Unveiling The Unstoppable Freelance Market Growth - From Gig To Glory

Stay ahead in the evolving world of freelancing with our in-depth analysis of freelance market growth. Uncover key trends, insights, and strategies shaping the flourishing freelance economy.

Author:James PierceReviewer:Camilo WoodJan 18, 202439 Shares39.2K Views

In the ever-evolving realm of work, the freelance market growthstands as a testament to the transformative power of independent careers. As technology continues to reshape traditional employment paradigms, freelancing has surged, creating a dynamic landscape of opportunities.

This article invites you to delve into the intricacies of this burgeoning sector, exploring the factors propelling its expansion, from technological advancements to changing work preferences.

Freelance Market Growth Statistics

How big is the freelance market? The market is divided into platforms and services based on component. The platform category is further divided into talent-based, hybrid, project-based, and solution-based categories.

Over the course of the projection period, the solution-based segment is expected to grow at a significant rate. Platforms for independent contractors that focus on solutions offer services or solutions to certain issues.

These platforms are used by freelancers to advertise their services, and clients utilize highly qualified freelancers to find specific solutions or services. Gigster, Toptal, Fiverr, and other applications are examples of solution-based freelance marketplaces.

According to Fiverr's fifth annual report on the economic impact of freelancing, published in May 2022, US freelancers made over USD 247 billion in 2021. Research indicates that there will be approximately 73.3 million independent contractors in the US by 2023.

Over the course of the projection period, the project-based segment is anticipated to increase at a notable rate. Platforms for freelancers working on projects include Freelancer, Guru, Upwork, and others. In project-based freelancing, a business engages a freelancer for a set amount of time to finish a particular project that must be finished on time. The segment's growth is further aided by the growing number of freelancers.

Segment Analysis Of Applications

Trends in freelancing market is divided into several segments based on the type of application, including project management, web and graphic design, sales and marketing, and IT.

Because of the e-commerce sector's explosive growth, the web and graphic design industry is anticipated to increase at a significant compound annual growth rate (CAGR) during the forecast period. The need for new web and graphic designers has been generated by the expanding e-commerce industry, which is driving the segment's expansion.

For the e-commerce websites, graphic designers are recruited to create many adverts and new portfolios. Furthermore, the quick development of digital communication has simplified the process of freelancers corresponding with clients worldwide. It is projected that the project management industry would grow quickly throughout the course of the projection period.

Due to their expertise in a variety of projects, independent project managers are in greater demand, which is expanding the market. Additionally, as the gig economy, also known as the freelance economy, grows, so does the number of freelance workers, which stimulates the market.

Analysis Of End Users

The market is divided into three categories based on the end-user: freelancers, small and medium-sized businesses, and major corporations. Throughout the forecast period, the big enterprise category is anticipated to have a significant share of the market. Large businesses are in great need of specialized expertise and projects.

The majority of huge businesses these days are concentrating on the expansion of their clients due to the advent of freelance technology. Studies reveal that almost 57% of respondents said they had made more connections with larger businesses. therefore encouraging the expansion of the segment.

