Municipal Bonds - Fueling Investment And Community Growth

Municipal bonds, often referred to as "munis," play a crucial role in the realm of finance, serving as a bridge between responsible investing and community development. These debt securities, issued by state and local governments, are not only an avenue for investors to grow their wealth but also a mechanism to fund essential public projects.

Author:Habiba AshtonReviewer:Gordon DickersonAug 30, 202312.2K Shares290.9K Views

Municipal bonds, often referred to as "munis," play a crucial role in the realm of finance, serving as a bridge between responsible investing and community development. These debt securities, issued by state and local governments, are not only an avenue for investors to grow their wealth but also a mechanism to fund essential public projects.

Let's explore the world of municipal bonds in detail, understanding their nuances, benefits, risks, and their evolving role in the investment landscape.

Understanding Municipal Bonds

At its core, a municipal bond represents a financial contract between an investor and a government entity. Governments, be they state, city, or county, issue these bonds to raise capital for a variety of projects, ranging from building schools and hospitals to upgrading transportation infrastructure.

When an investor purchases a municipal bond, they are essentially lending money to the issuing government in exchange for regular interest payments and the eventual return of the principal amount invested. The maturity date of a municipal bond, marking the repayment of the principal, can vary from short-term bonds maturing in one to three years to long-term bonds extending over a decade.

Video unavailable

This video is unavailable: Original link to video

Benefits Of Municipal Bonds

The appeal of municipal bonds stems from a combination of tax advantages, stability, and the satisfaction of contributing to local progress. One of the standout features of these bonds is their tax-exempt status.

Interest income earned from municipal bonds is generally exempt from federal income tax, making them an attractive proposition, especially for individuals in higher tax brackets. Additionally, if the bond is issued within the investor's state of residence, the interest income might also be exempt from state and local taxes, compounding the tax benefits.

Stability is another hallmark of municipal bonds. Governments have the power to levy taxes and generate consistent revenue streams, which bolsters their ability to meet their debt obligations. This translates to a lower level of risk compared to other investment options, making municipal bonds an appealing choice for risk-averse investors.

Moreover, by investing in municipal bonds, individuals play an active role in supporting community growth, as the funds raised through these bonds are channeled into projects that enhance public infrastructure and services.

Risks Associated With Municipal Bonds

While municipal bonds offer numerous benefits, it's important to acknowledge the potential risks associated with them. One significant risk is the impact of changing interest rates on bond prices.

When interest rates rise, bond prices tend to fall, which could result in a decrease in the market value of existing bonds. Additionally, municipal bonds are not immune to default risk.

While the likelihood of a government default is relatively low compared to corporations, it's not entirely impossible. This underscores the importance of researching the financial health of the issuer before investing.

Liquidity risk is another consideration. Municipal bonds, especially those from smaller issuers, might have lower trading volumes in the secondary market, leading to challenges in selling them quickly without impacting the market price. Understanding and managing these risks are vital aspects of building a well-balanced investment portfolio.

Types Of Municipal Bonds

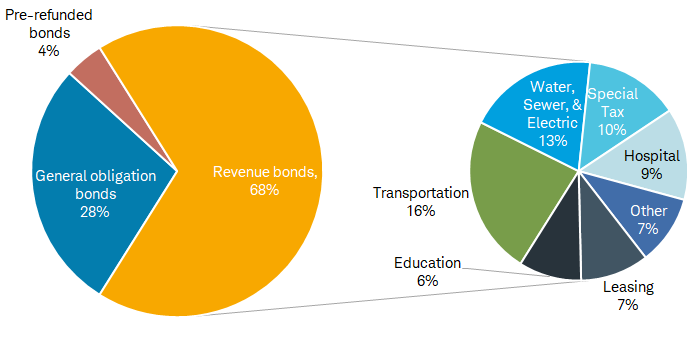

Municipal bonds come in different flavors, each with its own characteristics and risk profiles. The two primary types are general obligation (GO) bonds and revenue bonds.

1. General Obligation Bonds (GO Bonds) -GO bonds are backed by the "full faith and credit" of the issuing government. This means that the government pledges its taxing power to ensure the repayment of the bond. In essence, the government can raise taxes to meet its debt obligations, providing a strong safety net for investors. GO bonds are considered lower-risk investments due to this broad revenue-raising capability.

2. Revenue Bonds - Revenue bonds operate on a different principle. They are backed by revenue generated from specific projects or sources. For instance, a toll road might issue revenue bonds, with the revenue from toll collections serving as the source of repayment. While revenue bonds offer the potential for higher yields, they also carry a higher level of risk compared to GO bonds. The success of the underlying project directly influences the bond's performance.

