Digital Banking Transformation Odyssey - Tech Driven Triumph

Explore the future of finance with our comprehensive guide to digital banking transformation. Learn about the latest trends, technologies, and strategies reshaping the financial landscape.

Author:Stefano MclaughlinReviewer:Luqman JacksonJan 02, 20247.3K Shares100.6K Views

In the dynamic realm of finance, the winds of change are ushering in a new era – the digital banking transformation. As traditional banking methods evolve, institutions are embracing innovative technologies to meet the growing demands of a digitized world.

This paradigm shift encompasses a spectrum of advancements, from seamless online transactions to artificial intelligence-driven customer service.

Join us on a journey through the intricate landscape of Digital Banking Transformation, where we unravel the threads of technological disruption and strategic adaptation that redefine the way we interact with financial services.

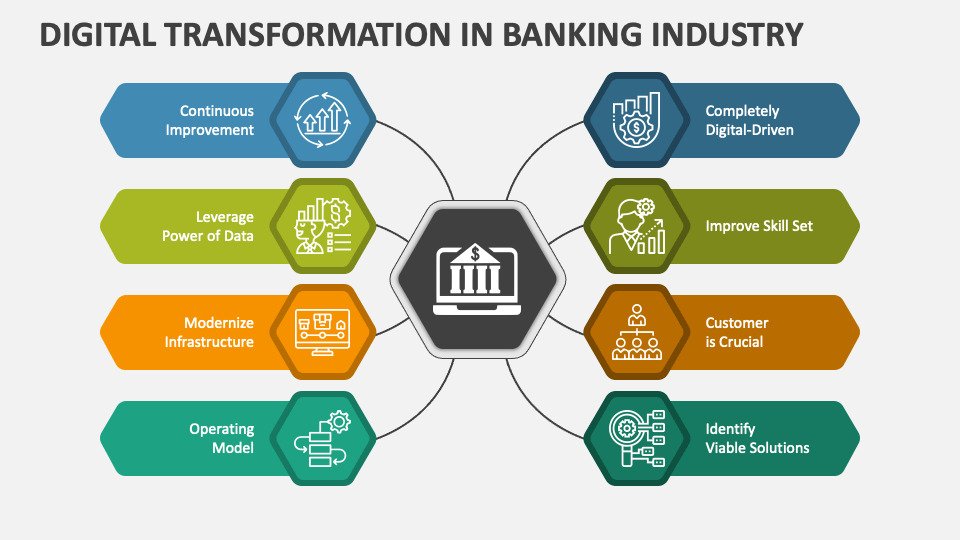

Importance Of Digital Transformation In Banking

Digital transformation in banking is much more than simply transitioning from a traditional to a digital environment. The entire concept of digital transformation strategy in banking is a critical process that banks and financial institutions use to assess, communicate with, and serve their consumers.

Understanding consumer behavior, interests, and needs is the starting point for digitization in banking and fintech. As a result, the banking industry has shifted from a product-centric to a customer-centric mindset.

According to MarketsandMarkets, the global digital banking platform market is predicted to rise at an 11.3% CAGR from USD 8.2 billion in 2021 to USD 13.9 billion in 2026. According to the report, this expansion is the result of increased desire among banks to provide the greatest customer experience and the growing adoption of cloud technology in banking institutions.

In terms of clients using digital banking, Statista projects that 2.5 billion people will use online banking services by 2024. Online banking applications, data encryption software, virtual assistants, KYC system software, website optimization, and other instances of digital banking transformation are provided.

This raises a slew of concerns about digitization in modern banks and other commercial institutions. Let us begin by examining how the digital process in banking began, taking into account the transition from a traditional to a digital approach.

The Shift From Traditional To Digital Banking

Most banks began their digital banking journey with a clear strategy years ago, despite significant hurdles along the road. The digital banking movement began when financial leaders noticed that the majority of their customers were using digital channels.

The banking industry has become more client-centric and technologically sophisticated as digital initiatives have been implemented from the top down. What is the current state of the transition from traditional to digital platforms? Let's go over the highlights of this journey.

Omni-channel took root in financial services as more clients utilized their mobile applications and websites to complete transactions. As a result, mobile banking became an essential component of the digital banking journey.

Traditional banks had to adapt to new technology and operating models that could keep them in the loop throughout the whole client journey in order to keep up with the ever-changing market.

Simultaneously, the rise in popularity of Artificial Intelligence (AI), blockchain, and the Internet of Things (IoT) has hastened the process of modernizing the banking business.

Currently, banks rely heavily on an omni-channel strategy, breaking down data silos from every channel to improve the client experience.

This digital banking transformation has assisted financial service providers in increasing efficiency, producing growth and convenience, and bringing in more prospective clients. This brings us to our next topic: the main criteria that enable digital transformation in banking and financial services.

What Is The Process Of Digital Banking Transformation?

While some financial institutions have been cautious to abandon tried-and-true techniques, the majority understand the enormous benefits of doing so. Changing the way technology define business activities, processes, competences, and models can result in enhanced operations and a better customer experience, not to mention staying ahead of the competition.

