Genius Frugal Habits You've Never Heard Of - Unconventional Money Secrets

Discover genious frugal habits you've never heard of that go beyond the ordinary. Maximize your savings and financial savvy with these innovative tips and tricks.

Author:Habiba AshtonReviewer:Gordon DickersonJan 05, 20243.5K Shares79.6K Views

Uncover hidden gems of money-saving strategies with our guide to genius frugal habits you've never heard of.In a world where financial mindfulness is key, exploring ingenious frugal habits can be the game-changer you've been seeking. Our journey begins by delving into the realm of frugal living principles.

Beyond the conventional money-saving tips, we unlock a treasure trove of innovative daily frugal living strategies that have the power to redefine your relationship with finances. From inventive budgeting techniques to resourceful lifestyle adjustments, this exploration promises to open doors to a more economically empowered and fulfilling life.

Discover genius frugal habits that go beyond the ordinary, offering innovative ways to save money. From personalized budgeting apps to eco-friendly DIY solutions, these unheard-of habits redefine frugality. Explore strategies that not only cut costs but also add efficiency and sustainability to your financial journey, making every penny count in unexpected ways.

What Does Frugal Living Mean?

Frugal living is a lifestyle philosophy centered around conscious and intentional management of financial resources. At its core, frugal living is not about deprivation but rather about making thoughtful choices to maximize the value of every expenditure. In essence, it's a strategic approach to money that emphasizes efficiency, simplicity, and sustainability.

At the heart of frugal living is the idea of prioritizing needs over wants. Individuals practicing frugality carefully assess their spending, distinguishing between essential and discretionary expenses. This discernment allows them to allocate resources judiciously, ensuring that money is directed towards necessities and meaningful experiences rather than impulsive purchases.

Frugal living involves cultivating a mindset of mindful consumption. It encourages individuals to be aware of their financial habits, track expenses, and seek cost-effective alternatives. From meal planning and DIY projects to exploring second-hand markets, frugal living champions resourcefulness and creativity as tools for financial success.

Savings play a pivotal role in frugal living. Setting aside a portion of income for emergencies or future goals is a common practice, fostering financial security and resilience. Additionally, frugal individuals often seek ways to reduce waste, whether through repurposing items or embracing eco-friendly practices, aligning their lifestyle choices with sustainability.

Many people have inquired if frugal means cheap or stingy. No, it does not. Buying new shoes every other month because you don't want to spend more than $10 is an example of being frugal. Frugal is purchasing those $60 shoes but saving money by cooking at home.

Here are some of our finest frugal living recommendations to help you maintain money in your pocket and a debt-free future on the horizon.

Create A Realistic Budget

Creating a realistic budget is the foundational step towards effective financial management. Start by assessing your monthly income and categorizing fixed expenses such as rent or mortgage, utilities, and debt payments. Factor in variable expenses like groceries, transportation, and entertainment.

Be honest about your spending habits and identify areas where you can cut back without sacrificing necessities. A realistic budget should not only cover regular expenses but also allocate funds for savings, emergencies, and future goals. Regularly review and adjust your budget as circumstances change.

By establishing a clear financial roadmap, you gain control over your money, avoid unnecessary debt, and create a framework for achieving both short-term stability and long-term financial success.

