Financial Planning For Families - Navigating Secure Futures

Discover comprehensive financial planning for families. Secure your family's future with expert advice on budgeting, investments, and wealth management.

Author:Liam EvansReviewer:Habiba AshtonDec 28, 202313K Shares237.1K Views

Welcome to the realm of financial planning for families, where every decision echoes the harmony of prosperity and security. In the intricate tapestry of life, family stands as the cornerstone of our aspirations and dreams. Embarking on a journey of financial well-being is not merely an individual pursuit but a collective endeavor that shapes the future for generations. This comprehensive guide navigates the complexities of managing finances within the familial context, offering insights into budgeting, investment strategies, and the holistic approach required for a resilient financial future. As we delve into the intricacies of financial planning for families, we embark on a path that goes beyond numbers, embracing the values that knit our familial bonds tighter in the face of life's uncertainties.

What Is Family Financial Planning?

Family financial planning is the deliberate and strategic process of managing financial resources to achieve the goals and aspirations of a family unit. It encompasses a comprehensive approach to budgeting, investing, and ensuring the financial security of all family members. At its core, family financial planning goes beyond day-to-day expenses; it involves making informed decisions to safeguard the family's economic well-being today and for future generations.

The foundation of family financial planning lies in creating a roadmap that aligns with the unique needs, values, and long-term objectives of the family. This process involves assessing current financial situations, setting realistic goals, and formulating actionable plans to attain them. Whether it's saving for a child's education, buying a home, or preparing for retirement, family financial planning provides a framework to navigate these financial milestones.

Key components of family financial planning include budget management, investment strategies, risk management through insurance, and estate planning. It requires open communication among family members to ensure everyone is on the same page regarding financial priorities and expectations.

Family financial planning is not a one-size-fits-all approach; it recognizes the diversity of family structures and tailors financial strategies accordingly. By proactively addressing financial challenges and adapting to changing circumstances, family financial planning seeks to create a stable and prosperous financial future for the entire family unit. Ultimately, it is a dynamic process that evolves with the family's life stages, promoting financial well-being and resilience in the face of economic uncertainties.

Family Financial Planning Best Considerations

If you want to make a financial plan for your family, there are a few important things to think about. Here are some of the most crucial points to discuss when you begin your family's financial planning.

Spending And Budgeting

The foundation of any family financial plan is a budget. It's time to create a family budget if you don't already have one. Utilizing online budgeting software makes this task simple. Regular spending tracking can assist you in adjusting your spending and preventing excess. Numerous budgeting applications keep track of your expenses automatically.

Review your budget every month as you keep tabs on your expenditures to determine whether any changes are necessary. For example, cutting back on expenses in one area can free up funds for one of your financial objectives. Doing an annual budget review is also beneficial if you want to see how your expenditure has evolved over time. The budget for the next year can then be created using that as a reference.

Paying Off Debt

Paying off debt is a crucial component of family financial planning, fostering stability and paving the way for future prosperity. Families strategize to eliminate high-interest debts, such as credit cards or loans, freeing up resources for essential needs and future goals. This process involves creating a debt repayment plan, prioritizing debts, and possibly negotiating with creditors for more favorable terms.

Your family's financial strategy must take debt—such as credit card, student loan, or mortgage—into consideration. You require a strategy and a schedule in particular for paying off those obligations. Setting a priority list for your debts will help you determine which ones to pay off first. If your lower rate mortgage can wait, high-interest credit card debt, for instance, can be worth prioritizing if it's causing you the greatest interest expense.

As families work towards becoming debt-free, they gain financial freedom, reduce stress, and position themselves to allocate funds towards savings, investments, and building a secure financial foundation for generations to come. When integrating debt repayment into your family's budget, consider your options for potentially expediting the payback. If a higher portion of your monthly payments are applied to the principle of your student loans or mortgage, refinancing to a lower interest rate, for instance, might enable you to reduce your total debt.

Budgetary Objectives

Family financial planning include deciding what financial objectives you wish to fulfill. These could consist of -

- Putting up $2 million for retirement

- settling your debt by the age of fifty

- putting up $100,000 for your children's college education

These are a few examples of long-term money objectives you could establish. In addition, you can have short-or mid-term objectives in mind, like putting aside $5,000 for a trip you plan to take in a few years or saving $10,000 for an emergency fund. It's important to keep your family's financial goals specific and reasonable. Assign due dates to each goal and specify the actions you must do to ensure that it is completed on schedule.

