Bond Price Calculator - Master The Market Simplify Investing

Ditch the jargon, dominate the market! bond price calculator unlock investment secrets for beginners & pros alike. Simplify your strategy, maximize returns.

Author:Hajra ShannonReviewer:Paula M. GrahamFeb 09, 2024429 Shares35.7K Views

Imagine this you scroll through Reddit, sipping your morning coffee, when a post about "bond yields" and "YTM" catches your eye. Intrigued by the potential profits, you click in, only to be met with a jargon-filled jungle of financial terms. Face value? Coupon rate? Maturity date? It's enough to make anyone want to close the tab and dive back into cat memes. Because just like a trusty sidekick in a video game, there's a powerful tool waiting to unlock your inner investing hero Bond Price Calculator. Think of them as your investment cheat codes, designed to simplify the complex world of bonds and turn you from a confused lurker into a confident market master.

Sure, Reddit boasts a diverse crowd, ranging from financial newbies to seasoned veterans. But here's the beauty of Bond Price Calculators: they cater to everyone. Beginners can ditch the confusing formulas and instantly estimate a bond's value, while experienced investors can leverage advanced features like yield analysis and comparison tools to refine their strategies. No matter your skill level, these calculators empower you to make informed decisions and navigate the market with newfound confidence.

So, how do these magical tools work? Buckle up, we're going on a guided tour! Just picture this: you feed the calculator some basic info about a bond, like its coupon rate, maturity date, and current market interest rates. Boom! It instantly spits out the estimated price and even forecasts your potential returns. It's like having a financial brain trust at your fingertips, 24/7.

But the adventure doesn't stop there. Think of Bond Price Calculators as your ultimate training ground. You can experiment with different scenarios, compare potential investments, and even test out advanced strategies without risking a real-world dime. It's the perfect playground to hone your skills and build your portfolio confidence before taking the plunge.

Understanding Bond Prices (Without The Headache)

Unraveling The Mystery Of Market Numbers

Ever feel like bond prices are speaking a language you just don't understand? You're not alone, Redditor. Demystifying these numbers can feel like deciphering ancient hieroglyphics. But fear not, because we're about to break it down into bite-sized pieces, no Rosetta Stone required. First, let's meet the key players:

- Face Value -Think of it as the "IOU" amount printed on the bond. It's the sum you get back when the bond matures, like winning back your lunch money at the end of recess.

- Coupon Rate -This is like your personal ATM, spitting out regular interest payments until the bond matures. It's a percentage of the face value, essentially a reward for lending your money.

- Maturity Date -This is the "expiration date" of your bond loan. It's like the day you get your lunch money back, with interest!

- Yield to Maturity (YTM) -This is the real MVP, the ultimate measure of your bond's profitability. It's the total return you'd earn if you held the bond till maturity, factoring in both coupon payments and the final face value payout.

Imagine the market as a giant game of tug-of-war. On one side, you have interest rates. When they rise, newly issued bonds offer sweeter deals, making older bonds with lower rates less attractive. This pushes their prices down, like a stock market crash in slow motion. On the other side, you have market dynamics like supply and demand. If everyone's rushing to buy bonds, their prices go up, just like your favorite meme stock during a Reddit frenzy.

Manual Calculations

So, how do you figure out the actual price of a bond? Well, you could grab a calculator, dust off your high school math skills, and dive into complex formulas involving present value and discounted cash flow. But honestly, who has time for that? That's where Bond Price Calculators become your investment superheroes, instantly crunching the numbers and giving you the answer in seconds.

Understanding the basics is key to mastering the market. With these concepts in your arsenal, you'll be well on your way to using Bond Price Calculators like a pro, unlocking the secrets of profitable investing one bond at a time.

Enter The Bond Price Calculator - Your Investment Sidekick!

Picture this you're scrolling through Reddit, feeling confident after mastering those bond basics. But how do you actually find the best deals in this jungle of bonds? Fear not, for your trusty sidekick has arrived theBond Price Calculator! Think of it as your investment Robin to your investing Batman, ready to swoop in and save you from financial confusion.

But the powers don't stop there. These calculators are like Swiss Army knives for investors, packing a range of features to suit any Reddit user's needs:

- Price Calculation -This is the bread and butter – the magic trick that unlocks the bond's true value. No more head-scratching formulas, just instant estimates that help you make informed decisions.

- Yield Analysis -Want to know how much you'll actually earn on your investment? The calculator dissects the bond's future payouts, giving you a clear picture of your potential returns. Think of it as a crystal ball for your financial future.

