How To Get Money Off Dasher Direct Virtual Card

Unlock instant cash rewards with how to get money off Dasher Direct Virtual Card! Discover the ultimate guide on how to maximize earnings and effortlessly get money off your Dasher Direct Virtual Card.

Author:Camilo WoodReviewer:Emmanuella SheaJan 19, 2024214 Shares15.2K Views

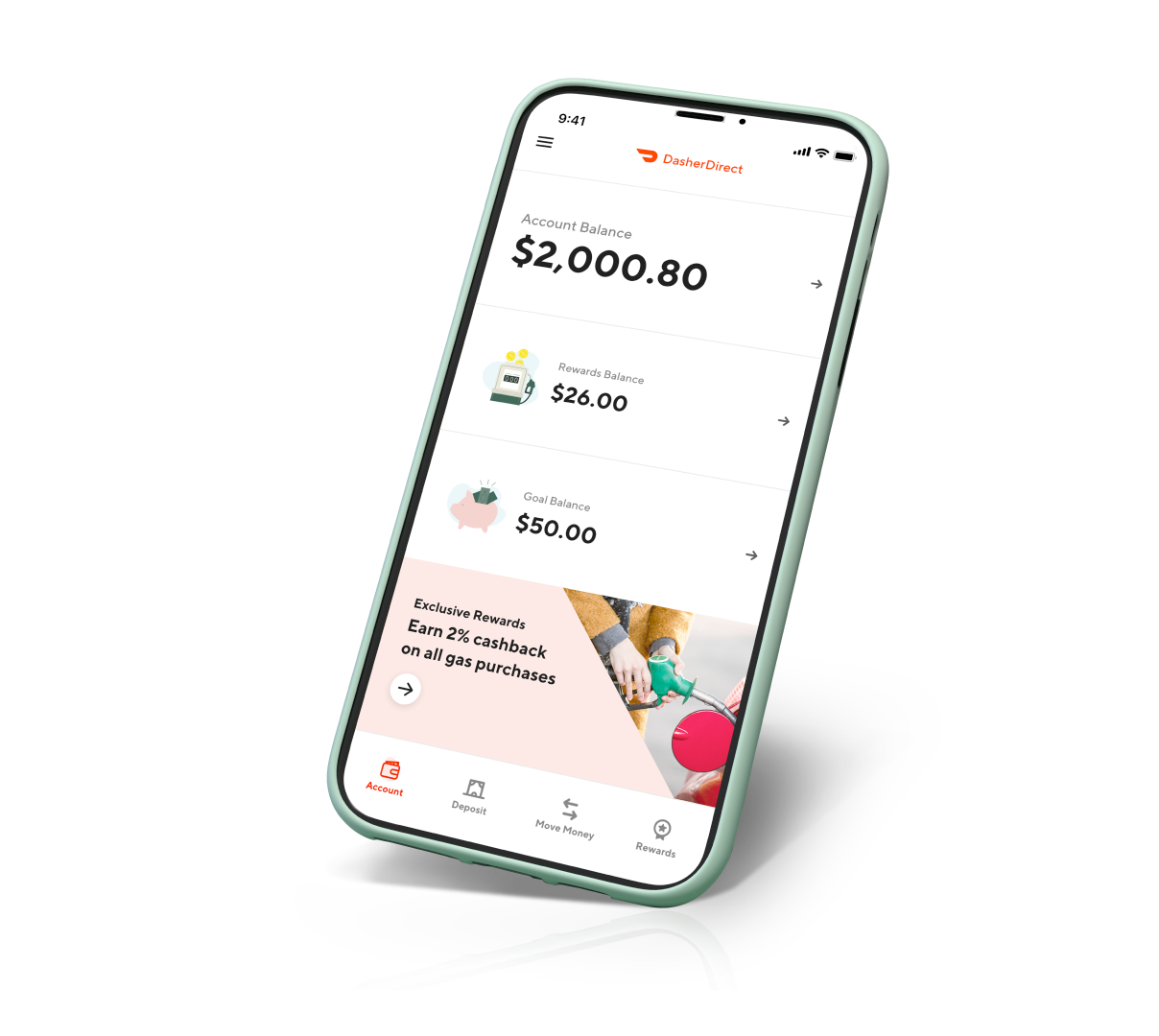

Unlocking your funds from the How to Get Money Off Dasher Direct Virtual Cardis simpler than you think! First, ensure you've activated the card through your Dasher app. Once activated, navigate to the 'Earnings' section within the app. Here, you'll find the option to transfer funds from your Dasher Direct Virtual Card to your linked bank account. Enter the desired amount, follow the prompts, and voilà! Your hard-earned cash swiftly moves from your Dasher card to your bank account, ready for immediate use.

