What Is International Banking? Global Finance Unleashed

Explore the world of international banking with our comprehensive guide. Discover key insights, global financial trends, and expert analysis to navigate the complexities of international finance.

Author:Luqman JacksonReviewer:Liam EvansJan 18, 202411.3K Shares177.6K Views

In an era marked by global interconnectedness,international banking stands as a cornerstone of the financial landscape, facilitating cross-border transactions, fostering economic growth, and shaping the dynamics of global trade. As nations become increasingly interdependent, understanding the intricacies of international banking has never been more crucial.

This introductory exploration delves into the multifaceted realm of International Banking, unraveling its mechanisms, examining the challenges and opportunities it presents, and shedding light on the pivotal role it plays in shaping the world economy.

International Banking Definition

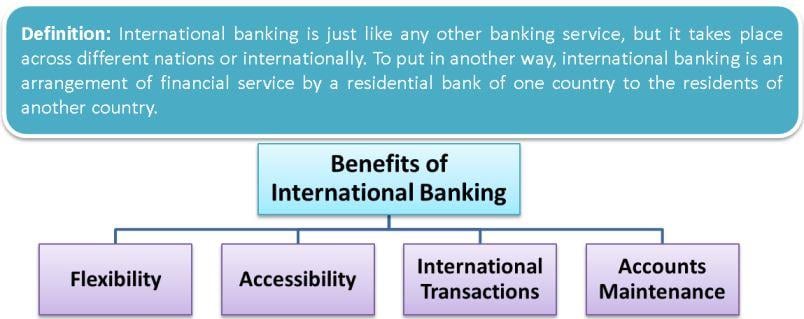

International banking is a multifaceted financial domain that extends its reach beyond national borders, encompassing a spectrum of services crucial for global economic interactions.

At its core, international banking involves the provision of financial services across different countries, catering to the diverse needs of businesses, governments, and individuals engaged in cross-border transactions.

The primary functions of international banking include facilitating trade finance, managing foreign exchange, and supporting international investments. Financial institutions involved in international banking navigate complex regulatory landscapes, diverse currencies, and varied economic conditions, requiring a sophisticated understanding of global markets.

One of the key aspects of international banking is its role in fostering economic development by promoting cross-border capital flows and facilitating international trade. Businesses benefit from access to a broader customer base, diverse investment opportunities, and risk management tools that enable them to navigate the challenges of operating in a global marketplace.

Best Strategies For International Banking

We see this all the time. When a firm develops worldwide, its treasury department may face the formidable task of creating a financial structure that not only improves visibility and control but also maximizes productivity. Treasurers are under increasing pressure to combine operations and consolidate the administration of fragmented supply chains on multiple continents.

Whether your firm operates in three or a dozen countries, these tactics can help your treasury avoid the frequent pitfalls of banking outside your home market and establish a consolidated international bankingstructure.

Design For The Long Term

There is no one-size-fits-all model in international banking. When creating a structure, think about your company's trajectory and long-term goals for new overseas operations, as well as the instances in which centralization makes sense.

If your operations are largely focused on meeting domestic demands, a high level of centralization may be appropriate. For example, if a new company in East Asia is only focused on supply chain management, a banking structure that delegated all decision-making authority to the North American headquarters would be appropriate.

However, if a company aims to expand into international markets, a regional model may offer greater flexibility and response to local needs.

Centralized decision-making may not benefit your organization if it is prioritized over the ability to react to regional needs. For example, a treasurer's first instinct may be to accept as much centralization as possible in order to achieve the aims of transparency and control.

However, not every decision must be approved at the headquarters, and a structure that promotes centralized control over regional flexibility can stifle expansion while also causing regulatory issues.

In some circumstances, allowing for more autonomy in regional banking arrangements can help with future growth, particularly if your company's focus switches to high-growing areas abroad.

Start From The Top

Obtaining senior-level support is critical for carrying out your treasury strategy. Optimizing your banking system will most likely necessitate resources and collaboration from a variety of stakeholders. Before you begin the project, you should create a sound business case that outlines the inadequacies of your current structures as well as the potential risks and benefits of your proposed changes.

Clarifying the project's KPIs ahead of time can help you track the program's performance more effectively, ensuring that support does not wane midway through implementation. Maintaining a consistent emphasis on your structure's KPIs to improve visibility, increase control, and reduce expenses will assist assure buy-in from key stakeholders throughout the project.

Prioritize Rationalization

Rationalizing accounts through an integrated global financial structure can give several advantages. Consolidating accounts among a few banking partners can help you decrease counterparty risk, lower borrowing costs, negotiate reduced transaction fees, and centralize control over banking choices.

