Technical Analysis Made Easy - Finviz Futures Charts And Indicators

Chart Your Path to Futures Profits: finviz futures makes technical analysis accessible & actionable. Visualize trends, leverage indicators, & win big. Explore Finviz today!

Author:Camilo WoodReviewer:James PierceDec 22, 20237.1K Shares188.9K Views

Ever watch the price of Bitcoin skyrocket, only to kick yourself for missing the bull run? Or maybe you've been paralyzed by indecision, unsure whether to buy or sell in the volatile crypto market. Fear not, fellow trader! Finviz Futuresis here to cut through the noise and empower you to make informed trading decisions with confidence.

Do you squint at complex charts, wishing you had a crystal ball to decode the market's hidden messages? Technical analysis can feel like a cryptic language, leaving many crypto traders lost in a sea of red and green candlesticks. But Finviz Futures is your Rosetta Stone, transforming confusing charts into actionable insights that even a beginner can understand.

Overwhelmed by the alphabet soup of technical indicators like RSI, MACD, and Bollinger Bands? You're not alone. These powerful tools can be daunting, but Finviz Futures makes them accessible and intuitive, helping you unlock their secrets and harness their power to predict market movements.

Putting the pieces together in the crypto puzzle can feel like a never-ending quest. You're constantly chasing the next big opportunity, only to find yourself on the wrong side of the trade. Finviz Futures is your missing piece, providing a comprehensive toolkit of charts, indicators, and strategies to help you complete the puzzle and finally turn your crypto dreams into reality.

New to the crypto scene but eager to dive in? Don't let technical jargon and complex platforms hold you back. Finviz Futures is designed for beginners like you, offering a user-friendly interface and step-by-step guidance to help you navigate the market with confidence and ease.

Futures Decoded - Unveiling Technical Analysis

What Is Technical Analysis?

Imagine the crypto market as a wild jungle, teeming with unpredictable creatures (prices) and cryptic signals (chart patterns). Technical analysis is your machete, helping you hack through the undergrowth and reveal the hidden order within. It's the study of past price and volume data to identify patterns and trends, allowing you to predict future market movements and make informed trading decisions.

Why Is It Important For Futures Trading?

Futures contracts offer a powerful way to leverage your crypto holdings and potentially magnify your profits. However, the increased risk demands a deeper understanding of market dynamics. Technical analysis provides the analytical tools you need to:

- Spot trends -Identify bullish and bearish momentum to capitalize on market swings.

- Predict turning points -Recognize potential reversals before they happen and avoid getting caught on the wrong side of the trade.

- Set entry and exit points -Determine optimal timing for buying and selling based on technical signals.

Common Challenges And Skepticism

Let's face it, technical analysis isn't a magic crystal ball. Some common challenges include:

- Complexity -Learning the language of charts and indicators can feel overwhelming.

- Subjectivity -Interpretation of technical signals can be subjective and prone to human error.

- False positives -Not every pattern leads to a successful trade, and indicators can sometimes be misleading.

This is where Finviz Futures comes in, offering a helping hand to navigate these challenges.

Finviz Futures - Your Visual Guide To Market Insights

Think of Finviz Futures as your sherpa in the crypto jungle. It simplifies technical analysis through:

- Intuitive charts -Visualize price movements, patterns, and indicators with ease, even if you're a beginner.

- Powerful indicators -Leverage a wide range of technical indicators like moving averages, RSI, MACD, and Bollinger Bands to identify trends, momentum, and potential overbought/oversold conditions.

- Customizable dashboards -Tailor your trading experience by creating personalized dashboards with the tools and indicators you rely on most.

Real-Life Examples - Seeing Is Believing

Let's see how Finviz Futures can be applied in real-world scenarios:

- Identifying a Bullish Trend - This chart displays a rising price trend, confirmed by a moving average line sloping upwards. This suggests a potential bull run, allowing you to consider buying positions with greater confidence.

