Use Mortgage Calculator For Your Monthly Mortgage Interest 2022

The complete guide to mortgage calculator in 2022 is available here. This manual was thoughtfully created with practical advice for managing your mortgage so you may save money and time!

Author:Gordon DickersonReviewer:Frazer PughAug 05, 20229 Shares271 Views

The complete guide to mortgage calculatorin 2022 is available here.

So, if you want to find out:

- Affordability of mortgages based on your income

- How to obtain a second mortgage and why

- Why and how to pay off your mortgage early

This manual was thoughtfully created with practical advice for managing your mortgage so you may save money and time!

Let's begin straight away.

Mortgage Interest Calculator

You want to find the right balance when it comes to mortgages, borrowing just enough to cover your mortgage payments but not too much that they become a problem. You could use our mortgage affordability calculator to assist you with that.

You can use the monthly interest rate to determine how much interest you'll pay on a mortgage each month.

You can use the monthly interest rate to determine how much interest you'll pay on a mortgage each month. You may usually calculate this by multiplying your yearly interest rate by 12.

After that, increase this by the remaining loan principle. As a result, you will pay less interest over the course of the mortgage; however, this isn't always the case with adjustable rate mortgages.

Being honest with yourself about your monthly income and anticipated expenses is important if you want to avoid getting a mortgage you cannot afford. You should also leave some room in your budget for unforeseen expenses or emergencies.

The major personal investment that most people make is typically purchasing a home with a mortgage.

How much you can borrow depends on a variety of factors in addition to how much a bank is ready to lend you. You must evaluate not just your financial status but also your priorities and personal preferences.

Simple Mortgage Calculator

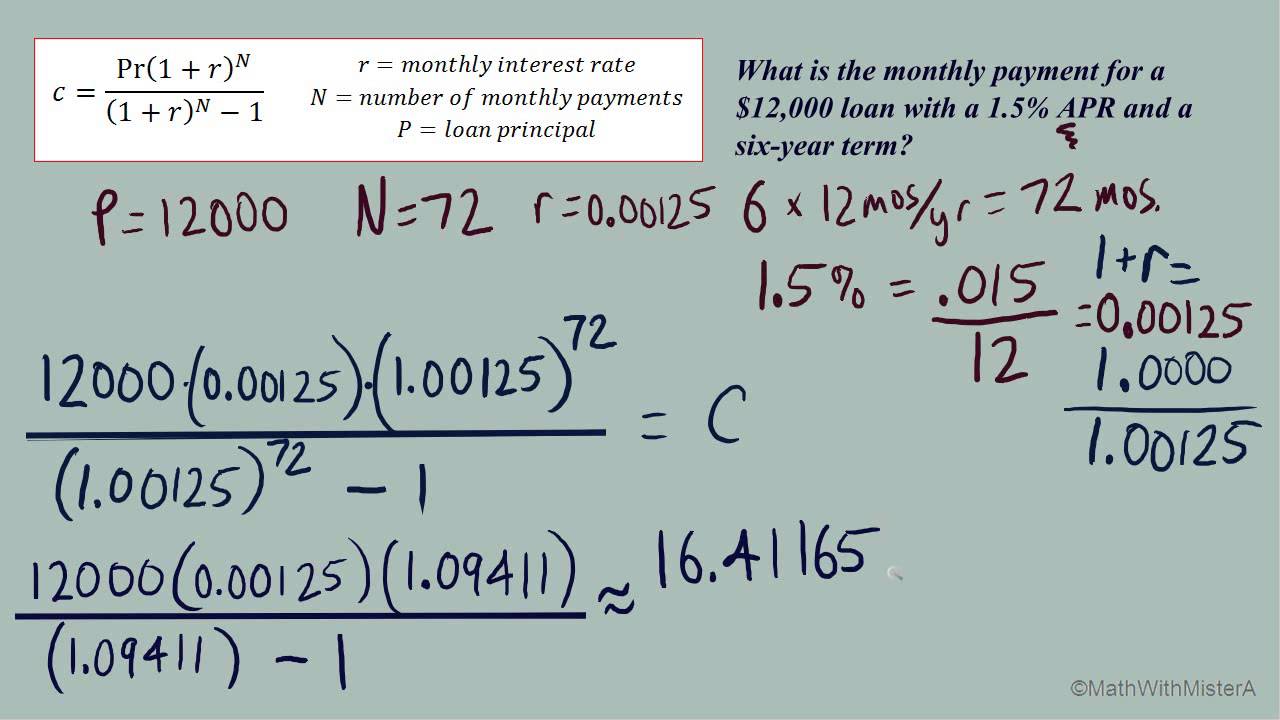

If you don't want to use a prepared calculator, you can perform the calculations manually using a spreadsheet application, a calculator app, or a pocket calculator.

You should first calculate your monthly interest rate. Since there are 12 payments each year, your annual interest rate can be calculated by dividing it by 12.

As an illustration, if your annual interest rate is 6%, your monthly interest rate will be 6% / 12 = 0.5 %. Find out how much of your mortgage's principal is still payable once you have that rate

You ought should be able to view that on your most recent mortgage statement or via a website or app for online banking.

The monthly interest amount is then calculated by multiplying the principal amount by the monthly interest rate.

The monthly interest amount is $200,000 * (0.5 / 100) = $200,000 * (0.005) = $1,000, for example, if the principal is $200,000 and the monthly interest rate is 0.5 percent.

The amount of principle you are paying down in a given month is equal to your monthly mortgage payment less the interest component.

How Much Mortgage Can I Afford On My Salary?

Whether you're a first-time homeowner or an experienced real estate investor, buying a house takes a lot of paperwork and patience.

If you want to be confident you're making the right financial decision, you must also do the arithmetic before you set your heart on a particular house.

In the event that you are pre-approved for a mortgage, the lender will let you know how much of a loan you might be eligible for.

Lenders consider your entire financial situation when calculating how much money you may borrow, even though your salary and credit score are apparent criteria.

