How A Biden Win Could Affect Your Paychecks? Dollars And Decisions

Explore the potential impact of how a biden win could affect your paychecks. Understand the economic policies and changes that might influence your financial situation under the new administration.

Author:Hajra ShannonReviewer:Paula M. GrahamDec 04, 2023598 Shares28.4K Views

As we delve into the potential consequences of how a Biden win could affect your paychecks, it becomes imperative to understand the economic policies and proposed changes that could shape the financial landscape. The outcome of a presidential election can have far-reaching effects on various aspects of our lives, including our finances. This exploration aims to provide insights into the intricate connections between political decisions and personal income, offering a comprehensive view of what a Biden victory might mean for your financial well-being.

Biden’s Policies For Student Loan Forgiveness

Understanding Biden's Economic Policies and Your Paychecks- It's no secret that millions of Americans are burdened by the $1.58 trillion-plus student loan issue. And the COVID-19 pandemic didn't help matters either. Biden, like other presidential candidates, ran on promises of student loan relief.

Even after being elected, Biden has reiterated his vow to cancel some student loan debt, even directing Education Secretary Miguel Cardona to investigate whether the president has the authority to cancel student loans. But then Biden abruptly changed course, shocking everyone by omitting student loan forgiveness from his 2022 budget. The plot thickens, indeed.

So, how a Biden win could affect your paychecks related to student loan debt? It's still a mystery, and we'll have to wait and watch how this one plays out during his presidency.

What we know about Biden's proposal - Just because he didn't include it in his budget for the year doesn't imply Biden has abandoned the notion entirely. We know Biden supported legislation enacted in the House last year that gave $10,000 in student loan forgiveness per borrower as part of a coronavirus relief bill. The bill, however, was not supported by the Republican-controlled Senate.

Despite the fact that Biden did not include student debt forgiveness in his budget, some Democratic leaders are urging him to cancel up to $50,000 per borrower and circumvent Congress by issuing an executive order. However, not everyone feels that the president has the authority to do so. And the Supreme Court will have a word in the matter as well.

The truth is that the government already has several student loan forgiveness programs, and none of them are particularly effective at actually forgiving loans.

Teacher Loan Forgiveness is a program meant to forgive up to $17,500 in federal student loans for teachers. However, the qualifications are stringent, including full-time teaching in low-income schools for five academic years.

To be eligible for the Public Service Loan Forgiveness program, you must work full-time for the government or a nonreligious nonprofit, be on an income-driven repayment plan, and demonstrate that you have made all of your student loan payments on schedule for the last ten years.

But who actually has their student loans forgiven? There aren't many people. Between November 2020 and April 2021, 98% of applicants for Public Student Loan Forgiveness were denied. That indicates that only two of every hundred applicants were granted for loan forgiveness. Yikes!

What is the moral of the story? If you're expecting your student loans to be forgiven, don't. You have two strong reasons not to rely on a government scheme to pay down your student loans. For one thing, there's no telling whether Biden's student loan debt forgiveness idea will ever become a reality. Second, even if it does, there is no way of knowing what the requirements will be or whether the plan will be effective.

Biden's Social Security And Retirement Account Policies

Yes, Biden wants to make changes to 401(k) plans and Social Security, but before we go into that, let's get one thing straight:

Do not let a change in White House administration drive you to make a costly mistake with your retirement savings strategy. Over the next four years, you'll hear a lot of predictions about how the economy and stock market will react to Biden's presidency, and none of them will be optimistic.

But here's the truth: with both Democratic and Republican presidents, the stock market has performed well and terribly. The same may be said for the overall economy.

The truth is that the individual who occupies the Oval Office has nothing to do with your retirement plan! Of course, that doesn't make for the same terrifying media headline, does it?

But it is correct. That's right, it's entirely up to you. So, continue to contribute to your 401(k) and Roth IRA, and don't cash them out "just in case." For a long-term investor like you, a four-year presidential term is merely a blip on the screen.

Okay, now that that's out of the way, let's speak about Biden's Social Security policies. First and foremost, Social Security is in jeopardy. Is there ever a time when it wasn't? The program's trust funds are scheduled to run out of money in around 15 years. Beneficiaries would only receive around 80% of what they are owed if this occurs.

Benefit Increases For Older Beneficiaries And Catch-up Contributions

Biden also wants to increase beneficiaries' benefits (say that three times fast) after they've been receiving Social Security for at least 20 years, allowing long-term retirees to keep more of their savings. He hasn't said how much that hike will be. So keep an eye out.