- Spotting a Potential Reversal - Here, the price continues to rise while the RSI indicator forms a bearish divergence, indicating weakening momentum. This could be a signal of a potential reversal, prompting you to consider closing long positions or even going short.

- Setting Stop-Loss Orders - Bollinger Bands can help identify potential support and resistance levels. In this case, placing a stop-loss order below the lower band adds an extra layer of protection against unexpected price drops.

Finviz Futures - Navigating The Crypto Maze

Trading without charts is like sailing blindfolded – you know you're moving, but where you'll end up is anyone's guess. That's where Finviz Futures comes in, equipping you with a treasure map and compass to navigate the volatile crypto market.

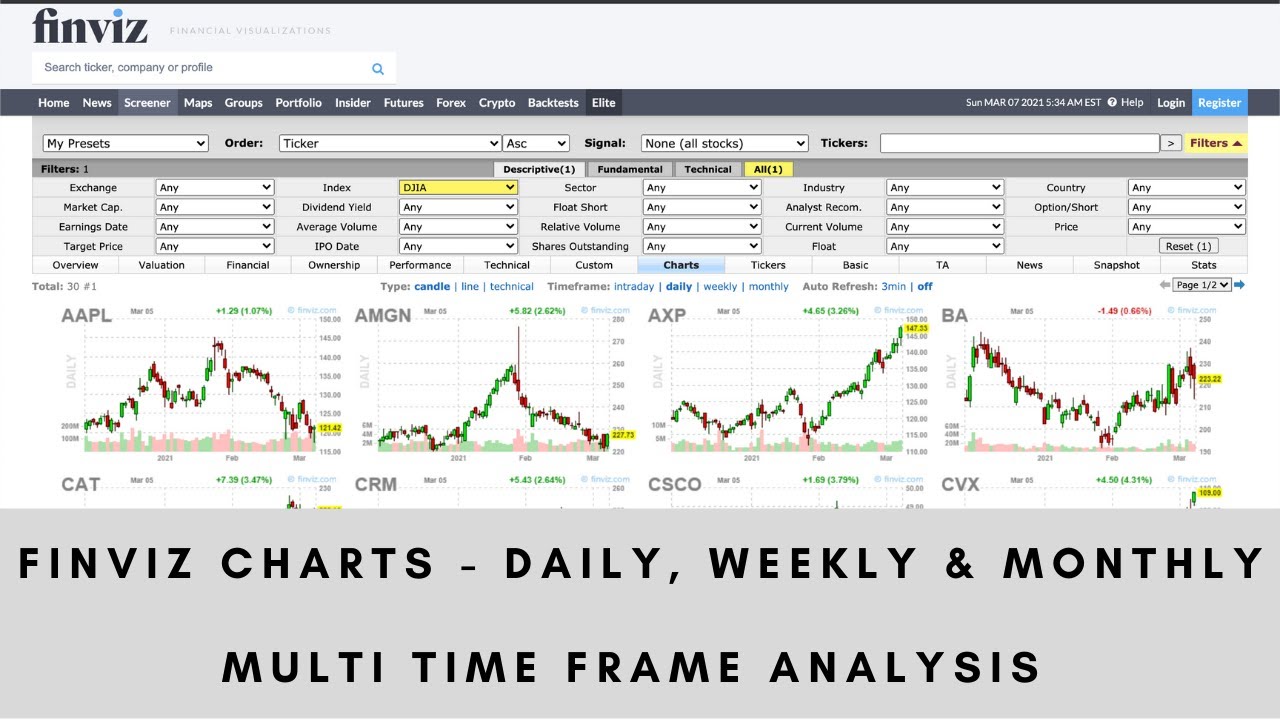

Unlocking Finviz's Charting Interface

Imagine Finviz's charting interface as your personal captain's cabin. It's clean, customizable, and packed with tools to plot your course. Drag and drop indicators, zoom in on specific timeframes, and personalize your layout to suit your trading style.

Chart Types - From Lines To Candlesticks (and Beyond!)

