Islamic Banking - A Growing Industry With A Bright Future

Islamic banking is a financial system that is based on Islamic law, or Shariah. Shariah prohibits interest-based transactions, which are seen as exploitative. Instead, Islamic banks use profit-sharing and risk-sharing models, which are more in line with Islamic principles.

Author:James PierceReviewer:Camilo WoodAug 25, 2023753 Shares150.6K Views

Islamic bankingis a financial system that is based on Islamic law, or Shariah. Shariah prohibits interest-based transactions, which are seen as exploitative. Instead, Islamic banks use profit-sharing and risk-sharing models, which are more in line with Islamic principles.

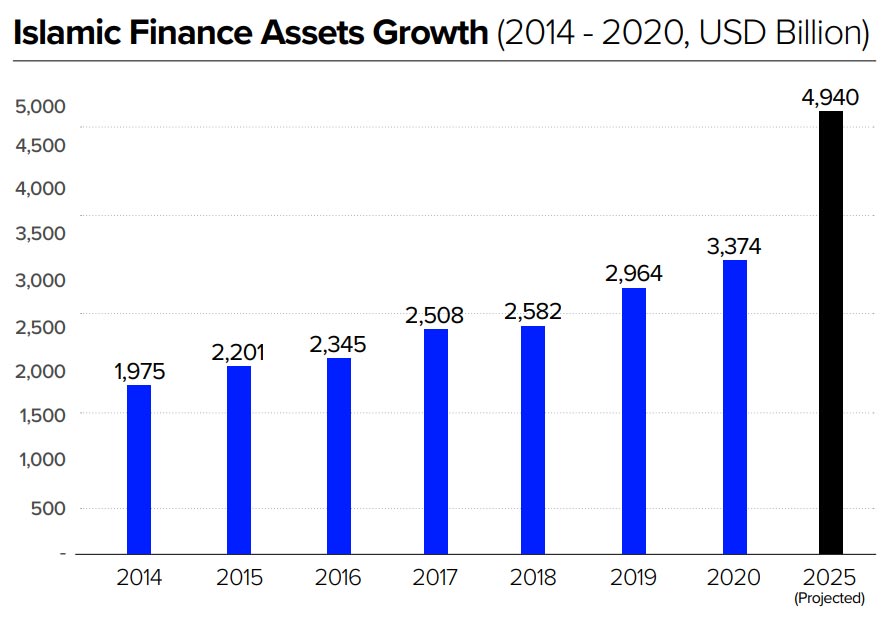

Islamic banking has been growing rapidly in recent years, with assets reaching over $2 trillion in 2022. This growth is being driven by a number of factors, including the increasing number of Muslims in the world, the growing demand for ethical and sustainable financial products, and the regulatory support for Islamic banking in many countries.

The future of Islamic banking is bright. The industry is expected to continue to grow in the coming years, driven by the factors mentioned above. Islamic banking is also well-positioned to benefit from the growing demand for ethical and sustainable financial products.

Islamic banking has the potential to have a significant impact on the global economy. It can help to promote financial inclusion, social responsibility, and sustainable development. Islamic banking can also help to reduce poverty and inequality.

The Rise Of Islamic Banking

Islamic banking has been growing rapidly in recent years, with assets reaching over $2 trillion in 2022. This growth is being driven by a number of factors, including:

- The increasing number of Muslims in the world -The global Muslim population is expected to reach 2.2 billion by 2030. This growth is being driven by factors such as population growth, urbanization, and economic development. The growing Muslim population is creating a demand for financial products and services that are compliant with Islamic law.

- The growing demand for ethical and sustainable financial products -There is a growing awareness of the need for ethical and sustainable financial products. This is due to a number of factors, such as climate change, income inequality, and corporate social responsibility. Islamic banking is seen as an ethical and sustainable alternative to traditional banking.

- The regulatory support for Islamic banking in many countries -A number of countries have introduced regulations that support Islamic banking. This includes countries such as Malaysia, Indonesia, and the United Arab Emirates. The regulatory support for Islamic banking is making it easier for Islamic banks to operate and grow.

The rise of Islamic banking is having a number of positive impacts on the global economy. Islamic banks are helping to promote financial inclusion, social responsibility, and sustainable development. Islamic banks are also helping to reduce poverty and inequality.

Here are some of the positive impacts of Islamic banking:

- Financial inclusion -Islamic banks are often more inclusive than traditional banks, offering financial products and services to people who may be excluded from traditional banking, such as women and the poor. This is helping to promote financial inclusion and economic development.

- Social responsibility -Islamic banks are committed to social responsibility, and they often invest in projects that benefit the community, such as microfinance and renewable energy. This is helping to promote social responsibility and sustainable development.

- Poverty reduction -Islamic banks are helping to reduce poverty by providing financial services to people who may not have had access to traditional banking before. This is helping to improve the lives of millions of people around the world.

- Income inequality -Islamic banks are helping to reduce income inequality by providing financial services to people from all walks of life. This is helping to create a more level playing field for everyone.