You should simultaneously take a thorough look at your finances to figure out how much you can comfortably afford.

Although financial advisors must abide by a few rules, you must decide how comfortable you are with debt.

A property that costs two to two and a half times its annual gross income is often beyond the financial reach of the majority of prospective homeowners.

This figure shows that a person making $100,000 a year can only afford a $200,000 to $250,000 mortgage. However, this estimate should only be used as a general guideline.

The last thing to consider while picking a property is a variety of other factors. Knowing how much your lender believes you can afford is a fantastic place to start (and how it arrived at that estimation).

In order to decide what kind of home you are willing to live in and what other forms of consumption you are prepared to give up or not engage in your home, you should first engage in some introspective thought.

While it has long been believed that real estate is a safe long-term investment, recessions and other calamities (like the COVID-19 outbreak) may put that belief to the test, leading potential homeowners to rethink their choice.

Keep in mind that just though you are eligible for a certain amount, it does not necessarily follow that you can afford the monthly payments. Consider your particular circumstances as well as your long-term financial goals and needs.

| Salary: | 40,000 USD |

| Recommended Mortgage: | 120,000 USD |

| Max Mortgage: | $250,000 USD |

The 28/36% Rule

Most financial experts agree that people should not spend more than 28% of their gross monthly income on housing and 36% on total debt, which includes housing as well as student loans, car loans, and credit card bills.

A tried-and-true formula for determining how much you can afford to spend each month on a home is the 28/36 percent rule.

To figure out what 28 percent of your income is, just multiply your monthly income by 28. For instance, if your monthly income is $8,000, your equation would be as follows: 8,000 x 28 = 224,000. Divide that sum by 100 to get 2,240; 224,000 x 100.

Depending on where you live and how much you earn, your annual wage might cover your mortgage or it might not. Making wise financial decisions may be aided by knowing what you can afford.

The last thing you want to do is agree to a 30-year mortgage that is too expensive for your budget, even if you can find a lender willing to underwrite the mortgage.

Three Times Your Salary Rule

The ideal mortgage is no more than three times your annual salary.

Consider your options carefully before taking on a mortgage that is more than $120,000 if your annual income is $40,000 or less. If you have a spouse and your combined income is $80,000, you can easily increase your loan amount to $240,000.

However, this does not imply that you should always choose the most expensive mortgage available. If you choose anything less than your limit, you'll have more room to spare to pay for other things like home improvements or to put money into a savings account.

The "three times your income" rule may not be practical for people who live in high cost of living areas.

Make sure you have solid financial status in other areas of your life if it appears that you could require a higher mortgage to buy a house. It's essential to set aside a sizeable emergency fund to account for the reality that your finances will be squeezed.

Additionally, you should have a retirement fund that is funded and a separate account set up to cover your moving and closing costs.

On the other hand, bigger mortgages aren't always the best. If your mortgage takes up too much of your income, the lender may apply higher interest rates and other penalties to make up for the greater risk of default.

What Factors Do Lenders Consider When Choosing Whether Or Not To Finance A Mortgage?

The following factors will always be taken into consideration when determining your ability to purchase a home, as well as the size and terms of the loan you will be awarded, even though each mortgage lender has its unique set of affordability requirements.

Debt-To-Income Ratio (DTI)

Your monthly debt to monthly income is compared through a computation known as the debt-to-income ratio, or DTI. A person's DTI will be higher if their debt-to-income ratio is higher, and vice versa.

This is an important number because it shows borrowers that you can take on more debt. A mortgage, let alone one with a good interest rate, will be harder to obtain the higher your DTI.

A borrower with a debt-to-income ratio of greater than 43% will frequently be rejected by lenders.

Debts include things like credit card obligations, child support, and other unpaid loans (auto, student, etc.).

In other words, if your monthly debt payments are $2,000 and your monthly income is $4,000, your debt-to-income ratio is 50%, which means that 50% of your monthly income is going toward paying off your debt.

On the other side, a debt-to-income ratio of 50% won't allow you to purchase your ideal home. The majority of lenders recommend keeping your debt-to-income ratio (DTI) under 43% of your gross income.

To calculate your maximum monthly debt based on this ratio, multiply your gross income by 0.43 and divide it by 12.

Your DTI only includes your debt commitments; it does not include your monthly expenses. As a result, costs like energy, gym dues, and medical insurance are not necessary.

Divide your gross monthly income, which is the amount you received before taxes and deductions, by the total monthly debt you have.

Your total monthly debt, including your rent of $1200, your auto loan of $200, your student loan of $150, and your credit card debt of $85 is $1,635.

Now, divide your monthly gross income ($4,000) by your debt ($1,635). 1,635 ÷ 4,000 = .40875. Your DTI is 41 percent, rounded up.

For instance, if you stop making the $85 monthly credit card payment, your DTI lowers to 39%.

Gross Income

This is the income a potential house buyer makes before taxes and other obligations are taken into account. Your base pay plus any bonuses you receive includes your bonus income, self-employment income, Social Security benefits, disability benefits, alimony, and child support payments.

Front-End Ratio

Gross income plays a significant role in determining the front-end ratio, also referred to as the mortgage-to-income ratio.

The percentage of your annual gross income that can be utilized to pay down your mortgage each month is represented by this number.

Principal, interest, taxes, and insurance, which includes both property insurance and private mortgage insurance if your mortgage calls for it, make up your monthly mortgage payment, collectively referred to as PITI.

A good rule of thumb is that the front-end ratio based on PITI should not be higher than 28% of your total revenue. However, many lenders permit borrowers to borrow in excess of 30%, and some even permit borrowers to borrow in excess of 40%.

Your Credit Score

Debt is the other factor in the affordability equation, with income being the first.

Mortgage lenders have developed a system for figuring out how risky a prospective homeowner is. Although the procedure isn't always based on the applicant's credit score, it frequently is.