3. Conduit Borrowers-Municipal bonds extend beyond traditional issuers to include private entities like non-profit colleges or hospitals. These entities borrow money through the municipal bond market, with the issuer handling interest and principal payments. In cases of payment defaults by the conduit borrower, the issuer is generally not obligated to cover bondholders' losses.

Tax Considerations And Yield Calculation

One of the standout features of municipal bonds is their tax-exempt interest income. Interest payments earned from these bonds are generally exempt from federal income tax, offering a significant advantage to investors.

Additionally, the interest income might also be exempt from state and local taxes if the bond is issued within the investor's state of residence. This tax advantage makes municipal bonds particularly appealing to individuals in higher tax brackets, providing an opportunity to optimize their after-tax returns.

Comparing the yield of a municipal bond to that of a taxable bond requires a nuanced approach due to the tax benefits involved. This is where the concept of taxable equivalent yield comes into play. Taxable equivalent yield accounts for the tax savings associated with municipal bonds and provides a clearer understanding of the bond's true yield.

Steps To Follow When Investing In Municipal Bonds

Investing in municipal bonds involves a thoughtful and strategic approach. Here are the steps to consider:

1. Set Investment Goals - Clearly define your investment objectives, risk tolerance, and income needs. Understand whether you're seeking stable income or potential capital appreciation.

2. Research Bond Offerings - Thoroughly research the issuer's financial health and the purpose of the bond issuance. A strong issuer with a stable financial outlook is more likely to meet its debt obligations.

3. Assess Tax Implications - Align your tax strategy with the tax advantages of municipal bonds. Consider whether the bonds are issued within your state of residence and how that impacts your tax liability.

4. Build a Diverse Portfolio - Integrating municipal bonds into your investment portfolio can contribute to balanced risk management. Diversification across asset classes can help mitigate the impact of market fluctuations.

Role Of Credit Ratings And Due Diligence

Credit rating agencies play a significant role in evaluating the creditworthiness of municipal bond issuers. These agencies assign credit ratings based on the issuer's financial stability and ability to meet its debt obligations.

Higher credit ratings indicate lower risk and can influence the interest rates at which bonds are issued. However, while credit ratings provide valuable insights, conducting your own due diligence is crucial.

Factors such as economic conditions, the issuer's financial management, and the purpose of the bond issuance can collectively impact the investment's risk profile.

Municipal Bonds In Economic Landscape

The attractiveness of municipal bonds is closely tied to the prevailing interest rate environment. In a low-interest-rate environment, the tax-exempt yields of municipal bonds can be particularly appealing to income-seeking investors.

Additionally, economic challenges or local financial downturns can impact the creditworthiness of municipal bond issuers. Staying informed about the economic dynamics that may influence the issuer's ability to meet its debt obligations is a vital aspect of managing your investment.

The Future Of Municipal Bonds

The landscape of municipal bonds is poised for evolution. As the world embraces sustainability and environmental responsibility, governments may increasingly issue bonds to fund eco-friendly projects. These initiatives could range from renewable energy projects to climate-resilient infrastructure.

Moreover, technological advancements, including blockchain technology, have the potential to revolutionize the issuance and trading of municipal bonds. Blockchain's transparency and efficiency could streamline processes and enhance investor confidence.

What are Municipal Bonds? | Fidelity Investments

Municipal Bonds FAQs

Can Municipal Bonds Be Callable?

Yes, many municipal bonds have call provisions. This means that the issuer has the right to redeem or "call" the bond before its maturity date. Callable bonds are often called when interest rates drop, allowing the issuer to refinance the debt at a lower interest rate. As an investor, a called bond might mean you receive your principal back earlier than expected, and you might need to reinvest in another bond at potentially lower yields.

What Are Pre-refunded Bonds?

Pre-refunded bonds are a unique type of municipal bond. They are issued by governments to refinance their outstanding debt. The proceeds from the new bonds are used to purchase U.S. Treasury securities, which are held in escrow to pay off the original bonds at their call date or maturity. Investors in pre-refunded bonds generally receive lower yields, but the bonds are backed by highly secure U.S. Treasury securities.

How Are Build America Bonds (BABs) Different From Traditional Municipal Bonds?

Build America Bonds (BABs) were introduced as part of the American Recovery and Reinvestment Act of 2009. Unlike traditional municipal bonds, the interest paid on BABs is taxable at the federal level. However, the federal government provides a subsidy to issuers, which helps reduce borrowing costs. This type of bond aimed to stimulate infrastructure investment during the financial crisis.

