How I Analyze A Royalty Exchange Investment

I've recently added music royalties to my financial portfolio, as I've previously blogged about. They are, in my opinion, an excellent way to broaden your horizons. I don't view them as a method to achieve high-yielding returns that aren't tied to other asset classes, but I do see them as a way to generate decent, consistent returns that aren't tied to other asset classes (primary stocks and real estate). Pause here for 5 minutes to read my article about music royalties if you haven't already. I'll be patient. This article of mine is about How I Analyze A Royalty Investment in a simple way.

Author:Emmanuella SheaReviewer:Frazer PughFeb 25, 202211.9K Shares543.2K Views

I've recently added music royalties to my financial portfolio, as I've previously blogged about. They are, in my opinion, an excellent way to broaden your horizons. I don't view them as a method to achieve high-yielding returns that aren't tied to other asset classes, but I do see them as a way to generate decent, consistent returns that aren't tied to other asset classes (primary stocks and real estate). Pause here for 5 minutes to read my article about music royalties if you haven't already. I'll be patient. This article of mine is about How I Analyze A Royalty Investmentin a simple way.

Before we get started, there are a couple disclaimers I'd like to make about royalty exchange:

- I'm not a certified public accountant. I'm not a financial advisor. Please conduct your own due diligence before making any investment.

- I've only been investing in music royalties for a few months, so I don't have years of personal experience or outcomes to draw on (but I've been doing everything I can to learn everything I can about this investment class).

- I believe in the KISS principle (Keep It Simple Stupid). I could easily complicate this, but because so many of the variables are unknown, the effort will yield diminishing results.

Let's get started about 'How I Analyze a Royalty Investment' now that's out of the way.

How Does Royalty Investment Work?

Royalty finance is a sort of investment in which the company receives money in exchange for future revenue. The money is returned to the investors in the form of royalties, which represent a percentage of the company's revenue. At the outset of the loan, the repayment conditions and the total amount owed are agreed upon.

Variables

Let's look at the factors that go into determining how much I'm willing to pay for a music royalty investment:

Purchase Price: This is simply the amount of the bid I'm looking at for the royalty I'm looking at.

Years Left: The amount of years I'll have ownership of this royalty. I just put in 10 years for royalties that are Life of Rights. Even while I'll continue to get royalty payments for Life of Rights after that 10-year term, it's hard to predict how big those payments will be.

First-Year Revenue Estimate: This is a best-guess estimate. I'll cut the latest 12 months of revenues by 2-10% if royalty has been earning stable royalties for several years. If the royalty hasn't been generating for a long time (less than three years), OR if the revenues are mostly driven by radio play rather than streaming (radio play declines after the first few years), OR if the prior royalty payments have been irregular, I may lower by up to 20%. If there's too much unpredictability for me to calculate a percentage that I'm comfortable with, then I'm out of this royalty.

Royalty Decline Percentage / Year: This is another gut call. If the royalty has been a consistent earner for a long time, I estimate a 2-10% annual drop. If the royalty has only been earning for three years or less, I'll increase it to ten percent to twenty percent. These figures correspond to my own analysis of royalties' performance, but your results may differ. Another important point to remember is that royalty payments are shifting in the future. Mechanical royalty pays are set to alter (rising 44 percent), and streaming services are gaining traction around the world. Having said that, it's always prudent to estimate conservatively.

Depreciation: Royalties can be depreciated over time, according to my accountant and everything I've read (including the IRS website). The general consensus appears to be 15 years, but I've also heard 10 years. However, please consult your own accountant! For my calculations, I'm assuming that I'll be able to deduct the royalty purchase amount over 15 years.

Tax Rate: The tax bracket you're in is referred to as your tax rate (if you are in the United States). This quantity is used to calculate the tax savings from depreciation, as well as the tax bill I'll have to pay if I don't depreciate everything.

Hypothetical Situation

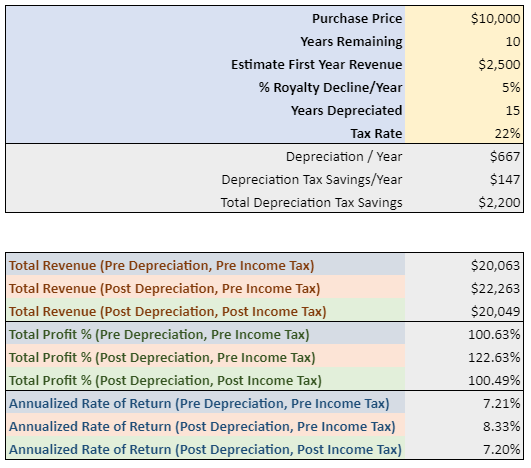

Let's start with a hypothetical example before moving on to real-world ones. This is the calculator I made and used for this study. Please feel free to download and use it as you see fit.

