10 Cybersecurity Threats In Fintech And Best Practices To Counter These Threats

Explore essential insights into cybersecurity threats in fintech, uncovering the key challenges and solutions to protect financial data and systems in the rapidly evolving digital finance landscape.

Author:Stefano MclaughlinReviewer:Luqman JacksonJan 17, 202418.3K Shares261.5K Views

The rapid evolution of Financial Technology (FinTech) companies has transformed the way we manage finances, offering unprecedented convenience and accessibility. However, this technological advancement has introduced significant cybersecurity risks, challenging the integrity and security of financial systems.

Let's delve into the top 10 cybersecurity threats in FinTech and explore effective solutions to these challenges.

10 Cybersecurity Threats In Fintech

The FinTech industry, with its rapid growth and technological advancements, faces significant cybersecurity threats. These threats range from traditional cyberattacks to more sophisticated methods exploiting emerging technologies. Understanding these threats is crucial for FinTech companies to develop robust security strategies.

1. Data Breaches

Data breaches in FinTech are alarming due to the highly sensitive nature of financial information. Cybercriminals exploit vulnerabilities to access and steal user data, resulting in financial fraud and identity theft. These breaches can occur through various means, including:

- Hacking -Cybercriminals use sophisticated techniques to exploit security weaknesses in software and networks.

- Malware -Malicious software is used to gain unauthorized access and damage systems.

- Physical Theft -Stealing devices like laptops or hard drives containing sensitive data.

- Social Engineering -Tricking employees into providing access to confidential information.

- Unsecured APIs -Exploiting vulnerabilities in APIs to access sensitive data.

- Insider Threats - Employees misusing or leaking information, either maliciously or unintentionally.

2. Phishing Attacks

Phishing remains a prevalent threat, with attackers using deceptive methods to extract sensitive information. These attacks typically involve:

- Email Scams -Fraudulent emails impersonating legitimate organizations.

- Smishing -Phishing via SMS, where attackers send text messages to lure victims.

- Spear Phishing - Targeted phishing attacks aimed at specific individuals or companies.

- Vishing - Voice phishing, using phone calls to extract personal details.

FinTech firms counteract this by educating users on spotting phishing attempts and implementing multi-factor authentication for added security. Advanced email filtering systems and updated security protocols are critical in thwarting these attacks.

3. Insider Threats

Insider threats arise from employees or partners misusing their access to sensitive data.

This includes:

- Malicious Insiders -Employees deliberately causing harm through data theft or sabotage.

- Negligent Insiders - Staff inadvertently compromising security through careless actions.

- Credential Theft -Attackers gaining access to insider credentials and masquerading as legitimate users.

FinTech companies are mitigating this risk through strict access controls and regular monitoring of employee activities. Promoting a culture of cybersecurity awareness and adherence to ethical guidelines is crucial in minimizing these incidents.

4. DDoS Attacks

Distributed Denial of Service (DDoS) attacks disrupt FinTech services by overwhelming systems with traffic.

These attacks involve:

- Network Flooding - Overloading the network with an excessive amount of traffic.

- Application Layer Attacks - Targeting specific aspects of an application or service.

- Multi-Vector Attacks -Combining different attack methods to overwhelm systems.

- Amplification Attacks -Exploiting vulnerable network protocols to magnify attack impact.

Investing in robust network infrastructure and real-time monitoring systems is key to detecting and mitigating these attacks. A well-defined incident response plan ensures quick recovery, reducing impact.

5. Regulatory Compliance

Navigating the complex regulatory environment is vital for FinTech companies.

Non-compliance risks include:

- Legal Repercussions -Facing lawsuits or legal actions due to non-compliance.

- Financial Penalties -Substantial fines imposed by regulatory bodies.

- Reputational Damage -Loss of customer trust and brand reputation.

- Operational Disruptions -Compliance failures leading to operational hindrances.

Adapting security strategies to evolving regulations and collaborating with legal experts for compliance is necessary to avoid penalties and reputational damage.

6. Mobile Security Risks

The widespread use of mobile platforms introduces several vulnerabilities, such as:

- App-Based Vulnerabilities -Flaws within mobile apps that can be exploited.

- Data Interception -Unauthorized interception of data transmitted over unsecured networks.

- Device Theft or Loss - Mobile devices containing sensitive information being stolen or lost.

- Insecure Wi-Fi Networks - Using public Wi-Fi for financial transactions can lead to data compromise.

Secure coding practices, regular updates, and robust encryption protocols are essential in securing mobile platforms. User education on mobile security risks further enhances protection.

7. Third-Party Risks

Collaborations with third-party vendors bring additional security challenges.

Dependencies on third-party vendors expose FinTech companies to additional risks, including:

- Vendor Data Breaches - Security lapses at vendor sites leading to data exposure.

