Tax-Deductible Charitable Donations - Doing Good And Saving On Taxes

Are you passionate about making a positive impact on society while also looking for ways to save money on your taxes? Charitable donations offer a unique opportunity to achieve both of these goals. When you donate to causes that are meaningful to you, you are not only aiding significant endeavors but also becoming eligible for substantial tax write-offs.

Author:Emmanuella SheaReviewer:Frazer PughJul 31, 20232.7K Shares129.5K Views

Are you passionate about making a positive impact on society while also looking for ways to save money on your taxes? Charitable donationsoffer a unique opportunity to achieve both of these goals. When you donate to causes that are meaningful to you, you are not only aiding significant endeavors but also becoming eligible for substantial tax write-offs.

Let's talk about charitable donations, explore the financial benefits they provide, and uncover strategies to maximize the tax advantages of your generosity.

What Is A Charitable Donation?

Making a charitable donation involves donating money or property to a qualified nonprofit organization with the aim of advancing charitable, religious, scientific, literary, or educational causes. These donations are vital in supporting nonprofit organizations in their efforts to make a positive impact in the community.

To encourage philanthropy, the government provides tax deductions for eligible charitable donations, which can considerably lower your taxable income.

The Tax Benefits Of Charitable Donations

Making charitable donations can provide you with several tax benefits, including:

Reducing Taxable Income

When you donate to qualified charitable organizations, you can deduct the amount from your taxable income. This deduction reduces the overall income subject to taxation, potentially resulting in a lower tax liability. For example, if your total annual income is $60,000 and you make $5,000 in qualifying charitable donations, your taxable income decreases to $55,000.

Itemizing Deductions

To claim tax deductions for charitable donations, you need to itemize your deductions on your tax return using Schedule A. This allows you to account for various deductible expenses, such as mortgage interest, medical expenses, state and local taxes, and, of course, charitable donations. Itemizing can be more beneficial than taking the standard deduction, especially if your total itemized deductions exceed the standard deduction amount.

Maximizing Deduction Limits

The Internal Revenue Service (IRS) sets limits on the percentage of your adjusted gross income (AGI) that you can deduct for charitable donations. Typically, cash donations have a limit of 60% of your AGI. Non-cash donations may have different limits depending on the type of property and the receiving organization. If your contributions exceed these limits, you can carry over the excess to future tax years, extending the tax benefits of your generosity.

Does Donating to Charity Save You Money On Taxes?

Donating Appreciated Assets

While cash donations are the most common form of charitable giving, donating appreciated assets can offer additional tax benefits. If you own assets such as stocks, mutual funds, or real estate that have increased in value since you acquired them, donating these assets directly to a qualified charity can be a tax-efficient way to support your favorite causes.

When you donate appreciated assets, you not only get a charitable deduction for the fair market value of the assets at the time of the donation, but you also avoid paying capital gains tax on the appreciation.

Let's look at an example to illustrate the tax advantages of donating appreciated assets:

Suppose you purchased stock for $5,000 several years ago, and it has now grown in value to $15,000. If you were to sell the stock, you would incur a capital gains tax on the $10,000 appreciation.

However, if you donate the stock directly to a qualified charity, you get a tax deduction for the full $15,000, and no capital gains tax is owed. This not only reduces your taxable income but also maximizes the impact of your charitable contribution.

Non-Cash Donations - Rules And Requirements

Non-cash donations, such as property, goods, or services, can also be tax-deductible if they meet certain requirements. However, it's essential to understand the specific rules governing non-cash charitable contributions to ensure you can claim the deductions correctly.

Fair Market Value (FMV)

When donating non-cash items, you must determine their fair market value (FMV) at the time of the donation. The FMV is the price that the property would sell for on the open market. For items worth $5,000 or more, you'll need to obtain a qualified appraisal to support your deduction.

Qualified Charities

Similar to cash donations, non-cash donations must be made to qualified tax-exempt organizations under Section 501(c)(3) of the IRS code to be eligible for deductions.

Documentation

Proper documentation is critical for claiming deductions on non-cash donations. For contributions less than $250, a receipt or written acknowledgment from the charity is generally sufficient. For donations exceeding $250, you must obtain a written acknowledgment that includes a description of the property donated, whether any goods or services were provided in exchange, and the estimated FMV of those goods or services.

