How To Write A Check - Check Writing 101

How to write a check? Learn the art of check writing with our comprehensive guide, covering steps, tips, and common mistakes for financial accuracy.

Author:Liam EvansReviewer:Habiba AshtonJan 26, 20246K Shares113.5K Views

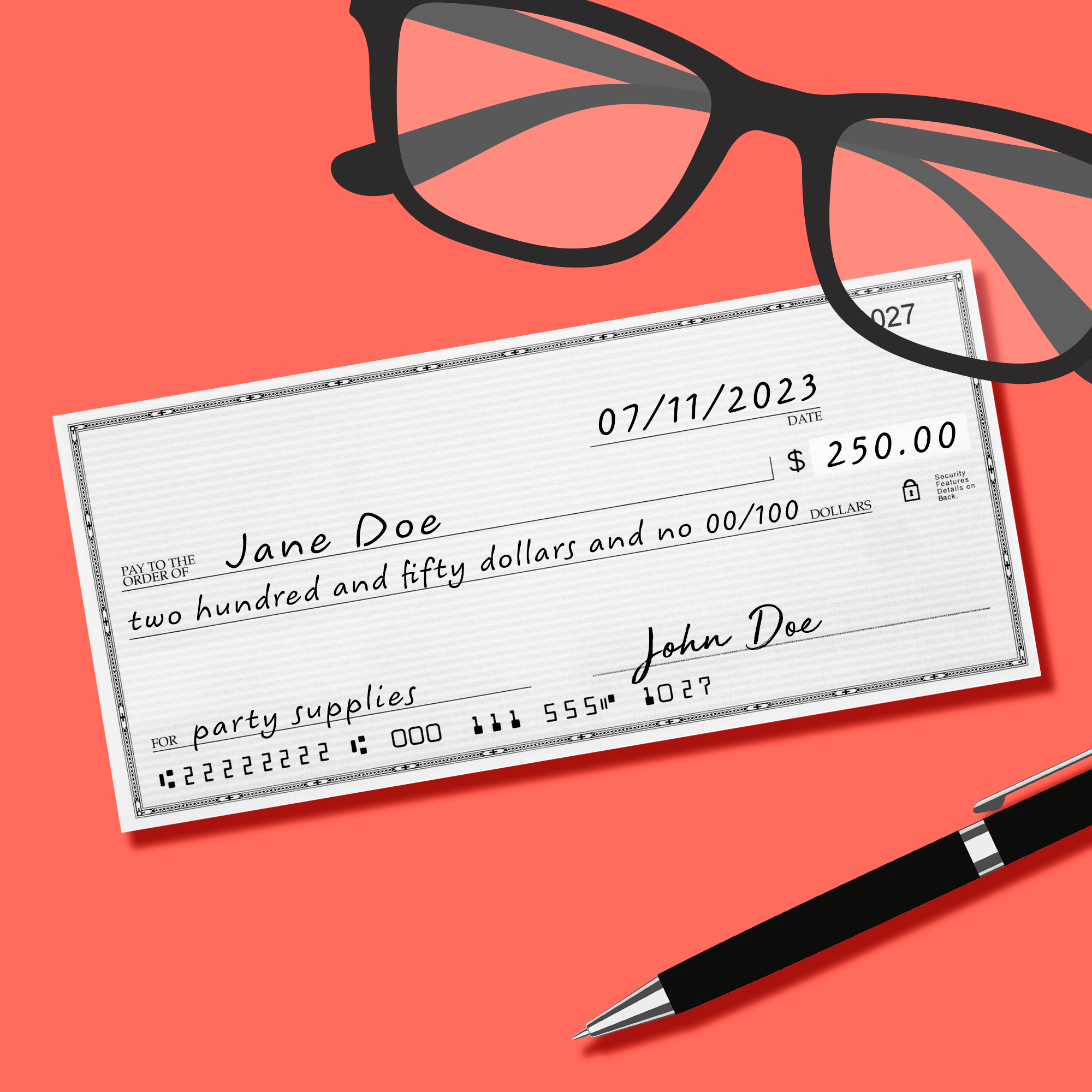

Writing a check may seem like a simple task, but it's a financial skill that everyone should master. Whether you're paying bills, making a donation, or settling a debt, knowing how to write a check accurately is essential for proper financial management. So, how to write a check?