You are not alone if you find it difficult to obtain the digital and leadership resources you require. Many financial institutions face this problem when attempting to enhance themselves or their operations.

However, starting the strategic planning process is one thing; maintaining momentum is another. Instead of viewing transformation as a daunting procedure, consider it a journey that begins with determining your destination and sketching out the path you'll follow to get there.

Here are a few crucial actions to take if your financial institution is ready to begin its digital transformation:

Assess Your Current Technology And Processes

Examine your current inventory of systems and goods, as this is your set of tools for completing your pre-transformation business operations. Are there any skills you haven't used yet? Do you implement annual product planning in accordance with your budget and strategic plan?

A thorough review will show you what you need to work on and where you can improve. You'll also learn how to make the most of what you already have and what additional digital tools or skills you should add to increase your online presence.

Customer satisfaction can be increased by being transparent about your operations. Ensure that your processes are uniform across channels and that they support digital account opening. Consumers can provide vital feedback on the apps and resources you offer through app store ratings and other social media platforms.

The following criteria will assist you in deciding whether or not to modify your processes:

- In-store services.

- Whether or not existing digital services are optimized for multichannel interactions.

The goal is to create a comprehensive list of procedures that will be involved in your transformation while keeping time and financial constraints in mind.

Evaluate Your Culture

In business, culture is everything, and a transition will frequently result in a drastic cultural shift, challenging the status quo. You must examine your culture's traits to ensure that the transformation improves the weaker portions while not destroying the better aspects of your culture.

Any company-wide shift creates an emotional burden on its employees, as digital transformation may be extremely difficult for an established culture. Whether or not higher management supports the changes you wish to implement will have a big impact on how successful those changes are. It may be more challenging to get everyone on the same page if decisions are made from the bottom up.

Have you examined the ideal organizational structure for digital optimization? Do you have digital specialists on staff who can assist employees or customers who are unfamiliar with technology? Are your recruiting and training efforts producing the required digital talent? These are the questions you must ask to guarantee that the planned changes protect your culture.

Consider the following considerations when deciding whether your firm is ready for digital transformation:

- Whether or if your current culture is adaptable.

- If the reform is supported by the leadership.

- A possible new organizational structure.

- How to integrate recruitment and training initiatives with digital needs?

Companies must have aligned and accountable leaders and people to support digital transformations in order to be successful.

Identify Client Needs Using Data And Analysis

Data aggregation can be difficult, yet it is necessary for understanding your target audience. Examine how you're doing it right now. Do you separate your customers based on demographics, lifecycle, and product mix? How do your digital offerings relate to different client segments?

Consider the following points as you develop your segmentation strategy:

- Which products are doing well and making the most money?

- What digital services do you provide that may be of interest to customers?

- Do you have a system in place to collect information on client behavior and preferences?

- Is there anything fresh you could offer that would stimulate growth?

The idea is to create a strategy for anticipating which customers are more likely to add digital services so that you can reach out to them with customized marketing.

Determine Resource Priorities

Working towards your goals from the start requires a practical and realistic approach. Consider that digital transformation can be accomplished gradually by beginning with a few essential projects that can be improved upon later. This mentality must be recognized by stakeholders.

Establish your digital transformation priorities by:

- Finding quick wins

- Taking into account other efforts that may be competing for resources

- Avoiding doing everything all at once

- Once you've determined your goals, develop a prioritized list of techniques that will allow your organization to implement change gradually, beginning with a few small triumphs.

Encourage Participation At All Levels

Following the establishment of your digital transformation goals, implementation comes next. And this takes work from everyone, not just those highlighted in our previous discussion on culture, but also enthusiastic buy-in from your employees and customers.

To generate enthusiasm for the transformation:

- Create a clear internal communications plan with specific roles and duties to ensure the success of your digital program, and continue to promote it internally.

- Create an external marketing plan that defines what customers may expect when they interact with your financial institution, as well as the advantages of new digital goods and resources.

- A standardized method of accessing and managing information allows employees to provide input that can lead to educated enterprise-wide choices.

- A well-structured change management program is critical for ensuring that staff at all levels receives sufficient assistance to carry out the transformation. Even with a systematic change management program, it can be difficult to achieve long-term change due to the various shifting difficulties that arise during the transformation. However, if the workforce is successful, they will become enthusiastic about change, ready for frequent new experiences and innovations.

Benefits Of Digital Transformation In Banking

Exceed Customer Expectations Through Improved Customer Journeys

Customer needs, desires, and behaviors should guide digital journeys. Instead of focusing on individual touchpoints, banks should address the entire customer journey, which spans various activities and channels. Leading banks are creating comprehensive digital experiences that involve prospecting, sales, onboarding, and continuing customer servicing.

Banks may differentiate themselves from the competition by adopting digital identity solutions. Banks frequently provide the same product at relatively similar prices; a digitized, more simple way to onboarding can help onboard more consumers faster. It has been demonstrated that banks with superior customer service grow deposits faster.

