How Will Economic Factors Impact The Bond Market Outlook?

The Bond Market Outlook is crucial for investors to understand the financial landscape, providing insights into trends, challenges, and opportunities in the dynamic bond investments world.

Author:Stefano MclaughlinReviewer:Luqman JacksonJan 09, 202420.9K Shares282.9K Views

The bond market outlookis crucial for investors to understand the financial landscape, providing insights into trends, challenges, and opportunities in the dynamic bond investment world.

Understanding the intricate relationship between economic variables and the bond market is essential for anticipating shifts, evaluating risks, and uncovering opportunities.

In this exploration, we delve into the dynamics that underscore the influence of economic factors on the bond market outlook, providing insights for investors seeking a nuanced understanding of these interconnected realms.

Bond Market Rebounds In 2023

There has been a positive return so far in 2023 from fixed-income markets, which have mostly normalized and rebounded. A credit spread bond's performance has outpaced that of a U.S. Treasury bond.

Underlying yield carry and tightening credit spreads supported the 2.77% increase in the Morningstar US Core Bond Index through December 5th. However, an increase in long-term interest rates somewhat offset the rise.

As the Federal Reserve raised the federal funds rate in 2023, short-term interest rates rose, further inverting the yield curve. A 30-basis-point increase from the beginning of the year, the yield on the 10-year U.S. Treasury rose to 4.18%, due to high inflation, quantitative tightening, and other technical reasons.

An extra credit spread over bonds with the same maturity that trade on the market So far this year, the best-performing bond market has been U.S. Treasury bonds. Both the Morningstar US High-Yield Bond Index and the Morningstar US Corporate Bond Index increased by 10.14% and 5.49%, respectively.

A combination of tighter credit spreads throughout the year and higher yields paid off investors for the risk of defaults or downgrades in credit ratings, leading to outperformance.

Bond Market Outlook In 2024

Investors, according to the mid-year bond market update, should prioritize bonds with longer maturities and secure high interest rates. Based on projections that inflation will continue to moderate and economic growth will slow, the Federal Reserve is expected to ease monetary policy in 2024 by lowering the federal funds rate.

Pandemics, supply chain disruptions, and geopolitical events contributed to higher-than-expected inflation in 2022. Overall inflation is predicted to slow down significantly due to deflationary forces in these categories.

The economy is predicted to feel the effects of high interest rates and tight monetary policy, with real GDP growth slowing to 1.7% annually in the fourth quarter of 2023. This slowdown will persist sequentially until the third quarter of 2024, when it finally bottoms out. During the year 2025, the pace of economic growth will increase.

The Federal Reserve is expected to cut interest rates at its March 2024 meeting and keep cutting them until they reach around 3.75 percent by year's end. Rate cuts by the Federal Reserve are expected to continue until the end of 2025, when they will drop to 2.25%.

The present high short-term rates will eventually fall in line with the federal funds rate, giving investors the chance to reinvest at lower rates when their short-term debt matures.

Corporate Bond Market Outlook For 2024

Corporate credit spreads have narrowed since then and are currently within a level where we think they are reasonably priced. As the economy continues to deteriorate and the market begins to anticipate more downgrades and defaults, credit spreads may come under pressure in the first half of 2024.

Although we anticipate a slowdown in economic growth over the first three quarters of the year, we do not anticipate a recession for the U.S. economy. Therefore, we anticipate that defaults and downgrades will stay quite near to their historically average levels.

In November 2023, the leveraged loan market's default rate was 1.48%, as reported by PitchBook. This percentage is lower than the 1.58% average over the past 10 years.

The economic forecast suggests that the additional spread on corporate bonds is sufficient, but credit spreads are far from inexpensive. The spread on the Morningstar US Corporate Bond Index has been plus-101 basis points for the majority of the last 23 years, with just 18% of those years seeing spreads below that level.

The Morningstar US High-Yield Bond Index's spread has been below its current level of plus-376 basis points just 25% of the time throughout the same timeframe.