Poor credit applicants can anticipate paying a higher interest rate, also known as an annual percentage rate, on their loan (APR). If you're planning to buy a house soon, pay close attention to your credit reports.

Make sure to read your reports carefully. Correcting any errors will take time, and you don't want to miss out on your dream home due to something that wasn't your fault.

How To Determine The Amount Of A Down Payment?

A lender can claim that you can afford a substantial estate, but are you really able to? Remember that the lender's requirements are primarily determined by your gross income and past debts.

The problem with using gross revenue is simple: What about taxes, FICA deductions, and health insurance premiums if you're budgeting up to 30% of your income? It won't help you now even if you get a tax refund, and how much will you get back?

Because of this, some financial gurus contend that considering terms of net income is more acceptable and that your mortgage payment shouldn't be more than 25% of your net income.

If not, you run the risk of becoming "house poor," even if you can afford to pay your mortgage on a monthly basis.

There's a chance that paying for and keeping your home may take up such a substantial amount of your income—far more than the nominal front-end ratio—that you won't have any money left over to pay off debts, save for retirement, or even just a rainy day.

Being home poor or not is mostly a matter of personal choice; just because you've been approved for a mortgage doesn't mean you can afford the payments.

How Lenders Make Their Decisions?

When establishing a homebuyer's affordability, the mortgage lender takes into account a number of factors, but they all come down to income, debt, assets, and commitments.

A lender wants to know everything that could jeopardize an application's ability to be repaid, including how much money it makes, how many demands are made on it, and the possibility that both will occur in the future.

Income, a down payment, and monthly expenses are frequently used to determine eligibility for financing, and the interest rate on the loan is influenced by credit history and score.

Costs Beyond The Mortgage

While there is no doubt that the mortgage is the biggest financial commitment associated with homeownership, there are several other expenses, some of which continue long after the mortgage is paid off. Smart consumers should keep the following in mind:

Taxes On Real Estate

If you buy a house, be prepared to pay property taxes; knowing how much you'll owe is a crucial part of a homebuyer's budget. The size of your home and land, as well as other elements like the market and local real estate conditions, are used by the city, township, or county to calculate your property tax.

The effective average rate of property taxes in the United States is 1.1 percent of the home's assessed value, according to the Tax Foundation. Property taxes vary by state, with some having lower rates than others.

For instance, the average in Oklahoma is 0.88 percent whereas it is 1.4 percent in New York. Property taxes are still your responsibility even if your mortgage is fully paid off.

Insurance For Your Home

Every homeowner needs home insurance to protect their residence and possessions against calamities caused by mother nature and by humans, such as tornadoes and theft.

Determine the type of insurance you'll require if you're purchasing a home. Most mortgage companies won't let you purchase a property unless you have home insurance that fully covers the cost of the home.

In fact, before granting your loan, your mortgage lender may require proof of home insurance.

The most recent information available as of early 2021 shows that the average premium for the most common type of home insurance in the United States was approximately $1,200.9 in 2018.

The price, however, varies according to the type of insurance you require and the state in which you reside.

Maintenance

Even if you build a brand-new home, it won't endure forever, and neither will the pricey appliances like refrigerators, dishwashers, and stoves.

The carpet, roof, furnace, driveway, and even the wall paint are all impacted. You can be in a difficult situation if your financial situation hasn't changed by the time your property needs significant repairs.

Utilities

All of these things are pricey, including cable television, telephone service, heat, insurance, power, water, sewage, and rubbish collection.

Both the front-end ratio and the back-end ratio do not take these expenses into account. Nevertheless, for the majority of homeowners, they are unavoidable.

Fees Charged By The Association

Monthly or yearly association fees are common in condos, cooperatives, gated communities, and planned communities.

These expenses could range from $100 annually to several hundred dollars per month. Some communities offer services including community pools, snow removal, and lawn care.

Some payments are only utilized to pay for the community's overhead costs. Despite the fact that more lenders are included association fees in the front-end ratio, it is important to keep in mind that these expenses are anticipated to increase with time.

Furniture and Decor

Before buying a new house, consider how many rooms will need to be equipped and how many windows would need to be covered.

Second Mortgage Calculator - How Much Can I Borrow?

Your salary, utility payments, and any other ongoing commitments, such as student loans or credit card bills, all affect how much you may borrow for a mortgage.

Your salary, utility payments, and any other ongoing commitments, such as student loans or credit card bills, all affect how much you may borrow for a mortgage.

These factors are taken into consideration when a mortgage lender determines how much they would want to lend you for a mortgage.

Interest rates should also be taken into account, and the majority of mortgage lenders will provide a guarantee that you can repay the loan even if interest rates increase.

Since a second house mortgage is used to buy a second property, it differs from a remortgage or a second charge mortgage. Second mortgages are for people who desire to purchase a second home as an investment property for buy-to-let or as a vacation home to rent out.

Additionally, they might be almost finished with their first mortgage payments and confident in their capacity to obtain a second mortgage.

It functions in the same way as a first mortgage but has stricter affordability criteria because paying off a second mortgage may be a significant financial strain.

Making sure your finances are in order is, therefore, necessary if you're searching for a mortgage for a second house. Calculate how much you want to borrow and your monthly payments with a second home mortgage calculator.

How Does A Second Mortgage Work?

Contrary to more movable assets like cash, such as your home's equity, it is typically not something you can use.

Contrarily, a second mortgage permits you to use the equity in your house as collateral. That money is no longer hidden away in your home but is now available for urgent needs. Depending on your financial goals, this can be advantageous or disadvantageous.

The particular requirements for getting accepted for a second mortgage will be decided by the lender you work with. But the most important prerequisite is that you have some equity in your home.

Your lender may only permit you to withdraw a portion of this equity in order to maintain a predetermined level of equity in your property, depending on the value of your home and the amount of unpaid principal on your first mortgage (typically 20 percent of its value).

