Compensated Vs Uncompensated Risk - Making Informed Investment Decisions

Let's look into two broad types of financial risk: compensated vs uncompensated risk. We will delve into the characteristics of each type of risk, its implications for portfolio management, and provide relevant examples to enhance our understanding of these concepts.

Author:Habiba AshtonReviewer:Gordon DickersonJun 22, 20234.5K Shares96.4K Views

One of the most commonly acknowledged facts about investing is that it involves risk. However, understanding the nuances of risk is crucial to make informed investment decisions.

Risk can be defined and measured differently depending on:

- Type of investment

- Objectives of the investor

Let's look into two broad types of financial risk: compensated vs uncompensated risk. We will delve into the characteristics of each type of risk, its implications for portfolio management, and provide relevant examples to enhance our understanding of these concepts.

The Key Risks Faced By Investors

Before delving into the details of compensated and uncompensated risk, it is important to identify the key risks that investors encounter:

- The Risk of Total Loss

- Volatility Risks

- Compensated Vs Uncompensated Risks

- Skewness

- Inflation

Let's closely examine these risks and their relevance to portfolio management.

The Risk Of Total Loss

When discussing investment risk, the possibility of a total loss often comes to mind. The fear of investing in a stock and losing all the invested money can be daunting. However, the risk of a total loss is relatively manageable, especially when diversification is employed.

Proper diversification involves spreading investments across various assets, significantly reducing the likelihood of experiencing a total loss. It is important to note that for an entire stock market or index to deliver a total loss, it would require a severe economic catastrophe affecting all functioning markets simultaneously.

Therefore, for a well-diversified investor, the risk of a total loss is significantly low, as long as the principles of capitalism continue to function.

What Is Volatility?

In contrast to the risk of a total loss, investors must contend with volatility risk, which is often the primary focus when describing investment risk.

Volatility refers to the degree of variability in investment returns. Investments with high volatility experience significant ups and downs, which can be unsettling and stressful for many individuals.

The impact of volatility risk depends on two factors:

- Investor's time horizon

- Investor's psychological tolerance for market fluctuations

Short-term investors, with a time horizon of around five years or less, should consider volatility as a crucial measure of investment risk.

Research conducted by Eugene Fama and Ken French titled "Volatility Lessons" revealed that over a one-year period, there is approximately a 36% chance of stocks delivering lower returns compared to risk-free investments such as treasury bills. This figure aligns with historical data across global stock markets.

However, for long-term investors with a more extended time horizon and a higher tolerance for market fluctuations, volatility risk becomes less relevant. It is important to note that even for long-term investors, volatility risk cannot be entirely ignored. Fama and French's research indicated that there was still a 4.08% chance of a negative equity premium over 30-year simulated periods.

While historical data suggests that periods of negative stock returns are often followed by positive returns, it is prudent to acknowledge the possibility of negative returns even over extended periods.

It is worth noting that investments with higher volatility also tend to offer higher expected returns. Long-term investors who can endure market volatility are likely to achieve better outcomes by investing in more volatile stocks rather than less volatile options such as bonds.

Compensated Vs Uncompensated Risk

To gain a comprehensive understanding of investment risk, it is essential to differentiate between compensated risk and uncompensated risk.

| Compensated Risk | Uncompensated Risk |

| Systemic risk priced into securities | Risk specific to individual companies, sectors, or countries |

| Higher expected return | No additional return or potentially lower returns |

| Investing in stocks, bonds, real estate | Investing in a single stock, sector concentration, country-specific risks |

| Cannot be eliminated through diversification | Can be eliminated or reduced through diversification |

| Enhances expected returns and portfolio performance | Can dominate overall outcome and hinder portfolio performance |

Compensated risk refers to systemic risk that is priced into securities by the market. When investors take on compensated risk, they are essentially buying future earnings at a discount, which translates to higher expected returns.

On the other hand, uncompensated risk is specific to individual companies, sectors, or countries and is not adequately rewarded with additional returns. Uncompensated risk can be eliminated or reduced through diversification.

Is Investing Risky?

Examples Of Compensated Risk

1. Investing in Stocks

By investing in stocks instead of keeping money in a high-yield savings account, investors are exposed to the performance risk of the underlying companies. This compensated risk offers the potential for higher returns as stocks are expected to generate greater long-term growth compared to risk-free savings accounts.