Optimistic Perspective On Interest Rate Trends

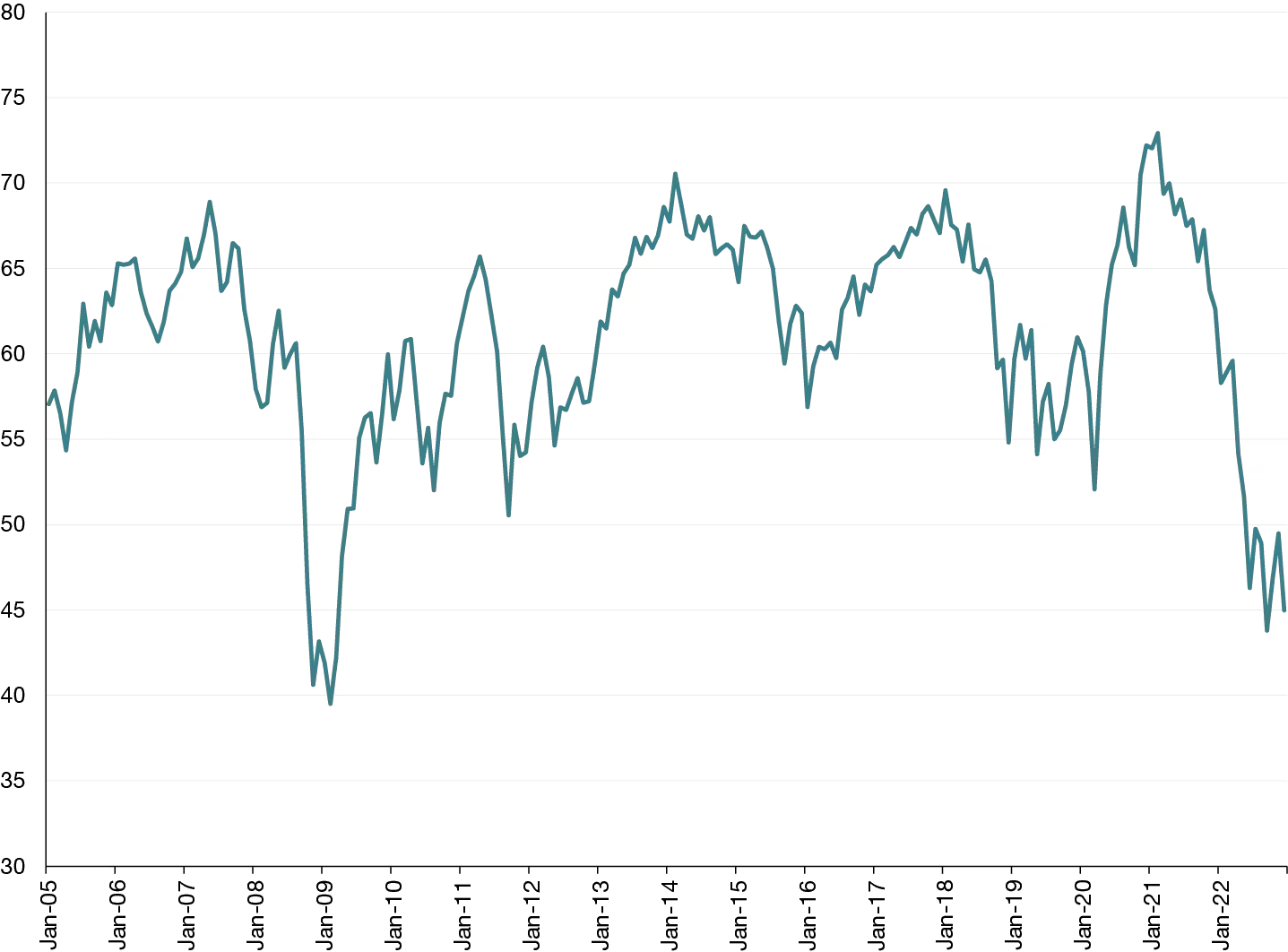

It is still too soon to tell if the Federal Reserve was able to achieve a "soft landing." The inversion of the Treasury yield curve in July 2022 indicated an impending recession. With a maximum duration of 24 months, the typical duration for a recession to follow an inverted yield curve is around 15 months.