To get approved for a second mortgage, you will unquestionably need a credit score of at least 620, however specific lender criteria can be higher. Also, remember that higher rates are correlated with higher scores. A debt-to-income ratio (DTI) of less than 43% will probably be necessary.

How Does Home Equity Work?

Before we go any further and examine what second mortgages are and who they are for, let's learn a little more about home equity. Your home's equity has an impact on the amount of money you can borrow when you take out a second mortgage.

Until the balance of your mortgage debt is paid in full, a lien remains on your home. Your lender has the right to repossess your mortgage loan if you default on it before it is paid off.

When you gradually pay off your principal loan amount, the portion of your loan that has been paid off is referred to as equity.

Calculating how much equity you have in your home is simple. Take the entire amount you owe and deduct the amount you have paid toward the principal balance of your mortgage.

You now own your home with $60,000 in equity, for instance, if you spent $200,000 on a house and paid off $60,000 in equity, including your down payment. The interest you pay has no impact on the equity in your house.

There are more ways to increase your home equity. If you reside in an area with a very active real estate market or make improvements to your home, its value will rise.

This increases your equity without increasing your payment obligations. On the other hand, you can lose equity if the value of your home drops and you decide to sell in a buyer's market.

What Is A Second Charge Mortgage, And How Does It Work?

Despite the fact that these are two separate types of loans, some people who are thinking about buying a second house may choose a second charge mortgage, which is frequently referred to as a second mortgage.

By taking out a secured loan against your property, known as a second charge mortgage, you can use the equity to help pay for a second mortgage to buy a new house.

The affordability requirements for a secured loan or second charge mortgage are less strict because your current property is utilized as security. On the other hand, a second mortgage is nothing more than a new loan.

Types Of Second Mortgages

The two types of second mortgages are home equity loans and home equity lines of credit.

Home Equity Loan

A home equity loan gives you the same ability to take out a lump sum payment from your equity as a cash-out refinance does. When you take out a home equity loan, your second mortgage provider gives you a percentage of your equity in cash.

In exchange, the lender acquires a second mortgage on your home. You pay back the loan in interest-bearing monthly installments, just like your initial mortgage. Most home equity loans have repayment terms of 5 to 30 years, so you must pay them back within that time frame.

A lump sum of money is given to you when you take out a home equity loan, which you must repay over time in predetermined monthly installments.

You might be a good candidate for a home equity loan if you are certain of the exact amount you need to borrow or like the idea of receiving your entire payment at once.

Home Equity Line Of Credit

In that, you are granted a credit limit and can borrow as much or as little as you like, a HELOC functions similar to a credit card. If you desire the flexibility of being able to borrow money as required, a HELOC can make sense.

The draw period and the payback term are the two-time frames in this type of second mortgage.

You may withdraw as much money as you require during the draw period, which may last between 5 and 10 years, up to your maximum. Simply make monthly interest payments on the amount you borrow.

After the draw period has passed, the repayment period (usually lasting 10–20 years) will start, and you will be obliged to pay back the principal borrowed as well as any accumulated interest. You will not be permitted to take out loans from your HELOC during the payback period.

A HELOC can be used for any purpose, but it's particularly helpful if you need to spread out the payment of a sizable financial obligation, like college tuition or a major home renovation.

What Factors Influence My Second Mortgage Application Approval?

All banks, building societies, and other mortgage lenders will view your current mortgage arrangement as covering the cost of your primary residence.

If you decide to buy a second property, your mortgage provider will regard it as such if you apply for a loan.

Your application will be viewed as a second home mortgage since you already have one, regardless of whether you intend to live there or rent it out.

Given that not all mortgage firms offer second mortgages, you should first ask your current mortgage provider if they would. It's likely that you'll encounter stricter conditions if you apply for a second mortgage with any of the lenders.

A larger down payment than what was allowed for your first mortgage is typically needed for a second mortgage on a home. Additionally, second home mortgage interest rates are probably going to be higher than regular mortgage interest rates.

What Is The Process For Getting A Second Mortgage?

The same standard financial checks will be performed on you, but because making two mortgage payments per month will be more expensive, the mortgage lender will be less willing to lend to you.

If you have some sort of security to safeguard the lender in the event that you are unable to repay the loan, banks are more likely to lend to you.

Property is typically seen as the principal form of security, so if you can't pay back your secured loan or second-charge mortgage, the bank may be able to seize your current home.

What To Consider About When Getting A Second Mortgage?

There is no denying the numerous advantages of a second mortgage. However, there are some disadvantages to take into account before you borrow one, just like with any other financial instrument.

When you take out a second mortgage, you are putting your home at risk since your lender will foreclose on it if you stop making payments. A second mortgage may also be expensive when interest, closing costs, and fees are added up.

Additionally, it could strain your finances. If you lose your job or incur a hefty medical bill, you risk going deeply into debt.

These risks, while not necessarily reasons to forego a second mortgage, should still be considered.

How To Get A Second Mortgage

Pay close attention to your financial situation. Once you know your credit score, calculate your DTI to see whether you can afford to take on additional debt.

Analyze your home's equity to see how much you own there: The market value of your home is calculated by deducting the balance of your mortgage.

Select the type of the second mortgage you desire: Do you want a home equity loan or a HELOC? The response will depend on whether you want a fixed sum of money or a revolving line of credit.

Look around you: Do some research to find lenders that offer the second mortgage you prefer. Consider borrowing money from banks, credit unions, and online lenders.

Speak with a Home Loan Expert: Once you've found one or two options that suit your needs and budget, it's a good idea to get in touch with a Home Loan Specialist. They'll be able to respond to all of your inquiries and make sure you're selecting wisely.

Pros And Cons Of Second Mortgages

Pros Of A Second Mortgage

Second mortgages could result in huge debt burdens. You might be able to obtain a second mortgage from some lenders that allows you to borrow up to 90% of the home's worth.

This implies that, especially if you've been making payments on your first mortgage for a while, you can borrow more money with a second mortgage than you can with other types of loans.