2. Investing in Bonds

Bonds also involve compensated risk as investors expect a higher yield compared to risk-free investments. By lending money to governments or corporations, bondholders receive interest payments and the return of their principal upon maturity. The risk of default or fluctuating interest rates is compensated by the higher yield offered by bonds.

3. Investing in Real Estate

Investing in real estate, whether through direct ownership or real estate investment trusts (REITs), carries compensated risk. Real estate investments have the potential to generate rental income and capital appreciation, which compensates investors for the risks associated with property ownership and market fluctuations.

Examples Of Uncompensated Risk

1. Investing in a Single Stock

Concentrating investments in a single company increases the exposure to company-specific risks. While there may be compensated risk associated with the stock market as a whole, the uncompensated risk specific to an individual stock could dominate the overall outcome.

2. Sector-Specific Risks

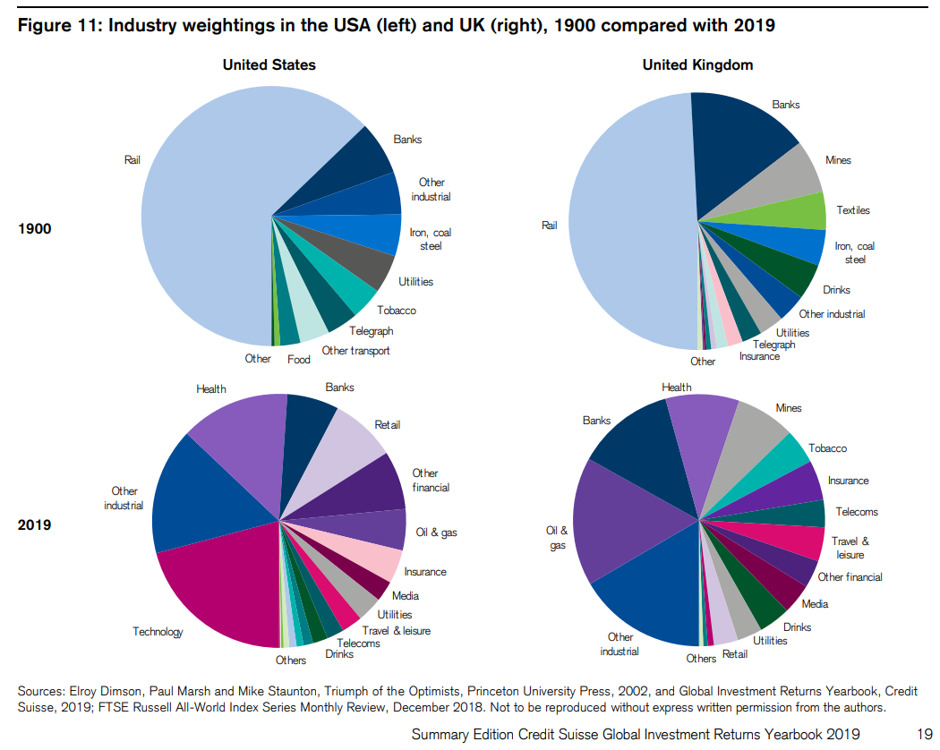

Investing heavily in a specific sector exposes investors to uncompensated risk. Disruptions or changes in the sector's dynamics can significantly impact the performance of investments concentrated in that sector. Diversification across various sectors helps mitigate this risk.

3. Country-Specific Risks

Investing heavily in a single country increases the exposure to country-specific risks such as political instability, regulatory changes, or economic downturns. Diversifying investments across different countries helps reduce the impact of these risks.

Remember!

As an informed investor, your goal should be to create a portfolio with the appropriate level of risk and to assume only compensated risks.

Understanding the distinction between compensated and uncompensated risk is crucial for investors to make informed decisions and manage their portfolios effectively.

Skewness - Examining The Distribution Of Outcomes

Skewness is a statistical measure that describes the distribution of outcomes relative to a normal distribution. It indicates whether the distribution is symmetrical or skewed towards one side. In the case of stock returns, the skewness is positive, indicating that there are more negative outcomes and fewer positive outcomes.