Assume the following for this example:

- Purchase costs are $10,000.

- The number of years left is ten.

- Revenue Estimated for the First Year: $2,500

- Royalty Decline Percentage / Year: 5%

- 15-year depreciation

- 22 percent tax rate

The payoff estimations look like this based on those variables-

As a result of our study, this investment is expected to return 7.2 percent per year over the next ten years (after tax). However, because most investments will tell you the return before you pay taxes, the 8.3 percent return is a better number to compare.

Keep in mind that this is an investment that will help you diversify your portfolio. The goal isn't to get gigantic, life-changing return percentages (but if you find any, please send them my way!). So an 8.3% return projection appeals to me greatly, and it's a deal I'd take every time.

Let's take a look at a real-world example from royalty on Royalty Exchange.

D-12 & Eminem Catalog Is A Real-Life Example

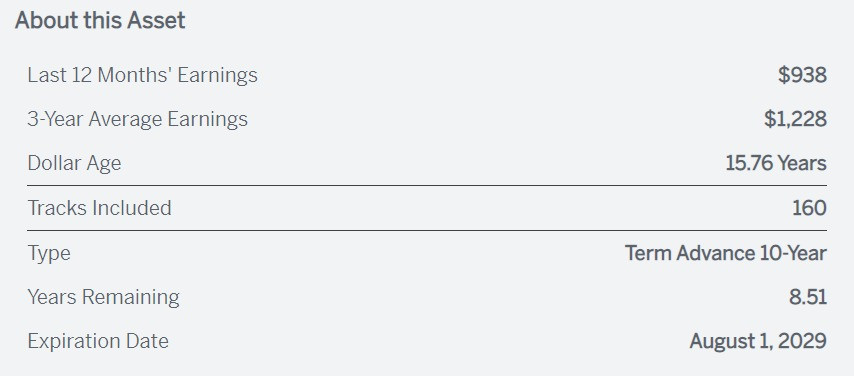

I'll look at a catalog from D-12 and Eminem that is presently up for auction.

(Here are some Royalty Exchange screen grabs for this deal that I'll utilize to influence my study.)

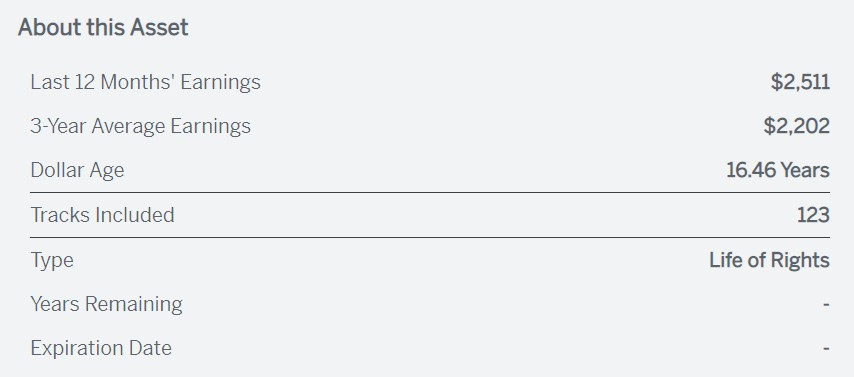

As you can see, this catalogue has been profitable for many years (15+). When compared to the three-year average, earnings appear to have dropped slightly over the last 12 months ($938 LTM vs. $1,228 3yr Ave).

Let's look into why that is.

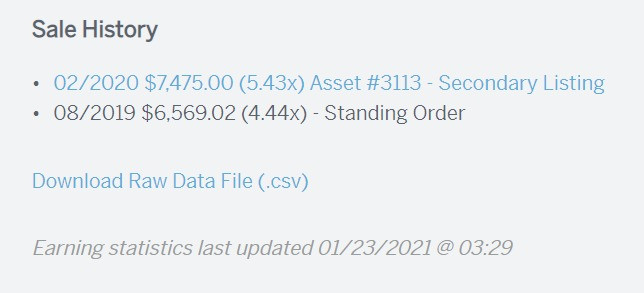

You'll find a section under Sale History where you can Download Raw Data File. This is where you'll find all of the information that feeds into the top-level graphs.