For a more seamless experience, consider using Instant Pay, which allows you to access your earnings instantly without waiting for scheduled deposits. Simply tap into the app, select 'Cash Out,' and within moments, your funds will be available in your bank account. Effortlessly managing your Dasher Direct Virtual Card earnings has never been more convenient. Get your money on your terms, and on your schedule, and fuel your financial freedom today!

7 Easy Ways To Get Money Off Dasher Direct Virtual Card

Dasher Direct virtual cards offer convenience for DoorDash drivers, but accessing cash without fees can be tricky. Here are 7 easy ways to get money off your Dasher Direct virtual card:

1. Free In-Network ATM Withdrawals

Find MoneyPass or Allpoint ATMs within the Dasher Direct network for free withdrawals.

Check the app or website for a network ATM locator.

2. Mobile Wallets

Set up Apple Pay, Google Pay, or Samsung Pay to make contactless payments at stores and avoid physical card usage.

Transfer funds from Dasher Direct to your linked bank account and then use your debit card for ATM withdrawals.

3. Cashback At Grocery Stores

Certain grocery stores, like Safeway and Kroger, offer cashback rewards on debit card purchases. Look for signs or ask the cashier.

4. Peer-to-Peer Transfers

Use services like Venmo or Zelle to send money to a friend or family member who can then withdraw it for you (be mindful of potential fees).

5. Online Bill Payments

Schedule bill payments directly from your Dasher Direct app to avoid late fees and potentially earn rewards.

6. Retail Gift Cards

Purchase gift cards for frequently visited stores using your Dasher Direct card. This way, you're essentially converting your balance into spendable cash at those stores.

7. Limited Cash Back At Certain Retailers

Some retailers, like Walmart, offer limited cashback (usually around $20) on debit card purchases exceeding a certain amount.

Bonus Tip -Consider opening a checking account with a bank that reimburses ATM fees. This can offset any out-of-network ATM charges you might incur.

Always compare fees and terms before using any method to withdraw cash. By planning ahead and choosing the right option, you can easily access your Dasher Direct funds without breaking the bank.

Additionally:

- Using your Dasher Direct card for unauthorized transactions or violating the terms of service could result in fees or account closure.

- Be cautious of scams and never share your PIN or card information with anyone.

DasherDirect Transfer Limits

1. Transfers From DasherDirect To External Bank Accounts

- Daily limit -$1,000 per day

- Monthly limit -No specific monthly limit mentioned by DoorDash, but it's advisable to check with their support for any potential restrictions.

2. Transfers To Other People (Peer-to-Peer)

- Daily limit -$2,000 per day

- Number of transfers per day -3

- Monthly limit -$5,000 per month

- Number of transfers per month -30

3. ATM Withdrawals

- Daily limit -$1,000 per day

- Number of withdrawals per day -5

- Monthly limit -$5,000 per month

- Number of withdrawals per month -150

4. Cash Deposits

- Daily limit -$1,500 per day

- Number of deposits per day -10

- Monthly limit -$3,000 per month

- Number of deposits per month -300

5. Cash Back At Point-of-sale

- Transaction limit -$100 per transaction

- No specific daily or monthly limits mentioned.

Additional considerations:

- Direct deposits into DasherDirect -$20,000 per day, 10 transactions per day, $25,000 per month, 60 transactions per month

- Instant Pay limit from DoorDash to DasherDirect -$1,000 per day for security reasons

Key points to remember:

- Limits are subject to change, so it's always best to check the latest information on the DoorDash website or app.

- Contact DoorDash support if you have any questions or need to request a limit increase.

- Plan your transfers and withdrawals accordingly to avoid exceeding limits and potential fees.

- Consider alternative methods to access funds if you need to exceed the transfer limits, such as using an ATM or cashback at a store.

Can I Transfer Money From My Virtual DasherDirect Card To My Bank Account?