- Comparison Tools - Feeling overwhelmed by choices? The calculator can compare different bonds side-by-side, highlighting their strengths and weaknesses. It's like having a personal investment advisor at your fingertips, helping you pick the winners from the pack.

And the best part? These calculators cater to every Reddit investor, from newbies to seasoned veterans:

- Beginners -Ditch the intimidation and dive into the market with confidence. The calculators do the heavy lifting, allowing you to focus on understanding the basics and building your portfolio.

- Active Investors - Take your strategy to the next level! Advanced features like yield curve analysis and scenario testing help you refine your approach and maximize your returns.

Whether you're a lurker curious about bonds or a seasoned trader looking for an edge, Bond Price Calculators are your ultimate allies. They demystify the market, empower your decisions, and guide you towards a brighter financial future. Embrace the power of these digital heroes, and watch your Reddit portfolio soar!

Level Up Your Investing Game

A Bond Price Calculator Tutorial For Redditors-

Forget about staring at confusing financial statements and deciphering cryptic bond jargon. It's time to master the market like a boss with your new best friend: the Bond Price Calculator! Imagine this: you're scrolling through Reddit, sipping your ramen noodles, when you stumble upon a post mentioning "high-yield bonds." Intrigued, you pull up your trusty calculator, ready to unleash its superpowers.

- Choose Your Champion -There are tons of free calculators online, each with its own quirky interface. Explore a few to find one that speaks your Reddit language – simple, visual, and maybe even throws in a meme or two.

- Feed the Beast -Now, let's fill in the blanks. Think of it like customizing your Reddit avatar, but for your bond investment. Enter the bond's coupon rate (like its karma points), maturity date (when you graduate to financial freedom), and the current market interest rates (the hot gossip of the investing world).

- Witness the Magic -Press enter, and boom!Your calculator spits out the estimated price like a genie granting your financial wishes. You instantly know if this bond is worth the hype or just another Doge meme waiting to crash.

Pro Tips For Reddit Investors

- Go Beyond Price -Don't just stop at the price tag. Dig deeper with features like yield analysis to see how much you'll actually earn over time. Think of it as checking a bond's post karma to gauge its long-term potential.

- Compare and Conquer -Feeling overwhelmed by choices? Use the calculator's comparison tool to pit different bonds head-to-head. It's like Reddit's "Best Of" award for investments!

- Stress Test Your Strategy - Don't just assume the best-case scenario. Play around with the calculator's "what-if" features to see how your investment might fare in different market conditions. It's like preparing for an AMA with the FED Chairman, without the existential dread.

Common Pitfalls To Avoid

- Calculator Hype -Remember, these tools are awesome, but they're not oracles. Always do your own research, consider expert advice, and stay informed about market trends. Think of it like cross-checking an investment tip with multiple subreddits before diving in.

- Overreliance -Don't let the calculator do all the thinking. Use it as a guide, not a crutch. Develop your own investing intuition and learn to analyze bonds beyond just their numbers. It's like mastering the art of spotting a genuine moonshot before everyone else catches on.

With this step-by-step guide and a healthy dose of caution, you're well on your way to conquering the bond market like a Reddit pro. So, unleash your inner investment hero, embrace the power of the Bond Price Calculator, and watch your portfolio moon! Remember, knowledge is power, and in the realm of finance, your calculator is your lightsaber. Now go forth and invest wisely, young Redditor!

Unleashing The Power Of Bond Price Calculators - Your Gateway To Investment Glory

Forget about dusty textbooks and cryptic financial jargon. Bond Price Calculators aren't just fancy math machines; they're superpowers for your portfolio! Let's see how these digital heroes have transformed real Reddit users from confused lurkers to confident investors:

From Meme Lord To Market Master

Remember u/RamenRamen88, the guy who turned his Doge profits into a bond bonanza? He credits his success to one thing: the Bond Price Calculator. He stumbled upon it while researching high-yield bonds, skeptical but curious. The calculator instantly revealed hidden gems and exposed risky duds, allowing him to build a diversified portfolio that's now the envy of Reddit's finance forum. "It's like having a financial cheat code," he says, "I wouldn't be where I am today without it!"

Wisdom From The Finance Trenches

Financial advisor Ms. Moneybags couldn't agree more. "Bond Price Calculators democratize investing," she declares. "They empower even beginners to make informed decisions and avoid costly mistakes." And what about Mr. Market Wizard, the Reddit legend known for his uncanny investment accuracy? "These calculators are game-changers," he reveals, "They help me analyze scenarios, compare options, and refine my strategies. It's like having a crystal ball for the bond market!"

