NBA Stock - Uncovering Opportunities In The World Of Sports And Finance

Unveil the hidden gems of NBA stock investments and gain insights into indirect investment strategies for both sports enthusiasts and experienced investors.

Author:Habiba AshtonReviewer:Gordon DickersonNov 13, 20239.5K Shares217K Views

At the intersection of sports and finance, the National Basketball Association (NBA) emerges as a paradigm of athletic excellence intertwined with financial acumen. This exploration delves into the intricate tapestry where the NBA converges with the financial realm, revealing a landscape brimming with opportunities for investors, enthusiasts, and analysts alike. The NBA's global reach and its dynamic business model offer a unique vantage point from which to examine the trends and strategies that sculpt the sports industry's financial underpinnings. As we embark on this journey, we aim to illuminate the hidden nuances and potential investment avenues within the NBA, providing insights that resonate with seasoned financial experts and passionate sports fans alike.

The realm of NBA finance extends far beyond the earnings generated by teams and players, encompassing a broader spectrum that includes merchandising, media rights, sponsorships, and the burgeoning field of sports analytics. In this blog post, we will navigate through these diverse yet interconnected domains, elucidating how they collectively contribute to the NBA's stockand financial ecosystem. Our discussion will transcend surface-level figures, venturing instead into an in-depth examination of the underlying factors driving the NBA's economic growth. From analyzing team valuations and revenue streams to exploring the impact of digital media and fan engagement, this piece aspires to provide a comprehensive overview of the NBA's financial landscape. Join us as we unravel the intricacies of this captivating intersection between sports and finance, unveiling the opportunities that lie within the exhilarating world of the NBA.

Navigating The Landscape Of NBA Stocks - A Comprehensive Overview

In the dynamic realm of sports and finance, the National Basketball Association (NBA) stands as a towering icon, captivating fans worldwide with its electrifying athleticism and captivating narratives. Beyond the hardwood courts, the NBA also presents a compelling arena for investment opportunities, offering a unique fusion of sporting passion and financial savvy. This comprehensive exploration delves into the multifaceted landscape of NBA stocks, providing insights into the diverse array of investment options and the underlying market dynamics that shape this exciting financial sector.

Introduction To NBA-Related Stocks And Investment Opportunities

The NBA's global reach, coupled with its ever-evolving business model, has spawned a rich tapestry of investment opportunities that extend far beyond traditional team ownership. While direct ownership of NBA franchises remains an exclusive privilege reserved for a select few, a plethora of publicly traded companies offer indirect exposure to the league's financial success. These companies, often referred to as NBA-related stocks, encompass a diverse range of industries, including

- Apparel -Sports apparel giants like Nike (NKE) and Under Armour (UAA) hold official partnerships with the NBA, designing and manufacturing uniforms and merchandise for teams and players. Their financial performance is intrinsically linked to the popularity of the league and the demand for NBA-branded apparel.

- Entertainment -Companies like Madison Square Garden Entertainment Corp. (MSG), which owns the New York Knicks, and Disney (DIS), which holds broadcasting rights for NBA games, offer exposure to the league's entertainment revenue streams. Their financial success hinges on the popularity of NBA content, ticket sales, and merchandising.

- Sports Betting -The burgeoning field of sports betting has created a new avenue for NBA-related investments. Companies like DraftKings (DKNG) and FanDuel offer online and mobile sports betting platforms, allowing fans to wager on NBA games and events. Their financial performance is directly tied to the growth and popularity of sports betting.

Understanding The Market Dynamics Of NBA Stocks

The market dynamics of NBA stocks are influenced by a complex interplay of factors, including

- League Performance -The overall performance of the NBA, as reflected in factors such as viewership, attendance, and merchandise sales, significantly impacts the financial performance of NBA-related stocks. A successful NBA season can boost investor sentiment and drive stock prices higher.

- Individual Team Success -The success of individual NBA teams can also influence the performance of NBA-related stocks. Teams with strong on-court performance and a loyal fan base tend to attract more attention and sponsorship opportunities, which can benefit companies that partner with those teams.