Yes, you can transfer money from your DasherDirect virtual card to your bank account! It's a convenient way to access your DoorDash earnings and manage your finances efficiently. Here's a quick overview of the process:

Transferring Money From DasherDirect To Your Bank Account

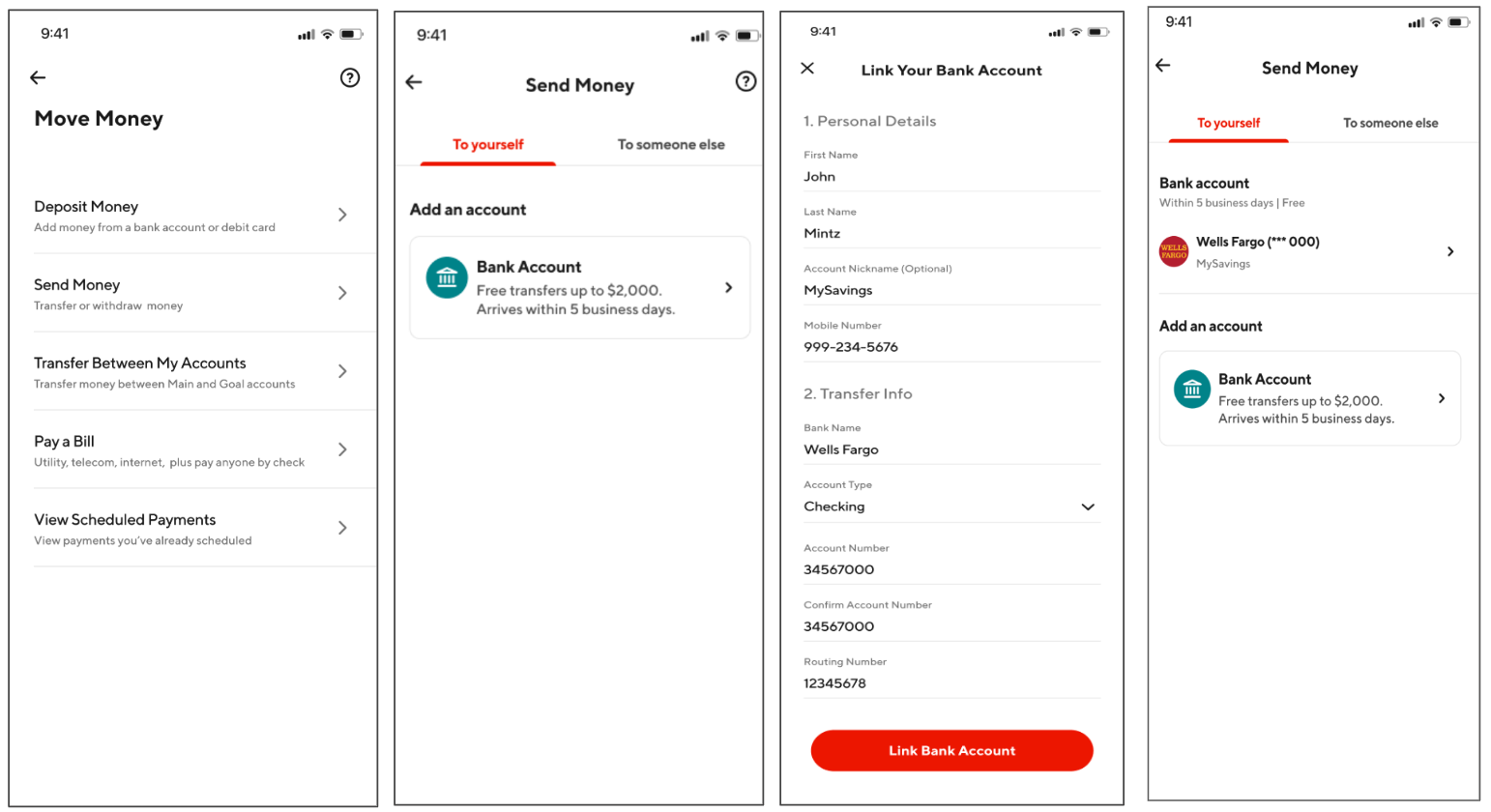

- Open the DasherDirect app -Locate the "Move Money" or "Transfer" option on the app's navigation bar.

- Select "Send money to someone" - Choose your desired method, typically "Bank account."

- Link your bank account - This might involve entering your bank account details or connecting through Plaid if it's not already linked.

- Enter transfer details -Specify the amount you want to transfer and confirm all information is accurate.

