How To Avoid Capital Gains Tax On Real Estate? Strategies For Real Estate Investors

Unlock the secrets on how to avoid capital gains tax on real estate. Expert strategies for tax-efficient property transactions.

Author:James PierceReviewer:Camilo WoodJan 25, 20248 Shares7.5K Views

Real estate investments can be lucrative, but the specter of capital gains tax often looms large when it comes time to sell. However, with careful planning and strategic approaches, it's possible to minimize or even avoid capital gains tax on your real estate transactions. So,how to avoid capital gains tax on real estate?

But, first what is capital gains tax? Have a look:

What Is Capital Gains Tax?

When you sell an asset or investment, you may be required to pay capital gains tax on the profit you made. It is computed by deducting any incurred costs and the asset's initial cost or purchase price (referred to as the "tax basis") from the sale price.

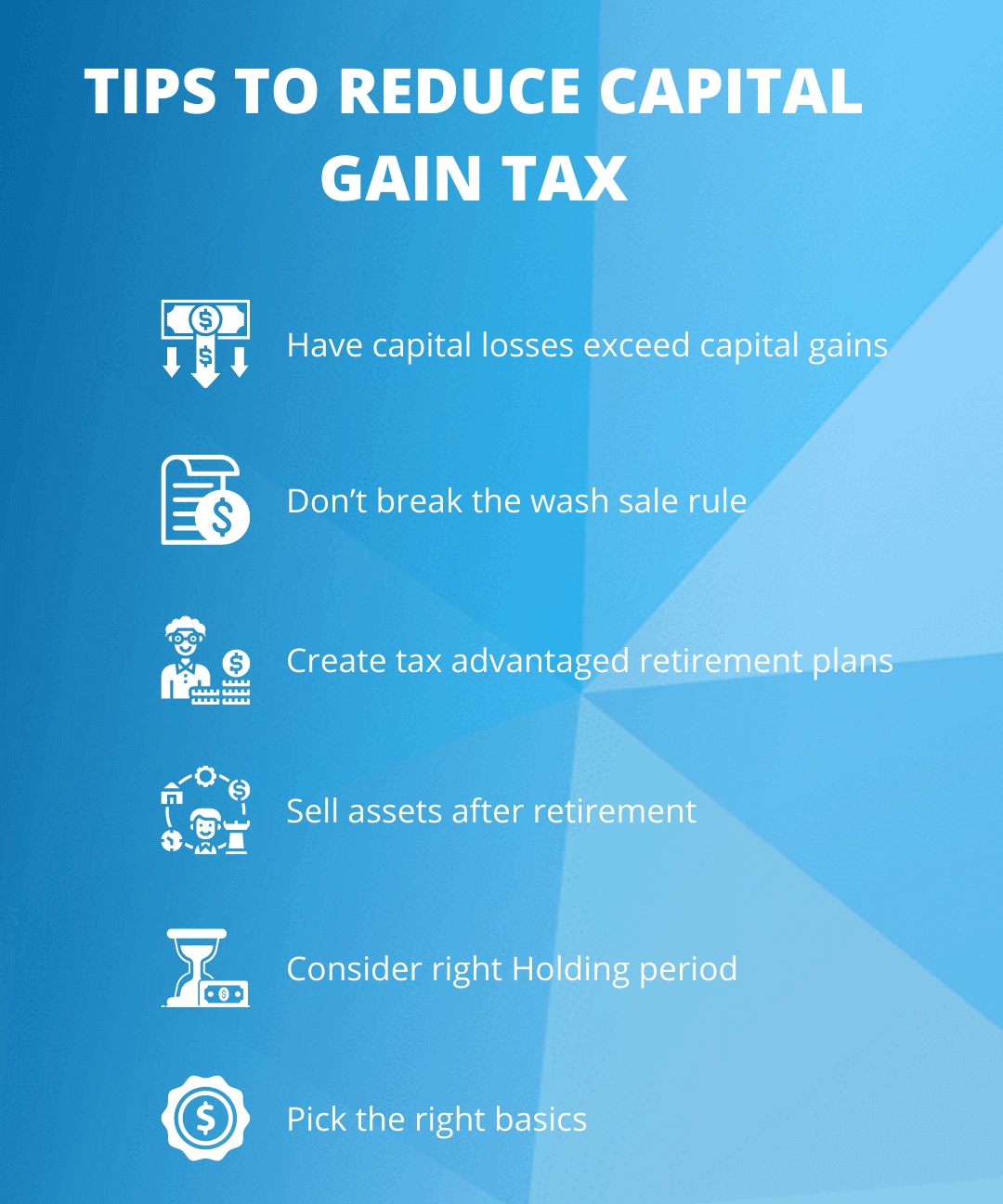

Long-term capital gains on assets held for more than a year are subject to special rates. Depending on your income, the long-term capital gains tax rates are 15 percent, 20 percent, or 28 percent (for specific asset classes, such as collectible small business shares).

Residential real estate is included in the category of taxable assets. Any profits you receive from selling your house have to be reported to the IRS: When you file your taxes for the year you sold the property, you compute any amounts owed and make the necessary payments.

Even though capital gains tax rates are generally lower than regular income tax rates, they can still pile up, particularly on earnings from expensive commodities like homes, which are often the largest single assets in a person's life.

The worth of your property and any changes in value are directly related to the capital gains tax. You might have a significant taxable gain if your home significantly increased in value after you purchased it and you realized this appreciation when you sold it.

How Do Real Estate Capital Gains Taxes Work?

If you sell a house for more money than you originally bought for it, you might have to pay capital gains taxon the difference. The good news is that an IRS regulation allowing you to exclude a certain amount of the gain from your taxable income helps many people avoid paying capital gains tax when they sell their principal residence.

Those who are eligible for the capital gain exclusion on house sales may generally exclude:

- Capital gains of $250,000 if you're single.

- $500,000 in capital gains if filing jointly as a married couple.

