How To Apply For Reseller Permit In Washington State In 2023

How to apply for reseller permit in Washington State is a straightforward process, but it requires some essential steps to ensure that your business operates within the law.

Author:James PierceReviewer:Camilo WoodNov 07, 20231.6K Shares109.2K Views

How to apply for reseller permit in Washington Stateis a straightforward process, but it requires some essential steps to ensure that your business operates within the law.

In this comprehensive guide, we will walk you through the process, from understanding the difference between a Sales Tax ID and a Reseller Permit to obtaining your Reseller Permit online.

By the end of this guide, you'll have the knowledge and tools necessary to acquire your Reseller Permit with ease.

What Is Reseller Permit?

Many wholesalers and retailers avoid paying state sales tax to manufacturers and distributors when purchasing goods to resale. Sales tax is still paid, but it is passed along to the buyer in the form of a surcharge added to the final purchase price. The shop will subsequently remit the collected sales tax to Washington State's Department of Revenue.

In the state of Washington, for instance, a resale certificate may be used to avoid paying sales tax when buying a wide range of art materials for resale. When an individual buys art materials for resale, they will be subject to sales tax. The cost of the art materials is then adjusted upward by the store to account for sales tax.

At the end of each month, the craft supply business totals up all of the sales tax from that month. After each month ends, the shop sends the government its share of the sales tax collected during that time period. While the retailer still acts as a middleman by collecting and remitting the tax to the state, the onus of paying sales tax is essentially transferred to the retail consumer.

The certificate is used to prove that sales tax was not collected on a particular transaction. A resale certificate is the same as a wholesale license, reseller's license, seller's permission, exemption certificate, or resale number. To make a tax-free purchase, the vendor must see a valid resale certificate proving the buyer plans to resell the item.

Items needed in the daily running of a company, such as paper, pens, etc., are not exempt from sales tax and therefore not be purchased under the sales tax exemption.

Criteria For Reseller Permit

- Business Licenses in Washington:The initial step involves ensuring that your business has the necessary licenses to operate legally in Washington.

- Endorsements:Specific endorsements relevant to your business type and activities may be required to complement the reseller permit.

- Labor and Industry’s Contractor's License (if applicable):In cases where your business activities align with contracting work, possessing the Labor and Industry's contractor's license is a prerequisite.

Reseller permits usually come with a standard validity period of four years, providing businesses with an extended window of tax exemption. However, exceptions apply, and the permit's validity is shortened to two years if any of the following conditions are met:

- You operate as a contractor.

- Your business is less than 12 months old.

- Your business hasn't reported gross income over the past 12 months.

- Your business was designated as "active non-reporting" at the time of permit application.

- Your business has failed to fulfill tax return obligations during the preceding 12 months.

Expiration of the reseller permit is a matter that requires vigilance. If your business's permit is not set for automatic renewal, you will be notified to apply for a new permit approximately 90 days before the existing one expires. This grace period ensures that businesses can maintain their operations without any interruptions.

If your business holds a reseller permit, it comes with the responsibility of ensuring its appropriate use. The permit is a valuable tool, but it must be wielded correctly. Here's a guide to using a reseller permit effectively:

Reseller Permit For Buyers

- Stay on Course:When utilizing your reseller permit, make sure to purchase only those items that you intend to resell within your business operations. It's essential that these items are destined for resale in the regular course of your business activities. When you eventually sell these items to consumers, you're required to collect both Washington state and local sales tax and subsequently remit that tax to the Department.

- Specific Guidelines for Your Industry:Depending on your specific industry, there may be nuanced rules and regulations governing the use of reseller permits. For industry-specific instructions and details, you can refer to the relevant Industry guides.

