and user-friendly digital banking services that are focused on the future.

Advanced Functionalities For Self-Service

Consumers today lack the patience to fill out a ton of paperwork and wait in line at a physical branch. Especially in the case of user-friendly self-service digital banking options that, through the preferred consumer device, offer a simple, quick, and enjoyable user experience.

Customers of all generations are now even more comfortable utilizing digital banking channels thanks to the COVID-19 problem, and many of them won't be visiting branches in the near future. The term "self-service capabilities" is no longer limited to everyday tasks like online account balance checks and money transfers. The most recent banking technology allows consumers to carry out sophisticated digital self-service tasks, including remote account opening and self-registration.

The best self-service banking options are those that are quick, easy to use, transparent, and accessible from anywhere at any time. Cutting-edge technology is used in the design of these processes, such as:

- KYC adherence

- Instantaneous identification verification

- Verification of the device

- Biometrics using fingerprints and faces

- Omnichannel functionality (internet, mobile app, and branch)

- Credit bureau checks in real time

- Prompt approvals

Every digital procedure should be created to guarantee a seamless consumer experience across channels, going beyond simple form-filling.

APIs

The development of a bank will depend on its capacity to create and engage in digital ecosystems in our highly interconnected society. The bank's capacity to integrate its goods and services with several applications and services from third parties, both internally and externally, is a crucial requirement.

Application Programming Interfaces, or APIs, are by definition the means by which two software systems, applications, or other services can exchange data and communicate with one another. Put differently, APIs enable secure, real-time communication between bank products and third-party solutions.

APIs, for instance, allow Core Banking Systems to receive requests for money transfers from many sources, such as payment switches, third-party financial service providers, card systems, and consumer mobile wallets.

But that's not all that APIs are.

These are the essential resources that let banks innovate and quickly adjust to a world that is constantly changing and focused on the needs of its customers. Consumers anticipate smooth connectivity across all platforms, channels, applications, and services. Additionally, banks can offer a superior connected, omnichannel experience with the aid of a sound API strategy.

Additional crucial advantages of APIs that hasten the development of digital banking are as follows -

- Data insights- Banks may target the proper market with the relevant financial services and acquire insights into consumer behavior by gathering and combining client data with the use of APIs.

- New revenue - To generate additional income, banks can charge for the use of their banking services and access to raw data.

- Agility- APIs reduce development time and time to market for new goods and services.

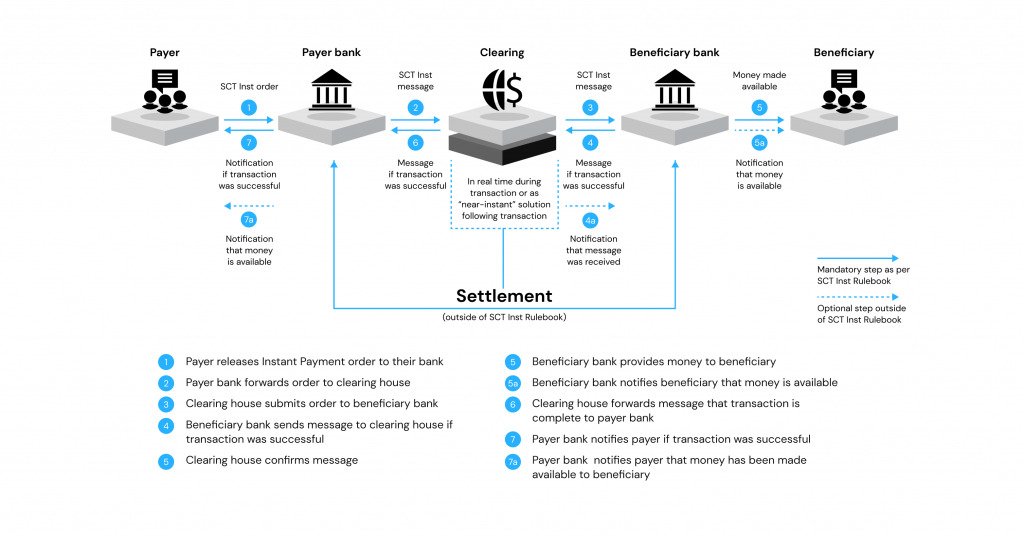

Quick Payments

When it comes to using their money, consumers don't expect anything less than instantaneous digital offerings. Banks are implementing immediate payment solutions that offer simple, quick, and real-time payments in order to satisfy these requests.

When funds are electronically moved between two accounts in a matter of seconds as opposed to the customary one to three business days, this is known as an instant payment.

Notifications (via SMS, mail, push notification, or other means) indicating the transaction has been successfully completed are nearly instantly sent to both the payer and the payee.

Among the many situations in which quick payments can simplify life for both payers and payees are splitting the tab with friends at a restaurant, sending money between peers, shopping online, and purchasing tickets for public transportation.