In this comprehensive guide, we'll walk you through the step-by-step process on how to write a check, cover essential elements, and provide tips for maintaining accuracy in your financial transactions.

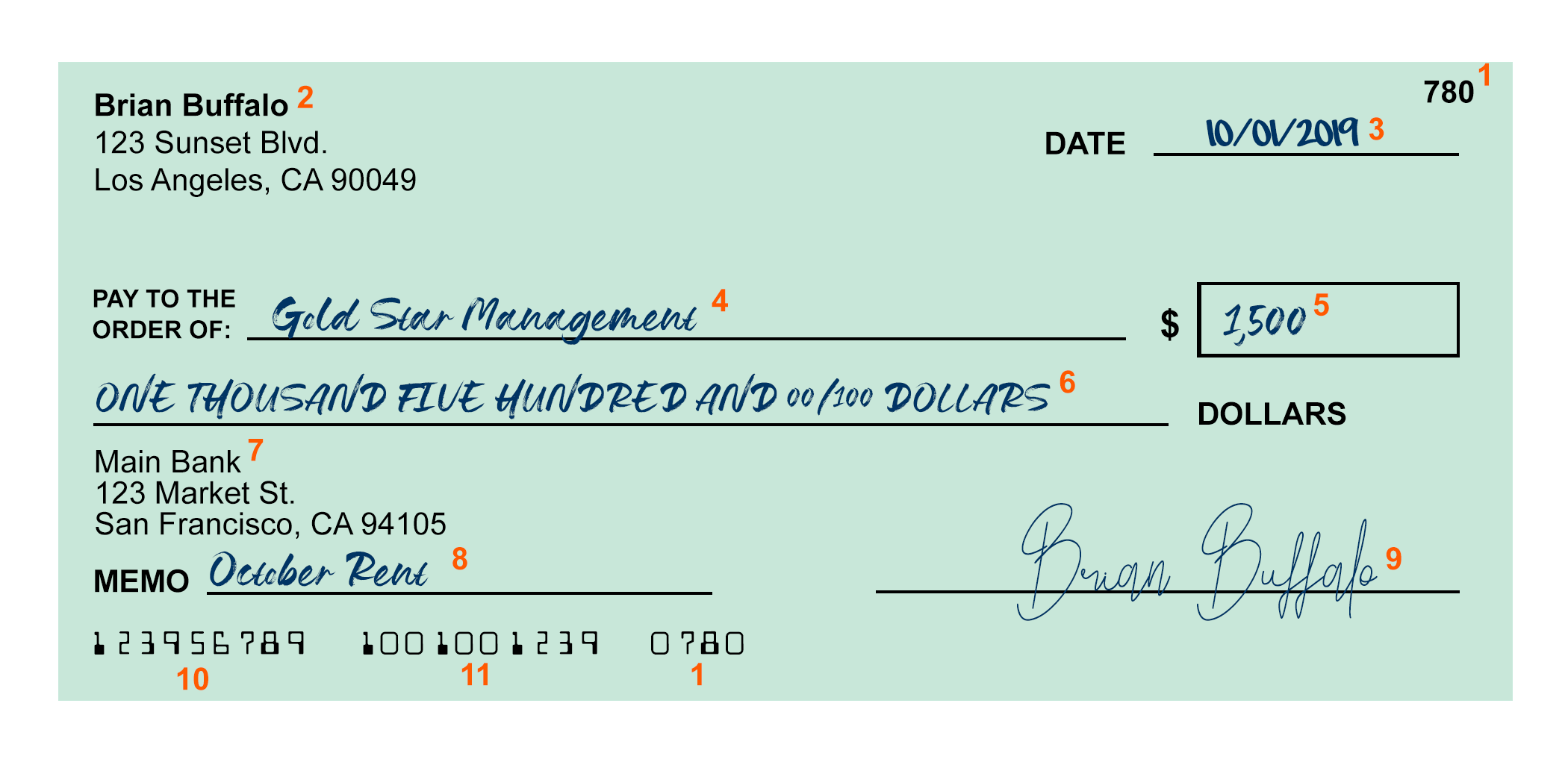

Step-by-Step Guide To Writing A Check

There was a time when many people always filled out their checks. It used to be easy, but now that debit cards, online banking, and mobile payments are around, it's not pretty. If you want to know how to write a check, these steps will help.