Think of different chart types as languages spoken by the market. Each reveals its secrets uniquely:

- Line charts -Simple and elegant, like a minimalist poem, they visualize price trends over time.

- Bar charts -These colorful rectangles add volume data to the mix, each bar depicting price range and trading volume for a specific period.

- Candlestick charts -The kings of clarity, candlesticks paint a vivid picture of market sentiment. Their shadows and bodies illustrate the opening and closing prices, while wicks depict high and low points. Green candles signify bullishness, while red signals bearishness.

Technical Indicators - Your Crypto Interpreters

Just like you wouldn't rely on gut feeling to decipher a foreign language, technical indicators provide objective interpretations of the chart's whispers. Let's explore some popular ones:

- Moving Averages -Imagine these as trend-smoothing filters, like a rolling average of your grades across semesters. They reveal underlying momentum and potential support/resistance levels.

- Relative Strength Index (RSI) -Picture this as a mood meter for the market. An RSI above 70 suggests overbought conditions, while values below 30 hint at oversold territory.

- Moving Average Convergence Divergence (MACD) -Think of the MACD as a dynamic duo of moving averages, highlighting momentum and potential trend reversals. When the "fast" line crosses above the "slow" line, it could signal a buying opportunity.

- Bollinger Bands -These act like elastic boundaries around the price, signifying periods of high or low volatility. Breakout from the bands can indicate potential trend continuations or reversals.

Finviz - Your Guide To Support & Resistance (and Beyond!)

Support and resistance levels are like hidden walls on the chart, where prices tend to bounce or stall. Finviz helps you identify them through:

- Chart patterns -Head and shoulders, triangles, and other formations hint at potential turning points.

- Indicator signals -Crossovers, divergences, and extreme values in technical indicators can point to support/resistance areas.

Entry & Exit - Knowing When To Dive In And Out

Finviz empowers you to make informed decisions about entering and exiting trades. Use technical signals and chart patterns to:

- Spot potential breakouts -When the price surpasses resistance or breaks below support with strong volume, it might indicate a new trend direction.

- Confirm trend continuations -Look for momentum indicators and chart patterns that reinforce the prevailing trend before scaling in or out of positions.

Mastering The Power Of Indicators

Imagine the crypto market as a roaring ocean, with waves crashing and currents swirling. Technical indicators are your buoys and beacons, providing actionable insights into market sentiment and momentum, and helping you navigate the choppy waters with confidence.

Finviz Indicators - Your Crypto Whispering Oracle

Finviz Futures goes beyond basic charts, offering a vast arsenal of indicators that translate the market's whispers into actionable signals. Here's how they work:

- Sentiment -Indicators like the Relative Strength Index (RSI) gauge market sentiment, highlighting overbought/oversold conditions. Imagine the RSI as a crowd meter – a high reading suggests a euphoric bull market, while a low reading indicates a gloomy bear market.

- Momentum -Indicators like the Moving Average Convergence Divergence (MACD) track momentum, identifying potential trend continuations or reversals. Think of the MACD as a speedometer – when the "fast" line crosses above the "slow" line, it might signal a gear shift in the market's direction.

- Volatility -Indicators like Bollinger Bands capture market volatility, indicating periods of high or low price swings. Picture these as elastic bands around the price – a breakout could signal a surge in volatility, demanding extra caution.

Diving Deeper - Individual Indicator Powerhouses

Let's delve into some of Finviz's most popular indicators and unlock their secrets:

- RSI -This king of sentiment indicators ranges from 0 to 100. Values above 70 suggest overbought conditions, potentially signaling a pullback. Conversely, values below 30 indicate oversold territory, possibly hinting at a reversal.

- MACD -This two-line indicator tracks the difference between two moving averages. When the "fast" line crosses above the "slow" line (bullish crossover), it can signal a potential buy opportunity. Conversely, a bearish crossover (fast line crossing below slow) suggests a possible sell signal.