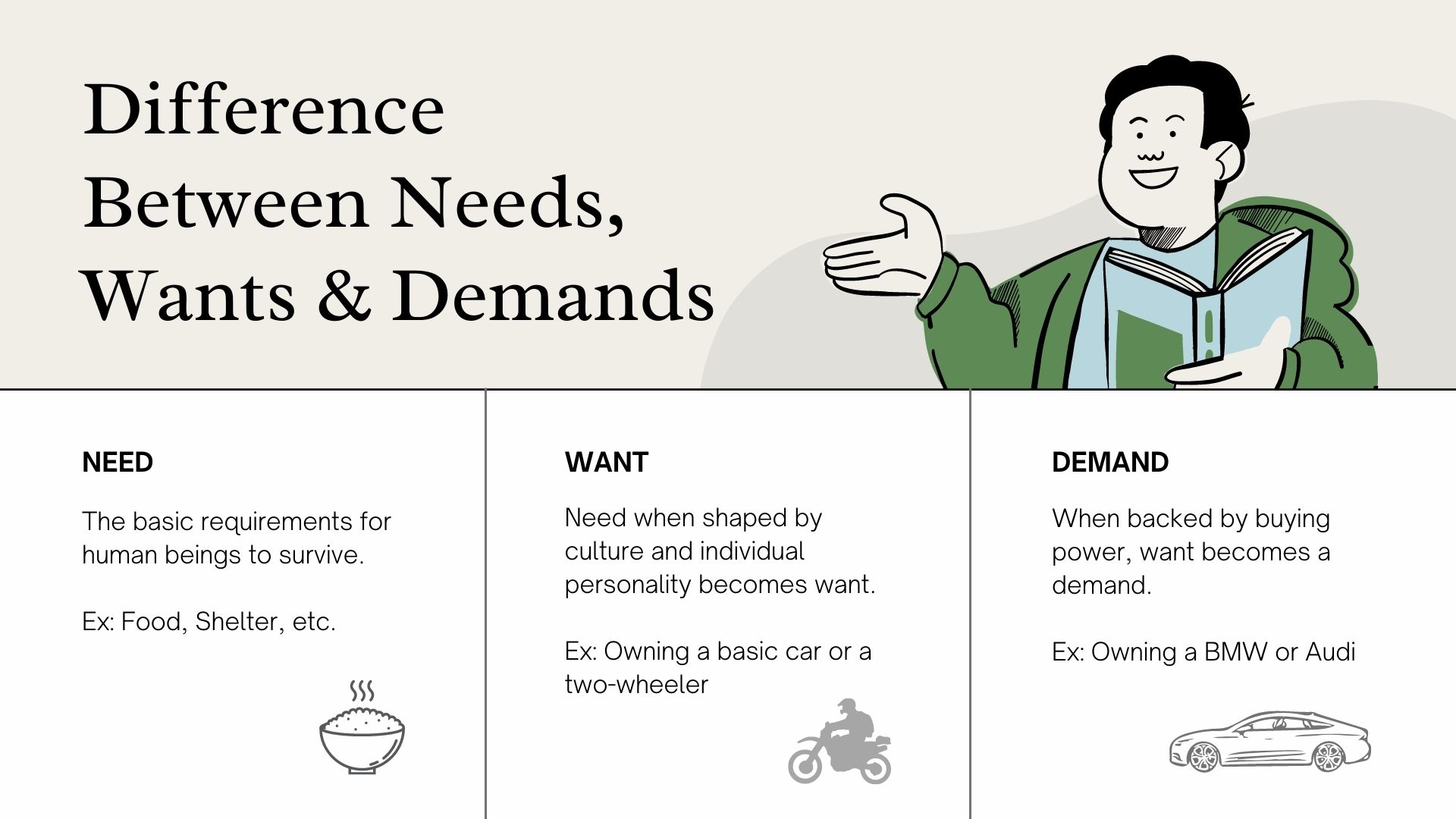

Differentiate Between Needs And Wants

Distinguishing between needs and wants is a fundamental principle in the journey towards financial mindfulness. Needs are essential for survival and well-being, encompassing necessities like housing, food, and healthcare.

Wants, on the other hand, are desires that enhance comfort or pleasure but aren't imperative for basic living. Frugal living involves a conscious effort to prioritize needs over wants, ensuring that financial resources are directed toward essential expenses first. This mindset shift encourages thoughtful spending, preventing impulsive purchases that can strain your budget.

By clearly delineating between needs and wants, you gain clarity in your financial decision-making, promoting a more intentional and sustainable approach to managing your resources. This simple yet powerful distinction is key to cultivating a frugal mindset and achieving financial stability.

Embrace Meal Planning And Cooking At Home

Embracing meal planning and cooking at home is a transformative frugal living strategy that redefines your relationship with food and finances. By dedicating time to planning your weekly meals, you not only gain control over your food expenses but also make healthier choices.

Create a menu, make a shopping list, and purchase ingredients in bulk to capitalize on discounts. Cooking at home not only saves money compared to dining out but also allows you to experiment with cost-effective yet nutritious recipes. This habit not only contributes to financial savings but also fosters a deeper connection to your food, promoting a healthier lifestyle.

