How To Do A Mortgage Rate Forecasts

In the ever-changing landscape of the housing market, staying informed about mortgage rates is crucial for potential homebuyers and current homeowners alike. Predicting mortgage rates involves a combination of understanding economic indicators, market trends, and the impact of global events. This guide aims to provide a comprehensive overview of how to do a mortgage rate forecast effectively.

Author:Camilo WoodReviewer:Emmanuella SheaJan 29, 2024389 Shares25.9K Views

In the ever-changing landscape of the housing market, staying informed about mortgage rates is crucial for potential homebuyers and current homeowners alike. Predicting mortgage rates involves a combination of understanding economic indicators, market trends, and the impact of global events. This guide aims to provide a comprehensive overview of how to do a mortgage rate forecasteffectively.

Understanding Economic Indicators

When delving into the realm of mortgage rate forecasts, a fundamental aspect is gaining insight into various economic indicators that directly influence interest rates. Let's break down three pivotal economic factors that play a significant role in shaping mortgage rates.

Interest Rates

- Overview:Interest rates set by central banks are among the primary drivers of mortgage rate fluctuations. Central banks, such as the Federal Reserve, make periodic announcements regarding changes to these rates, affecting borrowing costs across the economy.

- Actionable Insights:To stay ahead of potential shifts in mortgage rates, it is imperative to keep a vigilant eye on central bank announcements. Any adjustments in interest rates can have an immediate and direct impact on the cost of borrowing for homebuyers and existing homeowners.

Inflation Rates

- Overview:Inflation, the rise in the general price level of goods and services, is a crucial economic indicator. Central banks often respond to inflation by adjusting interest rates as a tool to maintain economic stability.

- Actionable Insights:Understanding the intricate relationship between inflation and interest rates is pivotal for accurate mortgage rate forecasts. Rising inflation may prompt central banks to raise interest rates to curb excessive spending, impacting mortgage rates in the process.

Employment Trends

- Overview:Employment trends, including unemployment rates, provide valuable insights into the overall health of the economy. A robust job market can lead to increased consumer spending, subsequently influencing interest rates.

- Actionable Insights:For those seeking to predict mortgage rates, paying close attention to employment trends is essential. In a strong job market, higher consumer spending may prompt central banks to adjust interest rates upward, impacting the overall interest rate environment.

Analyzing Market Trends

As we navigate the landscape of mortgage rate forecasts, understanding market trends is paramount. Here, we explore three key aspects that significantly influence mortgage rates and play a crucial role in shaping the housing market.

Housing Market Conditions

- Overview:The state of the housing market is a pivotal determinant of mortgage rates. The dynamics of supply and demand for homes directly impact the cost of borrowing. High demand typically leads to increased mortgage rates, while a buyer's market may result in lower rates.

- Actionable Insights:For individuals monitoring mortgage rates, keeping a close watch on housing market conditions is essential. Recognizing whether the market favors buyers or sellers provides valuable context for predicting potential movements in mortgage rates.

Government Policies

- Overview:Government policies related to housing and finance wield significant influence over mortgage rates. Policies that encourage homeownership, such as tax incentives and subsidies, can positively impact rates. Conversely, restrictive policies may have the opposite effect.

- Actionable Insights:Staying informed about government initiatives and policy changes is crucial for accurate mortgage rate forecasts. Understanding the incentives or constraints imposed by government policies allows individuals to anticipate potential shifts in mortgage rates.

Global Economic Factors

- Overview:The interconnectedness of the global economy means that international events can reverberate through local mortgage markets. Geopolitical events and economic crises in other parts of the world can influence investor sentiment and impact mortgage rates.

- Actionable Insights:Keeping an eye on global economic conditions is essential for a comprehensive mortgage rate forecast. Being aware of international developments enables individuals to factor in potential influences on local mortgage rates, providing a more nuanced perspective on the market.

Utilizing Financial Instruments

In the intricate world of mortgage rate forecasting, leveraging financial instruments is key to gaining deeper insights into market dynamics. Here, we explore three vital financial instruments that can aid in making more informed predictions about mortgage rates.

Yield Curve Analysis

- Overview:The yield curve is a graphical representation of the relationship between short-term and long-term interest rates. Analyzing the yield curve provides valuable insights into the prevailing economic conditions. An inverted yield curve, where short-term rates surpass long-term rates, is often considered a precursor to an economic downturn.

- Actionable Insights:For those delving into mortgage rate forecasts, studying the yield curve is a strategic move. Recognizing the shape and movements of the yield curve allows individuals to anticipate potential shifts in the economy and make informed decisions about mortgage-related strategies.

Mortgage-Backed Securities (MBS)

- Overview:Mortgage-backed securities (MBS) are financial instruments tied to the performance of mortgages. Investors trade these securities, and their movements can provide insights into investor sentiment and potential changes in mortgage rates.

- Actionable Insights:Monitoring MBS activities is crucial for understanding investor perceptions of the mortgage market. Changes in MBS values and trading patterns can offer valuable cues about the direction in which mortgage rates may be headed, helping individuals make more informed decisions.

