How Many Times Can You Get A VA Loan? Unlocking Opportunities

Explore how many times can you get a va loan with our comprehensive guide.Get expert insights and make informed decisions on your home financing journey.

Author:James PierceReviewer:Camilo WoodJan 08, 202411 Shares10.7K Views

Discover how many times can you get a va loanto achieve your homeownership goals. This crucial query how many times can you use the va loan delves into the intricacies of eligibility and the potential for multiple VA loan applications.

As veterans and active-duty service members seek to make the most of this exceptional benefit, understanding the parameters governing loan frequency becomes paramount.

In this exploration, we unravel the nuances surrounding the repetition of VA loans, providing clarity and empowering individuals to navigate the real estate landscape confidently.

What Is VA Loan?

A VA loan, or Veterans Affairs loan, is a mortgage option exclusively available to active-duty military personnel, veterans, and eligible surviving spouses. Administered by the U.S. Department of Veterans Affairs, this program aims to facilitate homebuying for those who have served in the armed forces.

VA loans offer several compelling advantages, including competitive interest rates, no requirement for a down payment in many cases, and the absence of private mortgage insurance.

These loans are designed to make homeownership more accessible for veterans by providing favorable terms and conditions. The VA loan program reflects a gesture of appreciation and support for the sacrifices made by military members, offering a path to secure housing and financial stability as they transition to civilian life or seek to enhance their living arrangements.

One of the greatest methods to locate you and your family a new home is with a government-backed VA loan that requires no down payment.

How Does A VA Loan Work?

A VA loan operates as a mortgage program designed to assist active-duty military personnel, veterans, and eligible surviving spouses in achieving homeownership. Administered by the U.S. Department of Veterans Affairs, VA loans have distinctive features that set them apart from conventional mortgages.

The fundamental mechanism involves the VA guaranteeing a portion of the loan, which significantly reduces the risk for lenders. This guarantee empowers veterans and service members to secure favorable terms, including lower interest rates and the potential for no down payment, making homeownership more attainable.

To acquire a VA loan, eligible individuals must obtain a Certificate of Eligibility (COE) from the VA, demonstrating their entitlement to the program. Borrowers then work with approved lenders, who facilitate the loan process.

One key aspect is the absence of private mortgage insurance (PMI), which contributes to cost savings for the borrower. VA loans can be used for various types of homes, from single-family residences to condominiums.

In essence, a VA loan simplifies the homebuying process for military-affiliated individuals by providing financial benefits and minimizing barriers, fostering a pathway to homeownership that aligns with their service to the nation.

Eligibility Requirements For VA Mortgages

VA mortgages, designed to support military personnel and veterans in achieving homeownership, come with specific criteria that applicants must meet to qualify for this valuable benefit. Understanding these primary requirements is crucial for those considering a VA mortgage.

Military Service Eligibility

The foundational criterion for a VA mortgage is the applicant's military service. Typically, veterans with a minimum of 90 consecutive days of active service during wartime or 181 days of active service during peacetime qualify. National Guard and Reserve members may also be eligible after six years of service.

Certificate Of Eligibility (COE)

To apply for a VA mortgage, individuals must obtain a Certificate of Eligibility (COE) from the U.S. Department of Veterans Affairs. This official document verifies the applicant's military service and establishes their entitlement to VA home loan benefits.

Creditworthiness And Financial Stability

While VA loans often have more lenient credit score requirements compared to conventional mortgages, lenders still assess the applicant's creditworthiness. A stable income, manageable debt-to-income ratio, and a demonstrated ability to meet financial obligations are crucial factors.

Property Requirements

VA mortgages are intended for primary residences, and the property being financed must meet the VA's minimum property requirements (MPRs). These standards ensure the safety, soundness, and adequacy of the home being purchased.

Navigating these primary criteria for VA mortgages empowers potential homebuyers with the knowledge needed to access the benefits and support offered by this unique mortgage program.

Benefits Of A VA Mortgage Loan

Embarking on the path to homeownership as a veteran, active-duty military member, or eligible surviving spouse brings forth a powerful ally: the VA mortgage loan. Tailored to honor and support those who have served our nation, this specialized home financing option comes laden with a multitude of benefits. Understanding the distinct advantages associated with VA mortgages is paramount for individuals seeking a cost-effective and accessible pathway to owning a home.

Zero Down Payment Requirement

One of the hallmark benefits of a VA mortgage is the absence of a mandatory down payment in many cases. Traditionally, down payments can be substantial hurdles for prospective homebuyers, often requiring significant savings. However, with a VA loan, eligible borrowers can secure financing without this upfront expense, presenting a remarkable opportunity to break down barriers to homeownership.