Account rationalization may also present chances to use banking technology and automated controls to support sophisticated treasury structures. When your accounts are fully rationalized, it may be much easier to establish payment and receivable factories, as well as implement cross-border notional pooling.

Establish Operational And Financial Control

The appropriate international structure will enable your company to gain centralized control over crucial decisions while being flexible at the local level. The decisions you make when developing your financial structures will affect the degree of autonomy kept at the regional level, hopefully finding the right balance. Consider how you could benefit from:

- In-house banking- Establishing an in-house bank can provide highly centralized control over funding decisions while yet allowing subsidiaries to be responsible for ordinary operations. Creating a centralized body capable of managing intercompany loans and making investment choices on behalf of subsidiaries allows headquarters to maintain greater control over the flow of cash while interfering less with ordinary business tasks abroad.

- Payment factories- Attaching payment and receivables systems to an in-house bank can also give consolidated operational oversight. By routing each invoice through a payment factory that transfers payments on your subsidiary's behalf, you may gain visibility into all areas of the subsidiary's activities, from supply chain sourcing to final sales. A payment factory also provides the possibility to add automated rules that govern routine expenditure decisions.

- Shared service centers -Alternatively, establishing shared service centers can give overseas subsidiaries access to company-wide resources, centralizing important operational areas while preserving a decentralized local funding structure. This can be beneficial for subsidiaries operating in countries with strict currency controls or unique restrictions that make international financial integration difficult. A shared service center enables a subsidiary to continue providing local banking services while employing corporate experience to manage difficult operational areas such as human resources, IT, and buying.

Remember That All Businesses Are Local

The extent to which you can consolidate financial structures across foreign enterprises will likely vary greatly by location. For example, operations in Europe are suited for establishing highly interconnected organizations. Every country in the SEPA zone has implemented a common set of regulations to make integrated banking operations simple and efficient.

Treasurers attempting to combine financial institutions in Southeast Asia or Latin America, on the other hand, face a complex patchwork of national regulations, currency controls, and foreign exchange concerns. The transaction costs and regulatory burden of an integrated banking organization in certain regions may be prohibitive.

In summary, your banking organization should be able to accommodate regional variance while also capitalizing on possibilities to cut transaction costs and improve control through centralization.

Ensure That Banking Choices Follow A Universal Policy

As your company grows, it's crucial to examine existing banking arrangements and ensure they're evolving in accordance with global rules governing foreign exchange, debt, and cash flow management.

A clear and thorough policy is especially vital for organizations that have taken a decentralized, autonomous approach to banking for their international operations. A universal policy that establishes risk management standards and cash flow targets for the entire organization can assist local subsidiaries in making sound judgments while operating independently.

International Banking Arrangements

We describe the most typical forms and types of international banking agreements and procedures before introducing you to ways to circumvent the SWIFT network and benefit from regional payment systems.

Bank Correspondent

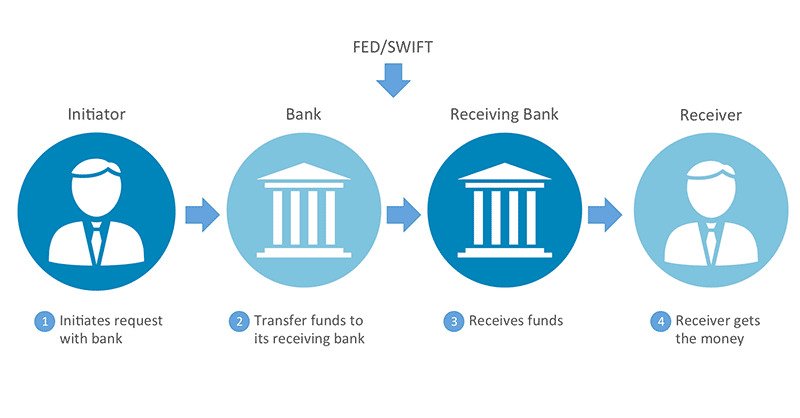

To enable smooth cross-border transactions, correspondent banks build connections with other banks overseas. Banks can execute transactions in foreign countries without physical presence thanks to correspondent banking connections. Or, to put it simply: The correspondent bank serves as a middleman by establishing connections between domestic and international banks.

A bank transfer utilizing SWIFT can only occur when two organizations have a direct business relationship. The money moves through a network of intermediary banks if there isn't a direct connection between the sending and receiving institutions. Two to five banks participate in each money transfer via SWIFT, which causes lengthy processing delays and increased transaction costs.

Office Of Representatives

Banks establish representative offices in order to carry out certain operations overseas. This involves, among other things, marketing and promotional efforts in addition to upholding connections with correspondent banks in the host nation.