Treasury Yields

- Overview:Treasury yields, particularly the 10-year Treasury yield, serve as important benchmarks for various interest rates, including mortgages. Changes in Treasury yields often precede shifts in mortgage rates, making them an essential indicator for forecasting.

- Actionable Insights:Tracking Treasury yields is a fundamental practice in predicting mortgage rate trends. Observing fluctuations in yields, especially the 10-year Treasury yield, allows individuals to gauge potential movements in mortgage rates and make timely decisions based on this critical financial benchmark.

Predictive Modeling

As we delve into the realm of predictive modeling for mortgage rate forecasts, harnessing the power of historical data analysis and embracing cutting-edge machine learning models are integral components. Let's explore these two approaches to gain deeper insights into predicting future mortgage rates.

Historical Data Analysis

- Overview:Examining historical mortgage rate trends involves scrutinizing past data to identify patterns and trends. Historical data serves as a valuable repository of information, offering insights into how mortgage rates have responded to specific economic conditions and events over time.

- Actionable Insights:For individuals seeking to forecast mortgage rates, a thorough analysis of historical data is foundational. Identifying recurring patterns and understanding the historical context of rate movements enhances the ability to make informed predictions about potential future developments in the mortgage market.

Machine Learning Models

- Overview:Embracing machine learning models for predictive analysis introduces a dynamic and sophisticated approach to understanding mortgage rate trends. These models have the capability to process vast amounts of data, discern complex patterns, and provide insights that may not be apparent through traditional analysis methods.

- Actionable Insights:Exploring machine learning models for mortgage rate forecasts is a forward-looking strategy. These models can analyze diverse datasets, considering a multitude of variables simultaneously. The result is a more nuanced understanding of the factors influencing mortgage rates and the ability to make predictions based on the intricate relationships identified by machine learning algorithms.

Real-Time Monitoring

Remaining vigilant in real-time is essential for accurate and timely mortgage rate forecasts. Two critical aspects of real-time monitoring involve staying informed about economic news and closely tracking communications from central banks, particularly the Federal Reserve.

News And Economic Reports

- Overview:Staying abreast of news related to the economy and housing market is a foundational practice for those engaged in mortgage rate forecasting. Economic reports, such as GDP growth, employment figures, and inflation rates, can offer real-time insights into the prevailing economic conditions and the potential direction of mortgage rates.

- Actionable Insights:For individuals actively monitoring mortgage rates, a proactive approach to economic news is paramount. Regularly checking and analyzing economic reports provides a dynamic understanding of the factors influencing the market, allowing for swift adjustments to mortgage rate forecasts based on emerging trends and developments.

Federal Reserve Communications

- Overview:The Federal Reserve plays a pivotal role in shaping interest rates, making monitoring their communications crucial for mortgage rate forecasters. Statements and communications from central bank officials can provide valuable guidance on the Federal Reserve's stance regarding interest rates, offering clues about potential future adjustments.

- Actionable Insights:To stay ahead in the mortgage rate forecasting game, individuals must closely monitor Federal Reserve communications. Insights gleaned from these communications can provide advanced notice of potential shifts in interest rates, allowing for proactive decision-making and strategic adjustments to mortgage-related strategies.

Reacting To Market Changes

In the dynamic world of mortgage rates, the ability to react swiftly to market changes is crucial. Two strategic approaches involve locking in rates and exploring flexible mortgage products, enabling individuals to navigate fluctuations in interest rates effectively.

Locking In Rates

- Overview:For individuals in the process of obtaining a mortgage, the option to lock in a rate provides a valuable strategy for mitigating potential risks. Locking in a rate involves securing the current interest rate for a specific period, shielding borrowers from potential rate increases during that time.

- Actionable Insights:Considered a proactive measure, locking in rates can be particularly advantageous when there is an expectation of rising interest rates. By taking advantage of a rate lock, individuals ensure a level of certainty in their mortgage costs, providing financial stability and protection against market uncertainties.

Flexible Mortgage Products

- Overview:Exploring mortgage products with flexible rates, such as adjustable-rate mortgages (ARMs), is a dynamic strategy in response to market changes. ARMs often have interest rates that adjust periodically based on prevailing market conditions.

- Actionable Insights:In a low-rate environment, flexible mortgage products like ARMs can offer opportunities for savings. These products are more responsive to short-term interest rate changes, allowing borrowers to benefit from lower rates when market conditions are favorable. However, it's essential to carefully consider the potential for rate adjustments in the future.

Risk Management Strategies

Effectively managing risks associated with interest rate fluctuations is crucial in the realm of mortgage rate forecasting. Here, we delve into two strategic risk management approaches, namely diversification and seeking financial counseling. Additionally, we explore external factors that, while not directly tied to economic indicators, can significantly impact mortgage rate environments.

Diversification

- Overview:Diversifying investments is a fundamental risk management strategy. By spreading investments across a mix of fixed-income and variable-rate instruments, individuals can strike a balance between potential gains and losses, particularly in the context of fluctuating interest rates.