Geographical Evaluation

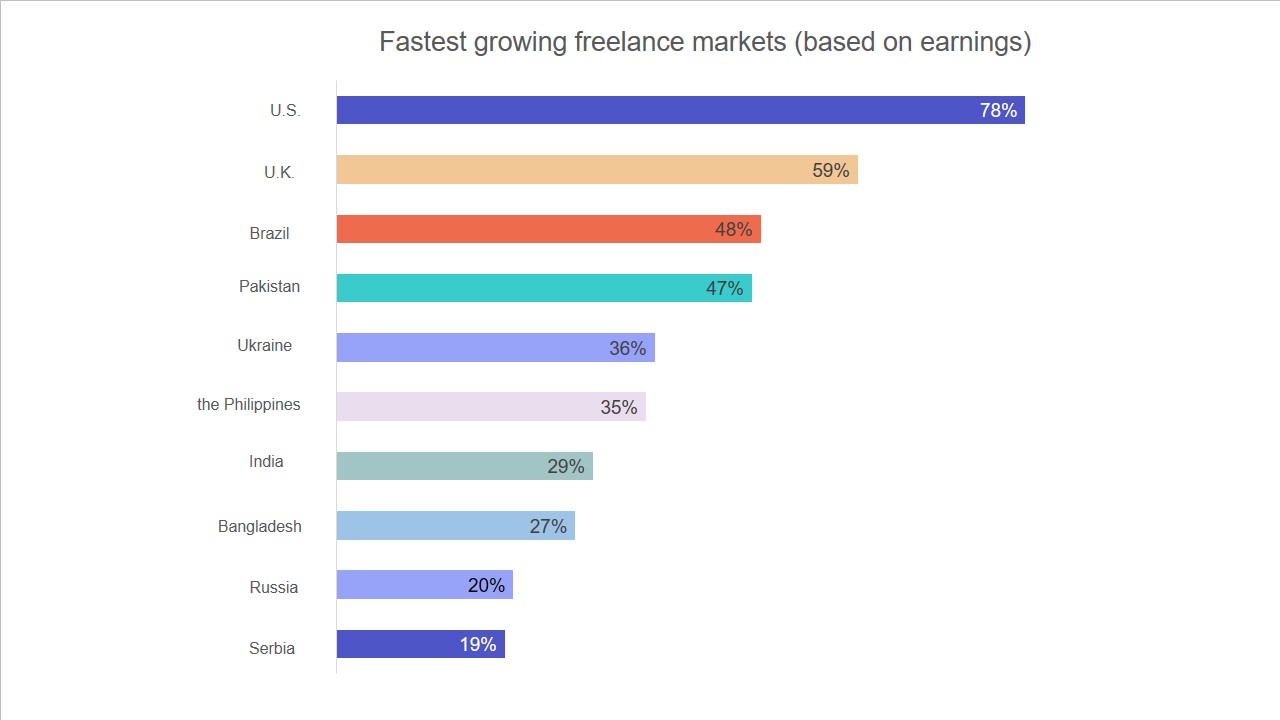

The markets for freelance platforms worldwide are divided into five regions: Asia Pacific, North America, Latin America, Europe, and the Middle East and Africa. Over the course of the forecast period, North America is anticipated to lead the market.

Over the course of the forecast period, North America is anticipated to lead the market. The notable advancements in corporate strategy and workplace culture are credited with the expansion of the regional market.

The emergence of freelance platforms in corporate work structures is causing a radical shift in the conventional methods of entering into long-term service contracts. Furthermore, a surge in the industry is anticipated with the introduction of new freelance platforms in the area.

The Mom Project, a community and digital talent marketplace, announced in October 2023 the introduction of SelfMade, a professional platform designed to assist mothers in building their brands and beginning their businesses. With the help of SelfMade, mothers may launch enterprises centered around their professional knowledge and abilities, allowing them to better balance the demands of their families and careers.

Competitive Environment

The study on the competitive landscape of the worldwide freelancing platforms market offers significant insights into the development initiatives and growth strategies put in place by the major market competitors.

TaskRabbit, Inc., DeeLance Labs LTD, crowdSPRING, LLC, WorkGenius, Expert360, Upwork® Global Inc., Freelancer Technology Pty Limited, Envato Elements Pty Ltd., Fiverr International Ltd., Guru.com, Nexxt, Inc., DesignContest LLC, People Per Hour Ltd., Dribbble, WriterAccess, Toptal, LLC, 99designs, DesignCrowd, Skyword, Inc., Bark.com Global Limited., Gigster LLC., and WorkMarket, Inc. are major competitors in the global freelance platforms market.

To increase its consumer base and market share, these large corporations use a variety of business development techniques, such as partnerships, acquisitions, product launches, and increased manufacturing capacity.

Gigster, a digital transformation and innovation company, unveiled three new service options in March 2023 that aim to help businesses expedite their workflows by leveraging data via artificial intelligence. The new services come with experienced development teams and tested procedures. This is carried out in accordance with the client's level of AI maturity and current business needs.