Expand Consumer Acquisition Via Digital Platforms

Customers no longer desire to create an account at a branch. Adding a digital channel as an account opening option gives users another option. If you've already developed digital channels, the goal now is to keep them competitive.

Digital channels are a more efficient and cost-effective approach to acquiring clients, and they help a bank become more competitive, particularly when competing against newer challenger banks. Identity verification is critical to the digital onboarding process since it allows banks to rapidly and securely check who they're doing business with.

Promote Automation And Efficiency

60% of business operations are not automated. Banks are spending vast sums of money on both their front and back-end architecture in the absence of digital technologies. Manually processing and verifying each new account opening, or verifying clients when they make a major transaction, is no longer scalable.

Automated verification relieves pressure on internal teams and frees up time for them to focus on tasks that require human input.

Avoid Fraud And Ensure Compliance

Understanding your clients online is critical for achieving compliance standards and reducing fraud in a digital environment. Because manual approaches to KYC and fraud protection cannot scale, many firms are turning to automated solutions powered by artificial intelligence (AI).

Comprehensive identity verification ensures that firms comply with AML and KYC rules while reducing fraud exposure through PEPs, penalties, and negative media solutions.

Technologies That Propel Banking's Digital Transition

An effective digital transformation strategy necessitates the use of cutting-edge technology. This is your chance to become acquainted with the current trends in digital banking.

ML And AI

Artificial intelligence (AI) has transformed the banking and financial industries, from chatbots and online assistants to data analysis and predictions. Machine learning (ML) also works with data and aids in the detection of fraud. It captures, stores, and compares client data in real-time to detect anomalies and recommend prompt preventive steps.

Blockchain

No discussion on digital transformation in banking and financial services would be complete without mentioning blockchain technology. The incorporation of blockchain technology into financial services has resulted in more transparency, safe transactions with digital customer identities, and an improved user interface.

IoT (Internet Of Things)

IoT enables operations such as biometric process authorization, asset tracking and monitoring, location-based services, and contactless payment. Through real-time data analysis, it tailors and personalizes client experiences. Through data transmission, IoT also enabled risk management and access to many platforms.

The Cloud Computing

Banks have moved from opposing cloud-based services to accepting their inevitability. Cloud computing enables banks to develop solutions that improve their operations by utilizing applications and infrastructure. Furthermore, cloud-based services result in increased productivity and immediate product and service delivery.

API

APIs (application programming interfaces) are critical in today's banking sector because they enable data sharing and improve the user experience, allowing banks to interact with new clients. Banks may expand into new markets and encourage innovation by making their APIs available to developers so that they can quickly build integrations and applications for their systems.

RPA

Because banks must deal with large amounts of data using standardized processes, robotic process automation (RPA) is the ideal solution for automating and cutting operating expenses. It also reduces manual effort, lessening staff workers' workload. Furthermore, because it does not interact with existing sophisticated banking systems, this technology may be introduced swiftly.

Big Data Analytics

Banks don't operate the same way they did a decade ago, and big data is a key part of that. Big data technology has advanced the banking sector's development by assessing client expenditure, monitoring risk, and controlling feedback.

Because of this technology, banks have also been able to keep up with changing and expanding market demand.

Digital Banking Transformation - FAQs

What Is Digital Banking Transformation?

Digital Banking Transformation refers to the strategic integration of digital technologies in the banking sector to enhance operational efficiency, customer experience, and overall agility.

How Is Technology Driving Digital Banking Transformation?

Technology plays a pivotal role by enabling features such as mobile banking apps, artificial intelligence, blockchain, and data analytics, which collectively redefine how financial services are delivered.

What Are The Key Benefits Of Digital Banking Transformation For Customers?

Customers benefit from enhanced convenience, personalized services, faster transactions, and improved accessibility to financial products through Digital Banking Transformation.

How Do Banks Ensure The Security Of Digital Transactions During The Transformation Process?

Banks implement robust cybersecurity measures, encryption protocols, and multi-factor authentication to ensure the security and integrity of digital transactions in the transformation journey.

What Challenges Do Banks Face In Adopting Digital Banking Transformation?

Challenges include legacy system integration, regulatory compliance, data privacy concerns, and the need for upskilling the workforce to adapt to new technologies.

Final Words

The wave of digital banking transformation is not merely a trend but a fundamental reimagining of the financial landscape. As institutions increasingly leverage cutting-edge technologies, customers can anticipate a more personalized, efficient, and accessible banking experience.

The synergy of data analytics, blockchain, and mobile applications is propelling the industry toward unprecedented heights of innovation. The future of banking is here, marked by agility, customer-centricity, and a commitment to staying ahead of the digital curve. Embrace the transformative journey - where traditional meets technological, and banking evolves into a seamless, secure, and interconnected ecosystem.

Stefano Mclaughlin

Author

Luqman Jackson

Reviewer

Latest Articles

Popular Articles