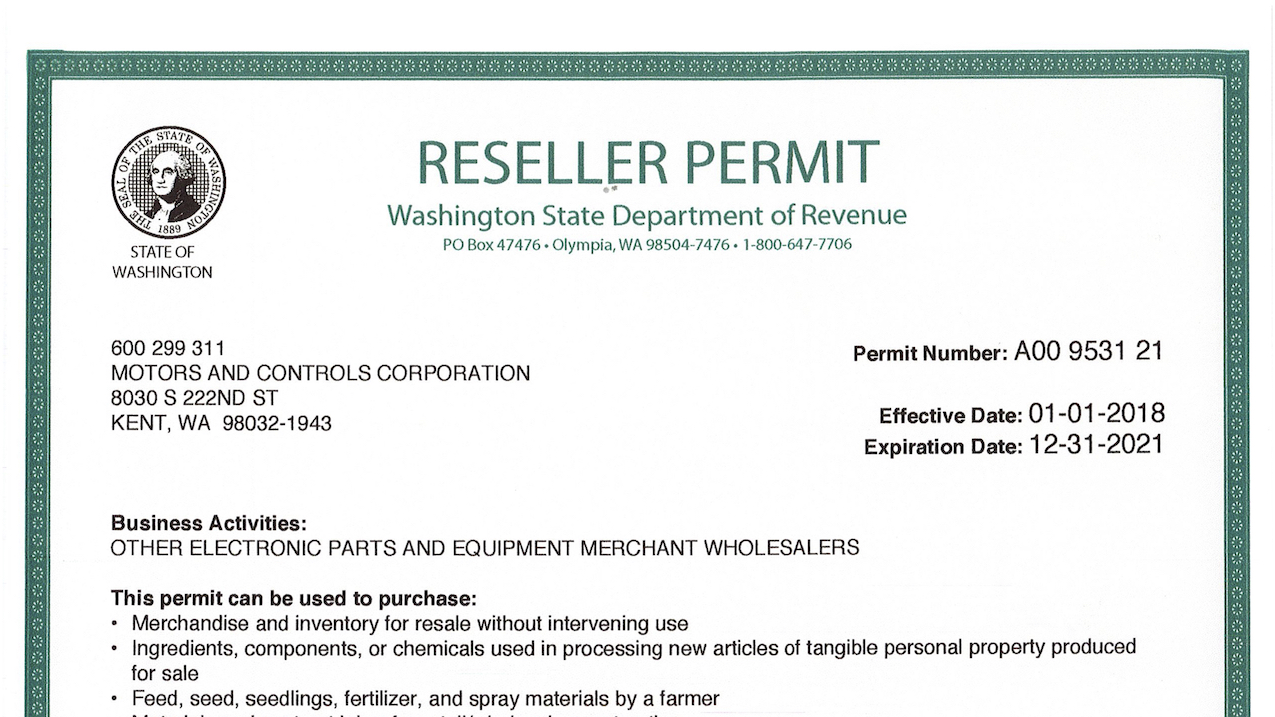

What Reseller Permits May Be Used For

Reseller permits can be effectively used for procuring the following:

- Merchandise and Inventory:You're permitted to purchase merchandise and inventory for resale without the requirement that these items be used by you first.

- Ingredients, Components, or Chemicals:These can be purchased for use in the process of creating new products for sale.

- Agricultural Supplies:If you're a farmer, you may employ the reseller permit to buy feed, seed, seedlings, fertilizer, and spray materials.

- Construction-Related Materials and Labor:When engaging in retail or wholesale construction activities, reseller permits can be utilized for obtaining materials and contract labor.

Watch Out For Reseller Permit Misuse

However, there are strict prohibitions in place. Businesses are not allowed to use reseller permits for:

- Personal or Household Use:It's strictly off-limits to use the permit for personal or household purposes.

- Giveaways:You can't employ the permit to acquire items meant for giveaways.

- Supplies and Equipment:Items like supplies and equipment, even if they're used in the business, are not eligible for purchase with a reseller permit.

- Tools or Equipment:Unless your business is directly involved in reselling or renting these items, they are excluded.

- Materials and Contract Labor for Certain Contracts:For public road construction or U.S. government contracting, the permit cannot be used.

- Equipment Rentals:Reseller permits do not cover equipment rentals.

The consequences of reseller permit misuse are severe, resulting in penalties for the buyer. In cases of inappropriate use, even if no fraudulent intent is found, a 50 percent penalty is imposed, and the outstanding tax must be paid.

What To Do Without A Reseller Permit

If you are purchasing goods for resale and do not possess a reseller permit or your permit has expired, you have two primary options:

- Pay Sales Tax Initially:Pay the applicable sales tax on your purchases and subsequently claim a Taxable Amount for Tax Paid at Source deduction when reporting the sale of those specific items on your tax return.

- Request a Direct Refund:Pay sales tax on your purchases and then seek a refund directly from the Department.

Reseller Permit For Sellers

Sellers engaged in wholesale transactions must obtain a valid reseller permit or equivalent documentation from customers who make purchases without paying retail sales tax.

It is essential for sellers to maintain proper documentation for all wholesale sales, retaining records for a minimum of 5 years from the date of sale. You also have up to 120 days from the sale date to collect this documentation.

During audits, you will be required to present documentation to support your wholesale sales. The options for documentation include:

- A Copy of the Reseller Permit:Retain a copy of the customer's reseller permit for your records.

- Business Lookup Tool:You can utilize the Business Lookup Tool to obtain a printout of the customer's information. This tool is useful for looking up individual business records.