- Supply Chain Attacks - Compromises in the supply chain affecting the integrity of services.

- Contractual Non-Compliance - Third-parties failing to adhere to contractual security obligations.

Conducting comprehensive risk assessments and establishing robust contractual agreements are crucial in managing these risks. Continuous monitoring of third-party security measures ensures compliance and security.

8. API Vulnerabilities

APIs are critical for data sharing in FinTech but introduce vulnerabilities.

APIs are crucial but can be vulnerable to attacks, such as:

- Man-in-the-Middle Attacks - Interception and alteration of data during API communication.

- Injection Attacks -Inserting malicious code into APIs to exploit them.

- Insecure Direct Object References - Exposing internal objects through APIs

Secure API design, strong authentication mechanisms, and regular security assessments are pivotal in mitigating these risks.

9. Ransomware Attacks

Ransomware attacks are increasingly targeting FinTech firms, posing serious operational and financial risks.

These include:

- Crypto-Ransomware -Encrypting valuable data and files.

- Locker Ransomware - Locking users out of their devices.

- RaaS (Ransomware as a Service) - Criminals offering ransomware tools as a service.

Regular data backups and robust network segmentation are crucial in limiting the impact of these attacks. Employee training in recognizing and responding to threats is essential for minimizing the risk of successful attacks. A well-prepared incident response plan is also vital for effective recovery and communication in the aftermath.

10. Artificial Intelligence And Machine Learning Risks

The use of AI and ML brings challenges like:

- Data Poisoning -Manipulating the data used to train AI models.

- Model Theft - Stealing proprietary AI and ML models.

- Adversarial Machine Learning -Crafting inputs to mislead ML models.

Ethical AI practices, algorithm transparency, and fairness assessments are necessary to mitigate bias. Rigorous testing and validation of AI models against potential attacks ensure the reliability and security of these systems in financial operations.

Additional Emerging Cybersecurity Challenges

In addition to these primary threats, the FinTech sector must also be vigilant about emerging cybersecurity challenges. These include:

Quantum Computing Threats

As quantum computing advances, it poses a future risk to current encryption methods, potentially rendering them obsolete and exposing financial data to new types of attacks.

Social Engineering Tactics

Beyond phishing, social engineering tactics are becoming more sophisticated, including baiting, pretexting, and quid pro quo attacks, which manipulate individuals into revealing confidential information or granting access to secure systems.

Cloud Security Vulnerabilities

With the increasing reliance on cloud services, vulnerabilities in cloud infrastructure can pose significant risks, including data breaches and service interruptions.

Internet Of Things (IoT) Exploits

IoT devices are becoming more common in the financial industry, but many lack robust security, making them potential entry points for cyberattacks.

Cryptocurrency-Related Threats

The rise of cryptocurrencies introduces new risks, including wallet thefts, exchange hacks, and the use of cryptocurrencies in money laundering or financing illicit activities.

By understanding and preparing for these diverse threats, FinTech companies can develop more effective strategies to protect their digital assets, maintain customer trust, and ensure the integrity of their financial services in a rapidly evolving digital landscape.