- Global Expansion -The NBA's growing international presence has opened up new markets for its brands and products. Companies with a global reach are well-positioned to capitalize on this expansion, potentially leading to increased revenue and stock valuations.

- Technological Advancements -Technological advancements, such as the rise of digital media and e-commerce, have transformed the NBA's business model and created new opportunities for revenue generation. Companies that adapt to these advancements and leverage technology effectively can gain a competitive edge in the market.

NBA Franchises As Investment Vehicles - Unveiling The Financial Strength Of Basketball's Elite

In the realm of professional sports, the National Basketball Association (NBA) stands as a pinnacle of athletic excellence and financial prowess. While the league's captivating games and iconic players captivate fans worldwide, NBA franchises also present compelling opportunities as investment vehicles. By delving into the valuation of NBA teams and exploring trends and predictions for their stock performance, we can uncover the potential of these franchises to generate significant returns for investors.

Assessing The Valuation Of NBA Teams - A Multifaceted Approach

Evaluating the worth of an NBA franchise requires a holistic approach that considers a multitude of factors, including

- Financial Performance -Revenue generated from ticket sales, merchandise, media rights, and sponsorships plays a crucial role in determining a franchise's value. Teams with strong financial performance are typically considered more attractive investment opportunities.

- Market Size and Appeal -The size and demographics of a team's market significantly impact its valuation. Teams located in major metropolitan areas with passionate fan bases tend to command higher valuations.

- On-Court Success -While not the sole determinant of a team's value, consistent on-court success can boost fan engagement, increase revenue streams, and enhance a franchise's overall appeal to investors.

- Ownership and Management -The expertise and vision of a team's ownership and management team can significantly influence its valuation. Experienced leadership can steer the franchise towards financial growth and enhance its investment potential.

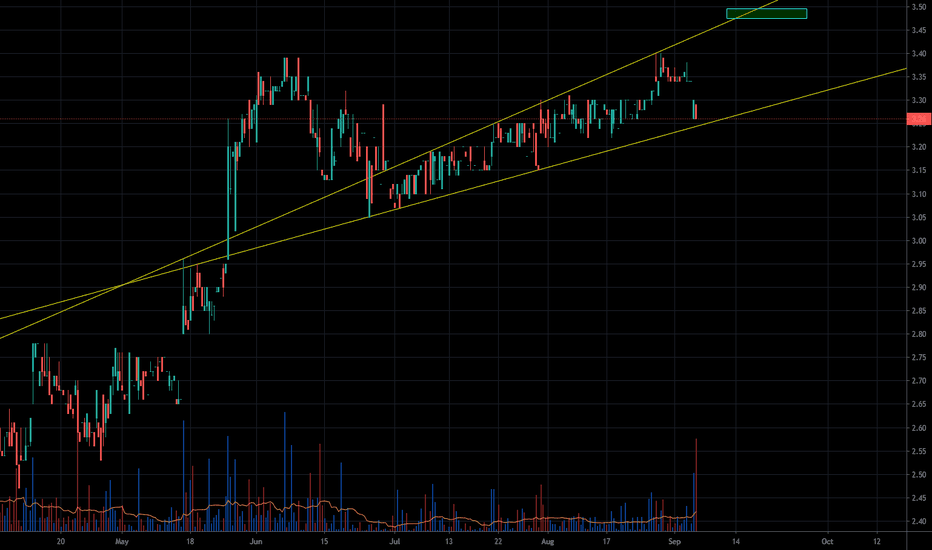

Trends And Predictions In NBA Franchise Stock Performance - Navigating The Investment Landscape

Over the past decade, NBA franchise valuations have witnessed remarkable growth, driven by factors such as increased global viewership, lucrative media deals, and expanding sponsorship opportunities. This upward trend is expected to continue in the coming years, making NBA franchises increasingly attractive investment prospects.

Several factors are likely to contribute to the continued growth of NBA franchise valuations

- Digital Media Expansion -The rise of digital media platforms has opened up new revenue streams for NBA teams, as they can now reach a wider audience and generate more income from streaming services and online advertising.

