If I Had Invested Calculator - A Powerful Tool For Financial Planning

If I had invested calculators are a powerful tool for financial planning. Discover how to use them to estimate your investment returns and make better investment decisions.

Author:Stefano MclaughlinReviewer:Luqman JacksonOct 12, 202318K Shares240.7K Views

An if I had invested calculatoris a powerful tool for financial planning that can help you estimate how much money you would have if you had invested a certain amount in the past. It can be used to calculate potential returns on investments in a variety of assets, such as stocks, bonds, mutual funds, and real estate.

Investment calculators are particularly useful for understanding the long-term effects of compounding. Compounding is the process of earning interest on your interest, and it is one of the most powerful forces in investing. For example, if you invest $1,000 at an annual return rate of 7%, your investment will grow to $2,593.74 in 20 years. However, if you reinvest your earnings, your investment will grow to $4,105.13 in 20 years. This is due to the power of compounding.

Investment calculators can be used to calculate your potential returns on different investments, compare the performance of different investment strategies, and set realistic financial goals. They can also be used to track your progress over time and make sure that you are on track to reach your financial goals.

This tool should be approached with a prudent mindset, understanding that past performance does not guarantee future results. While it offers valuable insights, it does not account for transaction costs, taxes, or other real-world factors that may impact actual investment outcomes.

We will delve into the functionalities, applications, and considerations surrounding the investment calculator. From exploring historical data to crafting more informed investment strategies, this tool proves to be an indispensable asset in the toolkit of any astute financial planner. So, let us embark on this journey into the world of retrospective investment analysis and discover how this calculator can empower you in your pursuit of financial prosperity.

Choose The Right One - What If I Had Invested Calculator

Factors To Consider When Choosing Investment Calculator

Here are some factors to consider when choosing an investment calculator:

- Ease of use -The calculator should be easy to use and navigate.

- Features -Think about the characteristics that matter to you, such as the capability to estimate investment returns for various asset classes, contrast the success of various investment methods, and monitor your development over time.

- Accuracy -Make sure to choose a calculator that is accurate and reliable.

- Cost -Some calculators are free to use, while others require a subscription fee. Choose a calculator that fits your budget.

Different Types Of Investment Calculators Available

There are a variety of different if I had invested calculators available, both online and offline. Some of the most popular types of calculators include:

- Basic calculators -These calculators allow you to calculate your potential investment returns for a single asset class.

- Advanced calculators -These calculators offer more features, such as the ability to compare the performance of different investment strategies and track your progress over time.

- Retirement calculators -These calculators can help you estimate how much money you need to save for retirement.

- Investment planning calculators -These calculators can help you create a personalized investment plan to reach your financial goals.

Best Calculators For Different Investment Needs

The best investment calculator for you will depend on your individual needs and preferences. However, here are a few of the most popular and highly rated if I had invested calculators:

- Bankrate Investment Calculator -This calculator is easy to use and offers a variety of features, including the ability to calculate investment returns for different asset classes, compare the performance of different investment strategies, and track your progress over time.

- NerdWallet Investment Calculator -This calculator is similar to the Bankrate Investment Calculator, but it also offers a few additional features, such as the ability to calculate investment returns for different investment goals, such as retirement or education.

- SmartAsset Investment Calculator -This calculator is a good option for investors who want to create a personalized investment plan. It allows you to input your financial information, such as your income, expenses, and investment goals, and it generates a personalized investment plan for you.

- SmartAsset Retirement Calculator -This calculator is a good option for investors who are planning for retirement. It allows you to input your financial information and it estimates how much money you need to save for retirement.