- Bollinger Bands -These dynamic bands expand and contract around the price, reflecting volatility. A breakout from the bands can indicate increased volatility, potentially leading to trend continuations or reversals.

Case Studies - Indicators In Action

Remember, indicators are not magic wands, but powerful tools when used strategically. Here are some real-world examples:

- Bitcoin Bull Run with RSI -In 2021, the RSI on Bitcoin's chart repeatedly dipped below 30, indicating oversold conditions. Savvy traders who used this signal to buy during these dips enjoyed significant gains as the bull run continued.

- Ethereum Trend Reversal with MACD -In 2022, a bearish crossover on the MACD indicator for Ethereum signaled a potential trend reversal. Traders who used this signal to sell their positions before the downturn mitigated their losses.

- Dogecoin Breakout with Bollinger Bands -A breakout from the upper Bollinger Band on Dogecoin's chart in 2023 signaled increased volatility and potential for a further upward surge. Traders who identified this breakout could have capitalized on the momentum.

Practice Makes Perfect - Hone Your Indicator Skills

Finviz Futures offers a vast playground for practicing your indicator skills. Here are some resources to take your trading to the next level:

- Finviz Tutorials -Explore their comprehensive library of tutorials and video guides on using various indicators effectively.

- Finviz Blog -Stay up-to-date with market insights and indicator strategies through their blog posts.

- Paper Trading -Use Finviz's paper trading feature to test your indicator-based strategies in a risk-free environment before deploying them with real capital.

Trading With Confidence - The Finviz Futures Advantage

We've charted the course, explored the tools, and unlocked the secrets of indicators. Now, it's time to set sail on your crypto trading journey with the confidence of a seasoned captain. Finviz Futures is your compass, guiding you through the volatile waters with a wealth of benefits:

Empowered Technical Analysis

- Visual Clarity -Say goodbye to chart confusion. Finviz's intuitive interface and customizable charts make technical analysis accessible and engaging.

- Data-Driven Insights -Dive deep with a vast library of technical indicators, each revealing a different facet of market sentiment and momentum.

- Actionable Signals -Translate technical whispers into informed decisions. Use Finviz to identify support and resistance levels, predict trend reversals, and spot optimal entry and exit points.

Beyond The Charts

- Mobile Mastery -Trade on the go with Finviz's powerful mobile app, keeping your finger on the pulse of the market even when away from your desk.

- Stay Informed -Never miss a beat with Finviz's real-time news alerts, ensuring you're always up-to-date on market-moving events.

- Practice Makes Perfect -Hone your skills and test your strategies in a risk-free environment with Finviz's advanced trading simulator.

Building Your Personalized Trading Strategy

- Start Simple -Don't get overwhelmed. Begin with a few key indicators like RSI and MACD, gradually adding more as you gain confidence.

- Backtest Your Strategies -Use Finviz's historical data to test your trading ideas before risking real capital.

- Diversify Your Approach -Don't rely solely on technical analysis. Combine it with fundamental research and risk management strategies for a well-rounded approach.

Frequently Asked Question

Is Finviz Futures Free To Use?

Yes, there is a free version with limited features. They also offer paid plans with more features and data access.

Can Technical Analysis Be Used To Predict The Future?

Technical analysis can help identify potential trends and patterns, but it cannot accurately predict the future. Always use caution and consider other factors before making any trading decisions.

Is Technical Analysis Enough For Successful Trading?

No, technical analysis is just one tool in a trader's toolbox. It's important to combine it with other factors like fundamental analysis, risk management strategies, and a good understanding of the market.

Conclusion

Navigating the volatile waters of the crypto market can feel like steering a ship through a hurricane. But with Finviz Futures as your compass, you can transform from a lost voyager into a chart-savvy captain, confidently charting your course to success.

This article has equipped you with the tools and knowledge needed to master technical analysis, unlock the power of indicators, and make informed trading decisions. Remember, success isn't just about tools; it's about practice, patience, and sound judgment.

Camilo Wood

Author

James Pierce

Reviewer

Latest Articles

Popular Articles