- Reseller Permit Verification Service:The Reseller Permit Verification Service is a free tool for searching and exporting multiple records to maintain accurate records.

Additionally, sellers have the option to accept other approved exemption certificates from customers. To be considered valid, these certificates must be correctly completed and signed by the customer.

However, if a buyer does not possess a valid reseller permit or approved exemption certificate, you are obliged to collect and remit the required sales tax.

Refusal Rights

It's important to note that sellers have the right to refuse to make tax-exempt sales if there are reasonable grounds to suspect the misuse of a reseller permit or if the permit is expired or otherwise invalid.

We recommend verifying the reseller permit information of your customers at least once a year to ensure continued compliance and adherence to the rules and regulations governing the use of these permits.

Properly utilizing and managing reseller permits is essential for smooth business operations and regulatory adherence.

How To Apply For Reseller Permit In Washington State

Starting a business in Washington often requires obtaining a Washington Sales Tax Number from the Washington Department of Revenue. This Sales Tax Number, sometimes known as a seller's permit, sales tax number, or sales tax license, is crucial for businesses that intend to sell taxable products or provide taxable services within the state.

Is A Reseller Permit The Same As A Sales Tax ID?

While the terms "Sales Tax ID Number" (sales tax permit or seller's permit) and "Reseller Permit" are often used interchangeably, they serve different purposes. The Sales Tax Number grants a business the authority to sell products and services subject to sales tax and collect the required taxes. On the other hand, a Reseller Permit enables a retailer to make tax-exempt purchases for items they plan to resell.

Steps To Acquire A Reseller Permit

Secure a Sales Tax Number - Before obtaining a Reseller Permit, you need to have a valid Sales Tax Number. To get one, visit the Washington Department of Revenue's website.

- Access the Department of Revenue Services Page- Log in to dor.wa.gov. Navigate to the Department of Revenue Services page.

- Request Your Reseller Permit- On the Department of Revenue Services page, locate the option to "Print your reseller permit." Proceed by selecting your business on the "Select Customer" page.

- Confirm Your Account- On the "Select Account" page, choose your excise tax account. Confirm your selection.

- Print or Download Your Reseller Permit- In the "Active Permit" table, you will find the "Print Permit" link. Click on it to open a new browser window displaying your reseller permit.

You can use the browser's menu to either print a hard copy or download a PDF version of the reseller permit.

Maintain And Utilize Your Reseller Permit

Remember that a Reseller Permit allows your business to make tax-exempt purchases for resale. Ensure that you adhere to the rules and regulations governing its use. Any misuse of the permit could lead to penalties and potential revocation.

As your business grows and evolves, it's essential to keep your information up to date with the Washington Department of Revenue. Renew your permits as needed and make sure you understand your responsibilities when using this valuable document.

Frequently Asked Questions

How Do I Start The Process Of Applying For A Reseller Permit In Washington State?

To begin the application process for a reseller permit in Washington State, you can visit the Washington State Department of Revenue's website. There, you'll find detailed instructions and the necessary forms to get started.

What Documents Are Required When Applying For A Reseller Permit In Washington State?

When applying for a reseller permit in Washington State, you typically need to provide your Social Security Number or federal employer identification number, a detailed description of your business activities, and information about your business structure, among other details. Be sure to check the specific requirements outlined by the Department of Revenue.

Is There A Fee For Obtaining A Reseller Permit In Washington State?

There is generally no fee for obtaining a reseller permit in Washington State. However, some endorsements or additional permits related to your business may have associated fees. It's advisable to review the Department of Revenue's guidelines for any potential costs.

How Long Does It Take To Receive A Reseller Permit Once The Application Is Submitted In Washington State?

The processing time for a reseller permit application in Washington State can vary. Typically, it takes a few weeks for the Department of Revenue to review your application and issue the permit. However, this timeframe may be influenced by factors like the volume of applications and the accuracy of the information provided.

Are There Any Specific Regulations Or Requirements For Reseller Permits In Washington State?

Yes, Washington State has specific regulations and requirements for reseller permits. These requirements can include maintaining accurate records of your sales, collecting and remitting sales tax, and ensuring that your business activities align with the purpose of the permit. Familiarize yourself with the state's guidelines to stay compliant.

Final Words

How to apply for reseller permit in Washington State is a fundamental step for businesses looking to streamline their operations and save on costs.

By distinguishing between a Sales Tax ID and a Reseller Permit and following the simple online application process, you can obtain your Reseller Permit efficiently.

With your permit in hand, you'll be able to make tax-exempt purchases for resale, contributing to the growth and success of your business.

James Pierce

Author

Camilo Wood

Reviewer

Latest Articles

Popular Articles