However, the magnitude of extreme positive outcomes is higher than that of extreme negative outcomes. This positive skewness implies the potential for higher returns but also a higher probability of negative outcomes.

Research conducted on global common stocks from 1990 to 2018 found that the equity premium was driven by just 1.3% of the stocks in the sample. The majority of the remaining firms, around 61%, actually destroyed wealth over that period. This highlights the significance of positive skewness in stock returns. Diversification helps mitigate the impact of negative outcomes and take advantage of the potential for significant positive returns.

The Impact Of Inflation

Inflation poses a significant risk to long-term investors. The primary objective of investing is to generate positive real (after-inflation) returns to meet future consumption needs. Bonds, often considered safer investments, have historically delivered lower real returns compared to stocks.

Over a long-term period from 1900 to 2018, global stocks delivered real geometric returns of 5%, while global bonds delivered real geometric returns of 1.9%. This 3% annualized difference over 119 years is substantial.

Consequently, holding a portfolio heavily weighted towards bonds may expose investors to substantial inflation risk, as the returns may not be sufficient to meet their financial goals after accounting for inflation.

Therefore, it is crucial for long-term investors to strike a balance between risk and return, considering both volatility and inflation. While bonds may provide perceived safety, the lower real returns over the long term may question their suitability as the sole investment option.

Investors with a longer time horizon and the ability to tolerate market fluctuations may find that the higher expected returns from stocks outweigh the short-term volatility and inflation risk.

Warren Buffett Explains How To Invest During High Inflation

People Also Ask

What Type Of Risk Should Investors Be Compensated For?

Typically, investors should be compensated for assuming additional risk by receiving higher expected returns. This is particularly evident when comparing stocks and bonds, as stocks, despite being riskier, offer a higher expected return known as the equity risk premium.

Which Kind Of Risk Are Investors Not Compensated For Bearing Which Are They Compensated?

Investors are compensated for bearing systematic risk, which is inherent to the overall market or economy. However, they are not compensated for non-systematic, diversifiable risks, which can be eliminated through diversification.

What Are The Different Types Of Risk Premiums?

There are five primary risk premiums:

- Business risk

- Financial risk

- Liquidity risk

- Exchange-rate risk

- Country-specific risk

Each of these risk factors can have a detrimental impact on investment returns, highlighting the need for investors to receive adequate compensation for taking on these risks.

What Are The 3 Types Of Risk In Insurance?

The three primary categories of pure risks in insurance are as follows:

- Personal risks - These risks directly impact the ability of the insured individual to earn income. Examples include risks related to health, disability, or loss of employment.

- Property risks- Property risks refer to risks associated with the loss or damage to physical assets, such as homes, vehicles, or personal belongings. Natural disasters, accidents, or theft are common examples of property risks.

- Liability risks- Liability risks cover potential losses resulting from legal obligations or claims arising from social interactions. This can include situations where an individual or organization is held responsible for causing harm or damage to others, such as personal injury or property damage claims.

It's important to note that not all pure risks are covered by private insurers. Some risks may be uninsurable or fall under the purview of other specialized insurance providers or government programs.

What Are The Two Types Of Risk In Insurance?

In insurance, risks can be divided into two main types:

- Financial Risk- This type of risk involves measurable monetary losses resulting from specific events, such as property damage or medical expenses. Insurance policies are designed to cover financial risks by providing compensation for incurred losses.

- Non-Financial Risk- Non-financial risks are those where the potential loss cannot be easily quantified in monetary terms. These risks include factors like reputation, legal issues, or strategic considerations that can impact individuals or organizations.

Both financial and non-financial risks play a significant role in the insurance industry, with insurers offering various types of policies to address these different risk categories.

Conclusion

In conclusion, understanding the difference between compensated vs uncompensated risk is vital for investors. Compensated risk, associated with market-wide factors, can provide higher expected returns, while uncompensated risk specific to individual assets or sectors does not offer additional rewards.

By diversifying and building a globally diversified portfolio of low-cost index funds, investors can eliminate uncompensated risk and focus on capturing compensated risk. This approach helps balance risk and return while increasing the likelihood of achieving investment goals.

Remember, investing involves risk, but by managing risk through diversification, investors can enhance their chances of success.

Habiba Ashton

Author

Gordon Dickerson

Reviewer

Latest Articles

Popular Articles