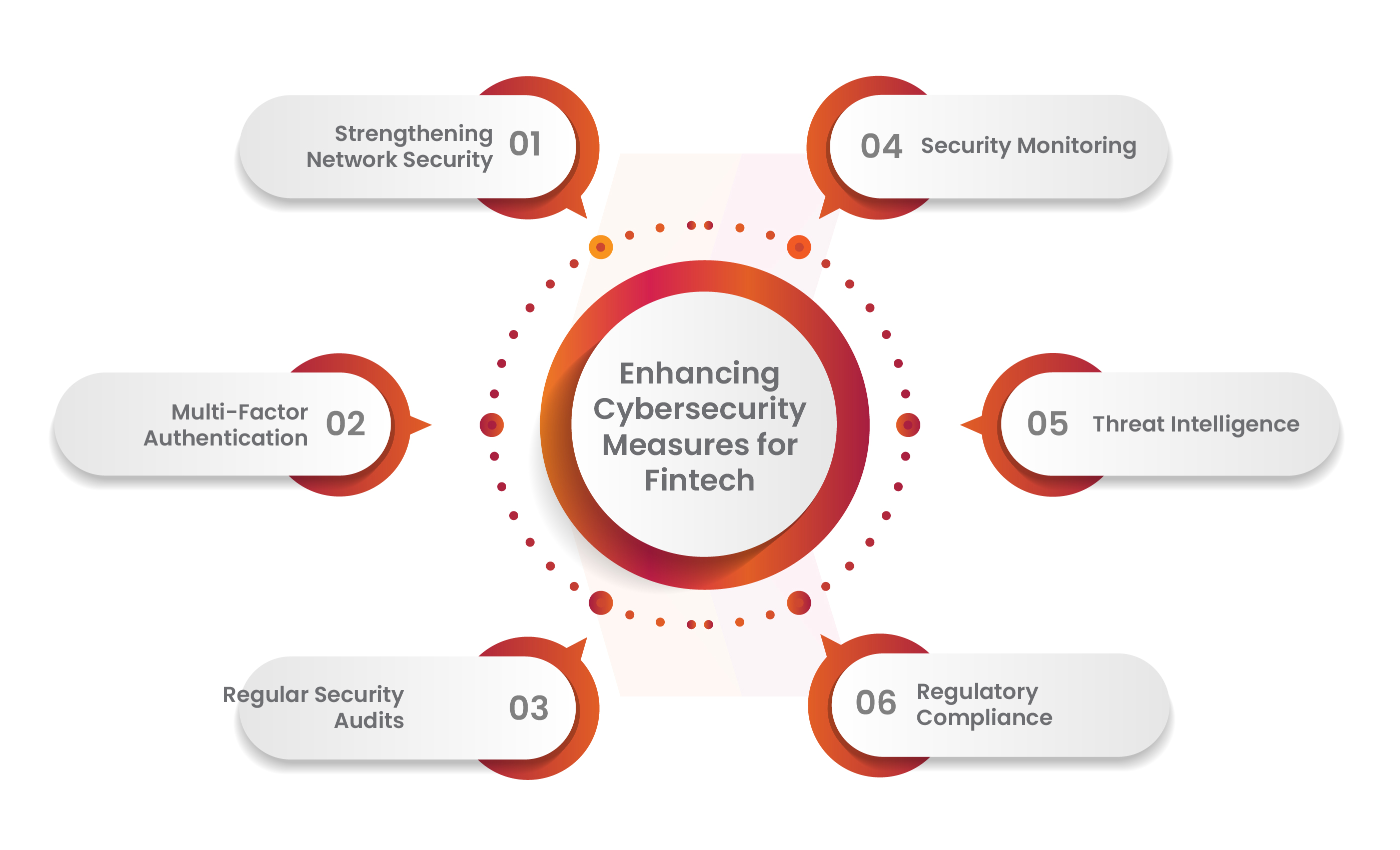

Best Practices In FinTech Cybersecurity

In the rapidly evolving FinTech sector, maintaining robust cybersecurity is paramount. Here we outline comprehensive best practices that FinTech companies should adopt to safeguard against a spectrum of digital threats.

Implementing Robust Encryption

Encryption is the cornerstone of data security. FinTech companies should employ end-to-end encryption for safeguarding data during transmission and storage. This ensures that even if data is intercepted, it remains indecipherable to unauthorized parties.

Conducting Regular Security Audits

Periodic security audits are critical for identifying and rectifying vulnerabilities. These audits should be comprehensive, covering all aspects of the FinTech ecosystem, including network infrastructure, applications, and end-user interfaces.

Developing A Comprehensive Incident Response Plan

An effective incident response plan is key to minimizing the impact of cyberattacks. This plan should outline clear procedures for threat detection, containment, eradication, and recovery. Regular drills and updates to this plan are essential as threat landscapes evolve.

Fostering A Culture Of Security Awareness

Human error remains a significant vulnerability. Regular training sessions, workshops, and communication campaigns can raise awareness among employees about cybersecurity best practices, phishing scams, and the importance of maintaining data confidentiality.

Adopting A Multi-Layered Security Approach

A multi-layered defense strategy, including firewalls, intrusion detection systems, and anti-malware software, provides a comprehensive shield against various cyber threats. This approach ensures that if one layer is breached, others stand to protect the system.

Ensuring Compliance With Regulations

Regulatory compliance is not just a legal obligation but also a trust factor for customers. Staying abreast of and complying with regulations like GDPR, PCI DSS, and others specific to different regions is essential.

Leveraging Advanced Technologies

Incorporating advanced technologies, such as blockchain, can enhance the security and transparency of transactions. Simultaneously, AI and machine learning can be used to predict and identify potential threats more efficiently.

Regularly Updating Systems

Cyber threats evolve rapidly, and keeping software and systems updated is crucial in defending against new vulnerabilities. This includes not just the core financial systems but also ancillary applications and employee devices.

Monitoring And Protecting Mobile Platforms

With the increasing reliance on mobile platforms, securing mobile applications is crucial. This involves implementing strong authentication mechanisms, securing APIs, and educating users about mobile security practices.

Managing Third-Party And Vendor Risks

Due diligence is necessary when working with third-party vendors. Regular assessments and audits of vendors’ security measures are important to ensure they comply with the company’s security standards.