As you make meal planning and cooking a regular practice, you'll discover the joy of preparing your meals, all while achieving significant savings and aligning with the core principles of frugal living.

Optimize Your Grocery Shopping

Optimizing your grocery shopping is a cornerstone of frugal living, where strategic choices can significantly impact your budget. Be proactive by seeking out sales, utilizing coupons, and considering generic brands for substantial savings without compromising quality. Buying in bulk for non-perishable items is a cost-effective approach, and embracing value over brand names ensures you get the most out of your budget.

As you navigate the aisles, focus on essentials and avoid impulsive purchases. The practice of optimizing grocery shopping extends beyond immediate savings, fostering a mindful approach to consumption and resource management. By incorporating these frugal habits into your grocery routine, you not only save money but also contribute to a more sustainable and intentional way of living.

Master The Art Of Smart Shopping

Mastering the art of smart shopping is a pivotal skill in the frugal living toolkit. It goes beyond mere purchases, emphasizing informed decision-making to stretch your budget effectively. Patiently wait for sales, compare prices online, and consider second-hand options for items like clothing and furniture.

Practice discernment in choosing quality over quantity, as investing in durable goods can lead to long-term savings. Smart shopping involves a mindset shift, cultivating an awareness of your needs and avoiding unnecessary expenses.

As you hone this skill, you not only save money but also contribute to a sustainable and intentional consumption pattern. By mastering the art of smart shopping, you empower yourself to make choices that align with your values, fostering a frugal lifestyle that prioritizes value and purpose over frivolous spending.

Cut Unnecessary Subscriptions

Cutting unnecessary subscriptions is a fundamental step in the frugal living journey, enabling you to streamline your expenses and allocate funds more intentionally. Review your monthly subscriptions, from streaming services to unused gym memberships, and assess their true value in your life.

Cancel or downgrade those that no longer align with your priorities, redirecting the saved money towards meaningful goals. This frugal habit not only simplifies your budget but also prompts a conscious evaluation of your lifestyle choices.

As you declutter unnecessary subscriptions, you gain financial clarity and flexibility, liberating resources for building an emergency fund, investing, or indulging in experiences that genuinely enhance your well-being. Cutting the excess ensures your financial resources are directed towards what truly matters, fostering a mindful and purposeful approach to managing your finances.

Prioritize Quality Over Quantity

Prioritizing quality over quantity is a fundamental principle in frugal living, emphasizing the value and longevity of your purchases. Rather than succumbing to the allure of mass-produced goods, focus on investing in durable and well-made items, even if they come with a higher upfront cost.

Quality purchases often outlast their cheaper counterparts, leading to long-term savings as replacements become less frequent. This mindset shift encourages thoughtful consumption, where each acquisition aligns with your needs and values. Prioritizing quality extends beyond material possessions, influencing lifestyle choices and fostering an appreciation for meaningful experiences over sheer accumulation.

By valuing craftsmanship and durability, you not only enhance your overall satisfaction but also contribute to a sustainable and frugal lifestyle that revolves around purposeful and enduring choices.

Embrace Energy Efficiency

Embracing energy efficiency is a practical and eco-conscious aspect of frugal living. Simple yet impactful habits, such as turning off lights when not in use and unplugging electronics, contribute to reduced utility bills. Investing in energy-efficient appliances and adopting environmentally friendly practices not only aligns with frugal living principles but also promotes sustainability.

Sealing drafts, optimizing thermostat settings, and incorporating renewable energy sources are additional steps that enhance energy efficiency, saving both money and valuable resources. This frugal habit not only lowers monthly expenses but also reduces your carbon footprint, reflecting a commitment to responsible and mindful living.

Embracing energy efficiency aligns with the core values of frugality, emphasizing not only financial prudence but also a broader awareness of resource conservation and environmental impact.

Build An Emergency Fund

Building an emergency fund is a cornerstone of frugal living, providing financial resilience in the face of unexpected challenges. Allocate a portion of your income to this fund, gradually accumulating a safety net equivalent to at least three to six months' worth of living expenses.