Interest rates on credit cards are greater than those on second mortgages. Second mortgages are categorized as secured debt, implying that they are supported by some kind of collateral (your home).

Compared to credit cards, second mortgages offer lower interest rates because the lender is less likely to suffer a loss.

There are no limitations on the amount of money that can be spent. You are free to use the money from your second mortgage however you see fit; there are no restrictions or constraints. When it comes to planning a wedding or paying off school loans, the sky is the limit.

Cons Of A Second Mortgage

Second mortgage interest rates are higher. Second mortgage interest rates are frequently higher than refinance interest rates. This is because lenders have less of an interest in your home than your primary lender does.

Your finances can be strained by second mortgages. You agree to make two monthly mortgage payments when you take out a second mortgage: one to your primary lender and one to your secondary lender.

This could have an impact on your family's financial situation, especially if you currently live paycheck to paycheck.

Is A Second Mortgage Right For You?

Second mortgages are liens held against a portion of the equity in your house that has already been paid off. When you take out a second mortgage, your lender might provide you with a single lump-sum home equity loan or a rolling line of home equity credit.

Your lender has the power to take possession of your home if you are in default on your second mortgage.

Refinances differ from second mortgages in that they increase your budget's monthly payment rather than changing the conditions of your current loan.

Second mortgages are typically more difficult to get than cash-out refinances since the lender has a smaller claim on the property than the primary lender.

Second mortgages are frequently utilized to pay for large, one-time expenses like paying for college or settling credit card debt.

Consider all of your options before applying for a second mortgage, and make sure you can afford the payments.

Your finances can be strained by second mortgages. You agree to make two monthly mortgage payments when you take out a second mortgage: one to your primary lender and one to your secondary lender.

This could have an impact on your family's financial situation, especially if you currently live paycheck to paycheck.

Mortgage Calculator

How To Pay Off My Mortgage Faster?

Since mortgages are frequently sizable commitments that persist for decades or more, paying off a mortgage early could save you tens of thousands of dollars in interest. Not to mention the relief from worrying about a mortgage payment each month.

Since mortgages are frequently sizable commitments that persist for decades or more, paying off a mortgage early could save you tens of thousands of dollars in interest. Not to mention the relief from worrying about a mortgage payment each month.

When you send your mortgage lender a check each month, the payment is split between the principle and interest. Early on in the loan, a sizeable portion of the payment is designated for interest.

With time, more of the payment is allocated to the principal. This process of recouping more of the lender's investment in the first few years is known as amortization. The secret to paying off your mortgage sooner is making additional payments to the principal.

Before deciding to early pay off your mortgage, consider the following:

- Do I have enough money in my emergency fund to pay costs for at least six months?

- Am I on track with my retirement savings and other important financial goals?

- Do I owe any money with a high-interest rate, such as on credit cards, and how much?

Paying off your mortgage early could be a sensible financial move if you can affirmatively respond to all three questions. A prepayment penalty may be imposed by some lenders; if yours does, make sure to factor that in as well.

6 Ways To Pay Off Your Mortgage Early

Make Additional Payments

The first choice is to split your mortgage payment in half and make two payments a month instead. Instead of the typical 12 months, you'll end up paying the equivalent of 13 months' worth of mortgage payments in a year.

This plan may be straightforward for some homeowners because it is rarely seen in the monthly budget.

To see if your lender will accept biweekly payments, you should ask; some won't. In this case, it's up to you to set aside those biweekly installments, which you'll pay in full each month.

Without the ease of a split monthly payment from the lender, the benefit of the additional year payment still stands.

The second choice is to increase your monthly payments in order to pay off the principle more quickly, which might end up saving you tens of thousands of dollars over the life of the loan.

Assume you have a $4 percent, 30-year mortgage on a $250,000 home. If you make an additional $100 monthly payment on the principal of your loan, you might reduce the length of your mortgage by four years and $27,957.

Since this technique does not obligate you to a payment, it is preferable to refinancing. If unforeseen circumstances prevent you from raising your monthly mortgage payment, you won't be penalized.

Make sure to confirm with your lender that the payments will be applied to the principle rather than the interest if you pick this option. Verify with the lender that the extra payment is not for the mortgage payment for the following month.

Change Your Loan to a Shorter Term

The most popular loan type is a 30-year mortgage, while lenders occasionally offer loans with shorter terms. The most common loan length is 15 years, but many lenders also provide 10-, 20-, and 25-year loans.

Greater monthly payments but lower interest throughout the course of the loan are the outcomes of shorter repayment terms. Think about the distinction between a 20 - and a 30-year term.

Most 20-year mortgages feature interest rates that are lower than 30-year mortgages. The difference between 20-year and 10-year rates is normally between 0.125 percent and 0.25 percent.

Let's say you borrow $250,000 for 30 years at a 3.75 percent interest rate. It would cost you around $1,150 each month in principle and interest payments.

If you had the same loan amount but a 20-year term at 3.625 percent, your monthly payment would be $1,450. A few hundred dollars more each month would be required, but ten years sooner you would be debt-free.

What is the best aspect? You would save approximately $65,000 in interest if you kept up with the 20-year mortgage until it was paid off.

You won't have to start over with another 30 years of payments if you refinance to a shorter term. Many homeowners who are deep into their initial mortgage term may not see the benefit of starting over with another 30 years of interest.

On the other side, a refinance over 15 years gives you the chance to lock in a low-interest rate and a shorter loan term, enabling you to pay off your mortgage more quickly. Just keep in mind that your monthly payments will increase the shorter the loan term is.

Recast Your Mortgage

In contrast to refinancing, recasting a mortgage allows you to keep your current debt. You only need to make a single principal payment, and the bank will adjust your repayment schedule to take the additional sum into account. The length of the loan will be shortened as a result.

Recasting is far less expensive than refinancing, which has higher expenditures. Recasting a mortgage typically only costs a few hundred dollars. On the other hand, refinance closing costs are typically in the range of a few thousand dollars.