- Review and submit -Verify all details and initiate the transfer.

Additional Details:

- Transfer speed:Transfers typically take 1-2 business days to process.

- Transfer limits:Check DasherDirect's website or app for daily and monthly transfer limits.

- Fees:DasherDirect currently does not charge fees for transferring money to your bank account.

Alternatives:

Instant cash outs -Consider instant cash outs to a linked Visa debit card for immediate access to your earnings, though fees might apply.

How Do I Remove My Card From DoorDash?

1. Using the DoorDash app:

- Open the DoorDash app and tap the account icon (usually in the top right corner).

- Select "Payment Methods" or "Payment".

- Under "Saved Payment Methods", swipe left on the card you wish to remove.

- Tap "Delete" to confirm.

2. Using the DoorDash website:

- Log in to your DoorDash account on the website.

- Click the menu icon (usually three stacked lines) in the top left corner.

- Select "Payment".

- Click the trash icon next to the card you want to remove.

For Dashers

1. Using the Dasher app:

- Open the Dasher app and tap the account icon.

- Select "Payment Methods".

- Swipe left on the card you want to remove and tap "Delete".

2. Contacting DoorDash support:

If you're unable to remove a card through the app or website, you can contact DoorDash support through:

Additional notes:

- You'll need to have at least one other payment method saved on your account before removing a card.

- If you're a Dasher, you can't remove the card that's currently being used for Instant Pay.

- If you encounter any issues, DoorDash support can assist you further.

Can I Instantly Cash Out On Dasher?

1. Instant Pay With DasherDirect (US Only)

- Fee-free instant access -Receive your earnings within minutes after each dash.

- No debit card needed -Your DasherDirect card acts as your payout account.

- How to activate - Go to the Earnings tab in your Dasher app.

- Tap the bank icon.

- Select "Switch Payout Account" and choose DasherDirect.

- Cashing out -Tap the "Cash Out" button on the Earnings screen.

2. Fast Pay (US And Canada Only)

- Cash out once daily -Withdraw earnings to a linked debit card.

- Small fee -$1.99 per transfer.

- How to activate - Go to the Earnings tab in your Dasher app.

- Tap the bank icon.

- Select "Fast Pay" and follow the prompts to link your debit card.

Choosing The Best Option

- Instant Pay with DasherDirect -Ideal for frequent dashes and immediate cash access.

- Fast Pay -Convenient for daily cash-out needs, but with a fee.

You should also keep in mind:

1. Eligibility requirements -Check if you meet the requirements for each option in your Dasher app.

2. Transfer limits -Both options have daily and monthly transfer limits.

3. Taxes -Set aside money for taxes as earnings are considered self-employment income.

How To Transfer Money From DasherDirect Virtual Card To Cash App?

While there's no direct transfer option between DasherDirect and Cash App, here are two workarounds to achieve this:

1. Transfer To A Linked Bank Account First

- Transfer from DasherDirect - Move funds from your DasherDirect virtual card to your linked bank account using the "Move Money" or "Transfer" feature within the DasherDirect app.

- Add Funds to Cash App -From your bank account, add funds to your Cash App balance using the "Add Cash" option within the Cash App.

2. Link DasherDirect Card To PayPal

- Link Card to PayPal -Add your DasherDirect virtual card as a payment method within your PayPal account.

- Transfer to Cash App - Send money from your PayPal balance to your Cash App account using the "Send Money" feature in PayPal, selecting Cash App as the recipient.

Maximizing Convenience And Efficiency

Maximizing convenience and efficiency is all about tailoring your approach to your specific needs and context. Here are some general tips to consider:

Automate Tasks And Processes

- Set up recurring payments and bills -Save time and avoid late fees by automating regular payments.

- Utilize time management tools -Schedule tasks, set reminders, and prioritize efficiently.

- Leverage technology -Use apps and automation tools to streamline repetitive tasks.

Optimize Your Workflow

- Plan your day -Prioritize tasks, delegate where possible, and schedule focused work periods.

- Minimize distractions -Avoid multi-tasking, create a clutter-free workspace, and limit notifications.

- Take breaks -Short breaks can improve focus and prevent burnout.

Utilize Digital Tools And Resources

- Cloud storage -Access files from anywhere and work collaboratively.

- Project management tools -Organize tasks, track progress, and communicate effectively.

- Communication platforms -Stay connected with colleagues and clients efficiently.