Donor-Advised Funds

Donor-Advised Funds (DAFs) are another valuable tool for philanthropic planning. DAFs are charitable giving accounts that allow donors to make contributions and receive an immediate tax deduction.

The funds are then invested and can be distributed to qualified charities over time. This strategy allows donors to take advantage of tax deductions upfront while maintaining flexibility in how and when they distribute the funds to charitable causes.

Charitable Trusts

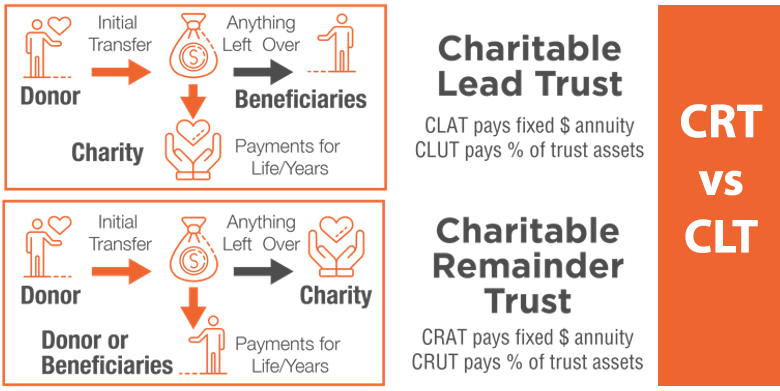

Charitable trusts, such as Charitable Remainder Trusts (CRTs) and Charitable Lead Trusts (CLTs), provide unique opportunities for philanthropic individuals to create a lasting impact on charitable causes while also enjoying certain financial benefits.

Charitable Remainder Trusts (CRTs)

A Charitable Remainder Trust (CRT) is a type of trust that allows you to donate assets, such as cash, securities, or real estate, to a charitable trust while retaining an income stream from the trust for a specified period or for life. After the trust term ends or upon your passing, the remaining assets in the trust are distributed to the charitable organizations you have designated.

Benefits Of CRTs:

- Immediate Charitable Deduction- When you fund a CRT, you can claim an immediate charitable deduction for the present value of the charitable interest in the trust, which reduces your taxable income for the year of the contribution.

- Income Stream- You or your chosen beneficiaries can receive regular payments from the trust during its term, providing you with additional income and financial security.

- Capital Gains Tax Avoidance - By donating appreciated assets to the CRT, you can avoid capital gains tax on the sale of those assets.

- Estate Tax Savings - The value of the charitable interest in the CRT is removed from your taxable estate, potentially reducing estate taxes.

Charitable Lead Trusts (CLTs)

A Charitable Lead Trust (CLT) is a trust arrangement that works in the opposite way of a CRT. In a CLT, the income from the trust is first directed to charitable organizations for a set term, and after that term ends, the remaining assets are passed to non-charitable beneficiaries, such as family members or other heirs.

Benefits Of CLTs:

- Estate Tax Mitigation - By placing assets in a CLT, you can reduce the taxable value of your estate, potentially minimizing estate taxes upon your passing.

- Charitable Giving - CLTs allow you to support charitable causes you care about during your lifetime or for a specified period, leaving a lasting legacy of giving.

Choosing The Right Charitable Trust

Deciding between a CRT and a CLT depends on your financial goals, family considerations, and philanthropic objectives. Both types of trusts offer unique advantages, and it's essential to work with a financial advisor or estate planning attorney to determine which option aligns best with your overall financial and charitable planning.

Impact Of Charitable Giving On Financial Planning

Incorporating charitable giving into your overall financial plan can be a powerful way to align your values with your financial goals. Charitable contributions not only provide tax benefits but also help diversify your assets and reduce tax exposure.

When integrating charitable giving into your financial plan, consider the following aspects:

Legacy Planning

Charitable giving allows you to create a lasting legacy by supporting causes that reflect your values and passions. You can designate specific charitable organizations or establish a charitable foundation to carry on your philanthropic endeavors beyond your lifetime.

Tax-Efficient Giving

By strategically planning your charitable donations, you can optimize your tax deductions and potentially reduce your overall tax burden. Utilizing advanced strategies like donating appreciated assets or utilizing donor-advised funds can enhance the tax efficiency of your giving.

Retirement And Wealth Preservation

Charitable giving can also play a role in retirement and wealth preservation planning. By including charitable trusts in your estate plan, you can ensure a steady income stream during your retirement while leaving a portion of your estate to support charitable causes.