However, you must be aware of the regulations if you wish to benefit from the capital gains tax exemption on house sales. Certain property types are not eligible, and you may not be able to take advantage of the exclusion due to specific ownership conditions.

Here's a detailed guide on how to avoid capital gains tax on real estate:

Primary Residence Exemption

The primary residence exemption stands as a cornerstone for individuals seeking to navigate the complexities of capital gains tax on real estate. This provision offers a pathway to potentially exclude a significant portion of capital gains from the sale of one's primary residence. To qualify for this exemption, certain ownership and occupancy requirements must be met.

When considering the primary residence exemption, it's essential to understand the criteria that define a property as a primary residence. Generally, this involves the property serving as the homeowner's main dwelling. Additionally, there are stipulations related to the length of ownership and the duration of occupancy.

Many jurisdictions provide a favorable tax treatment for capital gains realized from the sale of a primary residence. This tax benefit is often extended up to a certain threshold of capital gains. For instance, a predetermined amount of the gains may be exempt for single filers, with a higher limit for married couples filing jointly.

The ownership requirement typically mandates that the homeowner has owned the property for a minimum period, often specified in years. Simultaneously, the occupancy requirement usually dictates that the property must have been the primary residence for a significant portion of the ownership period.

1031 Exchange

An investor can exchange investment real estate held for investment purposes for other investment real estate under IRS Code Section 1031 with no immediate tax penalty. No gain or loss is recorded until the newly acquired property is sold under Section 1031 if you exchange business or investment property exclusively for business or investment property of a like type.

For a 1031 exchange to be valid, the replacement property must be of a like-kind, a term that is broadly interpreted for real estate transactions. This opens the door for flexibility, enabling investors to diversify their real estate portfolios without triggering an immediate tax obligation.

However, engaging in a 1031 exchange requires strict adherence to specific timelines. Within 45 days of selling the initial property, the investor must identify potential replacement properties. Subsequently, the acquisition of the replacement property must be completed within 180 days from the initial sale. Failure to meet these deadlines can jeopardize the tax-deferred status of the exchange.