The bond market's sentiment has been all over the place, with some thinking the Fed will keep rates high for a long time and others thinking they'll drop rates in 2024 to prevent severe economic harm.

In any case, investors could do well to brace themselves for a steepening or normalization of the yield curve, in which the yield on long-term Treasuries rises beyond that on short-term ones. In a higher-for-longer environment, when longer-term rates increase while short-term yields stay flat, the yield curve may steepen. This is also the case in a recessionary environment.

Given the more benign interest rate forecast, current prices might provide an appealing entry opportunity. We do not expect more curve inversion since it would necessitate reaccelerating inflation, which is highly unlikely.

Several parts of the Consumer Price Index have seen price drops recently. These include used automobiles and trucks, lodging, and airline tickets. fewer categories have significant price hikes, and more easing in the labor market might cause wages to expand at a slower rate over an extended period of time.

If the Federal Reserve sees its policy rate as being overly restrictive in light of the current inflation rate, it may reduce it, relieving some of the pressure to maintain high rates.

Duration, a measure of a bond's sensitivity to interest rates and a characteristic of bonds with longer maturities, has historically been an excellent time to hold when the Fed has finished rising rates.

Mortgages And Investment-grade Bonds Are Appealing

High initial yields and enabling variables support agency mortgage-backed securities (MBS) and investment-grade corporate bonds, which are anchored by an uncertain economic forecast. Yield spreads over Treasuries widened in 2023 due to the regional bank crisis, but they shrank as the economy recovered from the shock.

Mortgage securities will continue to be in short supply, which will push up valuations, as both housing supply and affordability are at record lows. One great way to diversify a portfolio and increase income without taking on the credit risk associated with stocks and other assets is with agency mortgage-backed securities (MBS).

Investors can earn the coupon payment without too much downside risk when they purchase investment-grade corporate bonds, which are backed by strong balance sheets and have low refinancing needs. Despite a widening of spreads, the longer duration of the sector compared to other credit sectors may lead to price appreciation in the event of an economic slowdown and a decline in Treasury yields.

Portfolios can benefit from investing in investment-grade corporate bonds as a safe haven, and investment-grade credit could do well if the Federal Reserve pulls off a "soft landing" and keeps the economy from entering a recession. Supply will likely stay low despite persistent investor demand because many companies with investment-grade ratings will wait for interest rates to fall before issuing new debt.

Developments In Public Sector Bond Market

Increasing Liquidity Will Remain A Focus

Besides cost-efficiency, issuer liquidity is the most crucial goal, therefore increasing liquidity will always be a priority. At SDI meetings, novel strategies to enhance liquidity have been addressed.

This includes sovereign debt management office incentives, assigning more to fast money accounts, reworking bank leverage ratios, and most intriguingly, introducing non-banks as principal dealers.

Last year, 70% of SDI European sovereign, supranational, and agency conference delegates thought non-banks should operate as main dealers to increase market liquidity.

Main Dealership Mode Questioned

Reviewing and introducing incentives is more crucial than ever to preserve this model despite primary dealership stress. In the SDI's 2023 public sector debt outlook study, 45% of global issuers wanted to provide dealers greater incentives. This is crucial for smaller banks that cannot meet commitments and compete with bigger ones.

Smaller Issuers Should Improve Price Discovery

Smaller public sector borrowers found price discovery difficult in 2023 owing to a broad range of fair value estimations due to liquidity issues.

This implies issuers will need to spend more time working with banks to identify solutions, such as expanding the use of taps of existing lines and issuing them straight into trading books and utilizing reference points from liquid issuers like the EU and KfW.