Use To Make Better Investment Decisions

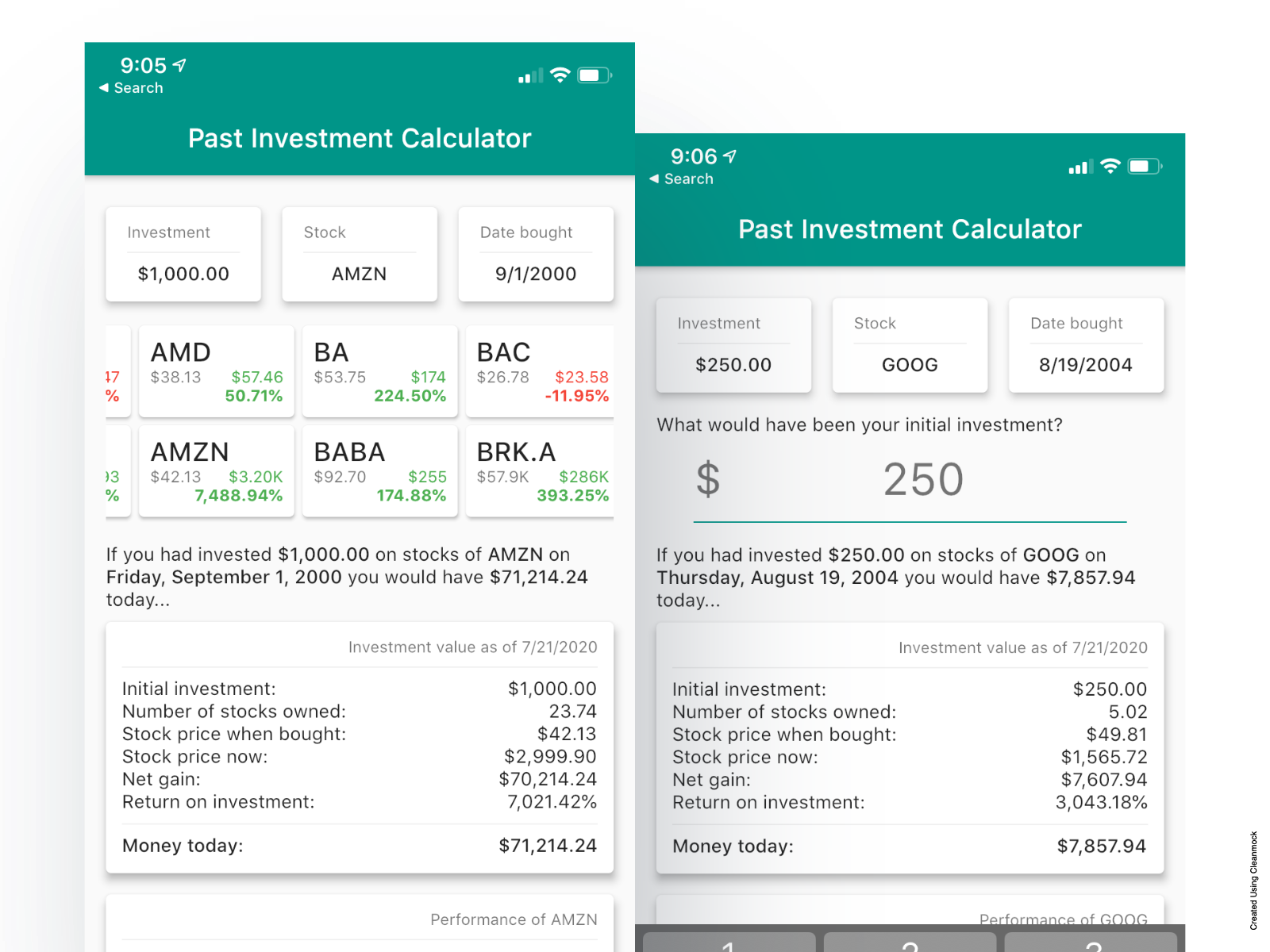

Example of how to use an investment calculator to calculate your investment returns. To calculate your potential investment returns using an investment calculator, you will need to input the following information:

- The amount you would have invested

- The date you would have invested

- The asset class you would have invested in

- The historical return rate of the asset class

For example, let's say you want to know how much money you would have if you had invested $1,000 in the S&P 500 index fund on January 1, 2010. You would input the following information into the calculator:

- Amount invested- $1,000

- Date invested- January 1, 2010

- Asset class- S&P 500 index fund

- Historical return rate- 10% per year

The calculator would then tell you that your investment would be worth $3,105.90 today.

Different Ways To Make Better Investment Decisions

There are a variety of different ways to use an investment calculator to make better investment decisions. Here are a few examples:

- Compare the performance of different investment strategies -You can use an investment calculator to compare the performance of different investment strategies. For example, you could compare the performance of investing in stocks versus bonds or investing in different types of stocks, such as large-cap stocks versus small-cap stocks.