The 1031 exchange is a powerful strategy for those aiming to leverage gains from one real estate investment into another without incurring an immediate tax burden. This approach allows investors to maintain and potentially increase their capital for further real estate ventures.

Capital Gains Exclusion For Special Circumstances

Beyond the conventional avenues of tax mitigation, some jurisdictions offer capital gains exclusion for specific circumstances, providing relief to individuals facing unique challenges. This exemption acknowledges that certain life events or unforeseen circumstances may warrant special consideration in the realm of capital gains taxation.

One common category within this provision involves health-related circumstances. If the sale of a property is prompted by health concerns, some jurisdictions may provide a partial or complete exclusion from capital gains tax. This recognizes the financial impact that health-related decisions can have on individuals and allows for a measure of relief.

Similarly, unforeseen circumstances such as natural disasters, property damage, or changes in the surrounding neighborhood may also trigger special consideration for capital gains tax. In these instances, jurisdictions recognize that external factors beyond the property owner's control can necessitate a sale.

Holding For The Long Term

Opting for a long-term investment strategy is a key consideration for individuals looking to mitigate capital gains tax on real estate transactions. The duration for which a property is held can significantly impact the tax implications, with long-term ownership often resulting in more favorable outcomes.

Long-term capital gains, those generated from the sale of an asset held for more than a year, typically benefit from lower tax rates compared to short-term gains. Governments incentivize long-term investment by providing reduced tax liability, recognizing the value of fostering stability and sustained growth in the real estate market.

Investors should be cognizant of the specific holding period required to qualify for long-term capital gains treatment in their jurisdiction. Meeting this holding requirement is essential for unlocking the tax advantages associated with long-term investments. It's important to note that the exact duration may vary, and staying informed about local regulations is crucial.

Offset Gains With Losses

Offsetting capital gains with losses from other investments is a strategic approach employed by savvy investors to minimize their overall tax liability. This practice, known as tax-loss harvesting, involves selling investments that have incurred losses to counterbalance the gains realized from the sale of real estate.

When executing tax-loss harvesting, investors should carefully consider the timing of their transactions. Selling underperforming investments to offset gains requires a deliberate approach to optimize the tax benefits. Additionally, it's crucial to adhere to tax regulations and guidelines to ensure compliance with the law.

By strategically pairing capital losses with gains, investors can effectively reduce their taxable income, resulting in a lower overall tax burden. This approach is particularly valuable for those facing substantial capital gains from real estate transactions, providing a means to achieve a more favorable tax outcome.

Qualified Opportunity Zones

Qualified Opportunity Zones (QOZs) present a unique and innovative strategy for investors seeking to defer and potentially reduce capital gains tax on real estate. These designated zones, often in economically distressed areas, offer tax incentives to encourage investment and revitalization.

Investors can defer capital gains by reinvesting the proceeds from the sale of a property into a Qualified Opportunity Fund (QOF) within a specific timeframe. This reinvestment allows the investor to defer the capital gains tax until the investment in the QOF is sold or until the end of the deferral period, whichever comes first.

Moreover, if the investment in the QOF is held for a certain duration, additional tax benefits may apply. For instance, a percentage of the deferred gains may be permanently excluded if the investment is held for at least five years. This exclusion percentage increases for investments held over seven and ten years.

Use Of Home Sale Exclusion

The use of the home sale exclusion is a strategic approach for individuals seeking to minimize or eliminate capital gains tax on the sale of their primary residence. This provision, often available in various jurisdictions, allows homeowners to exclude a portion of the capital gains realized from the sale of their home, thus reducing the taxable amount.

To qualify for the home sale exclusion, homeowners typically need to meet specific criteria related to ownership and occupancy. The property must have served as the individual's primary residence for a specified period, and certain ownership requirements must be fulfilled. Understanding and satisfying these criteria are crucial steps in leveraging the benefits of the home sale exclusion.