The rise of Islamic banking is a positive development for the global economy. Islamic banks are helping to promote financial inclusion, social responsibility, and sustainable development. Islamic banks are also helping to reduce poverty and income inequality. The future of Islamic banking is bright, and the industry is expected to continue to grow in the coming years.

The Benefits Of Islamic Banking

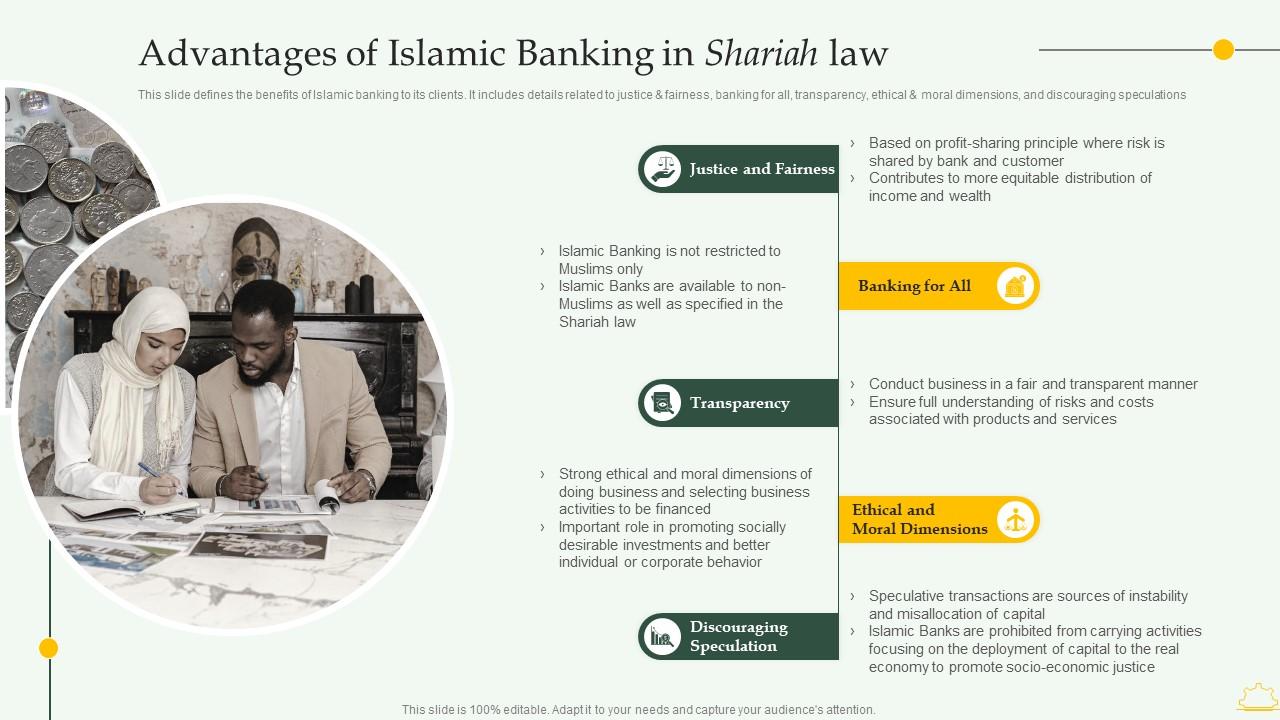

Islamic banking offers a number of benefits over traditional banking, including:

- Ethical and sustainable -Islamic banking prohibits interest-based transactions, which are seen as exploitative. Instead, Islamic banks use profit-sharing and risk-sharing models, which are more in line with Islamic principles. This makes Islamic banking a more ethical and sustainable option for investors and consumers.

- Inclusive -Islamic banks are often more inclusive than traditional banks, offering financial products and services to people who may be excluded from traditional banking, such as women and the poor. This makes Islamic banking a more accessible option for people who may not have had access to traditional banking before.

- Socially responsible -Islamic banks are committed to social responsibility, and they often invest in projects that benefit the community, such as microfinance and renewable energy. This makes Islamic banking a more socially responsible option for investors and consumers.

- Risk-sharing -Islamic banks do not charge interest, but they do share the risk of the investment with the customer. This means that both the bank and the customer have a stake in the success of the investment. This can be a more equitable arrangement than traditional banking, where the bank is essentially guaranteed a profit regardless of the success of the investment.

- Liquidity -Islamic banks offer a variety of liquidity products, such as money market instruments and investment accounts. This makes it easier for customers to access their money when they need it.

- Transparency -Islamic banks are required to be transparent about their financial dealings. This is in line with Islamic principles, which emphasize transparency and accountability.

Islamic banking offers a number of benefits over traditional banking. It is a more ethical, sustainable, inclusive, and risk-sharing option. It also offers greater liquidity and transparency. If you are looking for a more ethical and sustainable financial option, Islamic banking may be a good choice for you.

Here are some specific examples of the benefits of Islamic banking:

- In Malaysia, Islamic banks have played a significant role in promoting financial inclusion. In 2017, Islamic banks had a market share of 30% of the total banking sector in Malaysia, and they provided financial services to over 10 million customers.