Can Individual Investors Access The Municipal Bond Market Directly?

Yes, individual investors can access the municipal bond market directly. They can participate in primary offerings through brokerage accounts or directly from the issuer. Additionally, individual investors can buy and sell municipal bonds on the secondary market through brokerage platforms, much like stocks.

Are Municipal Bonds Suitable For Retirement Accounts Like IRAs?

Yes, municipal bonds can be suitable for retirement accounts like Individual Retirement Accounts (IRAs). Investing in municipal bonds within an IRA can offer tax advantages, although it's important to consider that the interest income from municipal bonds is already tax-exempt, which might not provide additional benefits within a tax-advantaged account.

How Do I Evaluate The Creditworthiness Of A Municipal Bond Issuer?

Evaluating the creditworthiness of a municipal bond issuer involves considering factors beyond credit ratings. Research the issuer's financial statements, economic conditions in the region, and the specific project being funded by the bond. Understanding the issuer's revenue sources and its ability to meet debt obligations is essential.

What Role Do Financial Advisors Play In Municipal Bond Investing?

Financial advisors can provide valuable insights and guidance when investing in municipal bonds. They can help investors understand the various types of bonds, evaluate risk factors, assess tax implications, and create a diversified portfolio that aligns with the investor's goals and risk tolerance.

Are Municipal Bonds Exempt From The Alternative Minimum Tax (AMT)?

Not all municipal bonds are exempt from the Alternative Minimum Tax (AMT). Certain types of municipal bonds, known as private activity bonds, might be subject to AMT. It's important to check the tax status of the specific bond you're interested in to determine whether it's subject to AMT.

What Are The Potential Effects Of Inflation On Municipal Bonds?

Inflation can have an impact on the purchasing power of future interest and principal payments. While the fixed interest payments from municipal bonds remain constant, their real value might decrease if inflation rates rise. Investors should consider the potential effects of inflation when evaluating the long-term performance of their bond investments.

Can Non-U.S. Residents Invest In Municipal Bonds?

Yes, non-U.S. residents can invest in municipal bonds. However, they should be aware of potential tax implications in their home country. The tax treatment of interest income might vary depending on the investor's country of residence and any tax treaties in place between their home country and the U.S.

People Also Ask

Are Municipal Bonds A Safe Investment?

Municipal bonds are generally considered a safe investment within the realm of fixed-income assets. Among municipal bonds, general obligation (GO) bonds tend to be safer than revenue bonds. This is because a municipality has the ability to increase taxes to meet its debt obligations for GO bonds. In contrast, revenue bonds rely on the earnings generated by a specific project, which introduces a level of risk tied to that project's success.

What Are Municipal Bonds Good For?

Investors find municipal bonds appealing for two primary reasons. Firstly, they offer tax advantages as the interest income is often exempt from federal taxes. Secondly, they are relatively low-risk investments. These income-generating bonds provide stability and are often included in well-diversified portfolios. However, it's essential to recognize that owning municipal bonds also comes with certain drawbacks.

What Is An Example Of A Municipal Bond?

Imagine you invest $5,000 in a 10-year municipal bond with a 5% interest rate. By doing so, you've essentially lent $5,000 to the municipality for a duration of 10 years. In return, the municipality will pay you $250 annually in interest, usually in biannual installments. Additionally, at the end of the 10-year period, you will receive your initial $5,000 investment as the bond matures.

Conclusion

In the intricate realm of finance, municipal bonds stand as a testament to the synergy between responsible investing and community growth. Their role in funding public projects while offering tax advantages positions them as a compelling investment avenue. From the steadfast security of general obligation bonds to the project-centric nature of revenue bonds, the spectrum of municipal bonds offers options for various risk appetites.

Armed with knowledge, investors can chart a course that aligns with their financial goals while contributing to the prosperity of their communities. As the investment landscape continues to evolve, municipal bonds remain a conduit for fortifying financial security and driving meaningful social impact. By understanding the intricacies of municipal bonds, investors can navigate this dynamic market with confidence, making informed decisions that harmonize financial growth and community advancement.

Jump to

Understanding Municipal Bonds

Benefits Of Municipal Bonds

Risks Associated With Municipal Bonds

Types Of Municipal Bonds

Tax Considerations And Yield Calculation

Steps To Follow When Investing In Municipal Bonds

Role Of Credit Ratings And Due Diligence

Municipal Bonds In Economic Landscape

The Future Of Municipal Bonds

Municipal Bonds FAQs

People Also Ask

Conclusion

Habiba Ashton

Author

Gordon Dickerson

Reviewer

Latest Articles

Popular Articles