Biden also wants caregivers to be able to make catch-up contributions to their retirement plans, which would allow them to contribute more to their 401(k) than the annual maximum normally permits. At the moment, you must have an earned income to contribute to a retirement plan, and only people over the age of 50 can make catch-up contributions.

Based on bipartisan legislation introduced by Representatives Jackie Walorski and Harley Rouda, Biden's proposal would allow people who have been out of the workforce for at least a year to care for a family member and have no income to make tax-advantaged catch-up contributions to their retirement plans.

You don't invest for retirement because you get a tax break, credit or no credit. You invest for retirement because long-term investment in a company retirement plan, particularly one with a match, is the most effective strategy to accumulate wealth for retirement.

So, if you're debt-free and have a fully stocked emergency fund saved, it's time to commit to investing 15% of your income in retirement.

American Rescue Plan Act

The president's first significant piece of legislation was signed into law in March 2021, infusing $1.9 trillion into the US economy. It contained financial safety nets such as $1,400 payments to households earning up to $75,000, prolonged unemployment benefits, and a child tax credit extension.

According to the Brookings Institution, this reduced overall poverty by 44% and raised Americans' financial health to unprecedented heights. According to the Bureau of Economic Analysis, after correcting for inflation, household disposable income reached a record $20 trillion in the month when Biden's bill was adopted. Retailers ranging from Walmart (WMT.N) to Nordstrom (JWN.N) attributed the rebound in demand to the aid package.

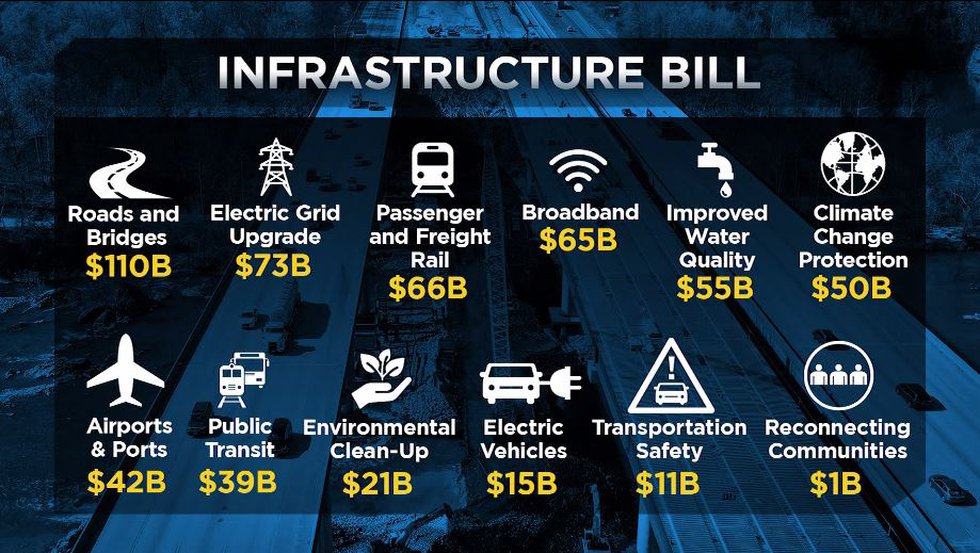

Infrastructure Investment And Jobs Act

Biden's $1 trillion plan was the next big spending package to be approved by Congress in November 2021. It delivered on the president's campaign promise to repair the country's roads and bridges while also increasing access to clean water and broadband internet. According to Moody's Analytics, it will support 600,000 new jobs by the end of next year and 800,000 jobs by 2025.

The bill benefits a few American industries, including tractor manufacturer Deere (DE.N) and construction equipment behemoth Caterpillar (CAT.N). Importantly, it would not have passed without the support of 19 Republicans in the Senate and 13 in the House, many of whom had previously attempted to enact an infrastructure package under Biden's predecessor, Donald Trump. Biden has a unique elasticity because of the unusual bipartisan victory.

The Chips Act

The approval of the "Chips and Science" plan allowed Biden to establish an industrial-policy legacy while also fulfilling a bipartisan desire to rely less on China's semiconductor industry. According to the Commerce Department, more than 460 companies have expressed interest in its $53 billion in research and development subsidies.

And the link between public and private investment is noteworthy. Micron Technology's (MU.O) $100 billion investment in a chip facility in New York is estimated to create nearly 50,000 employment in the state. The $20 billion expansion of Intel (INTC.O) in Arizona is planned to sustain 3,000 additional jobs.