Expanding Your Investment Horizons

But wait, there's more! These calculators aren't just for bond-obsessed Redditors. They can be your trusty sidekicks for other investment adventures too:

- Stock Savvy -Analyze potential dividends, compare P/E ratios, and discover undervalued gems with the flick of a virtual switch. Think of it as having your own mini stock market oracle.

- ETF Enchanter -Unravel the mysteries of Exchange Traded Funds, compare expense ratios, and find the perfect basket of assets to diversify your portfolio like a pro. No more deciphering cryptic ticker symbols – your calculator becomes your personal ETF decoder ring.

Knowledge is power, and in the realm of finance, your Bond Price Calculator is your lightsaber.Use it wisely, do your research, and watch your portfolio soar to new heights. After all, with the right tools and a dash of Reddit savvy, anyone can become the next investment hero!

People Also Ask

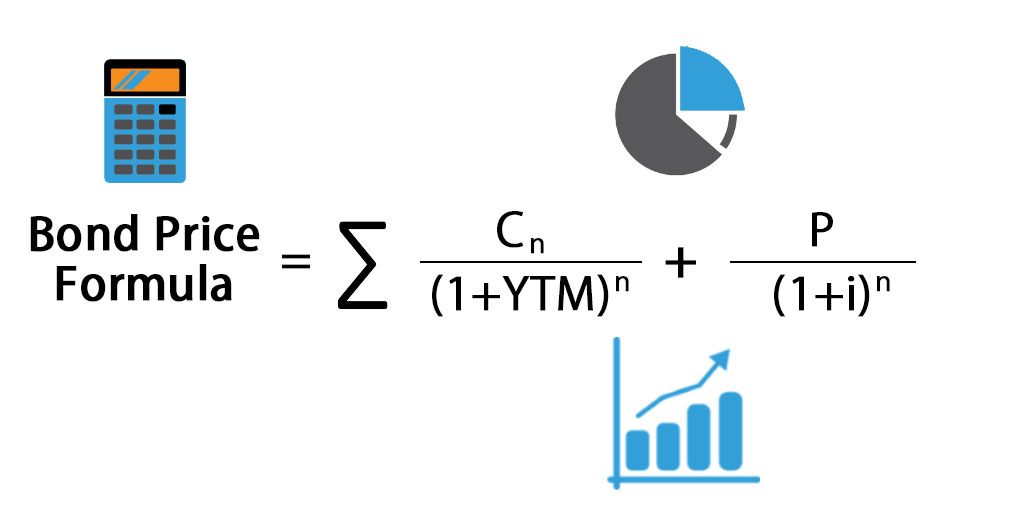

What Is The Formula For The Issue Price Of A Bond?

The issue price is determined by adding the present value of the bond's principal amount (also known as its face value or par value) to the present value of its future interest payments.

How Do You Calculate The Payment On A Bond?

If you know the face value of the bond and its coupon rate, you can calculate the annual coupon payment by multiplying the coupon rate times the bond's face value. For example, if the coupon rate is 8% and the bond's face value is $1,000, then the annual coupon payment is . 08 * 1000 or $80.

How Do You Calculate Bond Price?

- F = Face / Par value of bond,

- r = Yield to maturity (YTM) and.

- n = No. of periods till maturity.

Bond Price = C* (1-(1+r)-n/r ) + F/(1+r)n

Conclusion

So, fellow Redditor, you've seen the light. You've witnessed the magic wielded by Bond Price Calculator, those digital heroes demystifying the market and turning confused lurkers into confident investors. They're not just fancy math whizzes; they're your passport to financial freedom, your decoder ring for investment jargon, and your lightsaber against market mayhem.

Imagine navigating the bond market like a pro, spotting undervalued gems, optimizing your portfolio, and leaving FOMO in the dust. That's the power you hold in your fingertips. Ditch the fear, embrace the knowledge, and unleash the calculator's potential. Remember, Reddit is your community, and your fellow users are just a post away from sharing their own calculator-aided triumphs and hard-won wisdom.

Ready to take the plunge? Step into the world of free online calculators, explore their features, and find the one that speaks your Reddit language. Share your experiences, ask questions, and learn from the community. Remember, knowledge is power, and in the financial realm, your calculator is your trusty sidekick.

Hajra Shannon

Author

Paula M. Graham

Reviewer

Latest Articles

Popular Articles