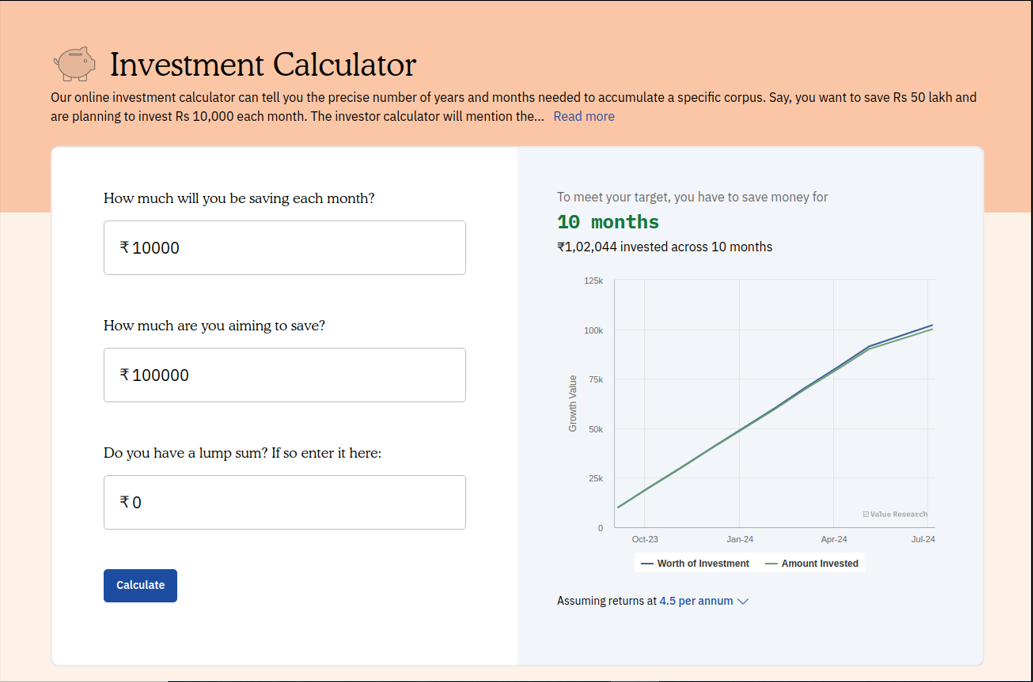

- Set realistic financial goals -You can use a calculator to set realistic financial goals. For example, you could use the calculator to estimate how much money you need to save for retirement or to buy a house.

- Track your progress over time -You can use an investment calculator to track your progress over time. This can help you stay on track to reach your financial goals.

- Identify potential investment opportunities -You can use a calculator to identify potential investment opportunities. For example, you could use the calculator to see how much money you could have made if you had invested in a particular stock a few years ago.

Here are some additional tips for using a calculator to make better investment decisions:

- Be realistic about your expectations. Investment calculators can give you a good estimate of your potential investment returns, but they are not a guarantee.

- Consider your risk tolerance. Some investments are riskier than others. It is important to choose investments that are appropriate for your risk tolerance.

- Do your research. Before you invest in anything, it is important to do your research and understand the risks involved.

- Rebalance your portfolio regularly. It is important to rebalance your portfolio regularly to ensure that it still meets your investment goals and risk tolerance.

Advanced Features Of Investment Calculators

In addition to the basic features described in Section 2, many investment calculators also offer a variety of advanced features. Here are a few examples:

- Investment risk calculation -Some calculators can help you calculate your investment risk. This can be helpful for choosing investments that are appropriate for your risk tolerance.

- Personalized investment plan creation -Some calculators can help you create a personalized investment plan to reach your financial goals.

- Taxation calculations -Some investment calculators can take into account taxation when calculating your investment returns. This can be helpful for estimating the true after-tax returns on your investments.

- Scenario analysis -Some investment calculators allow you to perform scenario analysis. This means that you can input different assumptions into the calculator to see how they would affect your investment returns.

Use Calculator To Calculate Your Investment Risk

To calculate your investment risk using an investment calculator, you will need to input the following information:

- The amount you would have invested

- The date you would have invested

- The asset class you would have invested in

- The historical return rate of the asset class

- The volatility of the asset class

The calculator will then use this information to calculate your investment risk.