- International Growth -The NBA's global popularity is expanding rapidly, particularly in markets like China, India, and Europe. This international growth is fueling revenue growth and increasing the value of NBA franchises.

- Evolving Fan Engagement -NBA teams are constantly innovating to enhance fan engagement, whether through interactive experiences at games or personalized content on digital platforms. This increased engagement can boost revenue and make franchises more attractive to investors.

Unlocking Investment Opportunities - Navigating The NBA Franchise Landscape

While investing in NBA franchises can be a lucrative endeavor, it's essential to approach such investments with caution and thorough research. Key considerations include

- Conduct Due Diligence -Thoroughly research a franchise's financial performance, market size, on-court success, and ownership structure to assess its investment potential.

- Diversify Investments -Avoid concentrating investments on a single franchise. Diversifying across multiple teams can mitigate risk and potentially enhance overall returns.

- Seek Professional Guidance -Consulting with financial advisors or experts specializing in sports investments can provide valuable insights and guidance.

- Long-Term Perspective -Investing in NBA franchises requires a long-term perspective. While short-term fluctuations may occur, the long-term growth trajectory of the NBA is likely to prevail.

NBA Players' Influence On The Stock Market

The National Basketball Association (NBA) has long been a global phenomenon, captivating fans worldwide with its fast-paced, high-flying action. But the NBA's influence extends far beyond the basketball court, reaching into the realm of finance and impacting stock markets around the world. NBA players, particularly star players, hold immense sway over the perception and valuation of teams and companies associated with them. Their on-court performances, off-court endorsements, and overall brand power can significantly influence stock prices, making them key figures in the financial world.

The Impact Of Star Players On Team Stocks And Investments

The presence of star players on an NBA team can have a profound impact on the team's financial performance. Star players attract fans, boost merchandise sales, and enhance the team's overall brand value. This increased demand translates into higher revenue for the team, which can lead to increased stock prices.

For instance, the acquisition of LeBron James by the Miami Heat in 2010 marked a turning point for the franchise. James' arrival led to a surge in ticket sales, merchandising revenue, and television viewership. The team's stock price also experienced a significant boost, rising from around $9 per share in 2009 to over $15 per share in 2011. This increase in stock value reflected the increased investor confidence and optimism surrounding the team due to James' presence.

Similarly, the drafting of Zion Williamson by the New Orleans Pelicans in 2019 generated immense excitement and anticipation. Williamson's exceptional talent and charismatic personality immediately made him a fan favorite and a marketing sensation. The Pelicans' stock price soared in the aftermath of the draft, reflecting the renewed interest and potential associated with the young star.

The impact of star players on team stocks is not always limited to the team they play for. Rival teams and even companies affiliated with the sport can experience fluctuations in their stock prices based on the perceived impact of star players. For example, the Golden State Warriors' dynasty, led by Stephen Curry, Klay Thompson, and Kevin Durant, had a ripple effect on the broader sports apparel and equipment industry. Companies like Nike and Under Armour benefited from the increased popularity of basketball and the Warriors' success, leading to gains in their stock prices.

Endorsements And Their Effect On Related Stocks

NBA players are not only influential on the court but also in the world of endorsements. Their endorsements of products, brands, and companies can significantly impact the financial performance of those entities. When a star player endorses a product or brand, it lends credibility and appeal, often leading to increased sales and higher stock prices.

Michael Jordan's partnership with Nike is perhaps the most iconic example of athlete endorsement. Jordan's signature Air Jordan shoes became a cultural phenomenon, generating billions of dollars in revenue for Nike. The success of the Air Jordan brand significantly boosted Nike's stock price, cementing the power of athlete endorsements in the financial world.

Similarly, LeBron James' endorsement deals with companies like Nike, Coca-Cola, and Beats by Dre have all had a positive impact on the stock prices of those companies. James' global popularity and influence have made him a highly sought-after endorser, and his endorsement deals are viewed as a sign of approval and quality by consumers.

Corporate Sponsorships And Stock Performance

In the dynamic world of sports marketing, corporate sponsorships have become a ubiquitous strategy for brands seeking to enhance their visibility, connect with target audiences, and foster positive brand associations. While the primary objective of sponsorships typically lies in brand-building and marketing goals, there has been a growing interest in understanding the potential impact of these partnerships on a company's financial performance, particularly in terms of stock price movements.