Balancing Philanthropy With Financial Goals

While charitable giving is a noble pursuit, it's crucial to strike a balance between your philanthropic objectives and your long-term financial goals. Before making significant contributions, evaluate your financial situation, including cash flow, debt obligations, and savings goals. Working with a financial advisor can help you align your charitable giving with your broader financial strategy.

Leveraging Charitable Donations For Personal And Community Impact

In addition to the tax benefits and financial planning considerations, charitable donations have a significant impact on both the individual donor and the community at large.

The Joy Of Giving Back

One of the most gratifying aspects of charitable giving is the joy of making a difference in the lives of others. Knowing that your contributions support important causes and help those in need can bring a sense of fulfillment and happiness that extends beyond monetary value. Giving back to society fosters a sense of purpose and connection, strengthening the fabric of the community.

Building A Stronger Community

Charitable donations play a pivotal role in building and sustaining strong communities. By supporting nonprofit organizations that address critical social issues, donors contribute to the overall well-being and development of the community.

These organizations often provide essential services such as education, healthcare, housing assistance, and support for vulnerable populations. By contributing to these causes, donors become agents of positive change, empowering individuals and families to lead better lives.

Inspiring A Culture Of Giving

When individuals and businesses engage in charitable giving, it creates a ripple effect that inspires others to follow suit. Acts of generosity and philanthropy set an example for future generations and encourage a culture of giving within families, communities, and corporate environments.

This culture of giving can lead to a more compassionate and empathetic society, where people actively seek opportunities to help others and create a more equitable world.

Supporting Local Nonprofits

Charitable donations are not just limited to large national or international organizations. Many donors choose to support local nonprofits that have a direct impact on their communities.

These grassroots organizations often rely heavily on community support to carry out their missions. By donating to local nonprofits, donors can witness the tangible results of their contributions and see firsthand how they are making a difference in the lives of their neighbors.

Collaborative Giving - Corporate Social Responsibility (CSR)

Corporate entities also play a vital role in philanthropy through their Corporate Social Responsibility (CSR) initiatives. CSR involves integrating social and environmental concerns into a company's business operations and interactions with stakeholders.

Many companies allocate a portion of their profits to charitable donations and community development projects. Through CSR, businesses actively contribute to society, showcase their commitment to social causes, and engage employees in meaningful volunteer activities.

CSR: What is Corporate Social Responsibility? Definition Examples Benefits

Combining Giving With Impact Investing

For donors looking to align their charitable giving with their investment strategies, impact investing offers a compelling option. Impact investing involves making investments that generate both financial returns and positive social or environmental outcomes.

By directing capital to businesses and organizations that address specific societal challenges, impact investors can create a dual impact: financial growth and positive change.

People Also Ask

What Are Types Of Donation?

- One-time donations

- Recurring donations

- Planned donations

- Tribute or memorial donations

- Stock donations

- In-kind donations

- Matching donations

- Workplace donations

What Is An Example Of A Charitable Trust?

A charitable trust example could be setting up a trust to leave a house to the local town for use as a community center, ensuring oversight and care after the donor's passing.

What Is An Example Of Charity Fundraising?

An example of charity fundraising is organizing shoe drives, which are popular and fun events that offer an alternative to traditional monetary donations for nonprofit organizations.

Conclusion

Charitable donations go beyond financial transactions; they represent a powerful act of compassion, generosity, and belief in a better world. Giving back to society allows individuals to create a lasting legacy, support causes they are passionate about, and enjoy valuable tax benefits. From cash donations to donating appreciated assets and establishing charitable trusts, there are various strategies to maximize the impact of your philanthropic endeavors.

Charitable donations can enrich your life and have a profound impact on others. Explore causes that resonate with you and seek professional guidance to align your giving with your financial goals. Together, we can make a positive difference in the world, one donation at a time.

Jump to

What Is A Charitable Donation?

The Tax Benefits Of Charitable Donations

Donating Appreciated Assets

Non-Cash Donations - Rules And Requirements

Donor-Advised Funds

Charitable Trusts

Impact Of Charitable Giving On Financial Planning

Leveraging Charitable Donations For Personal And Community Impact

People Also Ask

Conclusion

Emmanuella Shea

Author

Frazer Pugh

Reviewer

Latest Articles

Popular Articles