Competitive Interest Rates

VA loans frequently feature competitive interest rates, a testament to the government's guarantee of a portion of the loan. These rates are set to be appealing and competitive in the market, offering qualified borrowers a financial advantage over conventional mortgage options. The long-term impact of lower interest rates translates into substantial savings over the life of the loan, contributing to the overall affordability of homeownership.

No Private Mortgage Insurance (PMI)

Unlike many conventional loans, VA mortgages do not necessitate private mortgage insurance (PMI). This financial perk eliminates an additional monthly cost, as borrowers are not burdened with insurance premiums typically required when a down payment is less than 20%. The exclusion of PMI results in more manageable monthly payments, further enhancing the affordability of a VA loan.

Flexible Credit Requirements

While maintaining good credit remains essential, VA loans often exhibit more flexibility regarding credit score requirements compared to conventional mortgages. This flexibility acknowledges the unique financial situations that veterans may encounter during or after their military service. The emphasis is on evaluating the overall financial stability and ability to meet mortgage obligations rather than solely relying on a specific credit score threshold.

Streamlined Refinancing Options

VA loans provide a streamlined refinancing option through the Interest Rate Reduction Refinance Loan (IRRRL) program. This initiative facilitates the refinancing of an existing VA loan to secure more favorable terms, such as a lower interest rate. What sets IRRRL apart is its efficiency; the process requires minimal documentation, making it an accessible avenue for borrowers looking to enhance the terms of their mortgage.

Foreclosure Avoidance Support

In recognition of the potential financial challenges faced by individuals, the VA offers dedicated assistance to help borrowers avoid foreclosure. This proactive measure underscores the commitment to supporting veterans and their families in maintaining stable homeownership, reinforcing the long-term sustainability of VA-backed loans.

How Many VA Loans Can You Have At One Time?

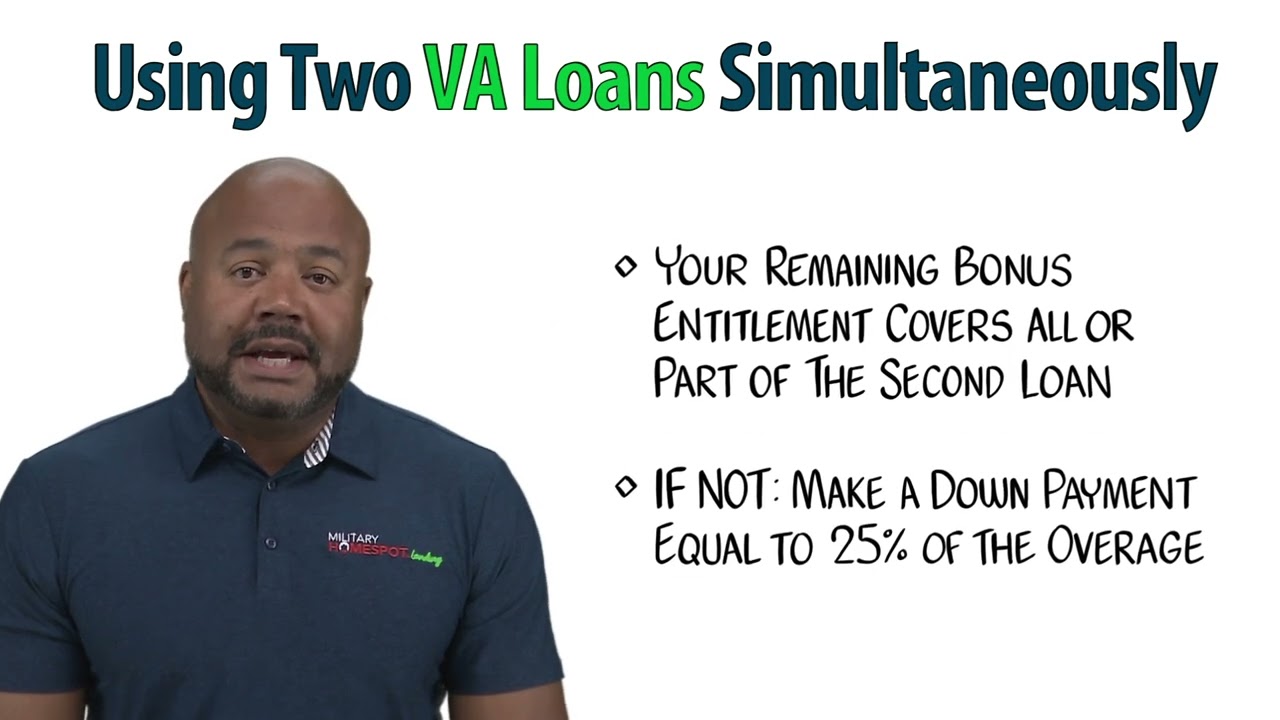

In general, you cannot take out more than two VA home loans at the same time since you must live or have lived in a residence to qualify for a VA loan. This can occur when selling one property to purchase another, or when keeping one home and purchasing another when assigned to a different military base. However, you cannot obtain a VA loan for an investment property that you do not live in.