- In Indonesia, Islamic banks have been active in investing in microfinance and renewable energy. In 2018, Islamic banks invested over $1 billion in microfinance and renewable energy projects.

- In the United Arab Emirates, Islamic banks have been involved in a number of social responsibility initiatives, such as providing financial support to orphans and widows.

These are just a few examples of the benefits of Islamic banking. As the industry continues to grow, Islamic banks are expected to play an even greater role in promoting financial inclusion, social responsibility, and sustainable development.

The Challenges Of Islamic Banking

Islamic banking is a relatively new and emerging industry, and it faces a number of challenges, including:

- Lack of awareness -Many people are still not aware of Islamic banking, and they may be hesitant to switch from traditional banking. This is due to a number of factors, such as the lack of Islamic banks in some countries, the lack of clear information about Islamic banking, and the misconception that Islamic banking is more expensive than traditional banking.

- Regulation -Islamic banking is not yet regulated in many countries, which can make it difficult for Islamic banks to operate. This is because Islamic banks need to comply with both Islamic law and the laws of the country in which they operate. This can be a complex and time-consuming process.

- Competition -Islamic banks face competition from traditional banks, which are increasingly offering Islamic-compliant products and services. This can make it difficult for Islamic banks to differentiate themselves from traditional banks.

- Lack of skilled professionals -There is a lack of skilled professionals in Islamic banking. This is because Islamic banking is a relatively new industry, and there are not many universities that offer courses in Islamic banking. This can make it difficult for Islamic banks to find qualified staff.

- High cost of compliance -Islamic banks need to comply with a number of regulations, both Islamic and secular. This can be a costly process, and it can make it difficult for Islamic banks to compete with traditional banks.

Despite these challenges, Islamic banking is a growing industry with a bright future. The industry is expected to continue to grow in the coming years, driven by the factors mentioned above. Islamic banking is also well-positioned to benefit from the growing demand for ethical and sustainable financial products.

Here are some specific examples of the challenges of Islamic banking:

- In Malaysia, the lack of awareness about Islamic banking is a major challenge. A survey conducted in 2017 found that only 20% of Malaysians were aware of Islamic banking.

- In Indonesia, the regulation of Islamic banking is still evolving. The Indonesian government has issued a number of regulations governing Islamic banking, but there is still some uncertainty about how these regulations will be implemented.

- In the United Arab Emirates, competition from traditional banks is a major challenge for Islamic banks. Traditional banks are increasingly offering Islamic-compliant products and services, and this is making it difficult for Islamic banks to differentiate themselves.

These are just a few examples of the challenges of Islamic banking. As the industry continues to grow, Islamic banks will need to address these challenges in order to remain competitive and sustainable.

The Future Of Islamic Banking

The future of Islamic banking is bright. The industry is expected to continue to grow in the coming years, driven by a number of factors, including:

- The increasing number of Muslims in the world -The global Muslim population is expected to reach 2.2 billion by 2030. This growth is being driven by factors such as population growth, urbanization, and economic development. The growing Muslim population is creating a demand for financial products and services that are compliant with Islamic law.

- The growing demand for ethical and sustainable financial products -There is a growing awareness of the need for ethical and sustainable financial products. This is due to a number of factors, such as climate change, income inequality, and corporate social responsibility. Islamic banking is seen as an ethical and sustainable alternative to traditional banking.

- The regulatory support for Islamic banking in many countries -A number of countries have introduced regulations that support Islamic banking. This includes countries such as Malaysia, Indonesia, and the United Arab Emirates. The regulatory support for Islamic banking is making it easier for Islamic banks to operate and grow.

People Also Ask

What Is Islamic Banking?

Islamic banking is a financial system that is based on Islamic law, or Shariah. Shariah prohibits interest-based transactions, which are seen as exploitative. Instead, Islamic banks use profit-sharing and risk-sharing models, which are more in line with Islamic principles.

What Is The Future Of Islamic Banking?

The future of Islamic banking is bright. The industry is expected to continue to grow in the coming years, driven by the factors mentioned above. Islamic banking is also well-positioned to benefit from the growing demand for ethical and sustainable financial products.

Is Islamic Banking Right For Me?

Whether or not Islamic banking is right for you depends on your individual needs and preferences. If you are looking for an ethical and sustainable financial option, Islamic banking may be a good choice for you. However, it is important to do your research and understand the risks and benefits of Islamic banking before you make a decision.

Conclusion

Islamic banking is a viable and growing industry that offers a number of benefits over traditional banking. If you are looking for an ethical, sustainable, and inclusive financial option, Islamic banking may be a good choice for you.

The industry continues to grow, and Islamic banks will need to address the challenges that they face, such as lack of awareness, regulation, and competition. However, the future of Islamic banking is bright, and the industry is well-positioned to meet the needs of a growing and diverse customer base.

James Pierce

Author

Camilo Wood

Reviewer

Latest Articles

Popular Articles