There are two primary ideas behind rapid payments:

An Instant Payment System Including Several Banks

In order to manage the risk involved with this fast payment solution, rules and a gross settlement procedure are necessary, but open APIs and round-the-clock payment processing capabilities are also necessary. Pan-European credit transfers are made possible via the SEPA Instant Credit Transfer mechanism, which allows monies to be available on the account in less than ten seconds.

A Closed-loop Payment System With An Instant Payout Option

The second idea is organizationally based and necessitates the appropriate license. The financial service provider should guarantee creative UX, flexible business parameters, and creative services or pricing in order to add value for retailers and customers. Technical requirements include account management on a private ledger, payment scheme integrations for deposits and withdrawals, and service provider integrations for value-added services.

Utilizing Cloud Infrastructure

BigTech, fintech, and even non-financial firms are becoming more and more of a threat to banks as they enter the financial sector. In order to effectively rival them, incumbents must move quickly and nimbly. As they develop their digital strategies, many are already considering the advantages of cloud technologies. With cloud computing, banks may use the internet to store data and apps and access scalable computer resources whenever they need them.

The top public cloud service providers, such as Google Cloud Platform, Amazon Web Services (AWS), and Microsoft Azure, provide banks with a variety of services that enable them to rapidly develop and expand innovations.

- Reduce expenses because banks don't need to invest as much in hardware and software infrastructure

- Facilitate the creation and introduction of new products, and assist banks in reacting more quickly to customer demand and technology advancements.

- Permit banks to hold large amounts of data while utilizing machine learning and robust data analytics to obtain insightful knowledge about the behavior of their clients.

Technology-Based On Biometrics

Consumers expect the best security and safety since they trust banks with their sensitive information. Financial institutions may achieve a seamless consumer experience by balancing security, speed, and convenience through the use of biometric technologies. Biometrics are bodily traits of humans, such as voice, iris, and fingerprints, that are used to confirm a customer's identification.

Biometric identifiers are far more difficult to exploit and impossible to lose than PINs or passwords. By 2023, about 2.6 billion biometric payment users will require a safe and efficient authentication mechanism. Biometric technology should provide a consistent, better user experience across all payment channels, from smartphones and ATMs to smart home appliances, with its accessibility and simplicity of use.

The following are some of the main ways that banks can enhance remote experiences with biometric technology -

- Banking on the go- To enable consumers to safely transfer money or access their banking accounts while on the road, financial institutions have integrated biometrics into their mobile apps.

- Online onboarding - Banks may streamline and expedite KYC and due diligence procedures with biometric authentication to reduce risks and guarantee positive onboarding experiences.

- ATM usage- Banks can ensure that only authorized clients can utilize ATM services by implementing biometric identifiers, such as fingerprint scanners, in their ATMs.

Chatbots

Achieving a high Net Promoter Score (NPS) and high customer satisfaction requires overcoming obstacles like long response times, a shortage of call center operators, and irregular work hours.

Any consumer in today's digitally connected world can share their negative banking experience with people worldwide by writing an online review. Artificial intelligence (AI)-powered chatbots can help banks enhance the caliber of their customer service by resolving some of the aforementioned issues.

Chatbots are computer programs that mimic human online chats on various platforms, such as mobile apps and websites. They serve as clients' personal digital assistants, providing real-time customer support, round-the-clock assistance, and a tailored experience. Furthermore, a sophisticated chatbot may assist users with routine banking chores, gather leads for marketing campaigns, and carry out cross-selling operations.

RPA, AI, And Machine Learning In Process Automation

Enhancing legacy systems and streamlining procedures are two major areas of emphasis for the digital transformation of banks. Working across departments and siloed systems has challenges, including inefficient workflows and cumbersome processes.

Robotic process automation (RPA), artificial intelligence (AI), machine learning, and integration and orchestration platforms are some of the breakthroughs that bring process improvement, cost savings, and productivity to the next level.

Research by Accenture claims that by using new automation technology, financial institutions in North America alone may increase productivity and save costs by $140 billion by 2025. Automation is the process of swapping out labor-intensive, repetitive manual operations with automated systems that operate faster and more accurately.

By doing this, the bank can attain operational agility, cut expenses, enhance customer satisfaction, and hasten its digital transformation. In the banking industry, process automation is crucial in the following areas -

- KYC (Know Your Customer), compliance, and customer onboarding

- Opening of an account

- Mortgage financing

- Core banking operations: automatic report creation

- Credit card transactions

- Client support

- AML and sanction screening

- Fraud detection

- Regular payments in addition to a lot more

Finding the most important areas to automate is the first step in creating a cohesive automation strategy. Here is where exciting new technologies like Process Mining might be helpful.