This prudent practice shields you from the financial strain of unforeseen events, such as medical emergencies or job loss, preventing the need for high-interest debt. An emergency fund instills peace of mind and empowers you to navigate life's uncertainties with confidence.

By prioritizing the creation of this financial buffer, you not only safeguard your financial well-being but also embody a key principle of frugal living — preparation and foresight in the pursuit of long-term financial stability.

Continuously Educate Yourself

Continuous education is a vital component of successful frugal living, empowering individuals to make informed financial decisions and adapt to evolving circumstances. Stay engaged with personal finance literature, and reputable blogs, and attend workshops or webinars.

By staying informed, you gain insights into innovative frugal strategies, investment opportunities, and money-saving techniques. The commitment to continuous learning fosters financial literacy, allowing you to navigate complex financial landscapes with confidence.

Whether it's understanding market trends or refining budgeting skills, the pursuit of knowledge equips you to make sound financial choices. Embracing a mindset of ongoing education is a testament to the dynamic nature of personal finance, reinforcing the core tenets of frugal living - mindfulness, adaptability, and a commitment to long-term financial well-being.

Does Frugal Mean Cheap?

While frugality and cheapness share a common thread of financial prudence, they diverge significantly in their underlying principles and implications. Frugality is a deliberate and mindful approach to managing resources, emphasizing efficiency, value, and thoughtful spending.

Frugal individuals prioritize quality over quantity, seeking to maximize the value of every expenditure by making informed and sustainable choices.

On the other hand, being cheap often conveys a connotation of excessive thriftiness without the same emphasis on value or long-term considerations. Cheapness may involve sacrificing quality, neglecting ethical considerations, or undermining the overall well-being for the sake of immediate cost savings.

Frugality, in essence, is about making wise and intentional decisions that align with one's values and financial goals. It is a strategic approach to living within one's means while maximizing value. Cheapness, however, may involve cutting corners at the expense of quality, sustainability, or ethical standards.

Genius Frugal Habits You've Never Heard Of - FAQs

How Can I Be More Frugal In My Daily Life?

Incorporate innovative frugal habits such as energy-saving practices, upcycling, and embracing a no-spend day to boost your financial resilience.

What's The Secret To Financial Empowerment Through Frugality?

The secret lies in adopting Genius Frugal Habits You've Never Heard Of, like negotiating bills, practicing mindful spending, and harnessing the power of delayed gratification.

Are There Unconventional Frugal Habits For Long-term Financial Success?

Yes, delve into long-term financial success with habits like investing in quality items, embracing a minimalist lifestyle, and building an emergency fund strategically.

Can Frugal Habits Positively Impact The Environment?

Absolutely! Uncover eco-friendly frugal habits, such as reducing waste, embracing second-hand shopping, and adopting sustainable practices, for a dual benefit to your wallet and the planet.

How Can I Make Frugality A Sustainable Lifestyle?

Sustainability in frugality involves developing habits like continuous learning about personal finance, adapting to changing circumstances, and maintaining a balanced approach to financial decisions for the long term.

Conclusion

This expedition into the world of genius frugal habits you've never heard of dawns that financial wisdom goes hand in hand with creativity and resourcefulness. Each uncovered habit is not merely a cost-cutting measure but a step towards financial liberation.

By incorporating these unheard-of strategies into your daily life, you not only save money but also gain a newfound sense of control and freedom. Let these ingenious frugal habits be the catalyst for a brighter, more prosperous future, where financial well-being is not just a goal but a sustainable way of life.

Jump to

What Does Frugal Living Mean?

Create A Realistic Budget

Differentiate Between Needs And Wants

Embrace Meal Planning And Cooking At Home

Optimize Your Grocery Shopping

Master The Art Of Smart Shopping

Cut Unnecessary Subscriptions

Prioritize Quality Over Quantity

Embrace Energy Efficiency

Build An Emergency Fund

Continuously Educate Yourself

Does Frugal Mean Cheap?

Genius Frugal Habits You've Never Heard Of - FAQs

Conclusion

Habiba Ashton

Author

Gordon Dickerson

Reviewer

Latest Articles

Popular Articles