MDBs Will Issue The First Hybrid Bonds On The Capital Market

Multilateral development banks are considering issuing hybrid debt to enhance lending while maintaining triple-A credit ratings. The African Development Bank has been planning the first capital market sale for months, attracting investors.

The purchase price has been a sticky issue. What should a top-rated MDB's subordinated bond cost? Expect MDBs to reach a deal that benefits them and investors in 2024.

Greenium May Narrow But Is No Longer Important

The ‘greenium’, the premium issuers get for issuing green bonds, decreased in 2023 and is predicted to fall in 2024 to levels similar to conventional bonds.

The EU's green issuance will dominate the SSA market's greenium because to its volume. Since issuers no longer prioritize greenium, its decline should not be a major worry.

EU Will Advance Toward Sovereignty

The EU is working on being a universally acknowledged ‘sovereign’ borrower. Introducing quotation obligations for primary dealers to increase secondary market liquidity and being classed as government bonds were EU achievements last year.

The EU will also create a repo facility enabling dealers to temporarily access EU assets in case of shortages this year. As EU bond liquidity improves, futures market plans will heat up.

Improvements To Market Infrastructure Will Accelerate

Bond market efficiency measures like automating and standardizing documents should progress. SDI's initial bond market infrastructure assessment found workflow procedures to be the main bond issuance inefficiency. Standardizing legal papers and order book procedures improved pre-trade efficiency the most.

But Digital Relationships Will Remain Secondary

Due to the absence of a uniform technology and structural standard, digital bonds will not become popular. Market players prioritize enhancing existing technological efficiency over new technology.

The SDI's market infrastructure survey found that just 29% of respondents wanted to use blockchain or distributed ledger technology in debt issues.

Will Retail Government Bonds Remain Important?

Last year, retail bonds helped European government debt management agencies finance their programs. The issue of these bonds took advantage of growing returns due to higher interest rates and less enticing bank savings choices.

Belgium issued the largest retail government bond in Europe, a €21.9bn one-year deal, before introducing longer-term products. Belgium will cut retail bond issuance this year, while other DMOs are undecided on the need for one.

EM Debt Restructuring Will Remain Complicated

Zambia's delays and difficulties in 2023 made debt restructuring difficult. The G20 framework has been blamed for the lengthy discussions, which gives developing market states little optimism this year. The biggest debt-for-nature swap deal ever was completed by Ecuador, which added many new features to the program.

FAQs - Bond Market Outlook

What Factors Contribute To Shaping The Current Bond Market Outlook?

A variety of factors, including interest rates, inflation expectations, and geopolitical events, play crucial roles in shaping the current bond market outlook.

How Do Economic Indicators Influence The Short-term Bond Market Outlook?

Economic indicators such as GDP growth, unemployment rates, and consumer sentiment can significantly impact the short-term outlook for the bond market, influencing investor behavior.

What Role Does Central Bank Policy Play In Determining The Bond Market Outlook?

Central bank policies, particularly regarding interest rates and quantitative easing, have a profound effect on the bond market outlook, influencing yields and overall market sentiment.

How Does Market Sentiment Affect The Bond Market Outlook During Periods Of Economic Uncertainty?

Bond market outlook changes can have an impact on investor confidence and bond prices because of factors like global events and economic uncertainty.

Are There Specific Sectors Within The Bond Market That Show Promising Trends In The Current Outlook?

Analyzing the bond market outlook may reveal sectors such as corporate bonds, government bonds, or high-yield bonds that exhibit promising trends based on economic conditions and market dynamics.

Final Words

Macroeconomic forces and financial market trends have an impact on the bond market outlook. Investors must be adaptable and aware of evolving economic landscapes to make informed decisions.

This analysis helps them navigate challenges and seize opportunities in the dynamic bond market, ensuring they are well-positioned to navigate the market's challenges and opportunities.

Stefano Mclaughlin

Author

Luqman Jackson

Reviewer

Latest Articles

Popular Articles