Analyzing The Impact Of Major Sponsorship Deals On Stocks

Assessing the impact of corporate sponsorships on stock performance can be a complex undertaking due to the numerous factors that influence investor sentiment and market dynamics. However, several studies have attempted to shed light on this relationship by analyzing data surrounding major sponsorship announcements and subsequent stock price movements.

One study, published in the Journal of Financial Economics, examined the stock market reaction to sponsorship announcements by major corporations. The study found that, on average, sponsoring companies experienced a positive abnormal return of 1.65% in the week following the announcement. This suggests that investors may perceive sponsorship deals as a signal of a company's strong financial position and growth potential.

Another study, conducted by researchers at the University of Oregon, focused specifically on corporate sponsorships of professional sports teams. The study found that sponsorship deals with winning teams had a more positive impact on stock prices compared to sponsorships of losing teams. This suggests that the success of the sponsored team can amplify the positive brand exposure and consumer sentiment associated with the sponsorship.

Case Studies Of Successful NBA Sponsorship Partnerships

The NBA, the premier professional basketball league in North America, has been a fertile ground for exploring the relationship between corporate sponsorships and stock performance. Several notable NBA sponsorship partnerships have demonstrated the potential for positive impacts on both brand equity and financial performance.

One such example is the partnership between Nike and the NBA. Nike, a leading global athletic apparel and footwear company, has been the official uniform and footwear provider of the NBA since 1985. This long-standing partnership has significantly enhanced Nike's brand visibility and recognition among basketball fans worldwide. In the years following the initial partnership agreement, Nike's stock price has experienced significant growth, suggesting that the NBA sponsorship has contributed to the company's overall financial success.

Another example is the partnership between Under Armour and Stephen Curry, a two-time NBA Most Valuable Player (MVP). Under Armour, a leading athletic apparel and footwear company, signed Curry to an endorsement deal in 2009. This partnership has been incredibly successful for both parties, as Curry's on-court achievements and charismatic personality have propelled Under Armour's brand to new heights. In the years following the partnership, Under Armour's stock price has experienced remarkable growth, with many analysts attributing a significant portion of this growth to the Curry endorsement deal.

Merchandising, Licensing, And Stock Impacts

The National Basketball Association (NBA) has established itself as a global powerhouse, not only on the court but also in the realm of merchandising and licensing. The league's iconic logo, team jerseys, and player memorabilia have become ubiquitous symbols of basketball culture, generating significant revenue streams that significantly impact NBA stocks.

Merchandising encompasses the production and sale of official NBA-branded apparel, footwear, accessories, and collectibles. The NBA's global reach and passionate fan base have fueled a thriving merchandising industry, with sales reaching an estimated $6 billion annually. This segment contributes substantially to the league's overall revenue, which in turn positively impacts NBA stock prices.

Licensing agreements grant companies the right to use NBA trademarks and logos on their products and services. These agreements generate substantial licensing fees for the NBA, further bolstering its financial strength. The league's extensive licensing program extends to a wide range of products, including apparel, footwear, electronics, video games, and even food and beverages.

The impact of merchandising and licensing on NBA stocks is evident in the financial performance of companies that hold these rights. For instance, Nike, the NBA's official apparel and footwear partner, has reported strong revenue growth driven by NBA-related products. Similarly, Fanatics, a leading sports merchandise retailer, has experienced significant growth due to its exclusive NBA licensing rights.

The Future Of NBA Stocks - Trends And Projections

The future of NBA stocks appears promising, driven by several key trends and projections. The league's global expansion, particularly in China and India, is expected to fuel further growth in merchandising and licensing revenue. Additionally, the increasing popularity of esports and sports betting is opening up new avenues for NBA-related investments.

Analysts project that NBA revenue will continue to grow at a healthy pace, reaching an estimated $20 billion by 2025. This growth is expected to be fueled by rising television rights fees, increased international revenue, and the expansion of digital media and streaming services.