Securing APIs

APIs are essential but vulnerable points in the FinTech architecture. Implementing strong authentication mechanisms, encrypting API traffic, and conducting frequent security assessments can significantly reduce API-related risks.

Preparing For Ransomware And Other Malware Threats

Regular backups, effective network segmentation, and employee training on recognizing potential threats are essential to mitigating the risks of ransomware and other malware.

Addressing AI And ML Security Concerns

AI and ML technologies should be deployed with a focus on ethical use and security. Regularly testing these systems against potential threats is crucial to ensuring they do not become the weak link in cybersecurity defenses.

Adherence to these best practices will enable FinTech companies to build a robust cybersecurity framework, effectively mitigating risks and ensuring the safety of their digital assets and customer data.

Cybersecurity Threats In Fintech FAQs

What Are The Most Common Types Of Cybersecurity Threats In FinTech?

Cybersecurity threats in FinTech typically include data breaches, phishing attacks, insider threats, DDoS attacks, mobile security risks, API vulnerabilities, ransomware attacks, and risks associated with AI and ML. These threats exploit vulnerabilities in financial technology systems to steal data, disrupt services, or gain unauthorized access.

How Do Data Breaches Occur In FinTech Companies?

Data breaches in FinTech companies can occur through hacking, malware attacks, physical theft of data storage devices, insider threats, unsecured APIs, and social engineering tactics. Hackers exploit vulnerabilities in security systems to access and steal sensitive financial data, leading to significant consequences like financial fraud and identity theft.

Why Are Phishing Attacks Particularly Dangerous For FinTech?

Phishing attacks are dangerous for FinTech because they directly target users, tricking them into revealing sensitive information such as login credentials and bank account details. These attacks often use sophisticated social engineering techniques and appear as legitimate communications, making them hard to detect.

What Are Insider Threats And How Can They Be Mitigated?

Insider threats in FinTech refer to risks posed by individuals within the organization who misuse their access to sensitive data. Mitigating these threats involves implementing strict access controls, conducting regular monitoring of employee activities, and fostering a culture of cybersecurity awareness.

How Do DDoS Attacks Impact FinTech Services?

DDoS (Distributed Denial of Service) attacks impact FinTech services by overwhelming systems with excessive traffic, leading to service disruptions. These attacks can cause significant operational and financial damage, making it critical for FinTech firms to have robust network infrastructure and real-time monitoring systems to detect and mitigate these attacks.

What Regulatory Compliance Risks Do FinTech Companies Face?

FinTech companies face regulatory compliance risks related to non-adherence to laws and standards such as GDPR, PCI DSS, and local financial regulations. Non-compliance can lead to legal issues, substantial fines, and damage to reputation and customer trust.

How Do Mobile Security Risks Affect FinTech?

Mobile security risks in FinTech arise from the use of mobile banking apps and platforms, which can be vulnerable to app-based vulnerabilities, data interception, and insecure user practices. These risks can lead

to unauthorized access to financial data and fraudulent transactions, emphasizing the need for secure coding practices, regular updates, and robust encryption protocols for mobile platforms.

What Makes Third-Party And Vendor Risks A Concern For FinTech Companies?

Third-party and vendor risks are a concern for FinTech companies because they often rely on external services for critical operations. Vulnerabilities in third-party systems can lead to data breaches and security lapses in the FinTech company’s own systems. Managing these risks involves conducting thorough due diligence, regular security assessments, and ensuring contractual compliance with security standards.

How Can API Vulnerabilities Be Addressed In The FinTech Sector?

API vulnerabilities in the FinTech sector can be addressed by implementing strong authentication mechanisms, encrypting API traffic, and conducting frequent security assessments to identify and rectify vulnerabilities. Secure API design is crucial to prevent unauthorized access and data breaches.

What Steps Can FinTech Companies Take To Prepare For Ransomware Attacks?

To prepare for ransomware attacks, FinTech companies should regularly back up critical data, implement effective network segmentation to limit the spread of malware, and train employees to recognize and respond to potential threats. Having a comprehensive incident response plan is also vital for quick and effective recovery in the event of an attack.

Conclusion

The progression of FinTech has revolutionized financial services, but it also necessitates robust cybersecurity measures. A multi-layered security approach, continuous education, and adaptation to emerging threats are imperative in safeguarding FinTech systems. Companies must prioritize these measures to protect their systems and maintain user trust in the digital financial landscape.

The magnitude of cybersecurity threats in FinTech, as evidenced by recent cyber attacks, underscores the importance of protecting critical data and infrastructure to prevent service disruption and financial losses. By addressing these top cybersecurity risks, FinTech companies can fortify their defenses against a landscape of digital threats.

Stefano Mclaughlin

Author

Luqman Jackson

Reviewer

Latest Articles

Popular Articles