Put The Date In

This goes on the line at the very top right of the check. In the US, write it as month-date-year. You can either write the whole date or just use numbers. Like, write June 20, 2023, or 6/20/2023.

Name The Recipient

Who is going to get the check? Put their name on the line that says "Pay to the order of." You can name a person or a company. When talking about a person, use their full name, not a nickname.

Type In The Amount In Numerals

This part is simple. You only need to write down how much you owe.

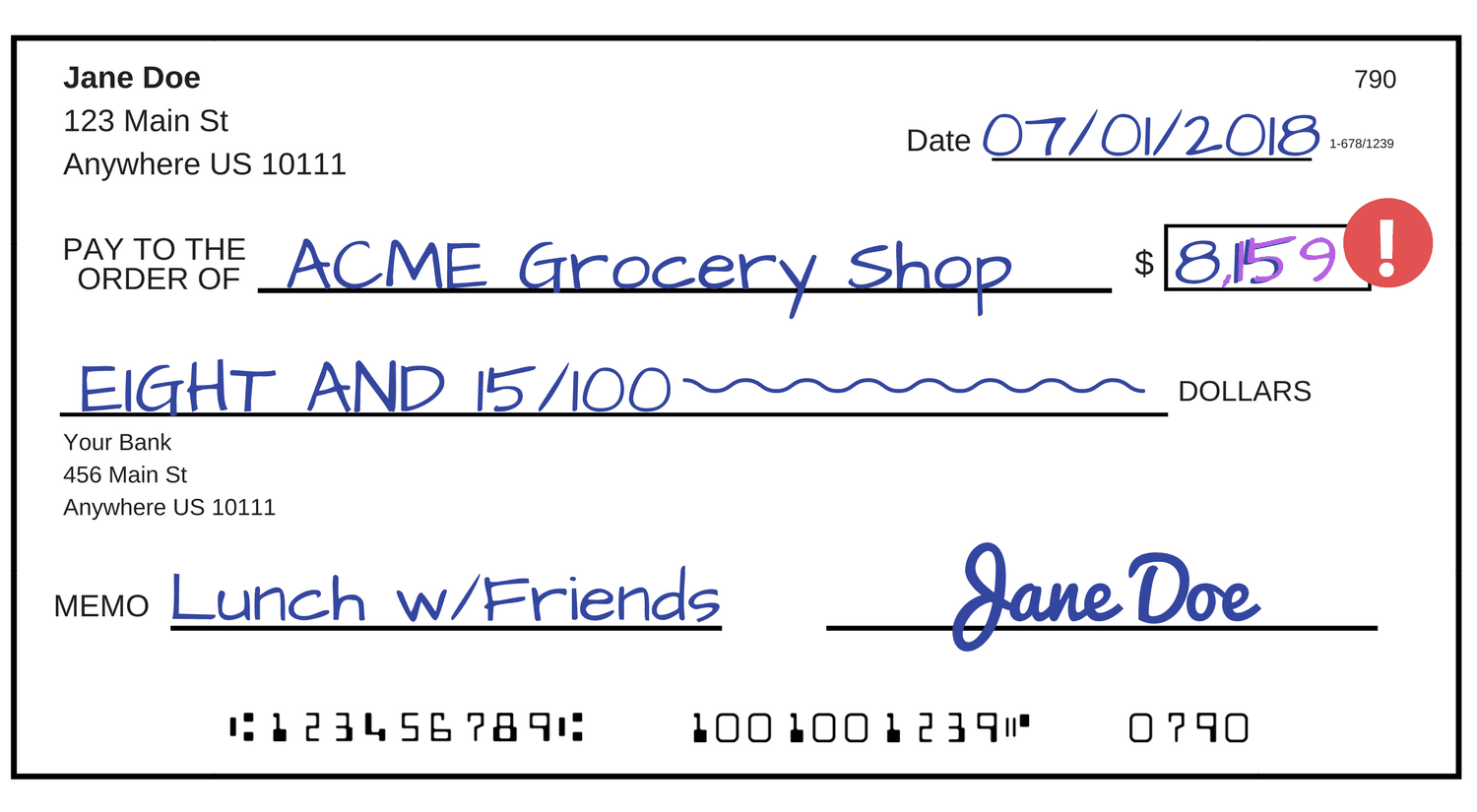

Write Down The Amount

This needs to go below the "Pay to the order of" line. Someone can't add more money if you put a cap on it. Add the number of cents (use a fraction, like 50/100) or the word "even" if the amount is even. Let's say the amount on the check is $100. If you only wrote "one hundred dollars," the person who receives the check might add a few cents to the total if there's room on the line.