Small-scale Services

Historically, the rigid, one-size-fits-all method known as "monolithic architecture" was employed in the development of numerous financial applications. However, as mobile devices proliferated and consumer demands shifted, the industry began to want applications that prioritized functionality above coding and were simpler to develop, scale, and upgrade. Microservice architecture can assist in accomplishing the aforementioned.

The banking application as a whole is split up into stand-alone services that can operate separately but can cooperate well thanks to microservices. This improves service reusability and business continuity because, unlike monolithic design, where a failure in one microservice might impact the entire business, a failure in one microservice doesn't interfere with the operations of the others.

Microservices enable banks the ability to move fast, boost business agility, continuously innovate, and deliver a consistent user experience across channels including web, mobile, and IoT. These advantages include scalability, high performance, and dependability.

Importance Of Innovation In Banking

Enhancing Customer Experience

Innovation in banking plays a pivotal role in elevating the overall customer experience. Traditional banking models are being reshaped by the integration of digital technologies, resulting in the development of user-friendly interfaces, intuitive mobile apps, and personalized services. By embracing innovative solutions, banks can create seamless interactions with customers, meeting their expectations for convenience and accessibility in an increasingly digital world.

Strengthening Cybersecurity Measures

As the financial industry becomes more interconnected and data-driven, the importance of innovation in bolstering cybersecurity measures cannot be overstated. Innovations such as advanced encryption, biometric authentication, and real-time fraud detection systems are crucial in safeguarding sensitive financial information. By staying ahead of evolving cyber threats, banks can instill trust and confidence in their customers, ensuring the security of transactions and protecting against potential breaches.

Driving Financial Inclusion

Innovation serves as a catalyst for financial inclusion by providing solutions that reach underserved populations. Fintech innovations, mobile banking, and digital payment platforms offer avenues for individuals without access to traditional banking infrastructure to participate in the formal financial system. This not only empowers individuals economically but also aligns with broader goals of reducing global financial inequality.

Improving Operational Efficiency

Efficiency gains are a direct outcome of innovation in banking operations. Automation of routine tasks, implementation of artificial intelligence for data analysis, and the utilization of blockchain for secure and transparent transactions contribute to streamlined processes. Enhanced operational efficiency allows banks to allocate resources more effectively, reducing costs and enabling a focus on strategic initiatives and customer-centric innovations.

Navigating Market Dynamics With Agility

In a rapidly evolving global economy, the ability to adapt to changing market dynamics is crucial for banking institutions. Innovations provide the agility needed to respond to shifts in regulatory environments, economic conditions, and customer expectations. Whether through the adoption of open banking frameworks or exploration of decentralized finance, staying at the forefront of innovation positions banks to navigate uncertainties and remain competitive.

Online Banking Innovations - FAQs

What Are The Latest Online Banking Innovations?

Online banking innovations encompass a range of advancements, including biometric authentication, AI-driven chatbots, and blockchain technology, revolutionizing the digital financial landscape.

How Do AI-driven Features Enhance Online Banking Experiences?

Artificial intelligence in online banking offers personalized insights, fraud detection, and virtual assistants, creating a more intuitive and secure user experience.

Are There Any New Security Measures In Online Banking Innovations?

Yes, innovations include multi-factor authentication, biometric security (fingerprint and facial recognition), and advanced encryption, ensuring robust protection against cyber threats.

Are There Any Environmental Sustainability Aspects In Online Banking Innovations?

Yes, many banks are adopting paperless processes, green banking initiatives, and eco-friendly practices in their digital services to contribute to environmental sustainability.

What Impact Do Mobile Apps Have On Online Banking Innovations?

Mobile apps contribute significantly to innovations by offering features like real-time transaction alerts, digital wallets, and seamless account management, providing users with on-the-go accessibility.

Conclusion About Online Banking Innovations

The realm of online banking innovations stands as a testament to the dynamic nature of the financial industry. As we navigate through the transformative landscapes of digital banking, the potential for enhanced user experiences and robust security measures becomes increasingly evident.

The journey from conventional brick-and-mortar banking to the realms of fintech marvels has not only made managing finances more convenient but has also fostered a sense of empowerment among users.

The continuous evolution of online banking technologies promises a future where financial transactions are not just transactions but seamless, intelligent interactions. Embracing these innovations ensures that individuals are not just keeping up with the times but actively shaping the future of their financial experiences.

Jump to

What Are Online Banking Innovations?

Online Banking Innovations - Latest Trends

Advanced Functionalities For Self-Service

APIs

Quick Payments

Utilizing Cloud Infrastructure

Technology-Based On Biometrics

Chatbots

RPA, AI, And Machine Learning In Process Automation

Small-scale Services

Importance Of Innovation In Banking

Online Banking Innovations - FAQs

Conclusion About Online Banking Innovations

James Pierce

Author

Camilo Wood

Reviewer

Latest Articles

Popular Articles