The strong financial performance of the NBA is likely to translate into positive returns for NBA stocks. Investors can expect to see continued growth in share prices and dividend payouts as the league expands its global reach and enhances its revenue streams.

Innovations And Emerging Markets In NBA-Related Stocks

The NBA is constantly innovating to stay ahead of the curve and explore new opportunities in the ever-evolving sports industry. The league's focus on technology, data analytics, and emerging markets is creating new investment avenues for NBA-related stocks.

The NBA's embrace of technology has led to the development of innovative products and services, such as the NBA app, which provides fans with real-time game statistics, player updates, and interactive features. These technological advancements are enhancing the fan experience and driving engagement, which in turn translates into increased revenue and higher stock valuations.

Data analytics is another area where the NBA is making significant strides. The league is collecting and analyzing vast amounts of data to improve player performance, optimize team strategies, and enhance marketing campaigns. This data-driven approach is providing valuable insights that are driving innovation and growth across the NBA ecosystem.

Emerging markets, such as China and India, are presenting exciting opportunities for NBA-related investments. The NBA's popularity in these regions is growing rapidly, fueled by a growing middle class and increasing interest in basketball. This expansion into new markets is expected to generate significant revenue streams and boost NBA stock prices.

Risk Management And Investment Strategies In NBA Stocks

As with any investment, there are inherent risks associated with investing in NBA-related stocks. However, by employing sound risk management strategies and implementing well-informed investment decisions, investors can mitigate these risks and increase their chances of success.

Diversification is a crucial risk management strategy for NBA stock investments. By spreading their investments across a variety of NBA-related companies, investors can reduce their exposure to any single company's performance. This diversification helps to protect against losses if one company experiences financial setbacks.

Conducting thorough research and due diligence is essential before investing in NBA-related stocks. Investors should carefully analyze the financial performance, growth prospects, and competitive landscape of each company they consider investing in. This research helps to identify companies with strong fundamentals and promising potential.

Staying informed about industry trends, news, and developments is critical for successful NBA stock investing. Investors should regularly monitor the NBA's financial performance, league initiatives, and market trends to make informed investment decisions. This ongoing information gathering helps to identify potential opportunities and mitigate risks.

Frequently Ask Questions - NBA Stock

Can You Buy Stock In The NBA?

Unfortunately, investors cannot purchase shares of the NBA because they are a private company. However, Nike (NYSE - $NKE) and Under Armour (NYSE - $UAA) are sports companies that traders can invest in.

Is The NBA A Private Company?

The structure of the NBA is surprisingly unclear, considering it is in its 75th year. It is a privately held company, but its Constitution and By-Laws define it as an Association. Decisions are made by the Board of Governors, and the relationship between members is referred to as a contractual one.

Can You Buy Shares Of Sports Teams?

If you're investing in public markets, you have a handful of teams that you can buy in the U.S. markets. These stocks (and their ticker symbols) include Atlanta Braves Holdings (BATRK)(BATRA). This company owns the Atlanta Braves of Major League Baseball and some associated real estate holdings.

Conclusion

Concluding this comprehensive exploration of NBA stocks, it is evident that the league's global reach, dynamic business model, and innovative spirit present a compelling investment opportunity for those seeking to capitalize on the intersection of sports and finance. As the NBA continues to expand its global footprint, enhance its revenue streams, and embrace cutting-edge technologies, the potential for growth in NBA-related stocks remains strong. By carefully considering the risks and implementing sound investment strategies, individuals can position themselves to reap the rewards of investing in the ever-evolving world of NBA stocks.

Jump to

Navigating The Landscape Of NBA Stocks - A Comprehensive Overview

NBA Franchises As Investment Vehicles - Unveiling The Financial Strength Of Basketball's Elite

NBA Players' Influence On The Stock Market

Corporate Sponsorships And Stock Performance

Merchandising, Licensing, And Stock Impacts

The Future Of NBA Stocks - Trends And Projections

Frequently Ask Questions - NBA Stock

Conclusion

Habiba Ashton

Author

Gordon Dickerson

Reviewer

Latest Articles

Popular Articles