Explain Why You Need It

Place this on the "Memo" line. You can skip this part, but it's helpful. It helps you remember why you sent the money.

Sign Your Name On It.

This goes in the check's bottom right spot. Keep in mind that if you don't sign your check, it will be returned. By signing, you agree to pay the amount written on the check to the person named on it.

Essential Elements Of A Check

Routing Number

Located at the bottom left of the check, the routing number is a nine-digit code that identifies the bank or financial institution.

Account Number

Adjacent to the routing number, the account number is a unique identifier for your specific bank account.

Check Number

The top-right and bottom-right corners of the check display the check number. This number helps track your checks and is useful for record-keeping.

Bank Information

The top portion of the check typically includes the name and address of your bank. This information is useful for the payee and can be used to contact your bank if necessary.

Tips For Accuracy And Security

Use Permanent Ink

Ensure that you use a pen with permanent ink to prevent alterations to the check.

Avoid Blank Spaces

Fill in all spaces on the check, including the dollar box and the payment line. Leaving blank spaces may lead to unauthorized alterations.

Keep Records

Maintain a record of each check you write, including the payee, amount, and date. This helps you track your spending and monitor your account.

Double-Check Details

Before signing the check, double-check all details, including the date, payee, and amount in both numerical and written forms.

Protect Your Checks

Keep your checks in a secure location to prevent unauthorized use. If your checks are lost or stolen, report it to your bank immediately.

Review Statements

Regularly review your bank statements to ensure that all check transactions are accurate. Report any discrepancies to your bank promptly.

Common Mistakes To Avoid

Post-Dated Checks

Avoid writing post-dated checks (checks with a future date). Some banks may process them, leading to unintended consequences.

Incomplete Information

Ensure that all required fields on the check are filled out completely. Incomplete information may lead to confusion or rejection of the check.

Signature Discrepancies

Sign your checks consistently with the signature on file with your bank. A mismatch may cause delays or rejections.

Forgetting To Endorse

If the back of the check requires endorsement, don't forget to sign it. Without proper endorsement, the payee may have difficulty cashing or depositing the check.

Additional Considerations

Electronic Payments

While checks are still widely used, electronic payment methods such as online banking, wire transfers, and digital payment apps are becoming increasingly popular. Consider using the method that best suits your needs and preferences.

Check Printing Services

If you write checks frequently, you may opt for check printing services provided by your bank. These services often include pre-printed checks with your account details, minimizing the need for manual entry.

Check-Cashing Policies

Be aware of the check-cashing policies of the payee's bank. Some banks may have specific requirements or fees for cashing checks.

Keep Checks Secure

Treat checks with the same level of security as you would cash. Safeguard them from theft or loss to protect your financial information.

Seek Assistance

If you are unsure about any aspect of check writing, don't hesitate to seek assistance from your bank or financial institution. They can provide guidance and answer any questions you may have.

FAQs

How Do I Properly Write A Check?

To write a check, fill in the date, payee, numerical and written amounts, sign it, and record the transaction in your check register.

Why Is The Check Number Important?

The check number helps track your checks for record-keeping and identification purposes.

Can I Use Any Pen To Write A Check?

Answer: It's advisable to use a pen with permanent ink to prevent alterations to the check.

Can I Write A Check On Paper?

It is possible, yes. But for professionals, it's better to have checks made just for them instead of making checks on paper. You will have to spend time and money on good checks that won't tear or go bad before they can be cashed. The payments will not be made on time.

Are There Alternatives To Writing Checks?

Answer: Yes, electronic payment methods, such as online banking and digital payment apps, are popular alternatives to traditional check writing.

Can I Write A Check To Myself?

Yes, you can send yourself a check. It is possible to move money from one bank account to another by writing yourself a check.

Conclusion

How to write a check? Mastering the art of check writing is an important skill for effective financial management. By following these guidelines, you can write checks confidently, accurately, and securely, ensuring that your financial transactions are conducted with precision and accountability.

Liam Evans

Author

Habiba Ashton

Reviewer

Latest Articles

Popular Articles