Additionally, if your mortgage has a low-interest rate right now, you might keep it if you refinance. If your interest rate is higher, refinancing can be the wiser course of action. Consult your lender or servicer if you prefer this choice. Some companies do not allow mortgage recasts.

Pay Your Principal In Lump Sums

An alternative to recasting is to make lump-sum payments to your principal whenever you can. If a homeowner receives a sizable bonus, receives an inheritance, or sells valuable goods, they may decide to utilize the extra money to reduce their mortgage.

Lump-sum payments might be the best choice for borrowers with VA and FHA loans because these loans cannot be recast. You'll also avoid paying the lender's recasting fee.

You may be required to tell some mortgage servicers when more money should be put toward the principle. Consult your servicer if you're unsure of how lump-sum payments will be used.

Round Up Your Mortgage Payments

Another way to significantly shorten the term of your mortgage is to round up. When calculating your mortgage payment, round up to the nearest $100. Pay $800 rather than $743. You might also pay $900 instead of $860.

Benefits And Drawbacks Of Early Mortgage Payoff

In the long term, you can save money by paying off your mortgage early. You'll have more money to play with each month and save money on interest if you cease making payments.

On the other hand, not everybody can afford to make additional mortgage payments. You could be better off investing the money or focusing on other debts instead. The following is a list of advantages and disadvantages of paying off your mortgage early.

4 Benefits Of Paying Off Your Mortgage Early

Spend less money and avoid interest.Your monthly mortgage payment includes an interest component, so the fewer payments you make each month, the less interest you'll have to pay.

By paying off your mortgage early, you could end up saving tens of thousands of dollars. Just make sure to let your lender know that any extra payments would only go toward the principle and not the interest.

There won't be any monthly payments going forward.By lowering your monthly mortgage payments, you can use that money for other purposes. For instance, you may invest the extra money or utilize it to cover your child's college expenses.

The property only has you as an owner.If you experience a financial setback, it's likely that you won't be able to make your monthly mortgage payments. Your home can be seized if you fall behind on your payments. When you own your house outright, there is no chance of losing it.

Mindfulness.You might simply enjoy the idea of not having to worry about a mortgage. The freedom that comes with not having to make mortgage payments is a powerful inducement.

4 Drawbacks Of Paying Off Your Mortgage Early

investing enables you to increase your earnings. Currently, the typical mortgage interest rate is around 3%. The average stock market return over a ten-year period is around 9%.

Therefore, investing in the stock market for 10 years will most likely result in a profit over paying off your mortgage 10 years earlier.

Mortgages are subject to prepayment penalties. If you sell, refinance, or pay off your mortgage within a certain amount of time after the original mortgage closes (usually three to five years), you will be charged a mortgage prepayment penalty by the lender.

Not all lenders levy this fee, and you usually won't need to worry about it if you plan to pay off your mortgage in more than five years. You should, however, always seek advice from your lender first.

There is no longer a tax deduction for mortgage interest. If you own a property, you can deduct the amount of mortgage interest you pay from your taxable income. You will lose this benefit if you pay off your mortgage earlier than planned.

Your credit rating will suffer. The variety of credit products you have is one of the factors that affect your credit score. You might, for instance, have a mortgage, a car loan, and a credit card.

If you stop using one type of credit, your credit score will suffer. It should just be a small adjustment, but it's something to consider.

Is It Possible For You To Pay Off Your Mortgage Early?

Most of the time, you can pay off your mortgage early without incurring penalties, but there are a few things to think about first.

Start by asking your loan servicer if there is a prepayment penalty associated with your mortgage. If it does, there will be a fee if you repay your loan early. Depending on your financial situation, this may affect your ability to pay off your mortgage early.

Second, see whether there are any restrictions on when and how to make additional payments.

It's important to make sure that any additional payments go toward the principle rather than the interest because some loans have stipulations that urge you to adhere to the payment schedule.