The first completely decentralized freelance network in the world, DeeLance, unveiled its Web3-based platform in March 2023 with the goal of revolutionizing the way independent contractors and possible employers interact.

Fiverr International Ltd., an international supplier of an online marketplace for freelance services with its headquarters located in Tel Aviv-Yafo, Israel, purchased Stoke Talent, a platform provider that helps businesses manage freelance talent, for USD 95 million in November 2021. With this transaction, corporate workflows for managing offline and online freelance marketplaces will be integrated in a comprehensive way.

Artificial Intelligence Effect On The Market For Freelance Platforms

The market is greatly impacted by artificial intelligence since it helps independent contractors obtain information by utilizing the new resources that AI provides. Because AI automates tasks and saves time, over half of independent contractors utilize it for research. To compete with Google, Microsoft, for example, integrated ChatGPT into the Bing search engine. Google has responded to this by introducing Bard, an AI chatbot designed to find answers quickly and professionally.

A study conducted by the American cloud computing corporation Citrix found that approximately 89% of senior professionals anticipate that new technologies will increase organizational efficiency by 2035.

Nonetheless, a few independent contractors think that in the upcoming years, artificial intelligence will pose a challenge to the industry. According to a survey, half of independent contractors think AI could eventually take the place of work, while the remaining half say AI helps them and will likely provide more benefits soon.

The COVID-19 epidemic had a detrimental impact on the market for freelance platforms, according to market research. The pandemic caused a number of firms to collapse, which reduced the hiring of freelancers and had an impact on the market for freelance platforms.

The University of Sheffield reports that the cultural sector has a higher rate of self-employment (37% versus 15%) than other industries, with freelancers earning over a third less than those in formal employment. Funding was the most important source of support throughout the epidemic, followed by chances for paid labor, networking, and overall health and well-being.

Tracking The Growth And Progress In Freelancing

Many particular marketplaces produce studies on the state of freelancing, which are frequently pretty good. Any serious freelancing student should read the most recent edition of Freelancing in America, a large Upwork poll, or the MBO Partners State of Independence report. Freelance Informergives an intriguing ongoing commentary on UK freelancing.

- Large marketplace organizations such as Malt, Catalant, and Toptal have also created outstanding blog channels and extensive studies on freelancing in their respective fields of expertise. And the major businesses, sometimes known as MBBs, as well as the huge audit and consulting firms, frequently include freelancing as an area of interest in their research. Even the HR trade association SHRM has expressed an interest in freelancing.

- However, there appears to be no primary source that provides objective, regular, third-party data on the freelance community's forward-looking mood, including what leaders, investors, and ecosystem partners are thinking and concerned about. It is a significant oversight for a worldwide professional community that contributes trillions to global GDP and employs a huge number of generally well-educated and ambitious individuals.

- Freelance leaders predict that 2024 will be a net growth year for freelancing in general. Over 83% were either strongly or moderately optimistic about the short-term prospects of freelancing, with an additional 21% neutral. Only roughly 6% had gloomy performance forecasts for the following 12 months.

- Freelance executives are "moderately" pleased with the performance of their platform or marketplace this year. Over 55% were either very satisfied (14%), or fairly satisfied (41%). 27% were neutral, while the remaining participants (18%) were disappointed. Despite a tough third quarter, 2023 is regarded as a minor success.

- Client relationships were viewed as a critical driver of performance in 2023, as well as a strength in most marketplaces, with 56% of CEOs viewing them as the most impactful driver. Freelance talent quality (44%), brand positioning (43%), and sales, marketing, and product alignment (41%), were all rated as important. Interestingly, pricing (22%), money (17%), and technology (9%) were viewed as secondary contributors in this year's performance.

- Freelance executives feel they are becoming more effective at obtaining, servicing, and retaining clients. This explains the increased emphasis on branding and confidence in the alignment of sales, marketing, and products. 73% of participants were highly or fairly confident in the effectiveness of their sales distribution system, with 21% neutral. Few (<5%) expressed active criticism.