- Actionable Insights:For those navigating mortgage rate uncertainties, diversification offers a shield against the impact of interest rate fluctuations. Balancing fixed-income and variable-rate investments provides a diversified portfolio that can respond more resiliently to changes in the interest rate environment.

Financial Counseling

- Overview:Seeking advice from financial advisors is a prudent step in managing individual financial situations amidst changing mortgage rate environments. Financial professionals can provide personalized guidance based on individual goals, risk tolerance, and the broader economic landscape.

- Actionable Insights:Engaging in financial counseling is a proactive measure to ensure that mortgage-related decisions align with individual financial objectives. Financial advisors can offer insights into the potential impact of interest rate changes on specific financial plans, allowing for informed and strategic decision-making.

External Factors

Natural Disasters And Climate Events

- Overview:While not directly linked to economic indicators, natural disasters, and climate events can have substantial repercussions on insurance costs and housing market dynamics. Considering these external factors is vital when making long-term mortgage rate forecasts.

- Actionable Insights:Acknowledging the influence of natural disasters and climate events on mortgage-related factors allows for a more comprehensive assessment of long-term risks. Incorporating these considerations into forecasts ensures a more resilient and adaptive approach to mortgage rate planning.

Pandemics And Global Crises

- Overview:Learning from experiences like pandemics and global crises is crucial. Understanding how such events can influence interest rates and housing market stability provides valuable insights for risk management strategies.

- Actionable Insights:Pandemics and global crises can introduce unprecedented challenges to mortgage rate environments. By learning from past experiences, individuals can better anticipate potential impacts, implement proactive measures, and make informed decisions to mitigate risks associated with such external factors.

Mortgage Rate Forecast - FAQs

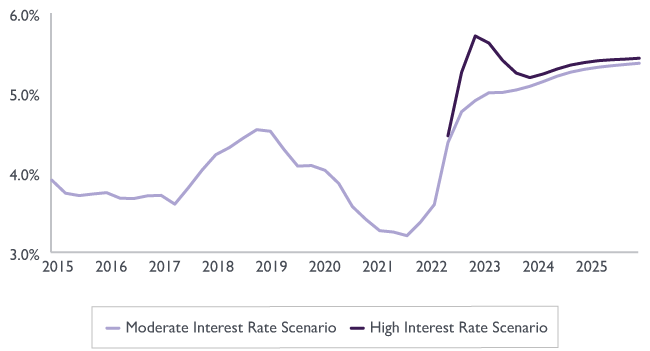

Where Will Interest Rates Be In 5 Years?

ING'sprojections for interest rates suggest a rate of 5.50% during the second and third quarters of 2023. Moving into 2024, their forecast anticipates an initial rate of 4%, followed by reductions to 3.75% in the second quarter, 3.5% in the third quarter, and a further decline to 3.25% in the final quarter of 2024. Looking ahead to 2025, ING predicts a continued decrease to 3%.

How Long Will Mortgage Rates Stay High?

Numerous experts anticipate that interest rates will persist at their present level throughout the majority of 2024. This could imply that mortgage rates remain relatively stable or experience only marginal changes for several months before potentially showing signs of decline toward the conclusion of 2024.

Should I Fix For 2 Or 5 Years?

The decision to fix your mortgage rate for 2 or 5 years depends on your individual circumstances, financial goals, and market expectations. Here are some factors to consider:

Fixing For 2 Years:

Pros:

- Short-Term Commitment:A 2-year fixed-rate provides a shorter commitment period, allowing you to reassess your mortgage strategy sooner.

- Potentially Lower Initial Rates:Shorter-term fixed rates may initially be lower than longer-term rates.

Cons:

- Risk of Rate Changes:If interest rates rise after the initial fixed period, you could face higher rates sooner.

- Less Stability:Short-term fixes may be less stable, leading to potential fluctuations in monthly payments.

Fixing For 5 Years:

Pros:

- Rate Stability:A 5-year fixed-rate offers more rate stability, protecting you from short-term market fluctuations.

- Long-Term Planning:Provides a longer-term outlook, allowing for better financial planning and budgeting.

Cons:

- Higher Initial Rates:Long-term fixed rates may have higher initial rates compared to short-term options.

- Less Flexibility:Limited flexibility if you want to take advantage of potential lower rates in the short term.

Considerations:

- Interest Rate Outlook:Assess current market conditions and expert predictions for interest rate movements.

- Financial Goals:Consider your long-term financial goals and whether rate stability or short-term flexibility is more important.

- Personal Circumstances:Evaluate your job stability, potential changes in income, and other factors that may impact your ability to manage rate changes.

Conclusion

Forecasting mortgage rates is a multifaceted process that requires a comprehensive understanding of economic indicators, market trends, and financial instruments. By staying informed and utilizing various analytical tools, individuals can make more informed decisions regarding home purchases, refinancing, and financial planning. Remember, while forecasts provide valuable insights, external factors can influence mortgage rates unexpectedly, so it's essential to stay vigilant and adapt to changing conditions in the housing and financial markets.

Camilo Wood

Author

Emmanuella Shea

Reviewer

Latest Articles

Popular Articles