Embrace Learning And Continuous Improvement

- Seek feedback -Identify areas for improvement and learn from mistakes.

- Explore new technologies and methods -Stay updated on advancements that can boost your efficiency.

- Challenge yourself -Step outside your comfort zone and try new things.

Personalize Your Approach

- Identify your most productive time of day -Schedule demanding tasks accordingly.

- Understand your working style -Introverts might prefer focused solo work, while extroverts might thrive in collaborative environments.

- Listen to your body -Take breaks when needed and prioritize your well-being.

Maximizing convenience and efficiency is a continuous process. Experiment, adapt, and find what works best for you to achieve your goals and live a more fulfilling life.

Consider These Context-specific Suggestions

- Traveling -Utilize mobile apps for navigation, translation, and bookings. Pack light and efficiently.

- Shopping -Create shopping lists, compare prices online, and leverage online grocery delivery options.

- Cooking -Plan meals for the week, prep ingredients in advance, and utilize multi-tasking cooking techniques.

- Exercise -Choose convenient workout routines, find an accountability partner, and track your progress for motivation.

By combining these general tips with specific strategies tailored to your needs, you can unlock a more convenient and efficient way of living.

How Long Does It Take To Transfer Money From DasherDirect?

The transfer time from DasherDirect depends on various factors, including the destination and the chosen method:

Within DasherDirect

- Instant Pay to DasherDirect card -Transfers are immediate after each dash with no fees.

- Transfer to a linked bank account -Typically free and takes 1-3 business days.

External Transfers

- Peer-to-peer services -Usually instant or within a few minutes, but might involve fees.

- Cashback at stores -Depends on store processing times, usually available immediately.

Factors Influencing Transfer Time

- Holidays and weekends -Transfers initiated on weekends or holidays might be processed on the next business day.

- Bank processing times -Each bank has its own internal processing times that can impact transfer speed.

- Technical issues -Occasional technical glitches on platforms might delay transfers.

Pro Tip:

- Check the specific timeframe within the platform or app you're using for transferring funds.

- Consider the urgency and any associated fees when choosing a transfer method.

FAQ's About How To Get Money Off Dasher Direct Virtual Card?

Can I Use Virtual Card At ATM?

Yes, the virtual card allows you to withdraw cash from ATMs that support contactless use. You will need a digital wallet (e.g. Apple Pay, Google Pay) and second, a virtual card PIN code, which you will find on the LHV mobile app or internet bank.

Does DoorDash Pay Daily?

Drivers delivering with DoorDash are paid weekly via a secured direct deposit to their personal bank account, or via no-fee daily deposits with DasherDirect (U.S. Only). Dashers in the U.S. and Canada can withdraw their earnings once daily with Fast Pay ($1.99 per transfer)

How Do I Cash Out Dasher Earnings?

Payments are transferred directly to your bank account through Direct Deposit and usually take 2-3 days to show up in your bank account, so payments will appear by Wednesday night. Fast Pay allows Dashers to cash out their earnings daily for a small fee of $1.99.

Conclusion

Accessing and withdrawing funds from your Dasher Direct Virtual Card is a straightforward process designed to provide flexibility and convenience for Dashers. By activating your card through the app and navigating to the 'Earnings' section, you gain instant control over your earnings. Whether you opt for standard transfers to your linked bank account or leverage the Instant Pay feature for immediate access, Dasher Direct Virtual Card empowers you to manage your finances on your terms.

Remember, staying informed about the various features and functionalities offered within the Dasher app ensures a smooth experience, allowing you to effortlessly access your hard-earned money whenever you need it. Embrace the simplicity and efficiency of the Dasher Direct Virtual Card to maximize your earnings and streamline your financial management as a Dasher.

Jump to

7 Easy Ways To Get Money Off Dasher Direct Virtual Card

DasherDirect Transfer Limits

Can I Transfer Money From My Virtual DasherDirect Card To My Bank Account?

How Do I Remove My Card From DoorDash?

Can I Instantly Cash Out On Dasher?

How To Transfer Money From DasherDirect Virtual Card To Cash App?

Maximizing Convenience And Efficiency

How Long Does It Take To Transfer Money From DasherDirect?

FAQ's About How To Get Money Off Dasher Direct Virtual Card?

Conclusion

Camilo Wood

Author

Emmanuella Shea

Reviewer

Latest Articles

Popular Articles