Republicans, especially Senate Majority Leader Mitch McConnell, also played an important role in enacting the measure, so both parties are expected to emphasize their support on the campaign road. However, Biden will benefit from demonstrating successful bipartisanship.

Inflation Reduction Act

The most recent of the president's major spending packages lacks Republican backing. It provided Biden with an opportunity to resurrect progressive proposals before of the 2022 midterm elections. Though the final plan reduced new expenditure from $1.8 trillion to $430 billion, it retained Biden's proposals for clean energy tax incentives and Medicare drug price negotiations. According to Bank of America, it has already sparked $132 billion in investment in over 270 new sustainable energy projects.

Republican-leaning states are also reaping some of the highest gains. Texas has been granted $67 billion for the generation of clean energy. West Virginia, the state with the highest reliance on coal for energy, has approved almost $400 million in grants for wind, solar, and clean storage projects. This makes it more difficult for Republicans to attack the package.

The Labor Market

Americans between the ages of 25 and 54 are working at the greatest rate in two decades, and Biden has described himself as the most "pro-union president" in American history. The moniker will most certainly pay off. According to Gallup, two-thirds of Americans support unions, the highest level since the labor movement's peak in the 1960s.

However, the good news could turn sour in the next 12 months. Over the last year, job creation has generally slowed as high borrowing rates force businesses to scale down their expansion ambitions. The Federal Reserve anticipates that unemployment will rise to 4.1% from 3.8% next year, implying that 500,000 people would lose their jobs. The president's pro-union position could backfire as well. According to research firm RSM, the 40-day United Auto Workers strike likely hampered economic growth.

Housing

The president has taken several steps to increase the supply of homes in the United States, including raising investment in manufactured homes and lowering residential zoning obstacles. While the administration claims that its initiatives have resulted in the construction of "tens of thousands of affordable housing units," Realtor.com reported in March that the US is still short 6.5 million homes.

Republicans in Congress haven't done much either. Several legislative ideas, such as enabling residential construction on federally owned property, have stalled. Meanwhile, mortgage rates have risen to their highest level since 2000, and home development has slowed.

Inflation

Prices have risen as a result of all of the federal spending. Rapid inflation is almost certainly the single most important reason households are gloomy about the economy. It has compelled the Fed to raise interest rates at an unprecedented rate in order to battle inflation.

And, while annual inflation has fallen to 3.7% in September from a high of 9% in June 2022, the recovery is far from done. increased prices will create financial anguish, as will any future economic downturn driven by increased interest rates.

How A Biden Win Could Affect Your Paychecks - FAQs

How Might A Biden Win Impact Paychecks?

A Biden win could lead to changes in tax policies and economic initiatives that may affect individuals' paychecks.

What Specific Tax Changes Are Proposed Under A Biden Presidency That Could Influence Paychecks?

Biden has proposed adjustments to income tax rates, credits, and deductions, potentially altering the amount people take home in their paychecks.

Will A Biden Win Result In An Increase In The Minimum Wage, And How Could This Affect Paychecks?

Biden has expressed support for raising the minimum wage, which could positively impact the paychecks of low-wage workers.

How Might Changes In Healthcare Policies Under Biden Influence The Amount Deducted From Paychecks For Health Insurance?

Healthcare policies can impact paycheck deductions. Understanding Biden's proposals can provide insights into potential changes.

Are There Potential Stimulus Measures Discussed Under A Biden Administration That Could Affect Individual Paychecks?

Biden has discussed stimulus plans that could have implications for individual paychecks. Exploring these plans is essential for understanding potential effects.

Conclusion

In the ever-evolving realm of politics, the fact how a Biden win could affect your paychecks is a topic of significant interest and concern. As we conclude our examination of this subject, it's clear that the potential effects on personal income are nuanced and multifaceted. By staying informed and understanding the potential policy shifts, individuals can better navigate the economic landscape and make informed decisions about their financial future in the wake of a Biden victory.

Jump to

Biden’s Policies For Student Loan Forgiveness

Biden's Social Security And Retirement Account Policies

Benefit Increases For Older Beneficiaries And Catch-up Contributions

American Rescue Plan Act

Infrastructure Investment And Jobs Act

The Chips Act

Inflation Reduction Act

The Labor Market

Housing

Inflation

How A Biden Win Could Affect Your Paychecks - FAQs

Conclusion

Hajra Shannon

Author

Paula M. Graham

Reviewer

Latest Articles

Popular Articles