When borrowing money to buy a second home, the amount owed on the first mortgage reduces your VA eligibility. In Phoenix, for example, the cap is $647,200. So, if your existing mortgage is $400,000, you might theoretically borrow up to $247,200 on your second house (the difference).

When it comes to a second VA loan, the total amount you can borrow between the two properties is still limited. If you require more than the VA home loan maximum, you might consider refinancing the first mortgage to a conventional loan and then using the VA loan for the second loan. If you pay off one VA loan and sell your home before taking out the next mortgage, you can acquire a seemingly infinite number of VA loans.

How Many Times Can You Use VA Loan?

The versatility of the VA loan program provides eligible veterans and service members with the opportunity to use this beneficial mortgage option multiple times. Unlike some other loan programs, there is no strict limitation on the number of times an individual can utilize a VA loan, making it a valuable resource for those who may move frequently or choose to refinance their homes.

The key factor influencing how many times can you use your va loan is the concept of entitlement. Each eligible individual is entitled to a certain amount of VA loan guaranty, which is a financial commitment from the Department of Veterans Affairs to repay a portion of the loan in the event of a default. Understanding how entitlement works is crucial in determining how often a person can leverage the VA loan benefit.

As long as a borrower has remaining entitlement and meets the eligibility criteria, they can use a VA loan for subsequent home purchases or refinancing. This flexibility allows veterans and service members to adapt their housing situations to their evolving needs without being constrained by limitations on the number of times they can access the advantages offered by the VA loan program.

So, you can ask this question how many times can I use a va loan? The answers is: You can use VA loan multiple times but only under certain conditions.

- Active-duty service personnel, qualifying veterans, and eligible surviving spouses can use their VA loan benefits as many times as they like during their lives.

- You can take out a VA loan as many times as you like if you can qualify with a lender and are still eligible.

- The most important aspect of knowing for future VA loan applications is entitlement.

- If you meet the program's service requirements and are a veteran or active service member, you are eligible for a VA loan.

Is It Difficult To Get A VA Loan?

An eligible veteran may typically get accepted for a VA loan and close in six weeks, which is comparable to a standard mortgage.

Pre-approval is one of the most important variables that can help you speed up the process and acquire the keys to your new house with fewer hiccups.

Pre-approval

Pre-approval for a VA mortgage, like pre-approval for a traditional mortgage, can save you time and increase your chances of purchasing a house with multiple bidders.

Furthermore, pre-approval distinguishes your offer to sellers and offers you a better understanding of what you can afford in the real estate market.

Pre-approval demonstrates to the seller that you have a competent lender ready to back up your house offer. If your offer is accepted, multiple stages toward loan approval have already been completed via the pre-approval process, saving you time during the loan processing process.

How Many Times Can You Get A Va Loan - FAQS

Is There A Limit To The Number Of VA Loans I Can Have Simultaneously?

VA loan limits often depend on your available entitlement and ability to meet lender requirements, allowing for flexibility in obtaining multiple loans.

Can I Reuse My VA Loan Benefit If I've Paid Off A Previous VA-backed Mortgage?

Yes, you can reuse your VA loan benefit, even if you've paid off a prior VA-backed mortgage, as long as you meet eligibility requirements.

Are There Restrictions On How Frequently I Can Apply For A VA Loan?

There are no specific time restrictions on applying for VA loans; however, meeting eligibility criteria is crucial for approval.

Is There A Waiting Period Between VA Loan Applications?

Generally, there is no specific waiting period between VA loan applications, but individual circumstances and lender requirements may vary.

Can I Use A VA Loan For An Investment Property More Than Once?

VA loans are intended for primary residences, but you can reuse the benefit if the property meets certain occupancy requirements.

Conclusion

The question how many times can you get a va loan involves a careful consideration of eligibility criteria and individual circumstances. The versatility of VA loans allows veterans and service members to explore homeownership repeatedly, fostering financial stability and fulfilling housing aspirations.

As you navigate this realm of mortgage options, armed with insights into the flexibility of VA loans, seize the opportunity to make informed decisions that align with your unique goals. Whether it's your first or subsequent venture into VA-backed homeownership, the support and benefits extended by this program continue to make it a valuable resource for those who have served our nation.

James Pierce

Author

Camilo Wood

Reviewer

Latest Articles

Popular Articles