Put Money Down For The Future

It's simple to let short-term spending take precedence over long-term investments, but you should make sure that you're also securing your financial future:

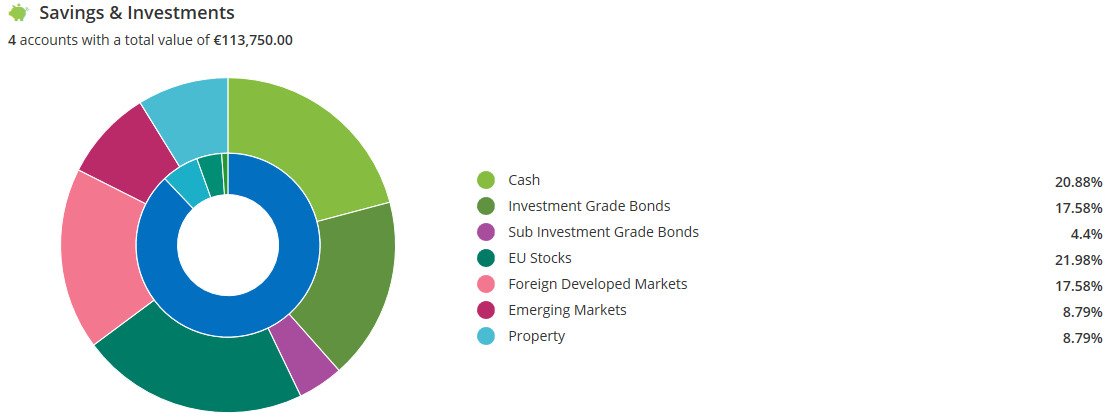

Retirement accounts- Don't disregard them, even though it's tempting to do so when you're young. When it comes to saving for retirement, time is your greatest ally, so even modest steps count. A lot of companies offer tax-advantaged retirement plans, such 401(k)s and 403(b), and many will match your contribution if you make one. Moreover, an IRA is available to anybody with earned income, enabling tax-advantaged investment opportunities.

529 accounts- A 529 plan can assist you in saving money for your child's college education whether you currently have children or intend to have children in the future. It enables you to make tax-advantaged investments to cover educational costs and even student loans.

Accounts subject to taxes - You can save money in basic taxable accounts like a brokerage account in addition to specialist accounts. In addition to allowing you to invest in potentially high-return assets like stocks and stock funds, the top brokerage accounts also often provide an enticing return on your investment.

In order to ensure that you have the money when you need it, account for your future investments in your budget. One of the most challenging aspects of financial planning is investing for the future, so now is a wonderful time to get professional assistance in developing this aspect of your strategy.

Get Insurance To Protect Yourself

Another component that might support your family in achieving its financial objectives even in the event of a family member's demise is life insurance. Similar to an emergency fund, life insurance keeps you from having to make unfavorable decisions like taking on expensive debt.

When one has dependents, such as children or a spouse, having life insurance is essential, according to Stuart Boxenbaum, CFP, president of Statewide Financial Group in Jupiter, Florida. However, many families could make mistakes when it comes to obtaining adequate coverage.

According to Boxenbaum, the basic criterion is to multiply the breadwinner's total income by at least five years, or up to ten, in order to calculate the death benefit. "The minimum death benefit should be $500,000, [or it] could be up to $1 million, if earnings are $100,000 annually."

Modify Your Strategy

As your life changes, it might be simple to create a plan and then forget to stick to it. And everything will alter. Some of your ambitions will be accomplished, babies will be born, and some individuals will leave your life. You must therefore modify the financial plan for your family in light of such adjustments.

According to Mangaliman, if you meet your deadlines or even beat them by paying off debt, you can use the extra cash flow for your next financial goal. When their children move out of the house, parents might also need to reduce their living expenses, which would require modifying the family's financial strategy.