15-year depreciation

22 percent tax rate

The payoff estimations look like this based on those variables-

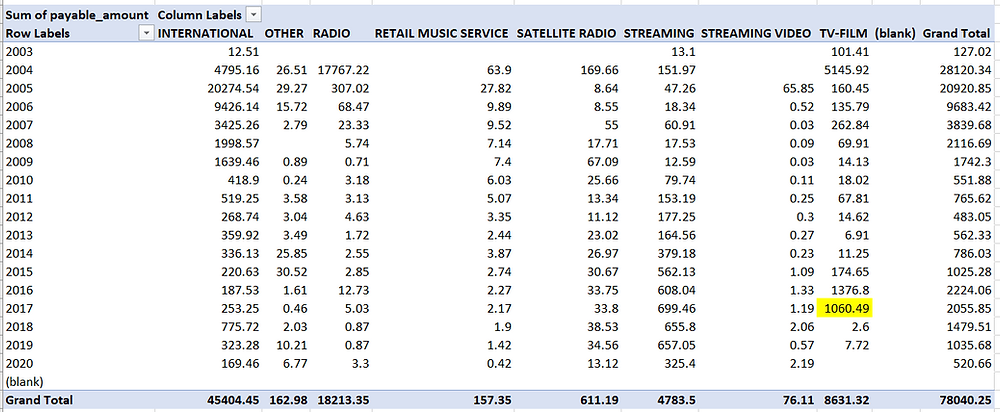

I downloaded the data, created a fast pivot table, and discovered the discrepancy. Some tracks from this repertoire appear to have been utilized in a television show in 2017. (you can go further into the details to see what shows etc., but not important for this analysis). This year's TV-Film royalties were $1,060, a considerable decrease from the previous year. The streaming numbers, as you can see, have stayed consistent over the last few years (note: 2020 data is only from 2 quarters).

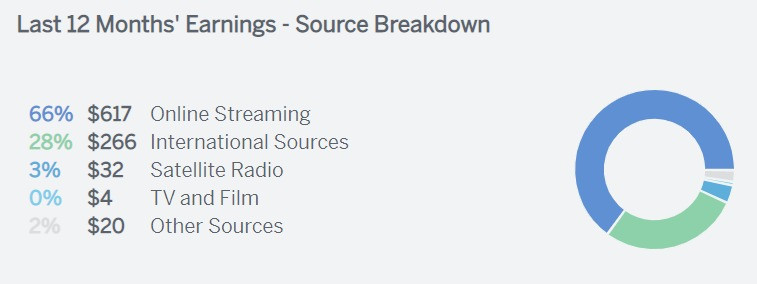

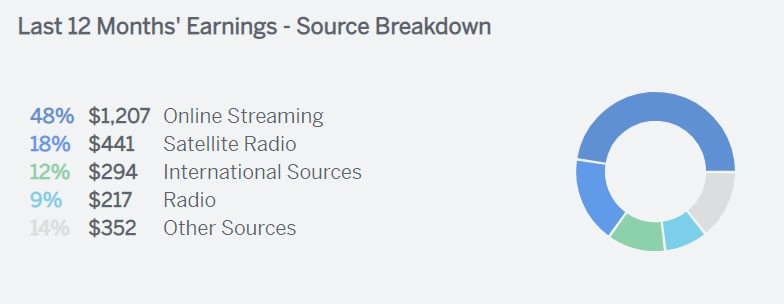

As you can see, Online Streaming has accounted for the majority of revenue over the last 12 months. International Sources tend to be a jumble of different things, making it difficult to pinpoint one source.

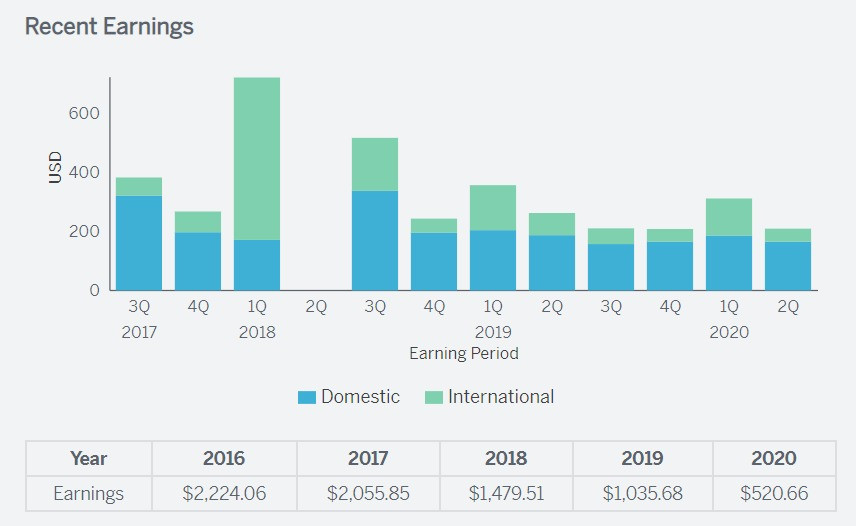

The large surge in the Q1 2018 payout from the TV-Film royalties from 2017 may be seen in the quarter-over-quarter results (generally royalties are paid out a couple of quarters after they were earned). I'm not sure about the gap in Q2 2018, but considering the surge in that quarter, royalties that would have been paid out then appear to have arrived in Q3 2018. However, it isn't very relevant to my analysis, so I'll move on.