- Most marketplaces are focusing their expansion efforts on enterprise customers. 57% of participants reported an increased emphasis on developing partnerships with large corporate or enterprise enterprises, while 37% reported a higher emphasis on SMB (small and medium-sized businesses). 11% targeted startups, while 5% emphasized non-profit and government institutions. 18% were not specific.

- Surprisingly, few platforms are looking for funding over the next 12 months. Only 12% of participants identified funding as an important aim for the coming year. In contrast, about 65% expressed no interest in increasing investment in 2024.

- Freelance executives report that platforms are prepared for a possible recession in 2024. A total of 50% of participants said their business was very or moderately prepared for a slump. An additional 41% were neutral. Only 9% expected to have a somewhat or severely tough experience.

- Governments were widely regarded as unhelpful to the freelancing economy. The majority of participants viewed government policy and regulation as detrimental or neutral, but rarely beneficial. A bright area was the Middle East, where Saudi Arabia and other governments encouraged freelancing. However, 54% of respondents believed their government was very or moderately antagonistic, with 34% neutral.

- Freelance executives are hopeful about the freelance economy's long-term growth. Despite only modest enthusiasm in 2023, 61% of participants said they were extremely confident about the growth of freelancers, while another 21% were moderately encouraged.

- The global freelance contribution to GDP exceeds one trillion dollars in the United States alone. This year alone, more than 60 million professionals in the United States identified as freelancers. Emergent Research for MBO Partners found that the number of full-time freelancers in the US increased by 90% between 2020 and 2023, while part-time freelancing increased by more than 130%. Over 80% of large corporations intend to boost their use of freelancing.

Furthermore, we notice a strong trend of increased freelancing engagement in Latin America, Africa, Central and Eastern Asia, and Southeast Asia. North America, the EU, the United Kingdom, and Australia are already active hubs of the freelance revolution. The top dozen freelancing marketplaces all have more than a million freelancers on their platforms. The largest, Freelancer.com, has a population of 59,000,000, which is somewhat larger than that of Saudi Arabia.

Freelance Market Growth - FAQs

What Factors Contribute To The Growth Of The Freelance Market?

The freelance market is expanding due to technological advancements, changing work preferences, and the global shift towards remote work.

How Has The Freelance Market Evolved In Recent Years?

The freelance market has evolved significantly with the rise of digital platforms, connecting freelancers with clients worldwide, and the increasing demand for specialized skills.

What Impact Does Freelance Market Growth Have On Traditional Employment Models?

The growth of the freelance market is challenging traditional employment models by offering professionals more flexibility and autonomy in their careers.

Are There Specific Industries Experiencing Faster Growth In Freelance Opportunities?

Yes, industries such as technology, marketing, and creative services are witnessing rapid growth in freelance opportunities due to the demand for specialized skills.

How Does Technology Contribute To The Expansion Of The Freelance Market?

Technology plays a crucial role by providing online platforms that connect freelancers with clients, facilitating remote work, and enabling seamless collaboration.

Conclusion On Freelance Market Growth

The freelance market growth reflects a seismic shift in how individuals approach work and employment. This analysis has unraveled the layers of this dynamic landscape, showcasing the resilience and adaptability of the freelance economy.

As more professionals embrace the freedom and flexibility offered by freelancing, the future promises continued expansion and innovation. The freelance market growth isn't just a trend; it's a paradigm shift, redefining the way we view and engage in work, opening doors to diverse opportunities, and paving the way for a new era of professional independence.

Jump to

Freelance Market Growth Statistics

Segment Analysis Of Applications

Analysis Of End Users

Geographical Evaluation

Competitive Environment

Artificial Intelligence Effect On The Market For Freelance Platforms

Tracking The Growth And Progress In Freelancing

Freelance Market Growth - FAQs

Conclusion On Freelance Market Growth

James Pierce

Author

Camilo Wood

Reviewer

Latest Articles

Popular Articles