One of the key advantages of the home sale exclusion is its potential to shield a significant amount of capital gains from taxation. The exclusion amount varies by jurisdiction and can be subject to limitations based on factors such as filing status. Homeowners should stay informed about the current exclusion limits applicable in their region.

Gift Or Inheritance

The transfer of real estate through gift or inheritance introduces another avenue for individuals to navigate capital gains tax implications. While gifting a property does not eliminate potential tax obligations entirely, it can alter the timing and responsibility for paying capital gains tax.

When a property is gifted, the recipient generally assumes the donor's original cost basis. This means that if the property has appreciated significantly since the donor acquired it, the recipient could face substantial capital gains tax upon selling the property. However, the advantage lies in the potential for the recipient to further increase the property's cost basis by holding onto it for an extended period.

On the other hand, inheriting a property often involves a stepped-up cost basis. In this scenario, the property's value is adjusted to its market value at the time of the original owner's death. This stepped-up basis can significantly reduce the potential capital gains tax liability if the inheritor decides to sell the property.

It's crucial for individuals involved in property transfers through gift or inheritance to understand the tax implications and plan accordingly. Seeking professional advice can help navigate the complexities of these transactions, ensuring compliance with tax regulations and optimizing the financial outcomes for all parties involved.

Installment Sale

The installment sale strategy is a creative approach that allows property sellers to spread out the recognition of capital gains over multiple years, potentially reducing the immediate tax impact. In an installment sale, the seller receives the sale proceeds in installments over time, rather than as a lump sum at the time of the sale.

This method can be particularly advantageous for sellers who may benefit from being taxed at lower rates over several years or for those aiming to minimize their overall taxable income. However, it's important to note that installment sales must adhere to specific regulations and guidelines to qualify for this favorable treatment.

The installment sale process involves the buyer making periodic payments to the seller, which may include principal and interest. The seller only recognizes a portion of the gain corresponding to the payments received in a given tax year. This deferral of capital gains recognition allows the seller to potentially optimize their tax situation.

FAQs How To Avoid Capital Gains Tax On Real Estate

What Is The Primary Residence Exemption, And How Can It Help In Avoiding Capital Gains Tax On Real Estate?

The primary residence exemption is a provision that allows homeowners to exclude a certain amount of capital gains from the sale of their primary residence. To qualify, there are ownership and occupancy requirements.

Are There Capital Gains Exclusions For Special Circumstances, And What Are Some Examples Of These Circumstances?

Some jurisdictions offer capital gains exclusions for health-related issues or unforeseen circumstances. These may include exemptions for situations such as a change in health or unexpected events affecting the property.

How Does Holding A Property For The Long-Term Impact Capital Gains Tax Rates?

Holding a property for an extended period may qualify for long-term capital gains rates, which are often more favorable than short-term rates. The specific holding period required varies by jurisdiction.

Why Is It Important To Consult With A Tax Professional When Dealing With Capital Gains Tax On Real Estate?

The tax implications of real estate transactions are complex and vary based on individual circumstances. Consulting with a tax professional who specializes in real estate ensures personalized advice tailored to the specific situation.

Conclusion

How to avoid capital gains tax on real estate? Avoiding or minimizing capital gains tax on real estate requires careful consideration of the available strategies and an understanding of the tax laws in your jurisdiction.

Each individual's situation is unique, so it's crucial to consult with professionals who can provide guidance based on your specific circumstances. By employing these strategies and staying informed about tax regulations, you can optimize the financial outcomes of your real estate investments.

Jump to

What Is Capital Gains Tax?

How Do Real Estate Capital Gains Taxes Work?

Primary Residence Exemption

1031 Exchange

Capital Gains Exclusion For Special Circumstances

Holding For The Long Term

Offset Gains With Losses

Qualified Opportunity Zones

Use Of Home Sale Exclusion

Gift Or Inheritance

Installment Sale

FAQs How To Avoid Capital Gains Tax On Real Estate

Conclusion

James Pierce

Author

Camilo Wood

Reviewer

Latest Articles

Popular Articles