So, here are my thoughts based on this information.

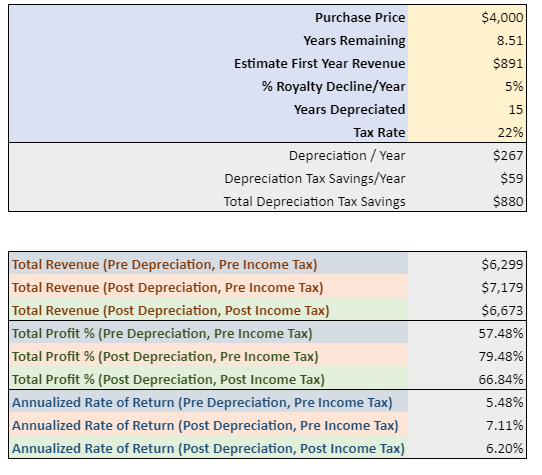

After removing the enormous TV-Film bump, this royalty appears to pay out rather reliably. The LTM earnings are $938. I'm confident in forecasting a 5% decrease in next year's dividend over the previous 12 months: As a result, I'm going to use $891.

Given the Dollar Age (the length of time the royalty has been paying out), I am certain that the royalty will continue to payout. I'm going to assume a 5% decline from the previous year.

So, based on those factors, I'd be perfectly happy with a $4000 offer. Over 8.5 years, this would yield a 7.1 percent estimated return (after depreciation but before income tax). That's not bad at all. Keep in mind that these returns are NOT GUARANTEEED in any way. However, I feel they provide a good starting point for evaluating the prospective return on this royalty.

Will the owner now accept a $4,000 offer? It doesn't appear to be promising, since there have already been two $5,200 offers that have been rejected. Finding the right match is part of the game.

Keep in mind that these aren't ventures in which you can get rich immediately. I simply use them to generate decent returns and diversify my portfolio away from the stock market and real estate (my other primary asset classes).

Let's have a look at another.

Actual Example 2-Tantric Catalog

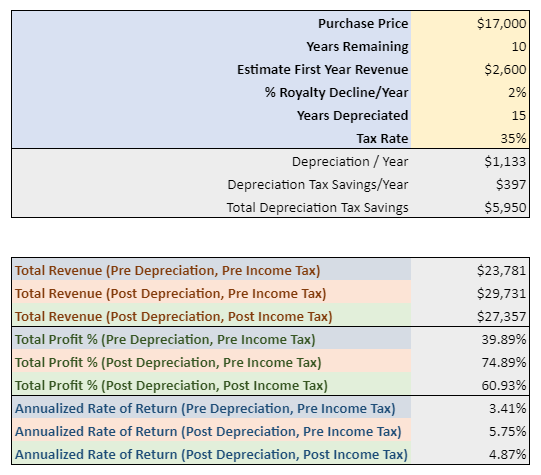

Here is the tantric catalog details, the ROCK band, in which the tax rate is adjusted to 35%.

The last 12 months' earnings-source breakdown is provided below.

Recent earnings graph is provided below.

This catalog appeals to me much. Strong income history that has actually increased over time, largely due to online streaming (after looking through the data file). This catalog has also been generating royalties for more than 16 years.

Here's a summary of the offers I put together for this:

Although the 5.75 percent pre-tax rate of return may not appear to be spectacular, keep in mind that this is a Life of Rights royalty. As a result, you'll continue to make money after the ten years depicted in this chart. Keep in mind that this proportion is only used as a starting point for studying the catalogue.

Conclusion

Finally, here are some answers to any questions you might have.

Will you become wealthy by investing in music royalties? Most likely not.

Is there any danger in investing in music royalties? Yes, of course.

Are the figures above fictitious? A hundred percent. However, I believe they aid in making well-informed investing decisions.

Will royalties be increased in the future? Yes, I think so. This asset class has a lot of upside potential in my opinion, but only time will tell. Allow your own due diligence to take effect here.

Should I invest everything I have in music royalties? There's no way! I presently have roughly 5% of my portfolio invested in royalties, and I sleep like a baby.

Conclusion

This is how I analyze a royalty investment. Is it enjoyable to invest in music royalty? It appeals to me greatly. Analyzing and trying to negotiate a bargain are two of my favorite things to do. It's also interesting to receive checks every three months and see how my investments are doing.

Will holding royalties improve my appearance? Unquestionably!

Emmanuella Shea

Author

Frazer Pugh

Reviewer

Latest Articles

Popular Articles