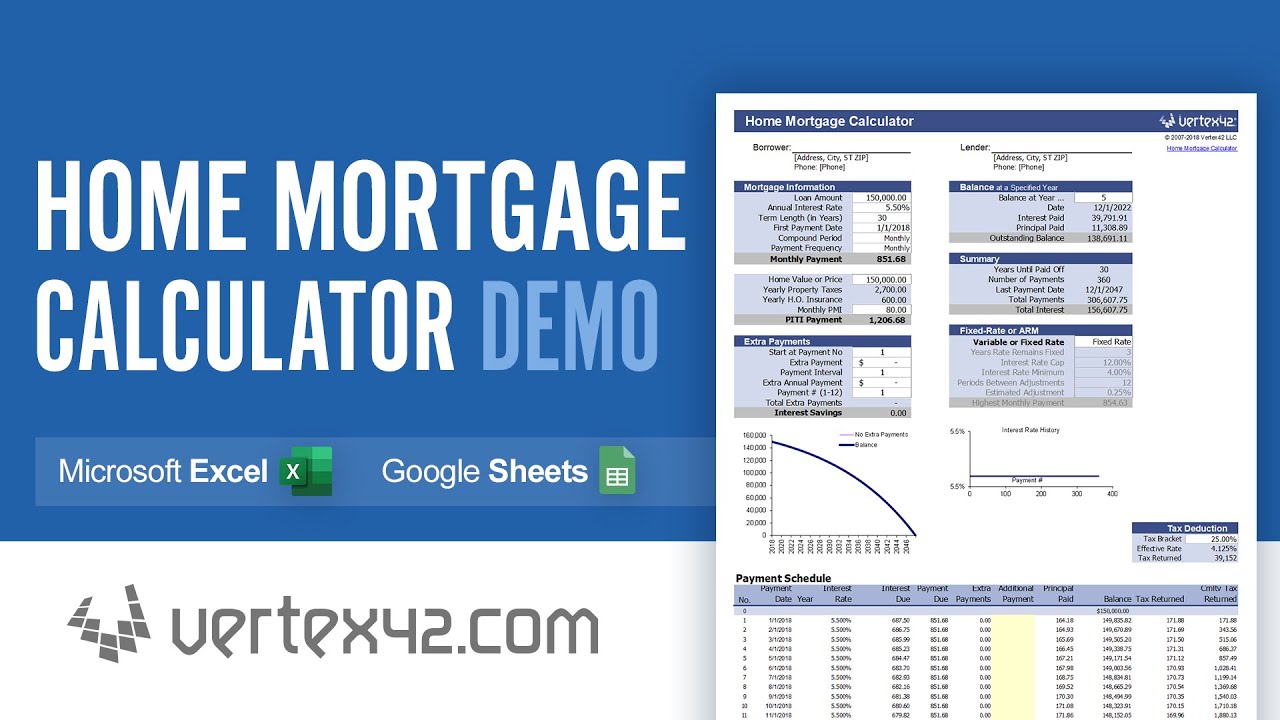

Home Mortgage Calculator Demo

Top 10 Questions To Ask Yourself Before Paying Off Your Mortgage Early

How Would You Put The Money You'd Save On Monthly Payments To Good Use?

You should have a plan in place for how you'll spend the extra money if you're paying off your mortgage early to increase your monthly cash flow.

It might be a wise use of your money if you decide to invest your $900 monthly investment instead of paying your $900 mortgage.

In the end, it's up to you to decide how to use the extra money. If you don't know what you'll do with the money or if you'd spend it on frivolous stuff, paying off your mortgage early might not be the best financial move.

The following ten queries should be answered before you pay off your mortgage early.

What Other Debts Do You Have?

For the first time, being aware of your mortgage rate is helpful since it enables you to compare all of your loan rates side by side.

Here's a quick tip: pay off your most expensive loans first. I realize that sounds dumb, but you'd be surprised at how many people don't do it correctly.

Many people make the error of assuming that the interest rate is what really matters and that the amount they owe is what makes the loan expensive. The risk of debt accumulation increases with an interest rate, which makes it harder to pay off the debt over time.

If you have credit cards, store cards, personal loans, or other high-interest debt, look into the interest rates you're paying. Before thinking about paying your mortgage off early, you should pay off any debts that are bigger than it.

Are You On Track With Your Retirement Plan?

Before paying off a mortgage, take some time to determine whether your retirement plan is feasible. You can do this by meeting with a financial advisor, using online calculators, or doing both.

Yes, saving for retirement with less liquid investments would arise from paying off a mortgage rather than making stock market investments. You could be able to contribute more to your retirement plans in the future if your household expenses are lower.

Having a paid-off home also implies you will have lower in-retirement expenses, which will allow you to reduce your expected withdrawal rate.

The time horizon has a significant impact on the decision-making process in this situation.

Those who have more time before retirement can benefit more from the compounding benefits of the investments they make today, whereas those who are close to or in retirement and intend to start using their investments may not get the best return on investment by allocating more money to their investment accounts.

What Is Your Mortgage's Interest Rate?

You must be aware of your current interest rate if you're considering paying off your mortgage early.

Why? Understanding your rate will provide you with the knowledge you need to decide whether or not overpaying is the right course of action for you, as we'll see in the next sections.

It's all too simple to hear a buddy say they've cut their mortgage term and interest rates by thousands of dollars and conclude that's what you should do as well.

Nevertheless, you need to perform your own calculations to ensure that paying off your mortgage early is the right move. The first step is to have your current mortgage rate close to hand.

What Is Your Investment Portfolio Like, And Where Do You Keep It?

Everyone should have an emergency fund, however, some people might need to increase their amounts to take into account their unpredictable income. It's important to think about how stable your actual income is.

While there is a certain amount of uncertainty in every life, it is especially significant for those who are self-employed or run their own business.

Additionally, it is not a good idea to make an opinion about how consistent your revenue is.

Be fully honest with yourself and determine your average salaries over the last year to gain a reliable estimate of your monthly income because it's easy to get this wrong, especially if you're supplementing with debt from credit cards or other sources.

Once you have it, you may begin to consider how things might change over the coming weeks, months, and years. Do you have a backup plan in place in the event that your most crucial client files for bankruptcy? Is the work you do truly risk-free? Will there be job cuts at work?

While none of us have a crystal ball, planning is often made easier with a little forethought. Since this study of our situation may clearly rule out the possibility of overpaying your mortgage, it is time and work well spent.

How Consistent Is Your Income?

Everyone should have an emergency fund, however, some people might need to increase their amounts to take into account their unpredictable income.

It's important to think about how stable your actual income is. While there is a certain amount of uncertainty in every life, it is especially significant for those who are self-employed or run their own business.

Additionally, it is not a good idea to make an opinion about how consistent your revenue is.

Be fully honest with yourself and determine your average salaries over the last year to gain a reliable estimate of your monthly income because it's easy to get this wrong, especially if you're supplementing with debt from credit cards or other sources.

Once you have it, you may begin to consider how things might change over the coming weeks, months, and years.

Do you have a backup plan in place in the event that your most crucial client files for bankruptcy? Is the work you do truly risk-free? Will there be job cuts at work?

While none of us have a crystal ball, planning is often made easier with a little forethought. Since this study of our situation may clearly rule out the possibility of overpaying your mortgage, it is time and works well spent.

How Much Money Can You Save By Taking Advantage Of Your Mortgage Interest Deduction?

Since they can write off their interest payments as a tax deduction, many homeowners think it's a smart idea to keep their mortgages

As previously mentioned, this deduction eventually disappears because interest payments on mortgages are front-loaded.

People who have held mortgages for a long time and have been able to pay them off may be overestimating the amount of taxes they save by doing so, and itemizing deductions may not save them nearly as much as the standard deduction.

Will The Current Mortgage Allow You To Pay Down The Loan Early?