Unexpected events, such as serious health problems or a drop in income, can postpone achieving some goals, so a family financial plan should be adjusted appropriately, he says. According to Boxenbaum, conducting an annual or semi-annual review is crucial. Even if the outcome of that routine review is simply "no changes," the process will force you to consider your financial strategy and any potential adjustments that may be necessary down the road.

Retirement Strategy

A common goal for many families is to retire. A crucial component of family financial planning is evaluating clients' retirement objectives and assisting them in creating a strategy to reach those objectives. If applicable, a successful retirement plan for a couple entails a thorough and well-coordinated strategy to guarantee that each person has the resources and financial techniques that work best for them.

As their financial advisor, you ought to urge your clients to fund their employer-sponsored retirement accounts (401(k)s and 403(b)s, and to fully utilize any employer match that may be offered. When compared to other retirement savings vehicles, these plans may have higher contribution limits and offer tax advantages. You should advise both spouses to open IRAs, either standard or Roth, based on their income, tax status, and eligibility, in addition to employer-sponsored plans.

Couples can diversify their retirement funds and enhance their long-term financial plan by utilizing the extra tax advantages and investment flexibility that IRAs offer. It is imperative that you motivate your clients to make regular contributions to their retirement accounts, especially in times of market volatility or uncertainty. Furthermore, emphasize the significance of routinely assessing and adjusting their investment portfolios in order to preserve the intended asset allocation and risk profile.

As your customers mature, talk to them about the best time to file for both spouses' Social Security benefits, keeping in mind their ages, life expectancies, and possible survivor or spousal benefits. Assist them in creating a retirement income plan that accounts for required minimum distributions (RMDs), tax consequences, and probable changes in their spending habits as they approach retirement.

Legacy Planning

Legacy planning is developing a plan for safeguarding a family's wealth and transferring it to subsequent generations in addition to life insurance. This can involve tax planning techniques to reduce estate taxes, if applicable, as well as estate planning techniques including drafting a will or establishing a trust. Give customers advice on the significance of establishing a power of attorney, will, and healthcare proxy. Talk about ways to minimize taxes and preserve money using gifting techniques, trusts, and charitable contributions.

In order to assist clients in creating a thorough legacy plan that is in line with their beliefs and long-term financial objectives, financial advisors want to collaborate with estate planning attorneys.

Financial Planning For Families - FAQs

Why Is Financial Planning Important For Families?

Financial planning for families is crucial for ensuring long-term stability, meeting goals like education and homeownership, and securing a comfortable retirement.

How Can Families Create A Budget For Effective Financial Planning?

Start by listing income and expenses, prioritize needs over wants, allocate funds to savings and investments, and regularly review and adjust the budget as needed.

What Role Does Insurance Play In Family Financial Planning?

Insurance provides a safety net for families, covering medical expenses, protecting assets, and ensuring financial stability in the face of unforeseen events.

What Key Aspects Should Families Consider In Their Financial Planning?

Families should focus on budgeting, emergency funds, insurance coverage, investment strategies, and estate planning to achieve comprehensive financial well-being.

How Can Families Align Financial Goals And Values In Their Planning?

Open communication is key. Families should discuss their values, priorities, and goals regularly to ensure that financial planning aligns with their collective vision for the future.

Final Thoughts

In the tapestry of life, financial planning for families emerges as the brushstroke that paints a secure and prosperous future. As we conclude our exploration into this vital realm, the significance of thoughtful financial management becomes clear. It's not just about numbers; it's about fostering resilience, creating legacies, and nurturing the dreams that define a family. From budgeting basics to sophisticated investment strategies, the journey of financial planning for families is a testament to the enduring spirit of unity and foresight. With each decision, we pave the way for a future where our loved ones thrive. So, let this be the beginning—a journey marked by financial wisdom, familial strength, and the promise of a tomorrow that is as secure as it is fulfilling.

Jump to

What Is Family Financial Planning?

Family Financial Planning Best Considerations

Spending And Budgeting

Paying Off Debt

Budgetary Objectives

Put Money Down For The Future

Get Insurance To Protect Yourself

Modify Your Strategy

Retirement Strategy

Legacy Planning

Financial Planning For Families - FAQs

Final Thoughts

Liam Evans

Author

Habiba Ashton

Reviewer

Latest Articles

Popular Articles