Use Calculator To Create A Personalized Investment Plan

To create a personalized investment plan using an investment calculator, you will need to input the following information:

- Your financial goals

- Your risk tolerance

- Your investment time horizon

- Your current financial situation (e.g., income, expenses, assets, liabilities)

The calculator will then use this information to generate a personalized investment plan for you.

Other Advanced Features Of Investment Calculators

Some calculators also offer other advanced features, such as the ability to:

- Calculate investment returns for multiple asset classes

- Compare the performance of different investment strategies over different time periods

- Track your progress toward your financial goals

- Generate investment reports

Investment Calculator Case Studies

Case Study 1

How a business owner used an investment calculator to make better investment decisions.

John is a successful business owner. He has always been good at saving money, but he has never invested in anything other than his business. One day, John decided that he wanted to start investing in the future. He did some research and learned about investment calculators.

John used an investment calculator to see how much money he could have made if he had invested in different asset classes, such as stocks, bonds, and real estate. He also used the calculator to compare the performance of different investment strategies.

After using the calculator, John realized that he was missing out on a lot of potential returns by not investing. He decided to start investing a portion of his income each month. He also created a diversified investment portfolio that included stocks, bonds, and real estate.

A few years later, John is very happy with his investment decisions. His investment portfolio has grown significantly, and he is now well on his way to reaching his financial goals.

Case Study 2

How a stock trader used an investment calculator to improve his trading performance.

Jane is a stock trader. She has been trading stocks for several years, but she has not been very successful. She recently decided to try using an investment calculator to improve her trading performance.

Jane used a calculator to see how much money she could have made if she had bought and sold different stocks at different times. She also used the calculator to test different trading strategies.

After using the calculator, Jane realized that she was making some common mistakes in her trading. She was also able to identify some new trading strategies that she could use to improve her performance.

Jane started using the new trading strategies that she had identified. She also became more disciplined in her trading. As a result, her trading performance has improved significantly.

Case Study 3

How a crypto trader used an investment calculator to reduce his investment risk.

Sam is a crypto trader. He has been trading cryptocurrencies for several years, but he has lost a lot of money due to the volatile nature of the market. Sam recently decided to try using an investment calculator to reduce his investment risk.

Sam used a calculator to see how much money he could have made if he had invested in different cryptocurrencies at different times. He also used the calculator to test different risk management strategies.

After using the calculator, Sam realized that he was taking on too much risk in his trades. He also realized that he needed to use better risk management strategies.

Sam started using the risk management strategies that he had identified. He also reduced the size of his trades. As a result, he has been able to reduce his investment risk and improve his overall profitability.

Frequently Asked Questions

How Much Would I Have Earned If I Invested?

You can calculate the return on your investment by subtracting the initial amount of money that you put in from the final value of your financial investment. Then you would divide this total by the cost of the investment and multiply that by 100.

What Is The Rule Of 72 For Interest Rate 12%?

The rule is this: 72 divided by the interest rate number equals the number of years for the investment to double in size. For example, if the interest rate is 12%, you would divide 72 by 12 to get 6. This means that the investment will take about 6 years to double with a 12% fixed annual interest rate.

How To Turn $500 K Into $1 Million?

The time it takes to invest half turn 500k into $1 million depends on the investment return and the amount of time invested. If invested with an average annual return of 7%, it would take around 15 years to turn 500k into $1 million.

Conclusion

The if I had invested calculator stands as an invaluable companion in the realm of financial planning. By harnessing historical data, it offers a retrospective view of potential gains or losses, shedding light on alternate investment scenarios. This tool is indispensable for those seeking to refine their investment strategies or gain insights into the potential growth of their assets.

However, it is crucial to remember that this calculator provides a hypothetical perspective, devoid of real-world considerations such as transaction costs and taxes. As such, it should be used in conjunction with prudent financial judgment.

Ultimately, the investment calculator empowers individuals to learn from the past, enabling them to make more informed investment decisions in the future. Its capabilities make it an essential component in the arsenal of any astute financial planner, offering a clearer path toward achieving long-term financial prosperity.

Stefano Mclaughlin

Author

Luqman Jackson

Reviewer

Latest Articles

Popular Articles