Credit card debt should always be paid off first because the interest rates are typically higher. Do you have a strategy to pay off the loan early, and if so, how much, assuming you don't have any or have already paid them off?

There will usually be a limit on how much you can pay, usually 10% of the entire loan amount, if you have a fixed rate loan and are paying off a sizable chunk of your debt.

Your obligation to pay an Early Repayment Fee (ERC) will therefore be nearly certain. Once the promotional rate period is over, there are often no restrictions, but it's a good idea to get in touch with the lender or review your mortgage offer to make sure.

Another thing to bear in mind is that the initial few years will primarily consist of interest payments (depending on how long you have had your mortgage).

This means that the repayments will be primarily top-heavy, and even if you decide to pay off the mortgage early with excess funds, your overall debt would not have lowered significantly.

Is It Possible That Inflation May Help You In Paying Down Your Mortgage?

You might not be aware of this, but it's important. Only 20 years ago, a house could be acquired for $5000 [compare that to the $35,000 price of a ridiculously overpriced bottle of champagne in Mayfair today].

This suggests that after 25 years, the amount you repay on your mortgage will be significantly less valuable than what you originally paid for it.

Do not be concerned about inflation; the amount you have been paying will be worth less in 25 years than it is today ($250K in 25 years will be worth less than $250K now).

If you don't mind spending money now that will only be worth a small portion of what it is in 25 years, pay off your mortgage.

Could You Receive A Greater Return On Your Investment Elsewhere?

Paying off your mortgage may or may not be the best use of your money, pound for pound, if the cost of financing is extremely cheap because there is an opportunity cost of cash to consider when borrowing money for real estate investment.

Think about whether you would prefer to preserve $200 or produce $500 in net cash flow each month by renting a home and benefiting from capital development

You have several important investing options if you can borrow money at a rate of two percent or higher and make a standard buy-to-let yield of at least fifteen percent.

Does Google Have A Mortgage Calculator?

On Wednesday, Google upgraded its search engine with new resources for anyone looking for mortgages, including a calculator, current average mortgage rates, and important phrases homeowners might need to be aware of.

Because it saw that many individuals were searching for answers to questions like "what is a mortgage?" and "what is APR?," among other things, Google teamed up with the Consumer Financial Protection Bureau to offer the new tools.

A mortgage is defined as "an agreement between you and a lender that allows you to borrow money to purchase or refinance a home and gives the lender the right to take your property if you fail to repay the money you’ve borrowed," according to the CFPB in the overview section.

Additionally, it provides definitions for important terminology like APR (annual percentage rate), ARM (adjustable-rate mortgage), amortization, appraisal charge, credit score, and more.

Your monthly mortgage can be calculated using the calculator section depending on a number of variables, including the loan amount, the interest rate for a certain loan period (such as a 30-year fixed), the state in which you reside, and your credit score.

You may also determine your potential housing budget using the "buy budget" tab, which takes into account your household's income, monthly debt obligations, anticipated down payment, and loan terms.

For first-time buyers, this section will be quite helpful because it provides an excellent beginning point for determining the cost of the home you can afford.

All of that will vary based on several of the elements you may see on this page.

The rates page displays the 30-year fixed, 15-year fixed, and 10/1 adjustable-rate mortgages' most recent average rate.

Again, you only need to enter the loan amount you're thinking about, the size of the down payment on your home, the state where you live, and your credit rating.

You may find the most popular tweets on mortgages and the latest news articles on mortgage rates by scrolling down.

There are a few other tools as well, but the majority link to news articles regarding subjects like mortgages or refinancing.

However, the procedure tab guides you through the entire mortgage application process, including budgeting, finding lenders, evaluating loan possibilities, and going over the necessary paperwork.

Again, if you've never looked for a home before or haven't in a while, this will be incredibly helpful. All of this data is offered by the CFPB; Google just makes it simpler to find.

People Also Ask

How Lenders Decide How Much You Can Afford To Borrow

Mortgage lenders must determine your capacity to pay back the sum you wish to borrow. The debt-to-income ratio is just one of several elements that go into that evaluation.

The percentage of your monthly pretax income that is used to pay off debt, such as your mortgage, vehicle loan, student loans, minimum credit card payments, and child support, is known as your debt-to-income ratio.

Lenders like debt-to-income ratios of 36 percent or below, which equates to a monthly ceiling of $1,800 on an income of $5,000 before taxes.

How A Mortgage Calculator Helps You?

Mortgage lenders help determine your capacity to pay back the sum you wish to borrow. The debt-to-income ratio is just one of several elements that go into that evaluation.

The percentage of your monthly pretax income that is used to pay off debt, such as your mortgage, vehicle loan, student loans, minimum credit card payments, and child support, is known as your debt-to-income ratio.

Lenders like debt-to-income ratios of 36 percent or below, which equates to a monthly ceiling of $1,800 on an income of $5,000 before taxes.

What Is The Easiest Way To Calculate A Mortgage Payment?

To calculate the number of loan installments, multiply the number of years in your loan term by 12 (the number of months in a year). A 30-year fixed mortgage, for instance, would require 360 payments (30x12=360).

Conclusion

The single largest personal expense that most people will ever make is the purchase of a home. Do the math carefully before taking on such a huge loan.

Consider your situation and how you want to live in the future, not just now but over the next decade or two, after you have run the numbers.

Before you purchase a new home, consider not just the cost of the purchase but also how your life and budget will be impacted by the subsequent mortgage payments.

Then, acquire loan estimates from a variety of lenders for the sort of home you want to buy to learn about the actual reductions you might be able to get.

A mortgage is a useful tool for buying a house since it enables you to do so without having to make a sizable down payment.

It's important to understand the mortgage payment structure when you take out a loan, as it includes not only the principal (amount borrowed), but also interest, taxes, and insurance.

It predicts the length of time it will take you to pay off your mortgage and, consequently, the cost of financing your home purchase.

Gordon Dickerson

Author

Frazer Pugh

Reviewer

Latest Articles

Popular Articles