The parent bank can effectively handle regional lending requirements and regulations thanks to a representative office. Consequently, the goal of a representative office is to better service clients in the home market rather than to expand into new markets.

Foreign Branches

Foreign bank branches serve as a way to enter new markets and reach a wider clientele, whilst representative offices are established overseas to carry out specific banking operations and to better serve the domestic market.

As a result, international bank branches allow banks to conduct business abroad. Depending on the rules and legislation of the host nation, the services provided overseas might not be the same as those provided locally.

Affiliated And Subsidiary Banks

Affiliate and subsidiary banks can be utilized in a manner akin to branch offices in order to expand into new areas. The ownership structure and degree of independence are where these companies diverge most.

A parent bank retains operational and strategic control over a subsidiary bank as long as the parent bank owns a majority (more than 50%) of the subsidiary. On the other hand, an associate bank's ownership position is less than 50%, which further diminishes the degree of control.

Offshore Banks

Known as tax havens, offshore financial centers are home to offshore banks. Asset protection against lawsuits or political unrest in their home country is a primary factor for firms and individuals to deposit money in offshore banks.

The rationale is that, in comparison to the parent bank, these nations typically offer more favorable legal, regulatory, and tax environments. Typically, offshore banks function as subsidiaries or branches.

International Banking Facilities

Banks can conduct International Banking Facility(IBF) activities from their existing locations, but they must keep separate books for IBF transactions. In 1981, the Federal Reserve approved the establishment of IBFs and freed them from reserve requirements. The Federal Reserve, as well as other state and federal regulators, continue to oversee IBF activities. They are not FDIC-insured.

To entice IBF company, certain states have offered additional tax benefits. In Florida, for example, IBFs are free from state income, intangible personal property, and documentary stamp taxes. Because of the exemptions they receive, IBFs allow US banks and financial institutions to compete more successfully for international deposits and loans in the Eurocurrency markets.

IBFs allow US banks to offer deposit and lending services to overseas customers through their domestic US offices, which were previously only available competitively from foreign locations. Depository institutions that may create an IBF include U.S. commercial banks, Edge Act businesses, foreign commercial banks with branches and agencies in the United States, savings and loan organizations, and mutual savings banks.

An Edge Act corporation (EAC) is a subsidiary of a U.S. or foreign bank that conducts foreign banking operations; these subsidiaries are called after the 1919 Edge Act that established them. The Edge Act, named after the United States senator who sponsored it, was an amendment to the Federal Reserve Act of 1913 that was offered to boost the competitiveness of American financial enterprises on a global scale.

Is International Banking Costly?

Now that you are more knowledgeable about the functions of international banking and the parties involved, you may be wondering what the expenses involved in making cross-border transfers are.

Every SWIFT transaction, as was previously indicated, may go through up to five (intermediary) banks before the funds are transferred to the recipient account. Transaction fees may result from this, reaching 5%. Nonetheless, there are ways to do foreign banking within local circumstances.

Americans utilize ACH for money transfers, but Europeans use SEPA. The goal of these payment methods is to reduce the cost and speed of money transactions inside a certain economic zone. The issue is that local payment methods are typically only available to businesses and individuals located in these areas. Here's where amnis enters the picture.

International Banking - FAQs

How Do Exchange Rates Impact International Banking?

Exchange rates play a crucial role in International Banking, influencing the value of transactions and affecting profits or losses for businesses engaged in cross-border trade.

What Are The Major Challenges In International Banking?

Challenges include regulatory complexities, geopolitical risks, currency volatility, and compliance issues, requiring banks to navigate a complex global landscape.

How Does International Banking Contribute To Economic Development?

By facilitating cross-border capital flows and supporting international trade, International Banking plays a vital role in fostering economic growth and development.

What Role Do Correspondent Banks Play In International Banking?

Correspondent banks act as intermediaries between financial institutions in different countries, facilitating transactions and providing access to foreign markets.

How Has Technology Impacted International Banking?

Technology has transformed International Banking with innovations like online banking, blockchain, and digital currencies, enhancing efficiency, security, and accessibility.

Conclusion On International Banking

International Banking emerges as a linchpin in the intricate web of global finance, serving as the conduit through which nations engage in economic cooperation and exchange.

As we navigate the complexities of international financial markets, it becomes evident that a nuanced understanding of International Banking is essential for businesses, policymakers, and individuals alike. The future of finance is undeniably intertwined with the global stage, and by grasping the nuances of international banking, we empower ourselves to adapt, thrive, and contribute to a more interconnected and prosperous world.

Luqman Jackson

Author

Liam Evans

Reviewer

Latest Articles

Popular Articles